“Fed Rate Cuts Are Now a Matter of If, Not Just When“

“Fed Rate Cuts Are Now a Matter of If, Not Just When“

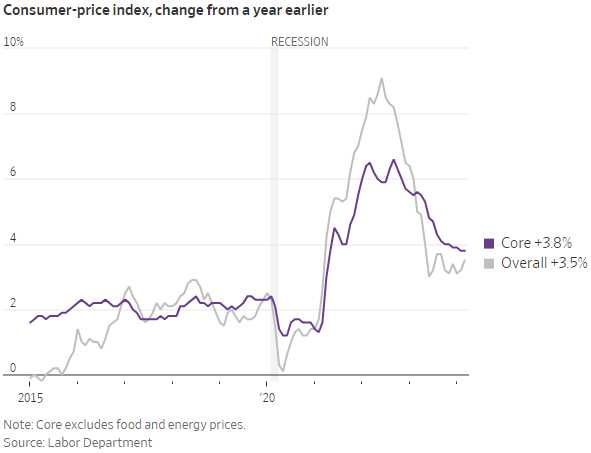

That’s the headline from today’s Wall Street Journal (.com) detailing how recent inflation reports have dashed hopes of a “soft landing” by the Fed, as inflation remains firmer than anticipated. This challenges the Fed’s ability to cut rates without clear evidence of a significant economic slowdown. The possibility of rate cuts is further complicated by solid hiring trends and the likelihood of inflation hovering closer to 3% rather than the Fed’s 2% target.

Powell and other Fed officials had previously hinted at the potential for rate cuts by midyear, contingent upon favorable inflation data. However, with inflation remaining elevated, the Fed is adopting a much more cautious approach, emphasizing the importance of interpreting economic data holistically rather than reacting to individual data points.

The March inflation report, while not significantly different from previous months, has raised questions about the Fed’s ability to achieve a “soft landing” for the economy.

The March inflation report, while not significantly different from previous months, has raised questions about the Fed’s ability to achieve a “soft landing” for the economy.

Investors have been overly confident in the Fed’s ability to navigate these challenges, potentially leading to market volatility if expectations are not met as expectations for 2024 rate cuts have now been dashed on the rocks of economic data. Stubborn inflation pressures persisted in March, derailing the case for the Federal Reserve to begin reducing interest rates in June and raising questions over whether it can deliver cuts this year without signs of an economic slowdown.

Ultimately, it’s NOT the Fed that actually sets our rates but our creditors and, yesterday, the yield on the benchmark 10-year Treasury note settled at 4.559%, marking its highest close since November and its largest single-day increase since September, 2022. An auction of 10-year Treasury notes on Wednesday afternoon was met by soft demand, with the weakest participation from investors since November 2022, according to BMO Capital Markets.

