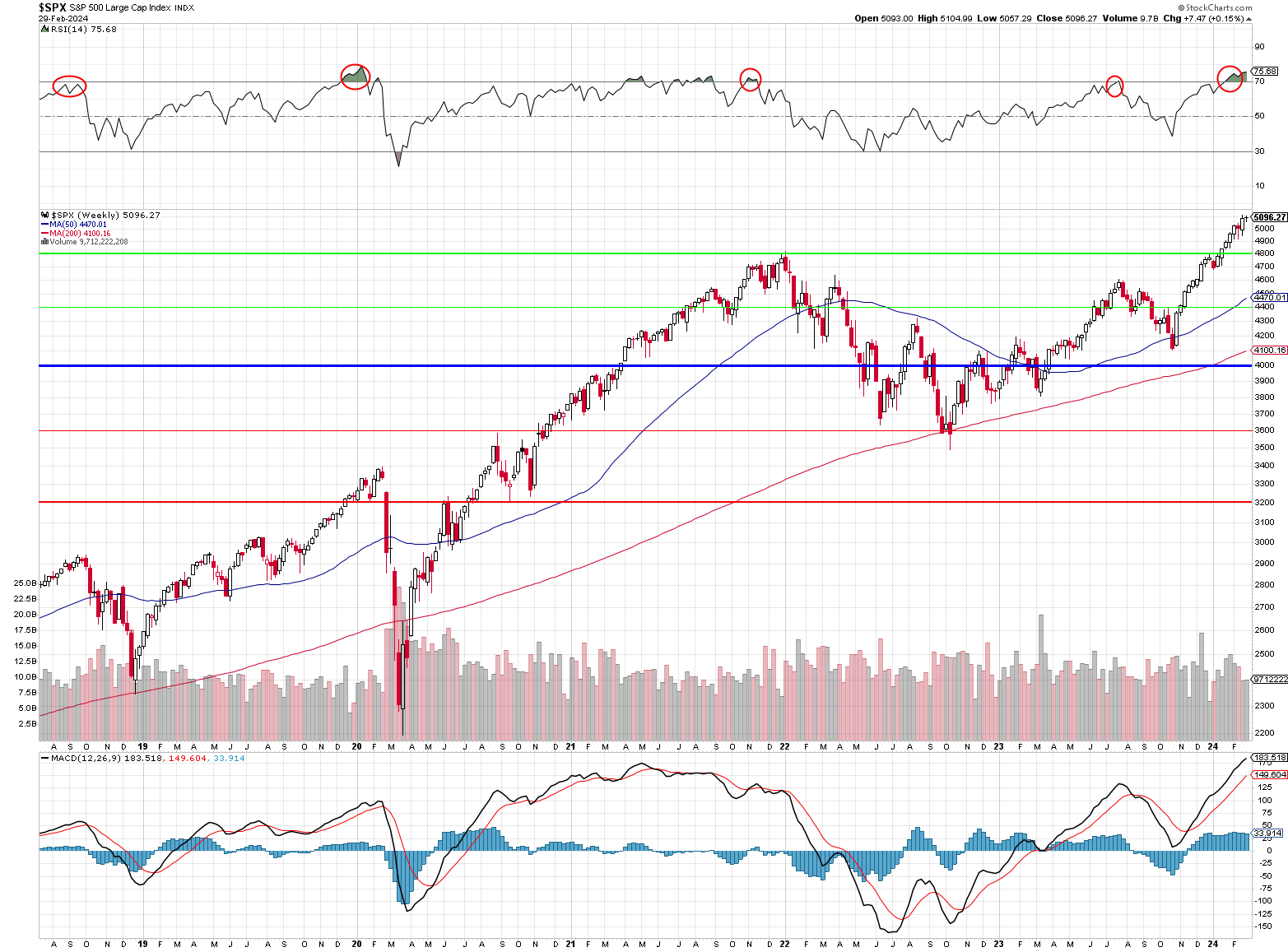

5,100?

