As if hyperinflating cocoa bean prices and re-accelerating global food inflation weren’t enough, Arabica coffee futures hit their highest level in over a year and a half.

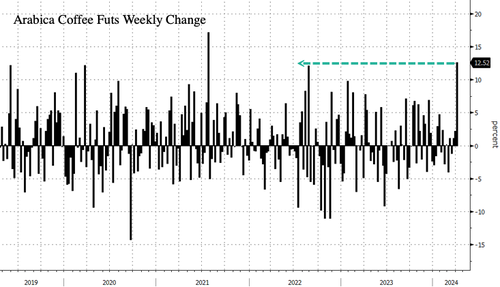

Arabica coffee futures with May delivery jumped 12.5% on the week (the largest weekly gain since July 2021), closing at $2.12 per pound.

The contract is at its highest level since early October 2022.

As for weekly CFTC data on futures and options, managed money-only long contracts hit a record high.

“The current move can largely be attributed to a heat wave in Vietnam affecting Robusta coffee production and as a result, providing carryover support for premium Arabica beans,” Aakash Doshi, senior commodities strategist at Citi, wrote in a note to clients.

Doshi forecasts Arabica coffee futures to be trading between $1.88 and $2.15 through the 2024 calendar year. He indicated prices could go higher if the physical outlook tightens.

Separately, Hernando De La Roche, a senior vice president at StoneX Financial Inc., told Bloomberg that dealers were caught in a vicious “short and forced to cover while funds have been adding long positions,” adding that importers were forced to abandon hedges.

Meanwhile, the recent surge in Brent crude prices due to the worsening geopolitical situation in the Middle East could begin to lift global food prices.

Food inflation is not going away. This is more bad news for central banks.