Irrational exuberance? You tell me:

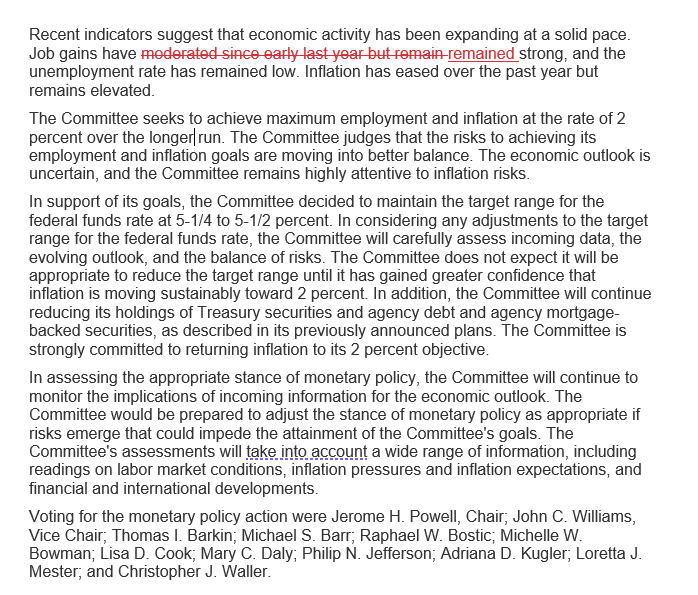

That is the ENTIRE change of language from the Fed, that job gains have REMAINED strong, as opposed to “moderated since early last year BUT remain” strong. Other than that, the March 20th statement from the Fed is WORD FOR WORD the exact same as it was on Jan 31st, when the S&P DROPPED 70 points – due to those 6 extra words, I guess…

Powell’s subsequent Q&A session offered more substantial clues to the market’s buoyant response:

Powell’s subsequent Q&A session offered more substantial clues to the market’s buoyant response:

-

Balanced Optimism: Powell’s nuanced defense of the Fed’s cautious yet optimistic stance reassured investors. His comments suggested a commitment to nurturing economic growth while keeping a vigilant eye on inflation risks. This balanced perspective likely bolstered investor confidence in the Fed’s navigational acumen through uncertain economic waters.

-

Economic Strength Confidence: The Fed’s decision to hold off on immediate rate cuts, coupled with Powell’s affirmations, underscored a belief in the economy’s resilience. This assurance, amidst inflationary pressures, painted a picture of an economy with a robust foundation, uplifting market sentiment.

-

Clear Communication: Powell’s articulate presentation of the Fed’s policy direction and economic outlook cut through the fog of uncertainty. This clarity is invaluable, calming market nerves by dispelling speculative anxieties and sketching a clearer trajectory of future monetary policy.

-

Data-Driven Flexibility: The emphasis on a data-dependent policy approach resonated with investors. This adaptability signals the Fed’s readiness to respond to evolving economic landscapes, a stance that underpins market stability.

-

Future Policy Signals: The markets are keenly parsing Powell’s words for hints of upcoming policy shifts. Any indication of the Fed’s openness to policy adjustments, based on incoming data, reassures investors of the central bank’s proactive support for the economy.

The market’s reaction to the Federal Reserve’s latest communication underscores the critical role of Central Bank signaling in shaping investor expectations and market dynamics. While the six-word adjustment in the Fed’s statement might seem minor, it, along with Powell’s subsequent commentary, has provided a fresh impetus to market optimism. This episode serves as a reminder of the delicate balance the Fed navigates in guiding economic perceptions and the potent impact of its words on market sentiment.

As we move forward, the key will be to watch how the Fed’s communications continue to influence market expectations and whether this optimism is a harbinger of sustained economic strength or a momentary uplift in an ever-volatile financial landscape.

Interestingly, Switzerland cut their rate back to 1.5% this morning with the SNB declaring victory over inflation and that sent their currency down 1.2% this morning, to an all-time low. The Swiss like that because it’s good for exports and the Swiss people are used to high prices and are among the most prosperous in the World (Bankers), so it’s all good over there.

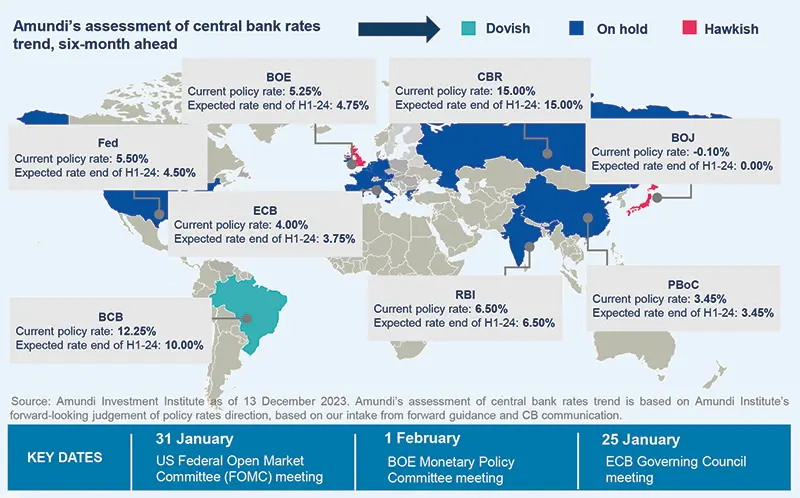

Meanwhile, the PBOC indicated that they would be considering further easing to “support the economy and technological innovation.” In other words, China is lagging in AI and chip development (and we are spending mega-Billions here to do the same) and, of course, they have a Real Estate crisis that needs to be papered over.

Recent economic data for China has shown moderate rebounds in industrial production and investment growth, aided by government stimulus, though retail sales growth remained tepid, indicating continued weak consumer sentiment. The PBOC’s cautious stance, as indicated by the “observation period” they are calling for and concerns over banks’ profit margins, highlights the delicate balance the central bank is trying to maintain. On one hand, it seeks to stimulate economic growth and innovation; on the other, it must manage the risks associated with too much liquidity, such as potential inflation or asset bubbles.

The actions and considerations of the PBOC occur against a backdrop of global economic uncertainty, including varying monetary policies among the world’s major economies. China’s efforts to make its monetary policy more independent reflect a broader trend of countries adapting their economic strategies to a rapidly changing global landscape.