Futures are tumbling this morning, hit by disappointing earnings and outlook from the largest US bank, JPMorgan whose stock is down around 3% in a soggy launch to Q1 earnings season, while growing fears of an imminent conflict between Israel and Iran have sent oil surging and futures sliding. As of 8:45am, S&P futures are down 0.7%, at session lows with Nasdaq also dumping after reports China has asked its telecom carriers to start phasing out foreign chips. The drop comes as we see safe having flows move capital into TSYs with bond yields sliding up to 10bps this morning. That said, the USD is higher again with the euro and cable sliding sharply. Commodities are mixed: oil and gold rally amid Middle East tension; base metals are lower amid lower-than-expected China exports (-7.5% vs. -1.9% survey vs. 5.6% prior), while the gold explosion documented last night continues, with gold futures trading just above $2,400 and spot trading just below. Today, the main focus will be banks earnings (C, JPM, WFC). We will also receive Univ. of Mich. Sentiment data.

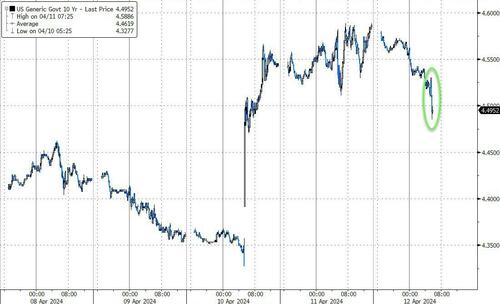

Bonds are bid also, 10Y -9bps…

In premarket trading, MegaCap tech are mostly lower: GOOG -45bp, TSLA -1.1%, while semis are lower amid headlines on China cutting American chip makers out of its telecoms systems (AMD -1.8%, INTC -1.7%, MU -94bp). Here are the most notable European movers:

- Applied Digital shares drop 11% after the data-center developer reported third-quarter adjusted diluted loss per share that was more than analysts had expected. The company also missed on revenue.

- Corteva shares slip 1.4% after a downgrade to neutral at JPMorgan, which says the agricultural products firm “has its work cut out” for it to reach its earnings guidance for 2024 amid falling crop chemicals prices.

- Coupang shares rise 4.4% after the e-commerce company said it would raise its monthly fee for “Wow” membership for new clients by 58%, starting on Saturday, according to emailed statement.

- DocuSign (DOCU US) shares gain 0.6% as UBS lifts its rating on the e-signature company to neutral from sell, with the stock now approaching fair value.

- Gitlab (GTLB US) shares climb after an upgrade to outperform at Raymond James, which sees the application software company ultimately exceeding $750 million in revenue for fiscal year 2025.

- Globe Life (GL US) shares are up 12%. The life insurance company said it intends to explore “all means of legal recourse against the parties responsible” after a short-seller report from Fuzzy Panda Research.

- Intel and AMD shares fall after the Wall Street Journal reported that China has asked its telecom carriers to start phasing out foreign chips.

The biggest highlight in premarket trading, however, was JPMorgan which dropped as much as 4.4% in premarket after its outlook for full-year net interest income missed expectations. Citigroup Inc. gained after its first-quarter profit topped estimates. Contracts for the S&P 500 fell 0.4%, while those on the Nasdaq 100 slid 0.5% after tech stocks jumped 1.7% Thursday. BlackRock rose in premarket after the world’s largest money manager reported a record $10.5 trillion in client assets. Wells Fargo shares retraced a slump after a miss on NII in its first-quarter report. State Street Corp. gained after its earnings beat estimates.

Separately, attention is also focused on the growing conflict between Iran and Israel where moments ago we got the following flashing red headline which hammered futures to session lows:

- *ISRAEL BRACING FOR POTENTIAL DIRECT ATTACK FROM IRAN IN DAYS

While there is nothing new there, we have heard that several times in the past few days, today the market is extra sensitive and it is sending oil surging, with WTI above $86 and Brent well into the $90.

European stocks were on course for their best day this month, with mining and energy shares leading gains amid a rally in oil and metals, however the gains have fizzled as geopol concerns emerge. The Stoxx 600 is up 0.6% after rising 1% earlier.

Earlier in the session, Asian equities slipped Friday with Hong Kong and South Korea leading the losses, as the region lacks positive momentum following a recent rebound. The MSCI Asia Pacific Index dropped as much as 0.2% in its third straight day of declines, the longest falling streak since early February. Chinese technology stocks including Alibaba and Tencent, as well as South Korea’s Samsung Electronics, were among the biggest contributors to the drop.Hong Kong markets underperformed, with the Hang Seng China Enterprises Index retreating after entering a so-called technical bull market earlier this week. Sentiment has turned cautious after Chinese price data released Thursday underscored deflationary pressures, putting a dampener on budding optimism that the economy is recovering.

