CPI tomorrow!

CPI tomorrow!

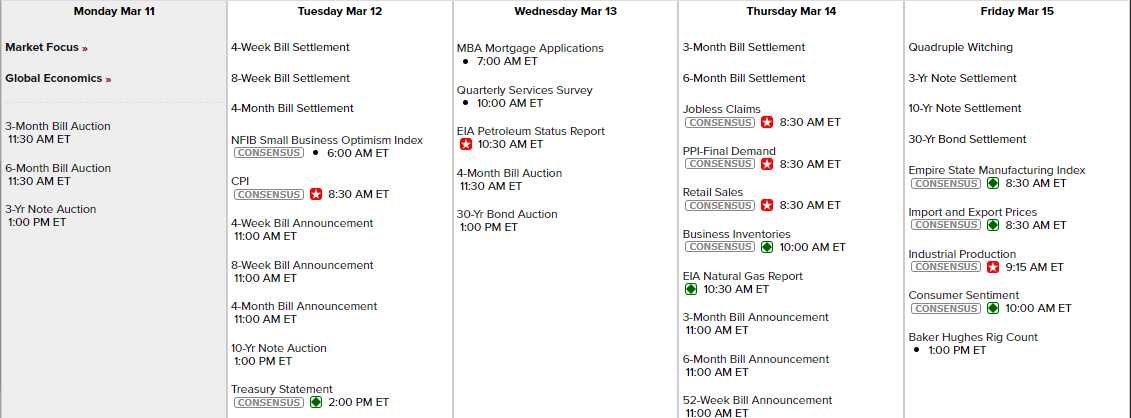

That’s the true test of Productivity, can we have a hot economy without inflation? The Fed wants to see CPI at 2% and, last month (Jan), Core CPI was 0.4%, twice as hot as expected and this month, just because they HOPE it happens, they are looking for 0.3% at the core and the headline as well.

Can the Fed claim to be done with high rates when the mission is very clearly NOT accomplished? Leading Economorons hang their hats on the theory of policy lag – it takes time for rate cycles to have a true effect on the economy so the pressure is still down – even if they lower rates a bit. Of course, they could be wrong and it could be a catastrophic mistake that will only be evident 6 months later – such fun!

PPI was a blazing hot 0.5% AT THE CORE in January and, for some reason, leading Economorons expect it to dive to 0.2% on Thursday – good luck with that! Similarly, Retail Sales were down 0.8% in January but expectations are for +0.6% in February – probably because we had an extra day (3.3%) vs last year but still a stretch.

Friday we’ll get Industrial Production and Consumer Sentiment, which has been improving but still only a shadow of where we were pre-Covid. With this stock market – imagine if the Consumers were actually enjoying it? Wow!

NO Fed speak because they make a decision on the 20th so it’s quiet time for the Fed. Lots of note auctions this week should be paid attention to and we shall see what transpires. We’ll also be reviewing our Member Portfolios this week:

And, of course, there are still earnings reports to mull over as well:

So no shortage of things to do this week and here’s the news we missed over the weekend:

- Global Population Crash Isn’t Sci-Fi Anymore.

- Life at Regional and Small Banks, a Year After SVB Failed

- Jamie Dimon and Ray Dalio Warned of an Economic Disaster That Never Came. What Now?

-

Bitcoin Tops $72,000 for the First Time as Rally Builds Steam

- Bubble Angst Belied by Big-Tech Weaklings, Broader S&P 500 Gains

- It Isn’t Just Big Tech Propelling Gains in the Stock Market Anymore

-

One of the Most Infamous Trades on Wall Street Is Roaring Back

- Asian Stocks Fall, Yen Extends Gain Against Dollar

- Eighty Percent of the World’s Stock Options Aren’t Traded Where You Think

- How Wall Street Is Turning Your Favorite Artist’s Songs Into Bonds

- Japan averts technical recession as revised fourth-quarter data shows economy grew 0.4%

- Japan’s Economy Expanded in Fourth Quarter on Capital Spending Boost

- China’s Slump Is One Big Cloud in Sunny Global Markets

- Miami’s Office Market Was Red-Hot. Now its Tallest Planned Tower Can’t Fill Its Space.

- Default Risk Fades in Emerging Markets as Riskiest Bonds Soar

- Traders Are on Alert for a Hotter-Than-Expected Inflation Print

- Surge Pricing Is Coming to More Menus Near You

- More Americans Are Using Their 401(k)s as Cash Machines

- Five Key Charts to Watch in Global Commodity Markets This Week.

- Oil Holds Decline as Investors Look Ahead to US Inflation Print

- Saudi oil giant Aramco posts $121 billion annual profit, down from 2022 record

- Two Canals, Two Big Problems—One Global Shipping Mess

- Feds reportedly open criminal investigation into Boeing 737 Max midair blowout

- Behind the Alaska Blowout: a Manufacturing Habit Boeing Can’t Break

- Nvidia is sued by authors over AI use of copyrighted works