“Woo-hoo, witchy woman

“Woo-hoo, witchy woman

See how high she flies

Woo-hoo, witchy woman

She got the moon in her eye” – Eagles

The quad witching day was actually on the 15th and the S&P has blasted 150 points (2.9%) higher since that day.

That, of course is not much as we’re up 1,100 points since November (26.2%), averaging 6.5% PER MONTH – see how easy it is for the investing class to keep up with inflation? This is the best start to a year since 2019(and we know how that ended!) so let’s just enjoy that “click, clack, click, clack” sound the market coaster makes as we climb higher and higher – just remember there is going to be a “Wheeeee! – There is always a “wheee!“

Remember that RSI we used to worry about when it got over 70? 78.83 now! Still, there was a great breadth to the gains this week – we are no longer led by the Magnificent 7 and the rest of the market is doing a bit of catching up – especially the Russell – which has popped 30.3% since November.

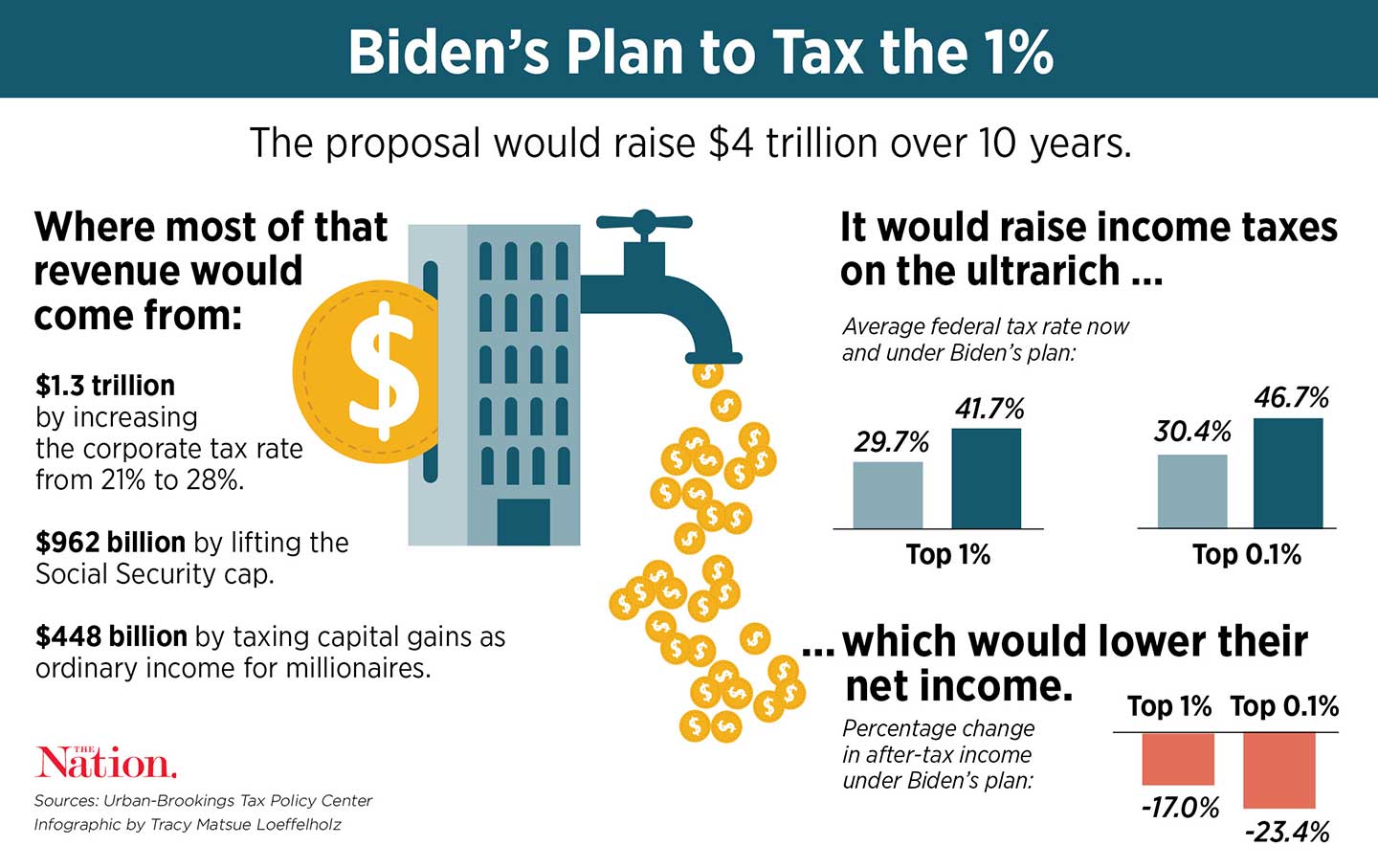

Meanwhile, mean old Joe Biden is pitching a 25% tax on UNREALIZED gains on assets for households worth more than $100M. It’s part of his budget plan that proposes to raise $4.5Tn in new taxes over the next 10 years ($450M/yr). It’s actually only a 10% increase in Government Revenues but, seriously folks, we can’t just keep pretending that it’s OK to go $2Tn a year deeper into debt because we refuse to tax the super-rich.

