Energetic?

That’s how they are describing President Biden’s LONG State of the Union address last night and sure, Trump and his co-conspirators set the bar very low by portraying Biden as too old and senile to make a statement, let alone an 80-minute, fact-filled address (not to mention his after-party). If this is the Biden that shows up for the debates – Trump is doomed (again).

Keep in mind Trump has never actually won the popular vote – even when we didn’t know how “well” he would govern, “crooked Hillary” beat him by 3M votes (5%). Just 4 years ago (5% of Biden’s life), Biden widened that gap to 7M more votes (10%) with a 10% greater voter turnout rate (65%) than the previous election.

Keep in mind Trump has never actually won the popular vote – even when we didn’t know how “well” he would govern, “crooked Hillary” beat him by 3M votes (5%). Just 4 years ago (5% of Biden’s life), Biden widened that gap to 7M more votes (10%) with a 10% greater voter turnout rate (65%) than the previous election.

Yet the Republicans are now all-in on Trump and could not find one thing to applaud last night – you would think someone dragged them to the opera or something… Looking at the electoral map, if you took away Florida and Texas, Trump would have had 165 out of 538 electoral votes but if you took away New York and California, Biden would still have 222 votes. Frankly, all the democrats have to do is turn Florida blue and you’ll never see another Republican president.

Trump won Florida by 400,000 (3.6%) out of 11M votes and he only won Texas by 600,000 out of 11M votes (low turnout). If the Democrats can energize their bases in either of those states and get out the vote – the GOParty will literally be over.

Here are a few key takeaways that stood out to me, including some points that could have stock market implications:

- Biden came out swinging against Trump and the MAGA wing of the GOP, drawing sharp contrasts on everything from Ukraine policy to the events of Jan 6th. He painted the stakes of the 2024 election in stark terms as a battle for the soul of Democracy. This pugilistic approach seemed calculated to project strength and vitality.

- On the economy, Biden touted job growth, falling inflation, and record small business creation on his watch. He positioned himself as a champion of the middle class while calling for higher taxes on corporations and the wealthy. One notable policy proposal was his plan to cut title insurance fees on federally-backed mortgages, which would save homeowners over $1,000 but would be BIG TROUBLE for the title insurance companies (if enacted).

- Abortion rights featured prominently, with Biden vowing to veto a national abortion ban and predicting the issue would energize women voters and propel Democrats to victory in 2024, as it did in 2022. He introduced guests impacted by abortion restrictions and IVF bans resulting from the overturning of Roe v Wade.

- On foreign policy, Biden took credit for uniting NATO against Russia’s invasion of Ukraine. In the Middle East, he called for a cease-fire between Israel and Hamas and announced the U.S. would establish a temporary Gaza aid pier. While condemning Hamas, he said Israel has a “responsibility to protect civilians.” This balancing act reflects the pressure he faces from progressives critical of his approach.

- Throughout the speech, Biden mixed appeals for bipartisanship with partisan jabs, relishing the occasional heckles and repartee with Republican lawmakers. The lively engagement seemed designed to counter concerns about his age and acuity ahead of his reelection bid.

Looking ahead to 2024, the electoral map favors Democrats if they can juice turnout, especially in Sun Belt swing states. But Biden will have to maintain the energy we saw last night in the debates and hope that economic headwinds don’t intensify. The GOP seems all-in on Trumpism for now, but a lot can change in the coming months (like Trump could be running from jail).

Watching Biden spar with the Republican hecklers was like witnessing a geriatric rap battle. Of course, if you’re holding out hope for bipartisan cooperation on any of these issues, I’ve got a bridge to sell you at Mar-a-Lago. The speech did, however, give us a glimpse into the administration’s priorities and the potential market movers on the horizon. So while we may be a nation divided, at least we can all unite in our quest to make a buck off the chaos.

Watching Biden spar with the Republican hecklers was like witnessing a geriatric rap battle. Of course, if you’re holding out hope for bipartisan cooperation on any of these issues, I’ve got a bridge to sell you at Mar-a-Lago. The speech did, however, give us a glimpse into the administration’s priorities and the potential market movers on the horizon. So while we may be a nation divided, at least we can all unite in our quest to make a buck off the chaos.

Other industries or sectors that could be impacted by the policies President Biden proposed. Here are a few that stand out:

- Pharmaceutical Industry: Biden called for capping insulin prices at $35 per month for all Americans and enabling Medicare to negotiate prices for more prescription drugs. This could put pressure on the profits of drug companies, particularly those that produce insulin or other high-cost medications.

