Wheeee!

We had a fun little sell-off yesterday but half of it is already back in the Futures so not much to say but corrections do happen in overbought markets and this barely qualifies as one. As anyone who’s played shoots and ladders knows – eventually you get to the top – despite the setbacks along the way.

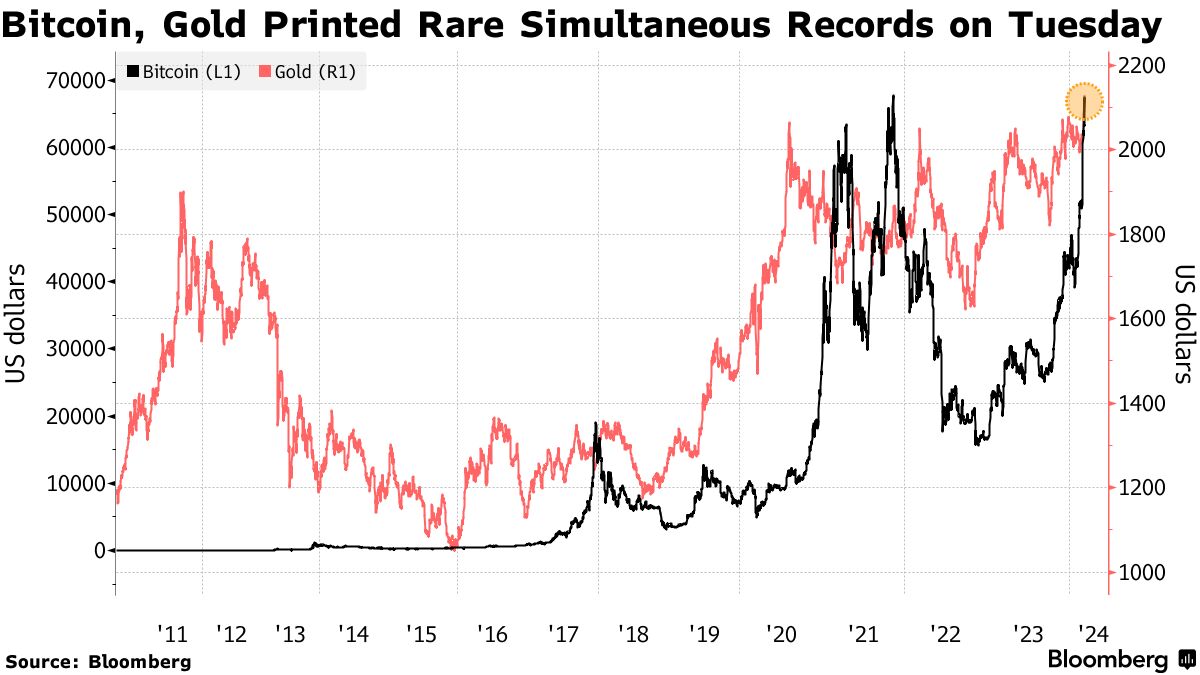

Speaking of setbacks, BitCoin dropped almost 30% overnight after hitting an all-time high into yesterday’s US close at $69,325. Just hours later, it fell below $50,000 but is back to $66,100 this morning after a wild, wild ride.

Gold also hit a new high at $2,141 and both indicate global concerns as Governments debase their currencies running infinite debt economies – consequences be damned. Of course you could argue that the consequences of not going further and further into debt would be much worse but we’ll likely never know as they’ve all gone too far to stop now.

Stocks are also a commodity. Like BitCoin, there are only a limited number of shares that have been printed and, unlike BitCoin, stocks are backed by ownership in an asset (the company) that actually produces dividends (earnings) for its stakeholders. Stocks are also priced in Fiat Currencies so they also go up as the currencies debase themselves.

This dynamic creates a fascinating environment for investors, where traditional assets like stocks and gold, and digital assets like Bitcoin, are all influenced by the broader economic policies and currency valuations. As currencies debase, investors flock to assets they perceive as stores of value or those that offer some form of yield or growth potential, further fueling the rally in these markets.

However, this rally brings with it the specter of volatility. Bitcoin’s dramatic drop and swift recovery underscore the inherent risks in digital currencies, which, despite their allure, can experience significant price swings. This volatility is not just confined to cryptocurrencies; stocks, too, can see rapid shifts in value, though typically not as extreme, given their underlying economic fundamentals.

Whether it’s the allure of cryptocurrencies, the relative stability of gold, or the growth potential of stocks, each asset class offers unique opportunities and risks. The challenge lies in balancing these elements to achieve a portfolio that reflects our investment goals, risk tolerance, and outlook on the global economy.

While the thrill of the market’s ups and downs can be exhilarating, it’s crucial to remember the Fundamentals that underpin these movements. The current economic environment, characterized by significant debt levels and currency debasement, will present both challenges and opportunities for us. Navigating this landscape requires a careful analysis of asset classes, a strategic approach to investment, and, perhaps most importantly, a long-term perspective that can weather the inevitable fluctuations along the way.