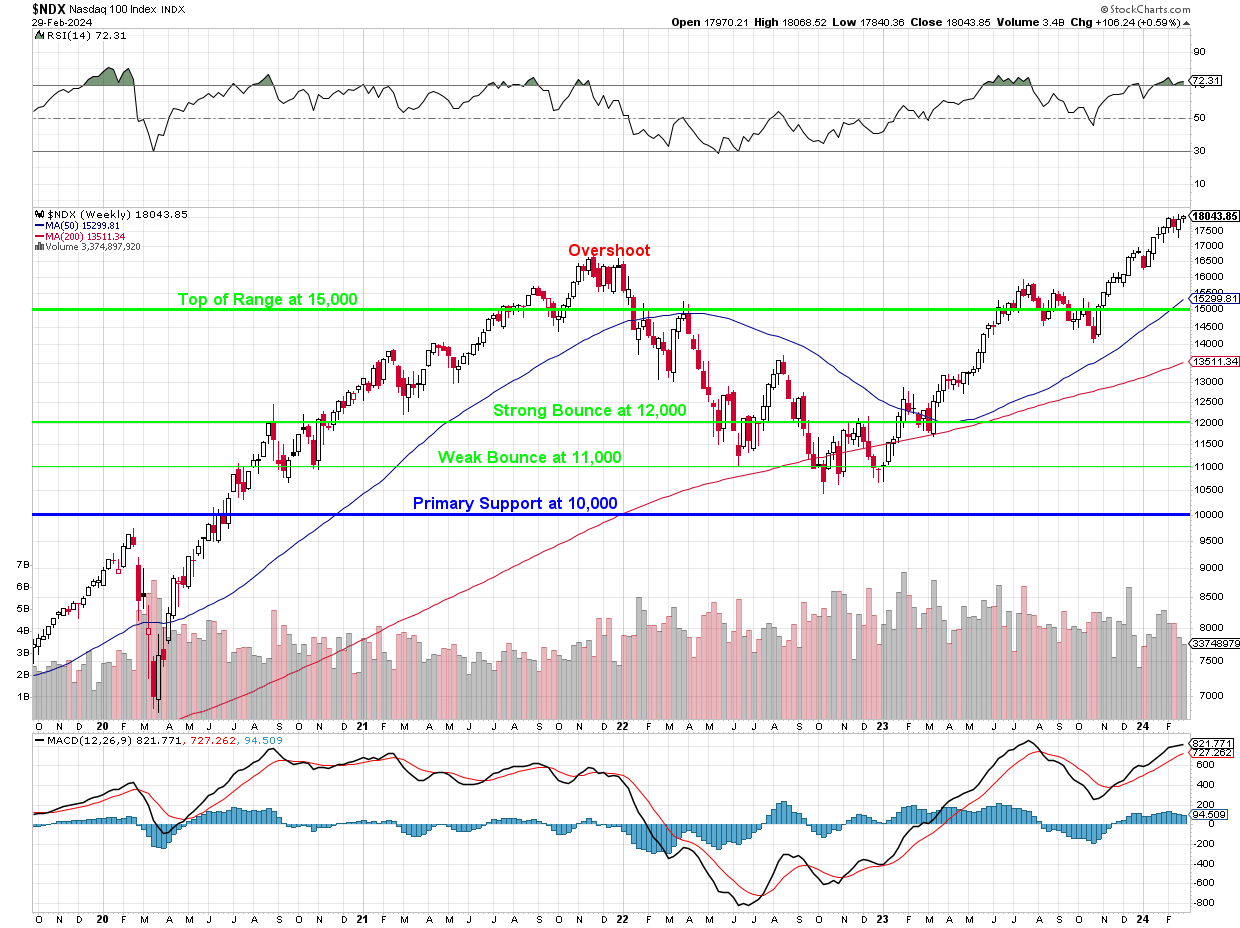

The Nasdaq closed over 18,000 yesterday and its RSI is also over 70 (overbought) but no one wants to say a bad thing about the markets at the moment – even with the Nasdaq up 7,000 (63%) points since Jan, 2023. That’s OK, I guess because the Nasdaq ran from 7,000 to 16,500 (135%) from March of 2020 to the end of 2021 before correcting to 11,000 and now we have our current rally – perhaps at the halfway point?

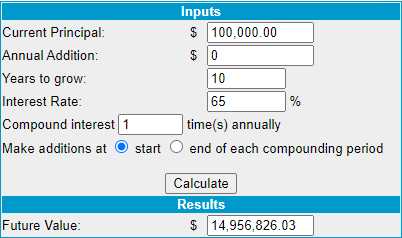

One thing I can tell you is the Nasdaq won’t go up 65% a year for 10 years because that would turn $100,000 into $14,956,000 and, while that would certainly solve everyone’s retirement problems – it would mean Wendy’s surge pricing for a Baconator would probably be about $1,000 in 2034 (really, do the math!).

One thing I can tell you is the Nasdaq won’t go up 65% a year for 10 years because that would turn $100,000 into $14,956,000 and, while that would certainly solve everyone’s retirement problems – it would mean Wendy’s surge pricing for a Baconator would probably be about $1,000 in 2034 (really, do the math!).