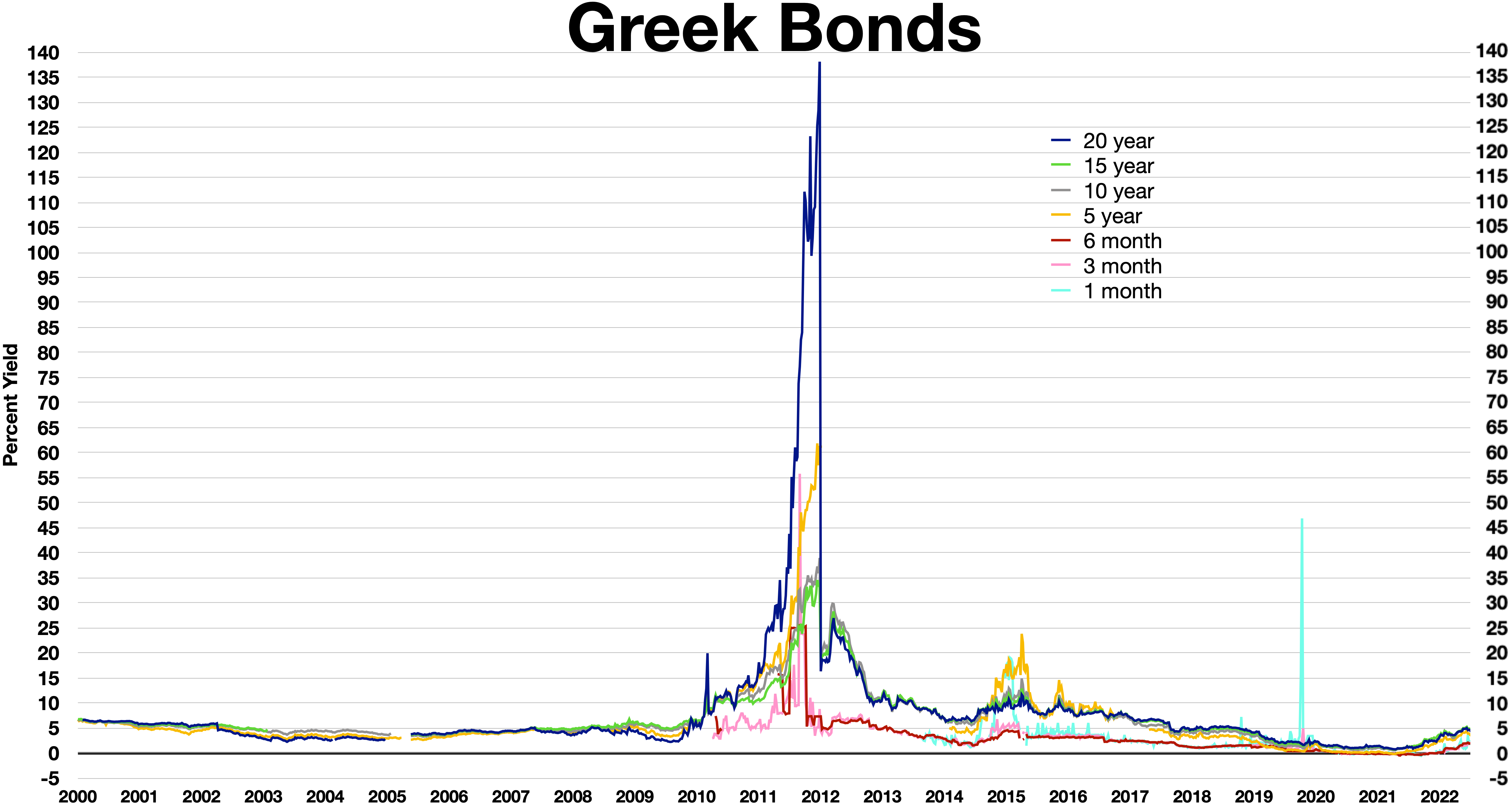

The Fed has the ILLUSION of control but not the actual control – as Greece’s Central Bank discovered in 2008. Here’s what happens when the Central Bank loses control of the narrative:

What actually happened to Greece back then? Well the very short story is Goldman Sachs engaged in some creative accounting on behalf of the Government and the 2009 National Debt was projected to be about $150Bn (about 75% of GDP) but a new Government came in in 2008 and had an audit done and it turned out the National Debt was actually $300Bn – 150% of GDP so, naturally, the value of the current notes crashed and new creditors demanded much higher rates due to the increased risk of lending.

As Greece was part of the EU, they couldn’t just print money to pay off the creditors and that led to the worst 2 years suffered financially by a country since post WW1 Germany. It’s kind of cute to realize that the US just auctioned off $300Bn worth of debt THIS WEEK and that our country, at $35Tn – is now 145% of our own GDP in debt.

