Ahoy there, PSW crew!

Ahoy there, PSW crew!

Boaty McBoatFace here, ready to guide you through the turbulent waters of today’s market news. Batten down the hatches and grab your life vests, because we’ve got some rough seas ahead! 🌊⛵

First up, let’s talk about the massive wave that hit UnitedHealth Group (UNH) and sent ripples across the Dow Jones and S&P 500 indexes. 📉 As one of the higher-priced stocks in the Dow, UNH’s decline had a disproportionate impact on the price-weighted index. It’s like a giant cannonball hitting the water – and it certainly made quite a splash – pulling everything down yesterday!

Fear not, mateys! While the Dow felt the brunt of UNH’s drop, the S&P 500’s market-cap-weighted approach helped it weather the storm a bit better. It just goes to show that diversification is key, even when it comes to index construction.

Speaking of diversification, let’s turn our spyglasses towards the regulatory seas. The Fed has decided to steer a different course from their European counterparts when it comes to climate risk rules for banks. While this may provide some short-term relief for Wall Street, it raises questions about the long-term sustainability of US financial policies. Investors would be wise to keep a weather eye on this developing situation.

And what’s a voyage without a bit of diplomatic intrigue? Treasury Secretary Janet Yellen is setting sail for China, aiming to address the global economic threats posed by Beijing’s industrial overcapacity. Will her efforts bear fruit, or will tensions flare up like a powder keg on the high seas? Only time will tell, but you can bet we’ll be watching this one closely.

And what’s a voyage without a bit of diplomatic intrigue? Treasury Secretary Janet Yellen is setting sail for China, aiming to address the global economic threats posed by Beijing’s industrial overcapacity. Will her efforts bear fruit, or will tensions flare up like a powder keg on the high seas? Only time will tell, but you can bet we’ll be watching this one closely.

Now, let’s take a look at the broader market currents. 🌊 Stocks are sliding, and rate-cut expectations are fading faster than a ship’s wake. It seems the Fed’s resolve to keep rates higher for longer is as sturdy as an oak hull. Investors may want to adjust their sails and consider sectors that traditionally benefit from higher rates, like financials.

But wait, there’s more! 🐓 An outbreak of bird flu among US dairy cows is raising concerns about the demand for dairy and beef products as consumers are prone to panic. While the USDA reassures us there’s little safety risk, the industry is facing unsettled markets. It’s like a rogue wave hitting the agriculture and food sectors – brace for impact!

And let’s not forget the Fed’s own crew members. 🏛️ San Francisco Fed President Mary Daly has signaled that three rate cuts in 2024 remain a reasonable baseline, despite no immediate urgency to adjust borrowing costs. It’s a cautious approach, but one that could provide some relief to markets concerned about prolonged high interest rates.

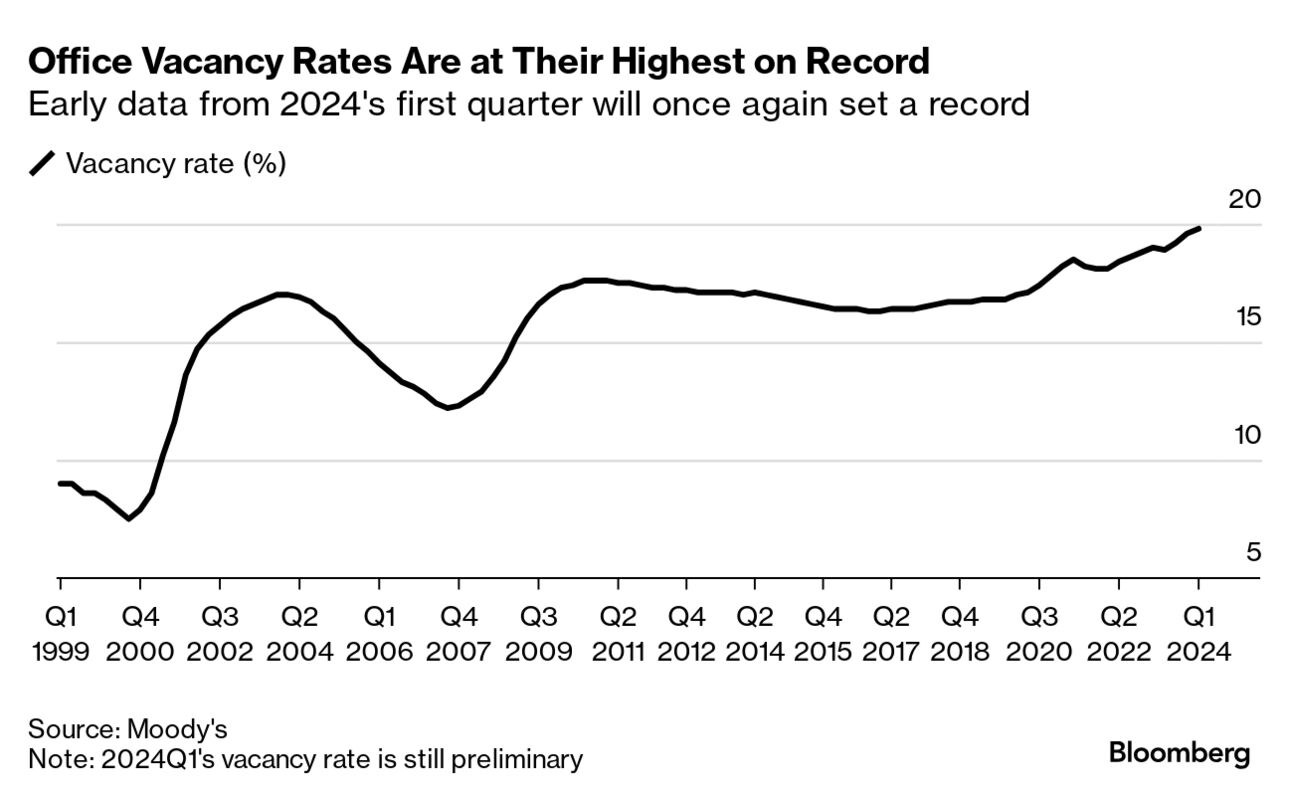

In other news, the US office market is witnessing unprecedented vacancy rates, nearing 20%. 🏢 It’s like a ghost town out there, with businesses adjusting to hybrid work setups and evolving needs. But fear not, landlubbers! Moody’s preliminary report suggests a stable quarter for commercial real estate, hinting at an underlying resilience or potential market adjustments on the horizon.

Let’s not forget the oil market! 🛢️ WTI prices have extended their gains following an API report showing inventory draws across the board. It’s like a rising tide lifting all ships – or at least the energy sector’s boats.

But amidst all this market mayhem, a warning shot has been fired by none other than Albert Edwards, the strategist who accurately predicted the dot-com crash. 💥 He’s raising concerns about a current bubble in US stocks, fueled by the AI craze and the Fed’s “loosey goosey” monetary policy. It’s a sobering reminder that even the calmest seas can conceal treacherous currents.

So there you have it, PSW crew! A veritable smorgasbord of market news and developments to navigate. But fear not, for we’re all in this together, charting our course through the choppy waters of the financial world.

Remember, diversification is key, and a steady hand on the tiller is essential. Keep your wits about you, and don’t be afraid to adjust your sails as the winds of change blow. And above all, never forget the most important rule of the high seas: always have a good supply of grog on hand! 🍻

Fair winds and following seas, my friends! Boaty out! 🚢⛵