Since the markets CLEARLY cannot sustain these sorts of gains indefinitely, it DEFINITELY is going to correct – Modus tollens! Unfortunately, WHEN is still in question. Both the Nasdaq and the S&P 500 are exhibiting strained RSI’s and, historically, that doesn’t last more than a few months but it won’t take much of a breeze to knock these indexes off their pedestals so we need to stay vigilant.

Meanwhile, we’re certainly enjoying the show. We added a dozen new trades to our Member Portfolios last Friday on the theory that our value stocks will eventually play catch-up if the rally continues. We also nudged our hedges a bit more bearish yesterday in our Live Member Chat Room — just in case…

SQQQ bottomed out at $6 on Dec 27 of 2021 an they did a 1:5 reverse split on Jan 13, 2022. The Nasdaq had topped out at 16,000 but it was already back below 11,000 on June 13th and SQQQ topped out at $63.96 – a double from the split against the 31% drop in the Nasdaq. This is important to keep in mind as we manage our hedges – which is why we recalculate them several times each month.

The subsequent resurrection of the Nasdaq (63%) has caused an 83% drop in SQQQ – which is less than we’d expect, actually, but here we are, back at $11 for the Ultra-Short Nasdaq ETF. Indexes are volatile things and all the more so when 7 stocks make up half of the index – keep that in mind.

But what could possibly go wrong with the Magnificent 7? Well, the gains are mostly based on AI and Google (GOOG) just pulled their AI release due to serious issues and Microsoft (MSFT) just announce AI for Finance and, whatever that means – I can think of 1,000 things that can go terribly wrong with that – just off the top of my head.

AND, now Elon Musk is suing OpenAI, who are also under a DOJ investigation, over “Abandoning their Mission” to prioritize the benefit to humanity over profits though, more specifically, he expected to have OpenAI for self-driving cars and Twitter but Microsoft outbid him.

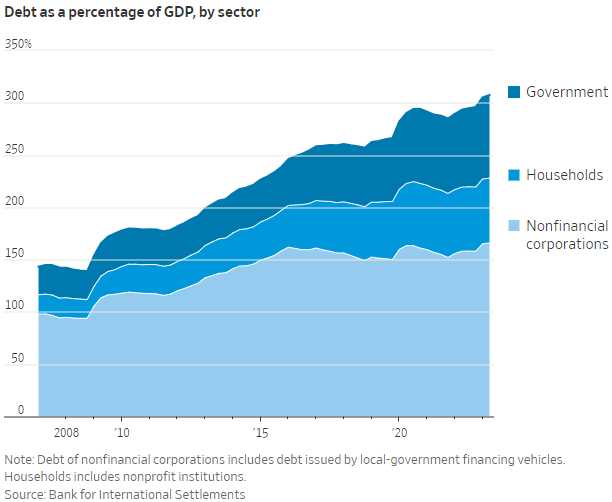

Meanwhile, over in the World’s second-largest Economy, China is still a slow-rolling disaster with 0.5% DEflation while Government Debt is now 79.4% of GDP (not counting local Governments) but Household debt is 62% of GDP (double the US) and NonFinancial Corporate Debt is 166% of GDP (WTF?!?) and that’s because the Government owns the Corporations too. Overall, China’s debt is 305% of their GDP – double the US debt load.

Meanwhile, over in the World’s second-largest Economy, China is still a slow-rolling disaster with 0.5% DEflation while Government Debt is now 79.4% of GDP (not counting local Governments) but Household debt is 62% of GDP (double the US) and NonFinancial Corporate Debt is 166% of GDP (WTF?!?) and that’s because the Government owns the Corporations too. Overall, China’s debt is 305% of their GDP – double the US debt load.

Fortunately, if we ignore it, it will go away. Isn’t that how we deal with all of our problems these days? China’s population peaked out in 2020 at 1.425 BILLION people but, like Japan, the population is collapsing and it’s expected to be HALF (700M) by the end of the century. That’s losing 100M people per decade and, if you substitute “people” with “customers” – you can see the problem fairly immediately. And who is going to buy all those unsold apartments?

Foreign Investments into China went NEGATIVE last year. In other words, more people took money out of China than put money in – that’s bad. Economic growth was 5% last year but it was 7% pre-Covid and it’s trending lower (with the population) and Chinese Consumer Confidence has fallen from 120 two years ago to 87.50 in the last poll so they are SCREWED, aren’t they?

Oops, sorry, that’s the US chart with expectations at 80% – move along folks, nothing to see here…

Ignore and Soar is the theme for 2024! How long can we keep it up? That’s going to depend on the Fed and what kind of economic Viagra they are willing to give us.

Have a great weekend,

-

- Phil