Second hand homes.

That’s what they call them in China. Kind of a negative connotation – we call them “existing homes” but, whatever you call them, they are worth 6.3% less than they were last year and that’s the biggest drop since data was first recorded in China in 2011. This is another indicator of China’s snowballing real estate crisis, which has now spread from the commercial to the residential sector.

Meanwhile, as Carlin said, “nobody seems to notice, nobody seems to care” and I’m having 2007 flashbacks as I hate to be the one saying “the sky is falling” but it very certainly is!

Meanwhile, as Carlin said, “nobody seems to notice, nobody seems to care” and I’m having 2007 flashbacks as I hate to be the one saying “the sky is falling” but it very certainly is!

The years-long property slowdown in China has dealt huge damage to the economy, reducing business for construction companies and other firms that thrived during the property boom, hitting confidence among nervous homeowners, and exacerbating the debt burden facing local governments which for years relied on land sales as their major source of revenue.

State-backed developer China Vanke was downgraded by Moody’s Rating this week and has become the latest to face scrutiny from investors. Country Garden (remember them?), once China’s largest developer by sales, missed a bond payment on Tuesday. Home sales at some of China’s largest developers continue to fall drastically. All this is happening while China’s Central Bank is still maintaining an artificially low rate of 3.95% – well under the rates of other major banks.

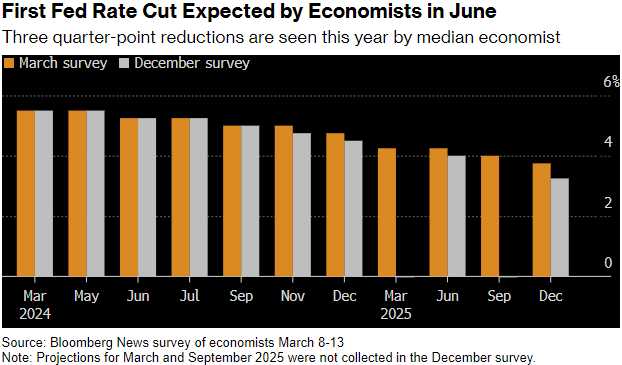

Our Fed Funds Rate is 5.25% at the moment and, despite all the much-higher-than-expected inflation data recently, Bloomberg’s panel of Leading Economorons still expect 3 cuts in 2024 and that’s this morning’s market-moving front-page headline! Who needs State-controlled media when you have Capitalist-controlled media? You think Putin is good at propaganda – watch “The Century of the Self“, if you really want to know how the sausage is made….

Our Fed Funds Rate is 5.25% at the moment and, despite all the much-higher-than-expected inflation data recently, Bloomberg’s panel of Leading Economorons still expect 3 cuts in 2024 and that’s this morning’s market-moving front-page headline! Who needs State-controlled media when you have Capitalist-controlled media? You think Putin is good at propaganda – watch “The Century of the Self“, if you really want to know how the sausage is made….

Meanwhile, the forecast for our Q1 GDP has been dropping all year, now just over 2% from over 4% in January. Stagnant Economy + Rising Inflation is what they call “Stagflation” and that is the textbook definition of what the Fed is steering us into – at least the markets are at all-time highs, right? That’s all that matters, right? Like I said – 2007…

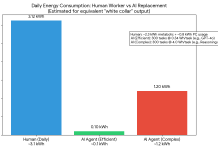

But this is not 2007 because 2007 was built on fake, Fake, FAKE profits in the Real Estate/Mortgage/Banking sector and that sector is 20% of our economy! As I noted yesterday, what’s driving the market higher is higher Corporate Profits (how they got there doesn’t matter) along with a new growth sector (Tech/AI) which is already leading us to massive productivity gains.

So we’re not so quick to short the market – even though the indexes are historically overbought and Consumers (60% of the GDP) are showing signs of strain – but we’re also not going to be idiots about it – let’s call it VERY cautiously optimistic for now but, underneath it all, America has it’s own bubbling real estate crisis that is not going to go away – certainly not with 8% mortgage rates!

Have a great weekend,

-

- Phil