- Eli Lilly (LLY) – Negative: As a major insulin producer, Eli Lilly could see profits squeezed if Biden’s $35/month insulin cap becomes law.

- Pfizer (PFE) – Negative: With a broad portfolio of prescription drugs, Pfizer may face pressure if Medicare gains more power to negotiate prices.

- Clean Energy and Electric Vehicles: The President highlighted his administration’s investments in clean energy jobs, electric vehicle charging stations, and advanced manufacturing. Companies in these sectors could benefit from ongoing government support and incentives.

- Tesla (TSLA) – Positive: Biden’s support for EVs and charging infrastructure could boost demand for Tesla’s cars and batteries yet, for some reason, Elon Musk has been sucking up to Trump recently. Probably Elon cares more about his tax bill than his company…

- NextEra Energy (NEE) – Positive: As a leading renewable energy provider, NextEra could benefit from increased government investment in clean power.

- Semiconductor Industry: Biden touted the impact of the CHIPS and Science Act in spurring domestic semiconductor manufacturing. Chip companies that are expanding production in the U.S. could see tailwinds from these efforts to boost the industry and reduce reliance on foreign suppliers.

- Intel (INTC) – Positive: Intel is investing heavily in domestic chip production, which aligns with Biden’s goal of reducing reliance on foreign suppliers.

- Applied Materials (AMAT) – Positive: As a key supplier to the semiconductor industry, Applied Materials could see increased demand as chip companies expand U.S. operations.

- Fossil Fuel Industry: While not mentioned explicitly, Biden’s focus on combating climate change and promoting clean energy could signal headwinds for oil, gas, and coal companies over time as the economy shifts towards lower-carbon sources.

- ExxonMobil (XOM) – Negative: Biden’s focus on climate change and clean energy could accelerate the shift away from fossil fuels, putting pressure on oil giants like Exxon.

- Chevron (CVX) – Negative: Like Exxon, Chevron could face headwinds as the administration prioritizes a transition to lower-carbon energy sources.

- Technology and Social Media: The speech included a call to action on regulating AI and banning targeted advertising to children online. While light on specifics, this suggests the administration may be looking at ways to rein in Big Tech, which could create uncertainty for social media and AI companies.

- Meta Platforms (META) – Negative: As the owner of Facebook and Instagram, Meta could face increased scrutiny and potential regulation around targeted advertising and content moderation.

- Alphabet (GOOGL) – Negative: Google’s parent company could also be in the crosshairs if the administration pushes for tighter rules on Big Tech and AI.

- Private Equity and Hedge Funds: Biden’s proposal to quadruple the tax on stock buybacks could have an outsized impact on Wall Street firms that rely heavily on this practice to boost returns.

- KKR & Co. (KKR) – Negative: As a major private equity firm, KKR could see reduced returns if Biden’s proposed tax on stock buybacks is enacted.

- Blackstone (BX) – Negative: Like KKR, Blackstone relies heavily on financial engineering tactics that could be impacted by increased buyback taxes.

- Childcare and Eldercare Services: The President’s comments about affordable childcare and expanded funding for home care services suggest these industries could be in line for more government support, which may create opportunities for companies in these spaces.

- Bright Horizons (BFAM) – Positive: As a leading provider of childcare services, Bright Horizons could benefit from increased government support for affordable childcare.

- Brookdale Senior Living (BKD) – Positive: Brookdale, one of the nation’s largest senior living operators, could see tailwinds from expanded funding for home care services.

Of course, much depends on which of these policy proposals actually become law, which will hinge on the balance of power in Congress. But the speech does provide a roadmap of the administration’s priorities and the industries they may look to bolster or regulate in the coming years.

8:30 Update: Consumer Credit came in up $20Bn for January and, more importantly, that’s up over $3Tn since the Pandemic began but there’s 300M of us so that’s “only” $10,000 of additional, revolving debt for every man, woman and child in this country while interest rates are skyrocketing.

Still, just consider the raw number. We have a $25Tn GDP and we’ve grown debt at $1Tn per year and that’s 4% but the country grows at about 3% so 4% of our 3% growth is based on the back of credit card debt increases. Is that sustainable? Is that what we should be betting our portfolios on?

