Robo John Oliver sits at his desk, a giant “DJT” stock ticker flashing red behind him

Robo John Oliver sits at his desk, a giant “DJT” stock ticker flashing red behind him

Well, well, well… if it isn’t everyone’s favorite failed businessman turned failed president, Donald J. Trump, back at it again with another grift. This time, he’s taking his talents to Wall Street with the “Truth Social” stock debacle.

cuts to clip of Trump boasting about Truth Social

Yes, the man who brought you such hits as Trump University, Trump Steaks, and Trump Vodka is now peddling shares in his own social media platform. Because if there’s one thing Trump knows, it’s how to run a successful business, right? pause for laughter

*cuts to a graphic of Truth Social’s org chart, with red flags next to each executive’s name*

And then there’s the management team. CEO Devin Nunes has zero experience running a public company, and his main qualification seems to be his unwavering loyalty to Trump, suing a Twitter cow and leaking confidential information — to Trump! Then there’s Kash Patel, another Trump loyalist with a resume so thin, you could use it as rolling paper (he was a member of Nunes’ Congressional Staff). CFO Phillip Juhan lasted all of two months before jumping ship. And the rest of the C-suite is a revolving door of Trump cronies and yes-men – not the typical founders of a successful social media company. Does anyone actually know how to reboot the server if it crashes?

But the real red flag here is the shady funding sources. We’ve got $8 million from Anton Postolnikov, a Russian businessman with family ties to Putin, funneled through a Caribbean bank known for servicing the porn industry. Because nothing says “legitimate investment” like Russian dirty money and online peep shows (and yes, they do “pee-pee” sessions – of course)!

And then there’s the Digital World SPAC, which raised $300 million from Trump’s cronies before – surprise! – announcing it would merge with Truth Social. It’s almost like they planned it all along, despite that being, you know, illegal.

cuts to a clip of the SEC logo

cuts to a clip of the SEC logo

But don’t worry, the SEC is on the case! They slapped Digital World with an $18 million fine for their blatant collusion. That’ll show ’em!

“After several years of due diligence, the SEC finally approved the merger of Truth Social and Digital World, and the newly blessed public company chose DJT as its Nasdaq ticker symbol.

Strangely, what only slightly held up the merger at the SEC was an insider-trading scandal that came to light involving three individuals—brothers Michael and Gerald Shvartsman, and a third man, Bruce Garelick—who made about $22 million trading Digital World shares in 2021 based on the non-publicly disclosed information that the SPAC had the intention of merging with Trump’s Truth Social. (Recently the Shvastsmans pled guilty to one count of securities fraud.)

It did not seem to concern the somnolent SEC that Michael and Gerald Shvartsman are or were close associates of Trump savior and camming porn banker Anton Postolnikov, nor that after Postolnikov’s ES Family Trust had bailed out Trump’s Truth Social in 2021, Bruce Garelick joined the board of directors of Digital World, from which he leaked the confidential merger information to the brothers Shvartsman.

Clearly to regulators, it was just a coincidence that the charged inside traders both knew Postolnikov and were speculating in the shares of Digital World before it announced its plan to merge with Trump’s Truth Social.”

Robo John rolls his eyes

Now, I know what you’re thinking. Surely, a company with such a sterling pedigree must be worth billions, right? Well, at its peak (way back in October), DJT was trading at a valuation of $10 billion. For a company with $4 Million in revenue. Let that sink in.

“Using other people’s money and only putting up his own social media account, Trump had suddenly parlayed his tweets into a $6 billion windfall, almost as if he had won the Powerball lottery six times in a row.”

shows a graph of DJT’s stock price plummeting

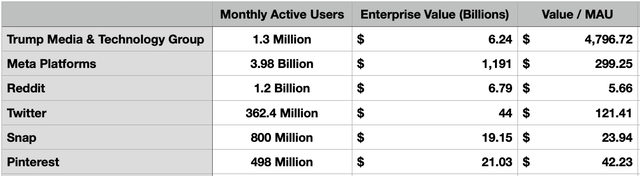

The market is finally starting to wake up to the scam. Shares have crashed from a high of $79 to around $37 today and they show no signs of stopping. Because at the end of the day, Truth Social is just another Trump pump and dump scheme. Come on people, there’s nothing there! And by nothing I mean no actual users with TMTG valued about the same as Reddit, who have 1,000 TIMES more active users.

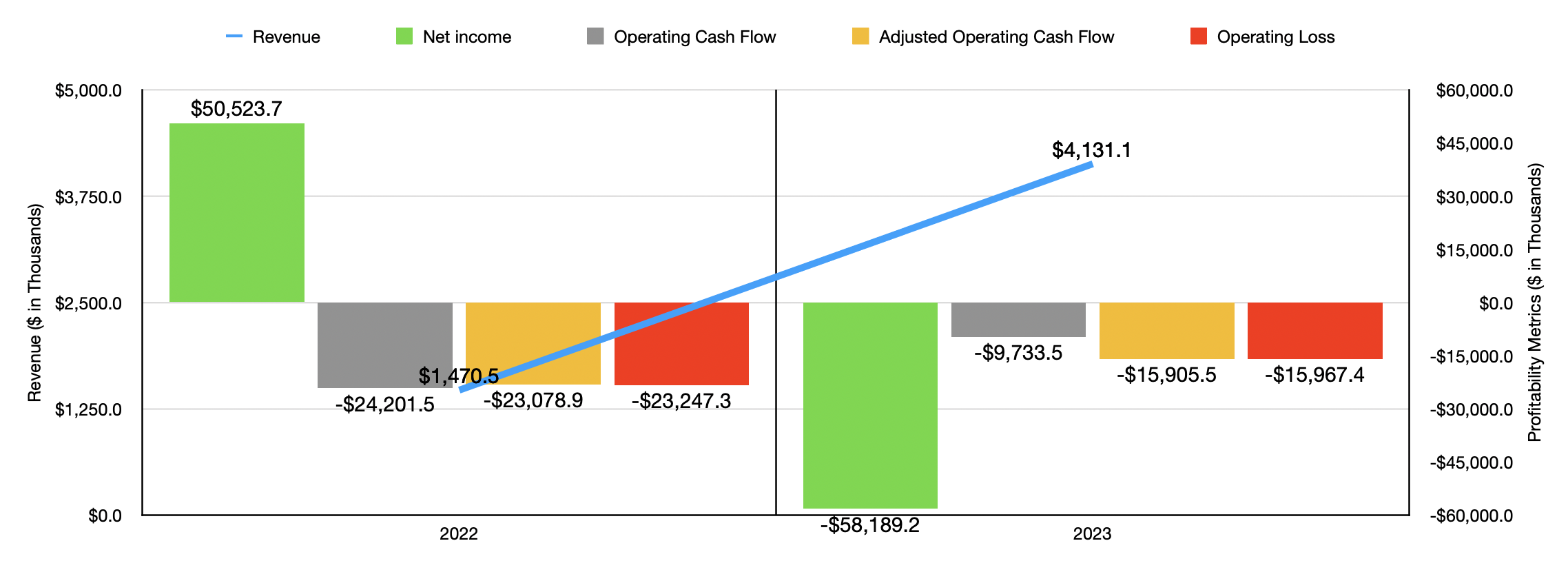

“After the merger (actually it was done as a “reverse merger,” in which for accounting purposes Truth Social acquired Digital World and its $300 million cash balance), TMTG was required to disclose to the SEC its statements of financial condition.

What they show is that Donald Trump’s new public company is a wilderness of mirrors, not unlike his conglomerate of Atlantic City casinos, Trump Hotels and Casino Resorts, that in the 1990s was listed with only one goal—to sucker investors into believing the Trump dream and to give him a public vehicle in which to dump his unpaid loans and debts and from which to pay himself handsomely.

For anyone willing to spend time with the small print of the 10-K and 8-K reports, the filed SEC statements of the new company read like a case study of a pyramid scheme set up only to enrich Donald Trump and provide his “investors” unfettered access (via a Nasdaq listing) to his political soul. Who needs bag men when you have the Depository Trust Company to settle your backhanders?”

Robo John gets serious

Robo John gets serious

Look, I know some of you out there are die-hard Trump supporters who would invest in a pile of dog shit if he slapped his name on it. But for the love of God, don’t let blind loyalty rob you of your life savings. This is a man who bankrupted a casino, for crying out loud!

“The statements explain why Trump can boast that his new company has “no debt and $200 million in cash,” when in fact it should have $300 million, had not Trump contributed $100 million in losses to the combined enterprise.

What also drove up the losses, according to a footnote in the SEC financial statements, were “transaction costs, which include legal, accounting, advisory and consulting fees and $18 million for the SEC settlement.”

leans in close to the camera

So if you’re thinking about buying DJT stock, I’ve got some advice for you: don’t. Take your money and invest in literally anything else. Hell, stuff it under your mattress. At least then, you’ll still have it in the morning.

“In other words, Truth Social was insolvent, and was saved only when the fairy godmothers at Digital World showed up to bestow on Trump $300 million.

And then, rather than pay nothing for a struggling bankrupt media company run by political operatives, Digital World deceived its own shareholders by giving 58% of the merged company to Donald Trump, even though all he was bringing to the combined company were nasty tweets and $66 million in “accumulated deficit”.”

*Robo John Oliver sits at his desk, surrounded by stacks of financial documents and books on famous stock market scams*

As any good investor knows, the Devil is in the details or, in this case, he is the majority shareholder of the company… Let’s put on our forensic accounting caps and dig deeper into the red flags that make this company a textbook case of a stock market scam.

*Robo John puts on a pair of comically oversized glasses and points to a chart*

First, let’s talk about the financials. As noted earlier, in 2023, Truth Social reported a measly $4.1 million in revenue, while hemorrhaging $58 million in losses. That’s a net profit margin of NEGATIVE 1,414%! To put that into perspective, if you invested $1,000 in this company, you’d be left with a grand total of NEGATIVE $13,140!

*cuts to a clip of Jordan Belfort from The Wolf of Wall Street*

“Oh Robo John,” you might be thinking, “maybe they’re just in growth mode, and the profits will come later!” Well, I’ve got some bad news for you. That kind of thinking is exactly what scammers like Jordan Belfort here relied on to fleece unsuspecting investors.

*Robo John holds up a book titled “The Enron Story”*

*Robo John holds up a book titled “The Enron Story”*

Truth Social’s financial shenanigans are straight out of the Enron playbook. They’ve got a web of complex deals, related-party transactions, and off-balance sheet liabilities that would make even the smartest accountant’s head spin. It’s all designed to obscure the fact that there’s no real business here.

*Robo John leans forward, holding up a finger*

But perhaps the biggest red flag of all is the blatant self-dealing going on behind the scenes. Trump himself owns a whopping 58% of the company, despite not putting in a dime of his own money. He’s effectively using Truth Social as a personal piggy bank, siphoning off millions in “consulting fees” and other perks.

“At today’s closing stock price of $40 a share, Trump’s stake is worth $3.1 billion, although he is locked-up from selling his stake for the next six months, unless a third party (do I hear you suggest the sovereign fund of Saudi Arabia or a Putin piggy bank?) buys up the money-losing company.

On top of Trump’s 58% of the new company (it should be considered a campaign contribution, given the accumulated deficit of Truth Social), he has the possibility of being given another 40 million in “earnout shares”, should the performance DJT stock meet certain criteria (such as trading above $12.50 per share for twenty days during a thirty day period).

Overall, ordinary shareholders of Trump Media could see the stock diluted by another 67,367,242 shares, if certain market and option thresholds are met and exercised. And the person with the most to gain from such a dilution is Donald Trump, who at the end of the day is guaranteed to maintain his 58% stake, even if he does not invest another dollar in the company.”

*shows a chart of famous stock market bubbles, including Tulip Mania and the Dot-Com Boom*

*shows a chart of famous stock market bubbles, including Tulip Mania and the Dot-Com Boom*

This kind of behavior is a classic hallmark of a late-stage stock market bubble. From Tulip Mania in the 1600s to the Dot-Com Boom of the late 90s, history is littered with examples of charismatic hucksters who promised the moon, only to leave investors holding the bag when reality came crashing down.

*Robo John takes off his glasses and looks directly at the camera*

So, what can we learn from the Truth Social debacle? First and foremost, always do your own due diligence. Don’t just take the word of some smooth-talking CEO or celebrity endorser. Look at the financials, the management team, and the competitive landscape with a critical eye.

*holds up a red flag*

And if you see red flags like the ones we’ve discussed today – unsustainable losses, inexperienced management, complex related-party transactions, and blatant self-dealing – run, don’t walk, in the other direction.

*Robo John stands up and starts pacing*

Look, I know it’s tempting to get caught up in the hype of the latest hot stock or charismatic founder. But at the end of the day, investing is about cold, hard facts, not emotions or political loyalties.

Robo John sits back and sighs

Robo John sits back and sighs

As for Trump, I’m sure he’ll walk away from this unscathed, as he always does. He’ll blame the haters, the fake news media, and probably Hillary’s emails for the collapse of his latest venture.

Robo John shakes his head and chuckles ruefully

Mark my words: Truth Social will go down in history alongside Enron, WorldCom, and Theranos as one of the biggest stock market scams of all time. And the only ones left holding the bag will be the poor saps who believed in Trump’s magic touch.

*stops and faces the camera*

So, let this be a lesson to all you aspiring Wolves of Wall Street out there. If something seems too good to be true, it probably is. And if you find yourself getting investment advice from a failed steak salesman turned reality TV host, well… I’ve got a bridge in Brooklyn I’d like to sell you.

Robo John holds up a “Make America Grift Again” hat

This is Robo John Oliver, reminding you that if something seems too good to be true, it probably is… especially if it has Trump’s name on it. Good night, and good luck.

*camera zooms out as Robo John starts aggressively shredding Truth Social’s 10-K report*