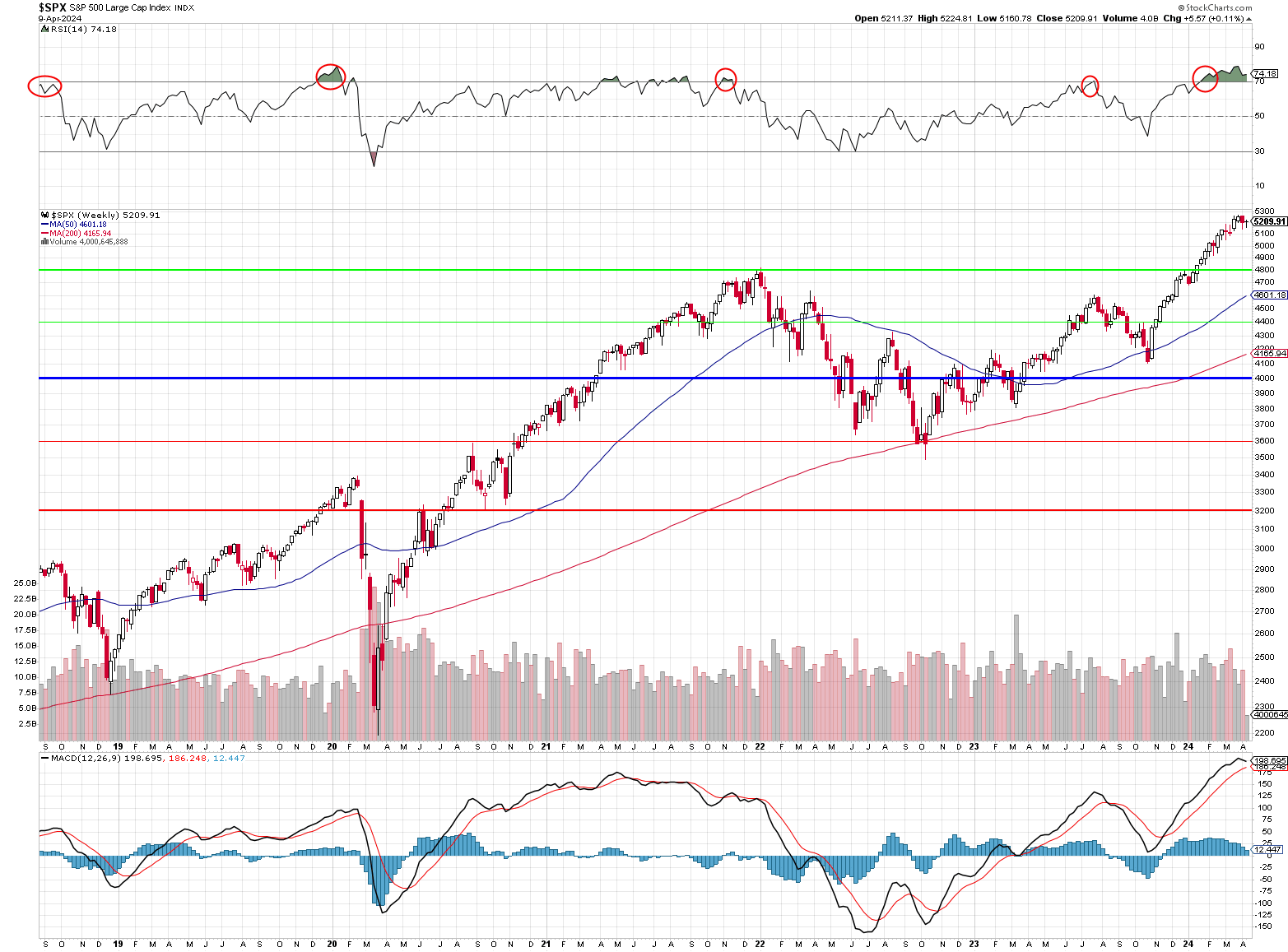

Can we hold 5,200 on the S&P?

We are miles (8.5%) over the top of our expected channel at 4,800 though we COULD make an argument that inflation has added 10% to the channel and 5,200 SHOULD be the top of our range but, either way – we’re toppy! And look at that RSI line – PAINFULLY bloated – like a pimple that’s ready to pop and don’t even get me started on the MACD, which has already begun to invert and will soon enter the dreaded Death Cross phase. NOT a good time to throw caution to the wind!