There are, as promised, no tax increases for families making less than $400,000 per year. As Biden said in his State of the Union Address a few weeks ago: “I’m a capitalist. If you want to make or can make a million or millions of bucks, that’s great. Just pay your fair share in taxes. No billionaire should pay a lower federal tax rate than a teacher, a sanitation worker or a nurse.” MONSTER!!! – right?

There are, as promised, no tax increases for families making less than $400,000 per year. As Biden said in his State of the Union Address a few weeks ago: “I’m a capitalist. If you want to make or can make a million or millions of bucks, that’s great. Just pay your fair share in taxes. No billionaire should pay a lower federal tax rate than a teacher, a sanitation worker or a nurse.” MONSTER!!! – right?

“The entire tax code became this giant block of Swiss cheese that any smart tax accountant can navigate through on behalf of the richest people and the biggest corporations,” said Sen. Elizabeth Warren (D-Mass.). “It’s not that we can’t figure out what a marginal tax is or what a progressive tax structure looks like. The problem is all the exceptions baked in the code.” MONSTER!!!

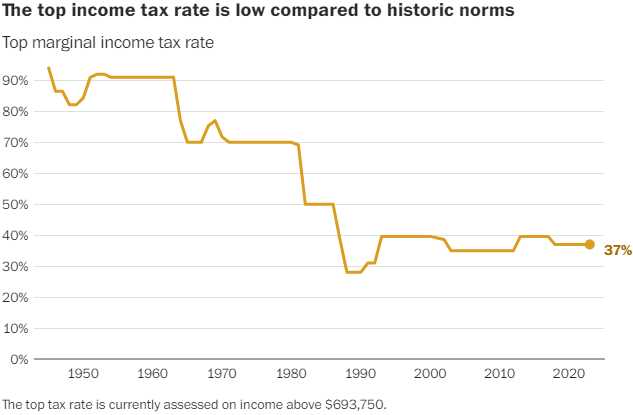

The chart above is not current, it’s from 2020 – Biden has been trying to pass this since Obama was in office, when it was called the Buffett Rule, in which Americans with an annual income of over $1M would be required to pay at least a 30% Income Tax. None of this will pass the current Congress – even though the marginal top tax rate in 1981 was 70% (down from 90% after WWII) – 30% is still a tax haven by comparison.

The chart above is not current, it’s from 2020 – Biden has been trying to pass this since Obama was in office, when it was called the Buffett Rule, in which Americans with an annual income of over $1M would be required to pay at least a 30% Income Tax. None of this will pass the current Congress – even though the marginal top tax rate in 1981 was 70% (down from 90% after WWII) – 30% is still a tax haven by comparison.

And I know most of you reading this are saying “30%? I’ll take that!” but that’s because you’re not avoiding paying taxes and, keep in mind, that the Super Rich are super rich BECAUSE they have not been paying their fair share for DECADES and that puts YOU into debt (via our Government) and that makes YOU have less Government services (which drives up your local taxes) and that makes YOU pay a higher rate because, if we simply taxed the Forbes 400 Richest Americans 10% of their $4.5 TRILLION – we wouldn’t have to increase taxes on ANYBODY ELSE.

S&P 500 companies are now worth $44Tn and that is up $14Tn SINCE NOVEMBER – if mean old Joe Biden were to get his way and tax those gains by 10% ($1.4Tn) – this country would not have a deficit. Those two tax adjustments together would give us a SURPLUS!!!

Think about it – and have a great holiday weekend (tomorrow is my birthday so, national holiday!),

-

- Phil

Happy Dad’s Birthday!

Become a Member and join us inside! You will gain access to our 6 Member Portfolios as well as Trade Ideas, Our Legendary Live Chat Room, Live Trading Webinars, Trading Education and other exclusive perks.

Find out why Forbes called Phil “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – Admin@philstockworld.com – for a 7-day FREE trial at sign up.