In FX, the Bloomberg Dollar Index rises 0.4% while the euro sank to the weakest level against the dollar in five months as prospects grow that the European Central Bank will start cutting rates in June, well before the Federal Reserve can begin easing because of stubborn US inflation. Markets are pricing three rate cuts in the euro zone this year and fewer than two by the Fed. The Swedish krona is the worst performer among the G-10 currencies, falling 0.8% versus the greenback after CPI rose less than expected in March.

Treasuries rise after a steep two-day fall, with US 10-year yields dropping 8bps to 4.50% after surging 22 basis points in the previous two sessions. Data Thursday showed US producer prices in March increased less than forecast, sparking relief after consumer-price growth exceeded forecasts the previous day. German 10-year yields fall 9bps after ECB’s Stournaras said it is time for the ECB to diverge from the Fed. The 10-year Treasury yield dropped seven basis points. Strategists at Bank of America Corp. said a rare rally in both tech stocks and commodities, combined with a jump in bond yields, has echoes of periods when bubbles are forming. The unusual price moves are consistent with bets that interest rates will stay higher for longer while economic growth remains strong — a so-called no-landing scenario.

While that narrative is “correctly in vogue,” there’s also a risk of higher inflation and an increased cost of capital, the strategists led by Michael Hartnett wrote. The price action is “typical of bubbly markets,” according to Hartnett, who makes a comparison with the pre-tech bubble period of 1999.

In commodities, WTI rises 2% to trade near $87 a barrel; spot gold rises 0.9% having earlier topped $2,400/oz for the first time while copper rises 2.3% to the highest since June 2022. Iron ore headed for its best week in two years on speculation that China’s economy may be on the mend, buoying the outlook for demand. A rally in industrial metals strengthened, with zinc rising to a one-year high on increased risks to supply.

To the day ahead now, and the Bank of England will release the Bernanke review on forecasting. Central bank speakers include the BoE’s Greene, the ECB’s Elderson, and the Fed’s Collins, Schmid, Bostic and Daly. Data releases include the UK GDP reading for February, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for April. Finally, earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.

Market Snapshot

- S&P 500 futures down 0.7% at 5,207

- STOXX Europe 600 up 1.2% to 510.39

- MXAP down 0.5% to 175.54

- MXAPJ down 1.0% to 536.11

- Nikkei up 0.2% to 39,523.55

- Topix up 0.5% to 2,759.64

- Hang Seng Index down 2.2% to 16,721.69

- Shanghai Composite down 0.5% to 3,019.47

- Sensex down 0.9% to 74,399.41

- Australia S&P/ASX 200 down 0.3% to 7,788.08

- Kospi down 0.9% to 2,681.82

- Brent Futures up 1.2% to $91.36/bbl

- Gold spot up 1.0% to $2,396.87

- US Dollar Index up 0.35% to 105.65

- German 10Y yield little changed at 2.38%

- Euro down 0.4% to $1.0678

Top Overnight News

- China posts weak trade numbers for Mar, with exports slumping 7.5% Y/Y (vs. the Street -1.9%) while imports dip 1.9% (vs. the Street +1%). RTRS

- China’s push to replace foreign technology is now focused on cutting American chip makers out of the country’s telecoms systems. Officials earlier this year directed the nation’s largest telecom carriers to phase out foreign processors that are core to their networks by 2027, a move that would hit American chip giants Intel and Advanced Micro Devices. WSJ

- Japan’s finance minister reiterated his readiness to act on excessive FX moves as the yen held near a 34-year low. Intervention will probably happen outside Tokyo trading hours to weed out overseas speculators. BBG

- Israel is preparing for a direct attack from Iran on southern or northern Israel as soon as Friday or Saturday, according to a person familiar with the matter. A person briefed by the Iranian leadership, however, said that while plans to attack are being discussed, no final decision has been made. WSJ

- The IEA trimmed its forecast for 2024 oil demand growth on Friday, citing lower than expected consumption in OECD countries and a slump in factory activity. The Paris-based energy watchdog lowered its growth outlook for this year by 130,000 barrels per day (bpd) to 1.2 million bpd, adding that the release of pent-up demand by top oil importer China after easing COVID-19 curbs had run its course. RTRS