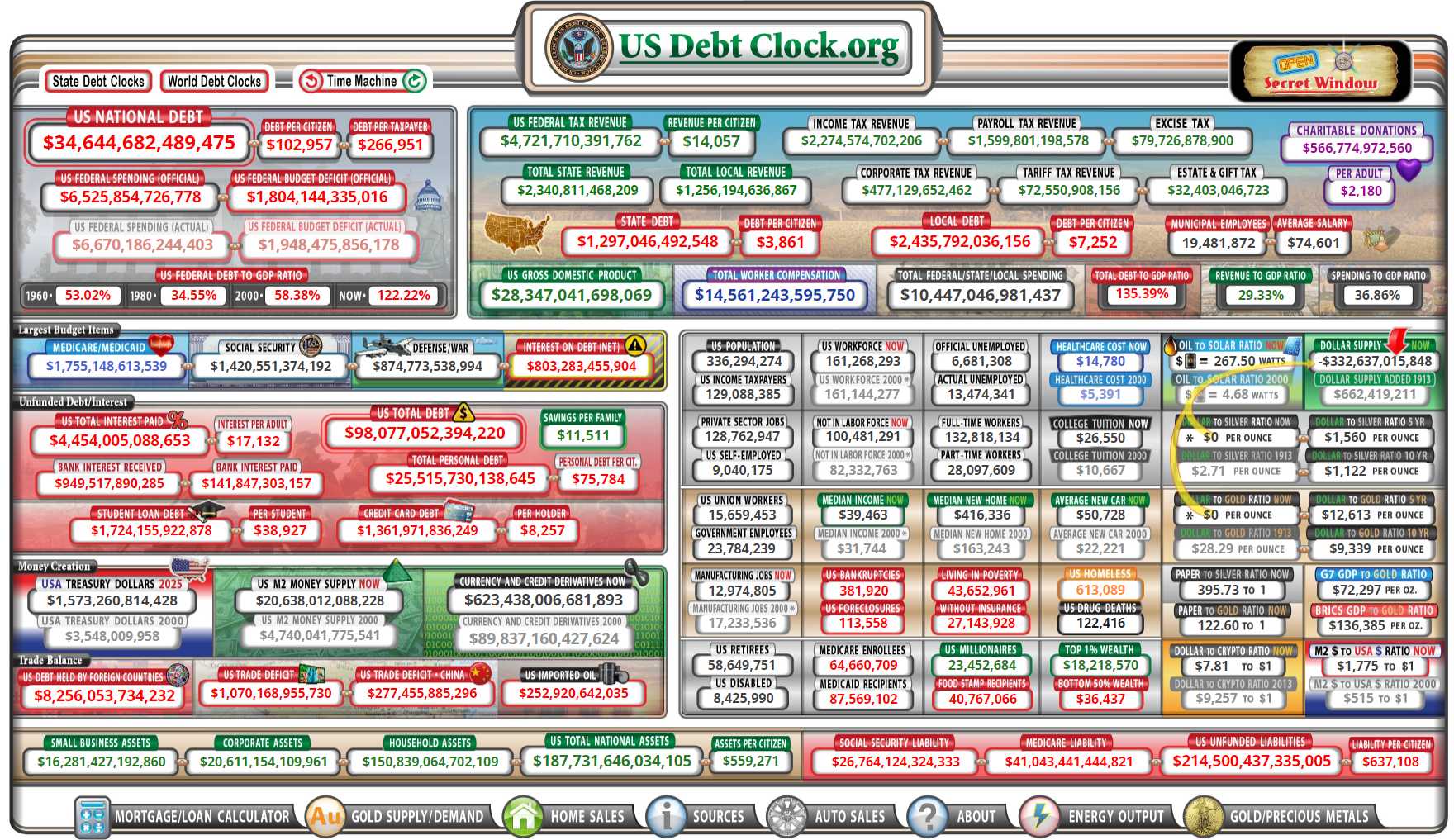

But, fortunately, unlike Greece – we can just keep printing money and the only people get hurt are the people who use money to buy things as inflation erodes the buying power of, not just what we earn, but our entire life savings! It also erodes the buying power of the Government which causes them to borrow more money and cause more inflation which further devalues our buying power and rapidly adds to the national debt to the point where interest on our National Debt is already $803,282,480,695 (as of 7:53) for 2024 – 3 TIMES what it was 2 years ago!

$800Bn in debt service is 50% of the ENTIRE annual income of the bottom 50% (165M) of the population. It is as much money as we spend on our Military (the most on the World by a mile) and it ONE HALF of our entire deficit. And THAT is at ONLY a 2.3% average interest rate on $34.6Tn in debt! Imagine where we’d be if we had to pay 5% interest – Greece is the word!

$800Bn is also the GDP of Switzerland – the 20th largest GDP in the World! That’s just the INTEREST we pay on our debt, suckers! Of course, this begins to beg the question – who on Earth is going to be able to lend us all this money? We don’t just need to borrow the $800Bn for interest and the $1.8Tn for this year’s ADDITIONAL deficit but we have to roll over about $7Tn of existing debt each year – as we’re CERTAINLY not going to be paying it back!!! ROFL, “pay it back” – I just crack myself up sometimes…

Fortunately, the $800Bn is included in the $1.8Tn deficit (thanks Trump!) so we only “NEED” to borrow $8.8Tn this year. That, unfortunately, is half the GDP of China (#2) and double the GDP of Japan (#3) – how long do you really think we can sustain this before the whole Global house of cards comes crashing down?

Well, Japan is 300% of their GDP in debt so maybe we can do it for years, we won’t be 300% of our GDP in debt until 2046 – plenty of time to get off the planet, right Elon?

That’s better than our current plan of burning this planet to the ground, I suppose…