Keep in mind that, prior to the mid 70s, there was essentially NO credit card debt at all. The first general-purpose credit card, BankAmericard (later Visa), was introduced in 1958, but it took time for widespread adoption. In 1970, only 16% of households had a credit card, and total revolving debt was a mere $5 Billion (and that is AFTER adjusting for inflation!).

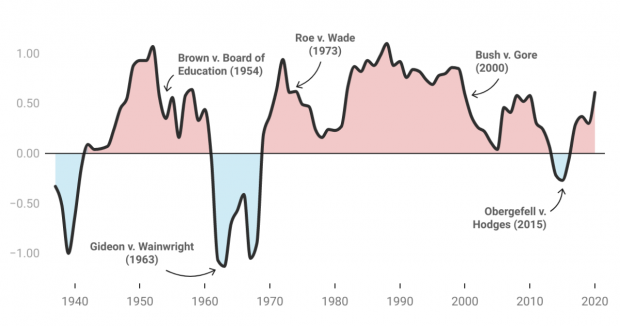

In 1978 with the Conservative Supreme Court’s decision in Marquette National Bank v. First of Omaha Service Corp. This ruling allowed banks to charge interest rates based on the laws of the state where they were headquartered, rather than the state where the borrower lived.

In 1978 with the Conservative Supreme Court’s decision in Marquette National Bank v. First of Omaha Service Corp. This ruling allowed banks to charge interest rates based on the laws of the state where they were headquartered, rather than the state where the borrower lived.

Why was this a big deal? Well, some states (like South Dakota and Delaware) had very loose restrictions on interest rates, essentially allowing banks to charge as much as they wanted. Banks quickly realized they could set up shop in these states and then offer credit cards to consumers nationwide, skirting the more stringent interest rate caps in other states.

This led to a “race to the bottom” as banks flocked to states with the most lenient laws, and credit card interest rates began to climb. In 1980, the average credit card interest rate was around 17%. By 1990, it had jumped to over 18%, and by 2020, it was hovering around 16% (though some cards charge much more). I know when I went to college in 1981, there were pre-approved offers from 5 different credit-card companies in my orientation packet!

But the Marquette decision wasn’t the only factor at play. In 1980, Congress passed the Depository Institutions Deregulation and Monetary Control Act, which phased out interest rate caps on deposit accounts. This meant banks could charge more for loans (including credit cards) and pay less for deposits, increasing their profit margins.

But the Marquette decision wasn’t the only factor at play. In 1980, Congress passed the Depository Institutions Deregulation and Monetary Control Act, which phased out interest rate caps on deposit accounts. This meant banks could charge more for loans (including credit cards) and pay less for deposits, increasing their profit margins.

The 1980s also saw the rise of securitization, where banks could bundle credit card loans into securities and sell them to investors. This allowed banks to offload some of the risk associated with credit card lending and freed up more capital to issue even more cards.

All of these changes created a perfect storm for the growth of credit card debt. Banks had more incentive than ever to issue cards, and consumers had easy access to credit with fewer restrictions. It was like giving a bunch of kids the keys to a candy store – a recipe for overindulgence and potential disaster, which happened in 2008 as our nation of consumers ran up $1Tn in credit card debt.

Fast forward to today, and we’re seeing the consequences of those decisions. Credit card debt has ballooned to unprecedented levels, and many consumers are struggling to keep up with the payments – especially as rates jump up. It’s like we’ve been on a decades-long shopping spree, and now the bill is coming due.

As investors, it’s important to understand this history and how it shapes our current economic landscape. The growth of credit card debt has fueled consumer spending and economic growth, but it’s also created a precarious situation where one wrong move could send the whole house of cards tumbling down.

And that brings us to Non-Farm Payrolls and, once again, it’s much stronger than expected (200,000) at 275,000 new jobs in February and that’s up from a revised 229,000 in January (353,000 was first estimate – so off by a mile) even though there were 2 (6.4%) less days – despite the bonus day.

Job growth is still way too hot for the Fed but the markets don’t really care. The Dollar is helping out at 102.4 – down 1.5% while the S&P gained 1.7% so we are not at all impressed by this repricing “rally” but there’s also no reason to adjust our hedges as our ill-gotten gains can serve as hedges this weekend.

More trouble for Boeing (BA) this morning as the wheels on the plane go round and then fall off the plane, apparently. A United (UAL) 777 took off from LA yesterday and one of the wheels fell off and plunged into a parking lot – totaling a car! The plane aborted and was able to land safely but holy cow Boeing – when is it going to end?

Have a great weekend,

-

- Phil