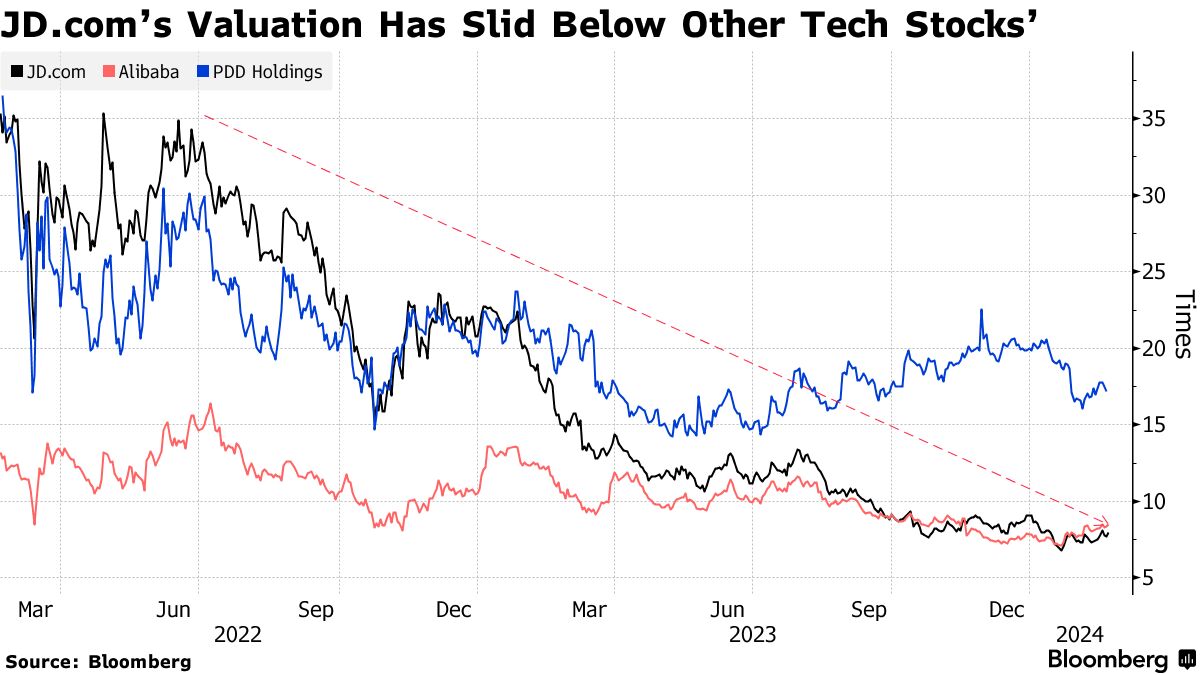

Speaking of fluctuations, JD.com just showed us why they were our Top Trade Alert on Jan 24th as the company announced not only decent earnings with a revenue beat but a $3Bn stock buyback – pushing them up 15% pre-market. JD reported Q4 sales of 306.1 Billion Yuan ($42.6Bn), surpassing analyst projections of around 300Bn Yuan. This growth is attributed to the company’s efforts to diversify its product offerings and implement discounts – as we expected would happen, of course!

China has, of course, been slow and has been exploring opportunities in overseas markets, including a potential acquisition of UK electronics retailer Currys Plc (like BBY for us), to establish a presence in Europe. JD’s proactive measures to adapt to China’s economic downturn – through price cuts, product diversification, and a significant stock repurchase program – demonstrate the company’s resilience and commitment to growth.

Our trade idea for JD in January was:

-

-

- Sell 20 JD 2026 25 puts for $6.90 ($13,800)

- Buy 40 JD 2026 $15 calls for $10.70 ($42,800)

- Sell 35 JD 2026 $30 calls for $4.70 ($16,450)

-

I feel more confident with JD as they have all that CASH!!! This is net $12,550 on the $60,000 spread so there’s $47,450 (378%%) upside potential at just $30 and we have the 5 open longs so we can absolutely generate income. The June $30 calls are $1 for 149 days (out of 723) but the $25 calls are $2.30 so, if we can get $2.30 for 10 of the short $30s, that’s $2,300 and maybe 5 sales like that would pretty much pay back our entry fee – if all goes well…

JD is still lower than our entry so the above trade is still playable and we’re very confident the spread should return the full 378% on cash over the next 21 months + whatever we make selling short-term calls along the way but certainly not yet, as the stock is still below our $30 target. See the original write-up for our Good, Bad and Ugly Report.

In other news, Super Tuesday went as expected and the only state Nikki Haley won was Vermont – where the “Republicans” are just moderate liberals. So it’s Trump/Biden again in 8 months – if both of them make it that far. Between Trump’s rapidly declining cognitive functions and Biden’s rapidly decomposing body – either one could keel over at any moment and then what?

Speaking of Vermont, Bernie Sanders, who is a year older than Biden but acts 20 years younger, was on the Late Show last night and the whole thing is worth watching but here’s one highlight clip: