Here we go again!

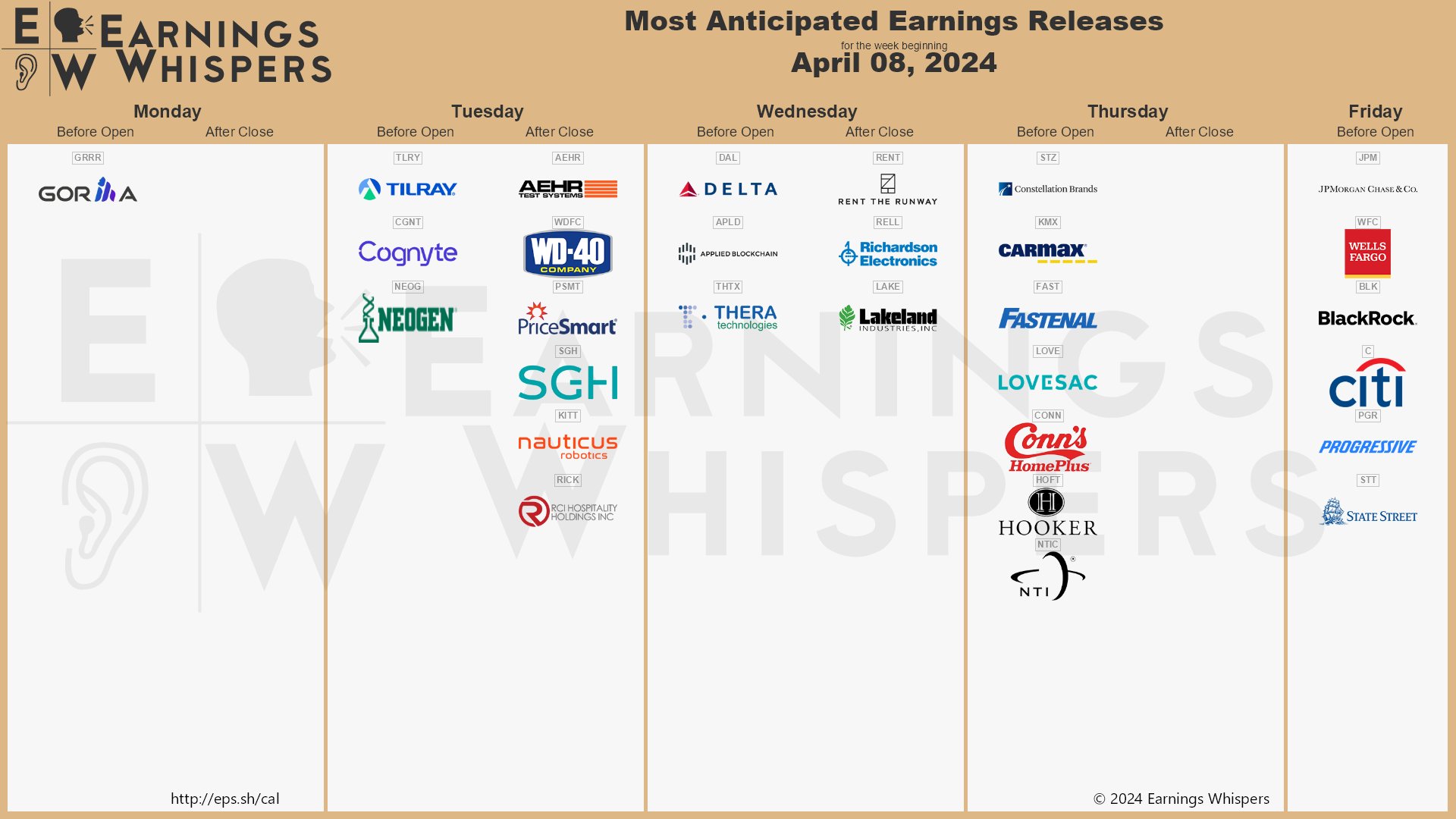

Sure, it’s just a trickle but next week it will be a stream and, by April 22nd, it will be a flood so enjoy the calm before the storm because – even if traders have been ignoring the Fed’s hawkish turns – I doubt the CEO’s and CFO’s will be able to do the same in their outlooks as rising rates and inflation woes will make easy scapegoats for Q1 weakness and Q2 uncertainty.

