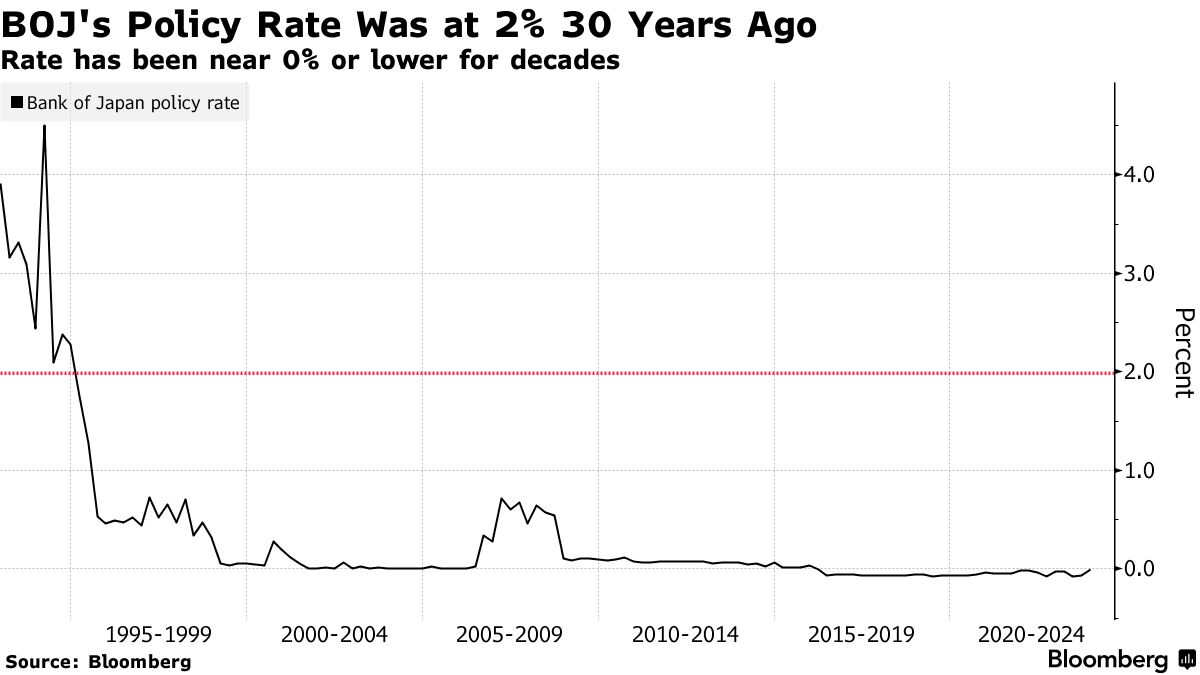

No more negative rates!

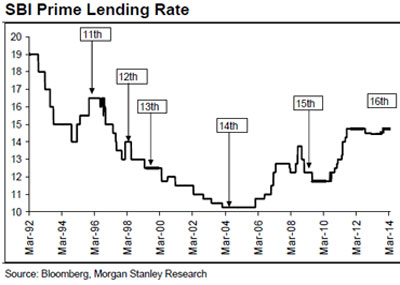

The BOJ voted 7-2 to raise their rates for the first time since 2007, moving from -0.1% to +0.05% and that does not seem to be enough to make Yen traders happy as Japan’s currency fell 1% on the news. 0.05% is miles below the US’s 5.25% and the ECB’s 4.5% and China’s 3.45% as well. And we are all just sucking wind behind India’s 14.95% Prime Rate and it’s India, not Japan, who are now the World’s 4th largest economy. Imagine how fast India would be growing if they could borrow money at 0%!

But 0% is not the cost of money, is it. 3.5-5% is historically normal in the Western World and Global Debt topped $307 TRILLION last year, which includes the money owed by individuals, corporations, and governments around the world. When you consider that Global GDP is “only” $100Tn – you can imagine the extent of this problem.

Or, maybe you can’t. Let’s say, instead that you make $100,000 per year and you are $307,000 in debt – that’s something we can wrap our heads around. Well, let’s say $40,000 goes to taxes and if you are a government, certainly 40% goes to actually running things, right – so we’re all in the same boat.

So now we have $60,000 to play with and we’re still $307,000 in debt – yikes. At 5.25%, we owe $16,117.50 in interest payments alone on our debt but, if that were credit card debt at 18% or more – we’d be pretty much Bankrupt already, right? Even at 5.25%, we only have $44,000 left to spend and here is the average family’s expenditures in 2019 – BEFORE all this inflation:

Don’t ask me where they are living for $1,343/month, I’ve been in hotel rooms that cost that much per night! $644/month for food? $266/month for entertainment? Does that include streaming services? No wonder movies are in the crapper – who can afford to go? $1,491 for education? If you start saving the day your KID (you can’t afford 2) is born, that’s going to be a whopping $26,838 towards college by the time they are $18 – no wonder students come out of school with $100,000 in debt and now wonder the average household has $307,000 in debts (including the money your government borrowed on your behalf)!

And no wonder people are unhappy? Who can afford to be happy? How is this going to be fixed and, again, this is 15% inflation ago! Any part of that that’s exceeding your salary growth is – MORE DEBT!

To navigate this financial quagmire, it’s crucial to acknowledge the intricate dance between inflation, debt, and economic growth. As central banks around the globe adjust their monetary policies, the ripples are felt far and wide, impacting everything from the cost of borrowing to the value of savings. The Bank of Japan’s modest rate hike highlights the delicate balance nations are trying to strike in fostering growth without exacerbating debt or inflation issues.

The global debt figure is staggering, indeed, but it’s the interest payments that are the real kicker. At higher interest rates, the burden of these debts becomes increasingly unsustainable, squeezing public and private budgets and leaving less room for investment in growth or innovation. For households, the squeeze is felt in every aspect of daily life, from housing costs to education, healthcare, and even leisure activities. The 2019 expenditure snapshot is a stark reminder of the budget tightrope families walk, even before considering the inflation surge that has only tightened the noose.

) Moreover, the international disparity in interest rates underscores a fragmented global economy where some countries can borrow cheaply to spur growth, while others grapple with prohibitive rates that stifle it. India’s burgeoning economy, buoyed by higher rates, stands in contrast to Japan’s cautious stance, revealing a complex tapestry of economic strategies and outcomes.

Moreover, the international disparity in interest rates underscores a fragmented global economy where some countries can borrow cheaply to spur growth, while others grapple with prohibitive rates that stifle it. India’s burgeoning economy, buoyed by higher rates, stands in contrast to Japan’s cautious stance, revealing a complex tapestry of economic strategies and outcomes.

This leads us to ponder the sustainability of our current economic model. Is it feasible to keep piling on debt in the hopes of outgrowing it? Or are we at a tipping point where the conventional wisdom of borrowing for growth collides with the harsh reality of finite resources and economic bandwidth?

As we delve deeper into these questions, it’s clear that there’s no one-size-fits-all solution. Each country must navigate its unique set of challenges, balancing growth, inflation, and debt in a way that sustains its economy without overburdening future generations. Yet, this global dilemma also calls for international cooperation, as the ripple effects of one nation’s policies can easily spill over borders, affecting global financial stability and growth.

The global economy stands at a crossroads, with the path forward requiring a careful blend of policy, innovation, and perhaps most importantly, a reevaluation of our relationship with debt and growth. The ultimate goal? To forge an economic system that is resilient, equitable, and capable of sustaining well-being for all, without further mortgaging our future.