- The US has proposed raising tens of billions of euros in debt for Ukraine secured against the future profits generated by Russian state assets that have been frozen by western countries. The G7 group of nations has been split on what to do with €260bn worth of Russian assets put on hold by the west since Moscow launched its full-scale invasion of Ukraine in February 2022. FT

- Big bank earnings kick off with net interest income in focus as fewer rate cuts are expected. JPMorgan is attracting most speculation over whether it will raise NII guidance — which analysts argue is conservative at $90 billion. Adjustments for Wells Fargo and Citi will also be scrutinized. BBG

- Roaring equity markets and the popularity of a new spot bitcoin exchange traded fund powered BlackRock to record assets under management of $10.5tn and net income of $1.57bn that was up 36 per cent year on year. FT

- KKR, one of the pioneers of the $15tn private capital industry, is hastening plans to sell large investments or take them public after higher interest rates caused a two-year slowdown in takeovers and initial public offerings. FT

- Sweden’s underlying inflation rate fell more than expected in March, fueling expectations for the Riksbank to start cutting interest rates ahead of major peers next month. A closely followed measure that strips out energy costs and the effect of interest-rate changes increased 2.9% from a year ago, a 26-month low, according to a statement from Statistics Sweden. That was less than the 3.2% expected by economists surveyed by Bloomberg as well as the 3.3% that the Riksbank projected. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed despite the gains on Wall St where softer-than-expected PPI eased some inflationary fears, while participants in the region were also cautious as they awaited the latest Chinese trade data. ASX 200 marginally declined as weakness in consumer-related sectors overshadowed the gains in gold miners. Nikkei 225 was underpinned on the back of a weaker currency and despite the selling pressure in Fast Retailing. Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong amid broad selling after the local benchmark index pulled back from the 17,000 level, while the mainland struggled for direction leading into the Chinese trade data.

Top Asian News

- US Senate Banking Committee Chair Brown urged for President Biden to permanently ban EVs produced by Chinese companies, according to a letter cited by Reuters.

- Japanese Finance Minister Suzuki said a weak yen has pros and cons, as well as noted that a weak yen could push up import prices and have a negative impact on consumers and firms. Suzuki reiterated that rapid FX moves are undesirable and that he is closely watching FX moves with a high sense of urgency, while he also repeated it is desirable for FX to move stably reflecting fundamentals and he won’t rule out any steps to respond to disorderly FX moves.

- Bank of Korea kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously, while it stated that it is premature to be confident that inflation will converge on the target level and it will maintain a restrictive policy stance for a sufficient period. BoK said it would monitor various factors including inflation slowdown, as well as financial stability and economic growth risks but noted the growth forecast is to be consistent with its earlier forecast or could be higher. BoK Governor Rhee said one in seven board members said the door for a rate cut should be open for the next three months and all 7 members said it is hard to predict policy decisions for H2. Furthermore, Rhee said the board is open to a rate cut if CPI slows in H2 although rate cuts might be difficult this year should inflation remain sticky and they have not signalled for a rate cut.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said current monetary policy settings remain appropriate, while it added that the Singapore economy is expected to strengthen and that prospects for the Singapore economy should improve over the course of 2024.

- Chinese Cabinet issues guidelines to strengthen the supervision and prevent risks to promote development of its capital market; China to tighten supervision of stock market to control risks.

- Chinese Cabinet issues guidelines to strengthen the supervision and prevent risks to promote development of its capital market; China to tighten supervision of stock market to control risks.

- China March Trade (USD): Balance 58.55bln (exp. 70.2bln); Exports -7.5% Y/Y (exp. -2.3%); Imports -1.9% Y/Y (exp. -2.3%).

- China’s Securities Regulator is proposing stricted differentiated regulatory requirements for high-frequency trading, plans to moderately increase requirements of operating income, net profit for Co’s listed on Chinext.

European bourses, Stoxx600 (+1.1%), jumped higher at the open and continued to make session highs as the morning progressed, though upward momentum has slowed in recent trade as we await US bank earnings. European sectors are firmer across the board; Once again Basic Resources and Energy top the pile, lifted by gains in the commodities complex. Optimised Personal Care is found at the foot of the pile. US Equity Futures (ES U/C, NQ -0.1%, RTY U/C) are trading on either side of the unchanged mark, seemingly taking a breather following strong Stateside performance in the prior session; Intel (-1.8%) and AMD (-1.9%) pressured in the pre-market on China-related reports via the WSJ.