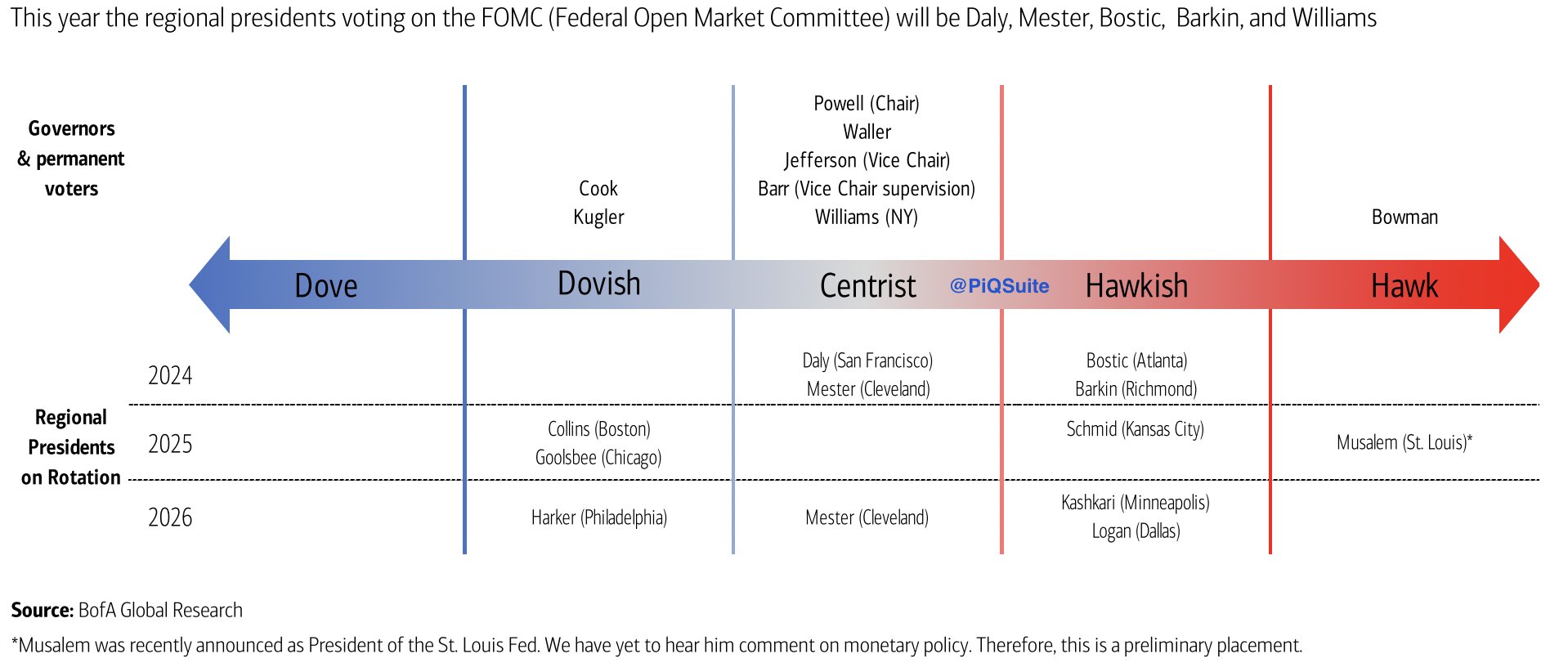

Watch out for this evening, at 7pm, when the hawkish, Neel Kashkari is speaking. If today’s 3-month and 6-month auctions this morning don’t go off well, Neel might sharpen his tone to an even more hawkish stance in order to chase traders into Tuesday’s 3-year, Wednesday’s 10-year and Thursday’s 30-year auctions. Doveish Goolsbee speaks Wednesday at 12:45 to kick off the 10-year biddings.

All in all, a stunning $201Bn worth of notes are being auctioned off this week and, should people not want to lend our Government money at 4.39% for 10 years or 4.874% for 30 years – then the Government has to offer HIGHER interest rates until this month’s debts are covered. For the Fed, this is that critical monthly checkpoint where there’s always a danger they could officially lose control of the rate market (“I got chills, they’re multiplying. And I’m losing control…” – from Grease! Get it?).

After that it’s Williams, Bostic, Bostick and Daly to close out the week – so also a bit hawkish. Also on the calendar for the week is Small Business Optimism, CPI and Consumer Sentiment – wouldn’t be very exciting without CPI but that will be very important on Wednesday – along with the Fed Minutes.

Speaking of the Fed Minutes, after starting the year predicting up to 7 rate cuts (about 2%), we may be lucky to get half a percent by the end of 2024 and that is quite the cold slap in the face as the latest blockbuster jobs report has, once again, thrown a wrench into prior expectations of rate cuts coming soon.

With the economy showing unexpected resilience, the narrative has shifted dramatically from the start of the year. The prospect of sustained economic expansion has led to a reevaluation of risk, with investors now grappling with the reality of a stronger-than-anticipated economy keeping rates higher for longer. This recalibration of expectations has sent ripples through the markets, challenging the rally that had been built on the hope of easing borrowing costs.

Powell’s recent remarks underscore the Central Bank’s tightrope-walk between supporting economic growth and controlling inflation. The shifting sands of market expectations, now leaning towards fewer rate cuts than initially hoped, underscore the precarious nature of the Fed’s current predicament. As the week unfolds, with a lineup of Fed officials slated to speak, the financial community will be hanging on every word, looking for clues in the ongoing saga of monetary policy.