I haven’t seen enough growth in Earnings to put us back in the 4,800 camp for our mid-range – though I would say I don’t think we will be seeing 3,200 (-38.5%) barring any massive catastrophe (like nuclear war or the complete melt-down of Chinese real estate) but a 10% pullback from here? Easy peasy.

This morning we are waiting on the March CPI report and this will be particularly significant for the Federal Reserve due to the firmer-than-anticipated inflation readings we’ve already seen in the preceding months. Chairman Powell had indicated a willingness to lower rates sooner than some colleagues, highlighting the “highly consequential” nature of the decision to cut interest rates. This stance puts additional pressure on interpreting the March CPI data correctly, as underreacting to earlier Inflation readings could risk an overreaction to a hot March inflation number.

Warren’s Note: Why This CPI Report Is a Potential Powder Keg

-

-

Fed’s Tightrope Walk: The Fed is walking a razor’s edge, trying to cool down inflation without snuffing out growth. Today’s CPI could either vindicate their cautious approach or force a drastic pivot. It’s more than just numbers; it’s a verdict on the Fed’s handling of a high-stakes economic balancing act.

-

Market on a Hair Trigger: The markets are wound tight, with every investor’s finger twitchy on the sell button. The CPI report is the match that could ignite a rapid reevaluation of risk, asset values, and the cost of money. It’s not just a report; it’s a potential starting gun for a race to rebalance portfolios.

-

Investor Strategy at a Crossroads: Today’s data doesn’t just inform; it directs. A hotter-than-expected CPI could reshape strategies overnight, pushing investors towards inflation-resistant assets, hedging strategies, and perhaps a more defensive posture overall.

-

The Verdict

As we stand on the precipice of what could be a defining moment for 2024’s market narrative, “Wednesday Worries” encapsulates the collective apprehension. The CPI data and Fed minutes have the market’s fate in their hands, and we could very well be on the cusp of a correction. For investors, today is not just another day in the market; it’s a moment to reassess, recalibrate, and possibly retrench.

In the grand chess game of market dynamics, today could be the day we see a king put into check. The question now is, how will the board respond?

While this week’s note auctions have gone off well so far, my main concern is for the CPI and rising oil prices. WTIC (/CL) averaged $77 in Feb and we opened March at $80 and averaged more like $81.50 and last March was $72.50 so both year/year and month/month comparisons are going to be ugly.

Gasoline (/RB) has been even worse, jumping from $2.25 in Feb to $2.55 (13.3%) on March 1st and averaging $2.66 (+18.2%) for the month. Natural Gas, on the other hand, went the other way and has been around $1.80 – down 25% from $2.40 last year and that should be good for PPI but not too helpful with CPI.

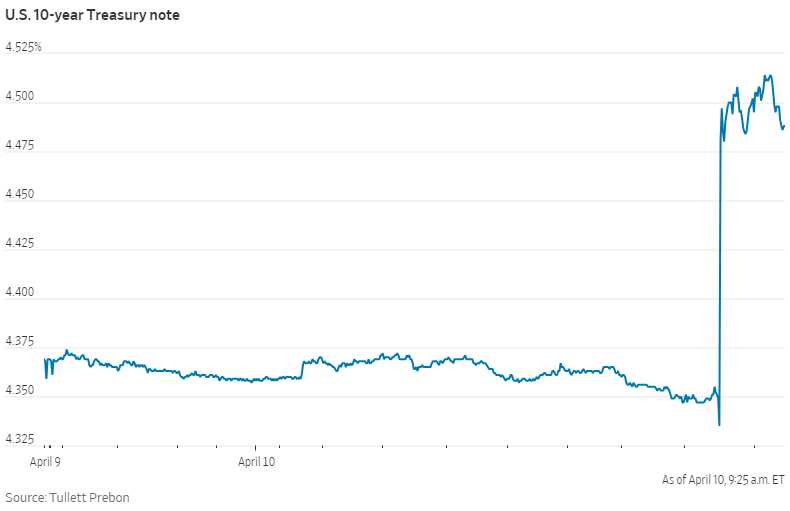

8:30 Update: As we expected (but in a complete surprise to Leading Economorons), CPI came in at 0.4% and CORE CPI came in at 0.4% as well, 33.3% higher than 0.3% expected and that has already sent the Futures into a power-dive of about 500 Dow points:

Now we’ll see what kind of spin we get from Michelle Bowman at 8:45 and Goolsbee speaks at 12:45 and then we get the Fed Minutes at 2pm – after the 10-year note auction at 1pm – so plenty more fun to come today with our Live Trading Webinar coming up at 1pm, EST – see you there!