Poor Apple!

Poor Apple!

They are only the first, Google (GOOG) also has an effective monopoly and they are trying to ban TikTok but that’s only going to make Facebook/Instagram (META) bigger and the are already bigger than TikTok. Fortunately, Truth Social (Trump) stands to benefit from all this nonsense.

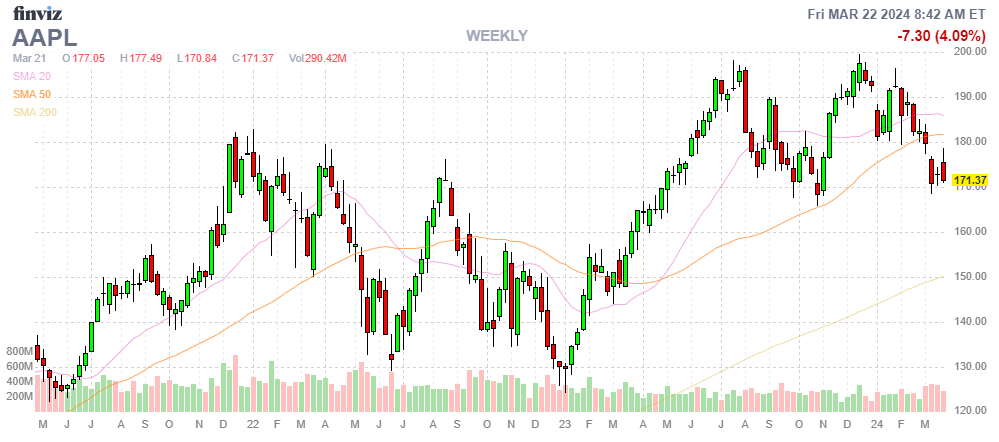

Just as AAPL was crossing the $3 TRILLION mark in valuation, along comes the DOJ to rain on their parade of profits – and Europe is right behind with their own likely fines. The U.S. Justice Department, backed by a chorus of 16 attorneys general, is accusing Apple of antitrust violations, while Europe is probing the company under its Digital Markets Act. The immediate fallout? A cool $113 Billion wiped off AAPL’s market value, with shares tumbling 4.1% and year-to-date losses deepening to 11% ($300Bn!).

At the heart of the U.S. lawsuit is the claim that Apple has been playing gatekeeper a tad too zealously, effectively stifling innovation by restricting rivals’ access to its hardware and software ecosystems. The allegations paint a picture of a digital fortress, with Apple accused of blocking everything from cross-platform messaging apps to third-party digital wallets and cloud streaming services. The European angle is somewhat similar, focusing on Apple’s app store fees and terms that could be seen as anti-competitive.

Apple’s defense is practically a love letter to its own innovation ethos, arguing that the lawsuit misunderstands both the facts and the law (not really what you want to be saying to the DOJ and 13 AGs), and warning of a “dangerous precedent” that could stifle technology and design. The company’s stance is clear: it believes in its right to craft an ecosystem that prioritizes user experience, privacy, and security, even if that means keeping a tight rein on its app store and device functionalities.

The Digital Markets Act looms large in this drama, threatening hefty fines for non-compliance, and adding another layer of complexity to Apple’s European operations. This comes on the heels of a €1.8 billion fine for restricting music streaming competition, underscoring the EU’s aggressive stance on tech regulation – here are the other companies in their cross-hairs:

The very qualities that make the iPhone “awesome” are at the center of this antitrust storm. The argument here is that Apple’s “Authoritarianism” in curating the iPhone experience is precisely what sets it apart from the Android ecosystem. The implication is that dismantling this curated experience in the name of competition could dilute the iPhone’s magic, making it less secure, less intuitive, and ultimately, less appealing.

In essence, the case against Apple challenges the fine line between innovation-led market dominance and anticompetitive practices that stifle rivals. It’s a classic antitrust dilemma: at what point does a company’s quest to deliver a seamless, integrated product experience cross over into monopolistic behavior that harms consumers and stifles competition?

For us, watching from the sidelines with a keen interest in market dynamics, this saga is not just about legal battles and regulatory fines. It’s a case study in how innovation, competition, and regulation intersect in the digital age. It’s about understanding the broader implications for the tech industry and the stock market, where regulatory scrutiny can erode Billions of investor value overnight, even if it does potentially open up new avenues for competition and innovation.

Let’s keep our eyes peeled for the broader market implications, the potential for regulatory overreach, and the ever-present question of what this means for investors and consumers alike. In the grand chess game of tech regulation, Apple’s next move will be closely watched, and it could set precedents that shape the industry for years to come.

🤖 Diving into Apple’s current predicament, let’s break down the situation. With Apple’s stock down 11% this year, standing at $171 and valuing the company at approximately $2.65 trillion with a P/E ratio of 26.65, the question of whether it’s a ripe bargain opportunity to “buy the dip” or a scenario to cautiously avoid is indeed confounding.

Buy on the Dip?

1. Innovation and Ecosystem Strength: Apple’s unparalleled ability to innovate and its robust ecosystem are significant moats. The company’s track record of delivering high-quality products and services that seamlessly integrate with one another creates a loyal customer base willing to pay premium prices. This loyalty not only sustains revenue streams but also provides a buffer against short-term market fluctuations.

