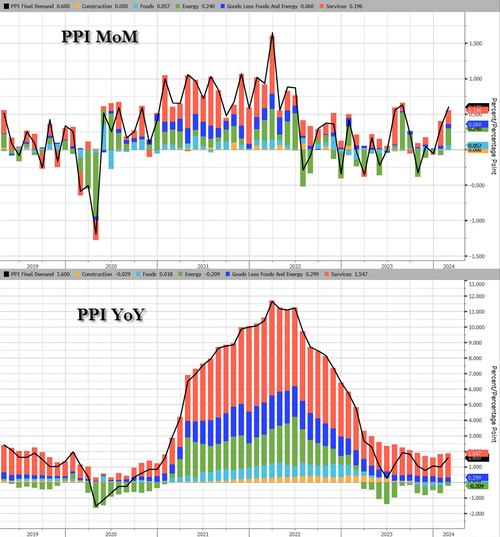

After the hotter-than-expected consumer price data, February Producer Prices were expected to slow their surge from January but they did not… with headline Final Demand PPI rising 0.6% MoM (double the 0.3% rise expected) – the hottest print since June 2022. That lifted the YoY PPI to +1.6%, its highest since September…

Source: Bloomberg

That was the second big beat for PPI in a row with Energy costs leading the MoM charge. 70% of the rise in February Goods PPI can be attributed to the index for energy, which jumped 4.4% (one-third of the February advance in the index for final demand goods can be traced to a 6.8% increase in prices for gasoline.)

Source: Bloomberg

PPI: Final demand goods

-

Prices for final demand goods advanced 1.2 percent in February, the largest increase since moving up 1.7% in August 2023. Nearly 70 percent of the broad-based rise in February can be attributed to the index for final demand energy, which jumped 4.4%.

-

Prices for final demand goods less foods and energy and for final demand foods also increased, moving up 0.3 percent and 1.0 percent, respectively.

Product detail:

- One-third of the February advance in the index for final demand goods can be traced to a 6.8- percent increase in prices for gasoline. The indexes for diesel fuel, chicken eggs, jet fuel, beef and veal, and tobacco products also rose. Conversely, prices for hay, hayseeds, and oilseeds decreased 8.3 percent. The indexes for iron and steel scrap and for asphalt also fell.

PPI: Final demand services

-

Prices for final demand services moved up 0.3 percent in February after rising 0.5 percent in January. Leading the February increase, the index for final demand services less trade, transportation, and warehousing advanced 0.5 percent. Prices for final demand transportation and warehousing services rose 0.9 percent.

-

In contrast, margins for final demand trade services declined 0.3 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail:

-

A quarter of the February increase in the index for final demand services can be attributed to a 3.8-percent rise in prices for traveler accommodation services.

-

The indexes for outpatient care (partial); airline passenger services; loan services (partial); securities brokerage, dealing, and investment advice; and alcohol retailing also moved up.

-

Conversely, margins for chemicals and allied products wholesaling fell 6.4 percent.

-

The indexes for automobiles and parts retailing and for services related to securities brokerage and dealing (partial) also decreased.

This is not good news for the disinflationistas. And it will stop President Biden’s narrative that ‘prices are coming down’ or refocus his blame-game that ‘Big Corporate’ greed is driving ‘shrinkflation’…?