2. Financial Health: Apple’s financials remain strong, with a solid balance sheet, substantial cash reserves, and a history of delivering shareholder value through dividends and share buybacks. These factors provide a cushion against regulatory fines and the costs associated with compliance or restructuring if required.

3. Market Position and Brand Value: Despite regulatory challenges, Apple’s brand remains one of the most valuable globally. Its market position in various segments, including smartphones, wearables, and services, continues to be robust. The company’s ability to enter and dominate new product categories should not be underestimated.

Stay Away?

1. Regulatory Risks: The ongoing antitrust lawsuits and investigations in the U.S. and Europe present significant risks. The outcomes are uncertain and could result in substantial fines, forced changes to Apple’s business model, or restrictions that could hamper its operational efficiency and profitability.

2. Market Sentiment and Volatility: The stock market is sensitive to regulatory news, and further developments in the antitrust cases could lead to increased volatility in Apple’s stock price. The potential for negative headlines in the short to medium term could impact investor sentiment and stock performance.

3. Valuation Concerns: Even with the dip, Apple’s P/E ratio of 26.65 might still be considered high by some investors, especially in a market environment where tech stocks are being reevaluated in light of interest rate hikes and inflation concerns. The question remains whether the current price fully accounts for the regulatory risks and potential growth headwinds.

Dissecting the potential impact of regulatory actions on Apple’s revenues and profits requires a nuanced understanding of its business model and the specific segments that could be affected by regulatory decisions. While exact figures can be elusive without detailed internal data, we can sketch a broad outline based on publicly available information and reasonable assumptions.

Revenue and Profit Sources for Apple

Apple’s revenue streams are diversified across several segments:

-

- iPhone: Historically, the iPhone has been Apple’s cash cow, contributing a significant portion of its revenue and profits.

- Services: This includes the App Store, Apple Music, iCloud, Apple Pay, and various subscription services. The Services segment has been growing steadily, becoming a more significant part of Apple’s revenue mix.

- Wearables, Home, and Accessories: This includes the Apple Watch, AirPods, and other accessories.

- Mac and iPad: Sales of Mac computers and iPads also contribute to Apple’s revenue, with varying degrees of significance over time.

Potential Impact of Regulatory Decisions

-

-

App Store Revenues: The DOJ and EU’s focus on dismantling parts of what makes the iPhone and iPad ecosystem so tightly integrated could have a direct impact on the Services segment, particularly the App Store. If Apple is forced to allow alternative app stores or sideloading of apps, it could lose a portion of the revenue it currently generates from app sales and in-app purchases. Considering the Services segment accounted for around 19% of Apple’s total revenue in recent quarters, with a significant portion of that likely coming from the App Store, the impact could be substantial.

-

Device Sales: Any regulatory decision that undermines the seamless integration of Apple’s hardware and software could potentially affect the desirability of Apple’s devices. This could impact sales of iPhones and iPads, which are critical to Apple’s revenue. However, the magnitude of this impact would depend on how significantly the user experience is affected, which is hard to quantify without knowing the specifics of any regulatory actions.

-

Cross-Device Ecosystem: Part of Apple’s appeal lies in its ecosystem’s interoperability—how devices like the iPhone, iPad, Apple Watch, and Mac work seamlessly together. Regulations that force Apple to open up this ecosystem could dilute its uniqueness and potentially impact sales across all hardware segments.

-

Estimating the Impact

While it’s challenging to pinpoint a precise percentage of revenues and profits that could be affected without specific regulatory outcomes, a rough estimate could suggest that a significant portion of Apple’s Services revenue (potentially up to half, given the importance of the App Store) could be at risk, along with an indeterminate impact on hardware sales due to ecosystem changes. This could translate to a low double-digit percentage impact on overall revenues and potentially a higher impact on profits, given the high margins in the Services segment.

However, it’s crucial to consider Apple’s history of resilience and adaptability. The company has navigated past challenges, including regulatory ones, by innovating and adjusting its business model. Moreover, the global loyalty to the Apple brand and the continued demand for its products provide a buffer against potential negative impacts.

In conclusion, while the threat from DOJ and EU regulatory actions is non-trivial and could affect a significant portion of Apple’s revenues and profits, the exact magnitude would depend on the specifics of the regulatory outcomes and Apple’s responses. Given Apple’s track record, it’s reasonable to expect the company to find ways to mitigate these impacts over time.

Strategic Consideration:

Given these factors, the decision to buy on the dip or stay away hinges on your investment horizon and risk tolerance. For long-term investors who believe in the company’s fundamental strengths and its ability to navigate regulatory challenges, this dip could represent a buying opportunity. Apple’s history of innovation, strong financials, and market leadership position it well to continue delivering value over the long term.

However, for those with a shorter investment horizon or lower tolerance for regulatory and market volatility, it might be prudent to adopt a wait-and-see approach. Monitoring the developments in the antitrust cases and assessing their potential impacts on Apple’s business model and market position would be wise before making a commitment.

I’d lean towards viewing this as a strategic buying opportunity for those with a long-term perspective. Apple’s core strengths and its ability to adapt and innovate, even in the face of regulatory pressures, suggest that the company is likely to continue being a dominant force in the tech industry. However, keeping a close eye on the unfolding regulatory landscape and being prepared to reassess the situation as new information emerges is crucial.

Have a great weekend,

-

- Phil & Warren