Top European News

- ECB’s Kazaks says they will cut in June if nothing surprising occurs, via TV3; data will be clearer by then. Wage growth remains strong but inflation has decreased. The time for a cut is approaching.

- ECB’s Stournaras says now is the time to diverge from the Fed; reiterates call for four rate cuts this year; there is a risk inflation will undershoot 2%.

- Riksbank’s Breman says inflation has fallen from high levels but the risk of setbacks remains. Key factor is that household inflation expectations remain at a high level. Today’s inflation figure shows we have a positive ground for inflation stabilising at 2%. Believe that household inflation expectations will also fall in the future as price increases slow; Co. pricing behaviour will be key.

- Goldman Sachs expects the ECB to cut rates four times this year in June, July, September & December

FX

- USD is stronger vs. most peers as Wednesday’s CPI report has prompted a reassessment of the Fed’s position vs. other major central banks in the easing cycle. Interim resistance comes via the 13th Nov high at 105.95 but broader focus is on a breach of 106 to the upside.

- EUR’s descent vs. the Greenback has continued into today’s session as emphasis on potential diverging Fed/ECB paths guides price action. EUR/USD hit a new YTD at 1.0676.

- GBP initially defended the 1.25 mark, before succumbing to the broader Dollar strength; An in-line UK GDP release has been vastly overshadowed by a broad reassessment of the relative BoE/Fed paths. GBP entered 2024 on the front foot amid expectations it would lag the Fed and ECB in cutting rates.

- JPY is holding up better than peers vs. the USD. Albeit, it has been a pretty painful week for the JPY following Wednesday’s US CPI print which launched the pair from a 151 handle to 153+.

- Antipodeans are both softer vs. the USD to similar degrees amid light newsflow for both currencies. AUD/USD is below its 50 and 200DMAs at 0.6543 but holding above the weekly low at 0.6498.

- PBoC set USD/CNY mid-point at 7.0967 vs exp. 7.2365 (prev. 7.0968).

Fixed Income

- USTs off lows with newsflow light into a number of Fed speakers. USTs have bounced by around 10 ticks from today’s 108-00+ base, but remain much closer to the week’s trough of 107-27+ than the 109-26+ peak.

- Bunds are bid as markets digest the ECB’s read-between-the-lines guidance towards a June cut with sources and ECB speakers since outlining this more explicitly, guidance which contrasts with hawkish Fed re-pricing. Bunds have been lifted back towards this week’s 132.86 peak, currently 132.44, whilst the German 10yr yield sits comfortably below 2.40%.

- Gilts gapped higher by around 30 ticks given the above EGB action, and remained near session highs at around 97.87. A slightly stronger UK GDP print will give the BoE scope to continue to traverse the Table Mountain; Bernanke forecast review due shortly.

Commodities

- Crude is firmer on the session, given the heightened geopolitical environment and despite the firmer Dollar. Brent June trades within a USD 90.04-64/bbl parameter thus far.

- Precious metals are surging across the board despite the rise in the Dollar with the geopolitical landscape underpinning the havens ahead of weekend risk and a potential Iranian offensive against Israel; XAU tested USD 2,400/oz to the upside at fresh ATHs.

- Base metals are also soaring despite the stronger Dollar and downbeat headline Chinese trade data, with the internals revealing a Y/Y increase in copper imports.

- Shanghai Gold Exchange will raise margin requirements for some gold futures contracts to 9% from 8% effective from the settlement on April 15th and will raise daily trading limits for some gold futures contracts to 8% from 7%.

- MMG ‘s (1208 HK) Las Bambas copper mine in Peru and protestors reached a deal on lifting the road blockade near the mine, according to sources cited by Reuters.

- Japanese aluminium premiums for April-June shipments at USD 145-148/T, +61-64%, via Reuters citing sources.

- IEA OMR: World oil demand growth forecast -130k BPD to 1.2mln BPD; 2025 demand growth seen at 1.1mln due to sub-par economic outlook; China’s 2023 post-COVID release of pent-up demand has effectively run its course. Sustained output curbs by the OPEC+ alliance mean that non-OPEC+ producers, led by the Americas, will continue to drive world oil supply growth through 2025. Robust production from non-OPEC+ coupled with a projected slowdown in demand growth will lower the call on OPEC+ crude by roughly 300 kb/d in 2025.

Geopolitics: Middle East

- “The (Israeli) army and the Mossad approved plans to target the heart of Iran if Israel (is) bombed from inside Iranian territory”, via Al Jazeera citing Yedioth Ahronoth.

- Hamas sources: “The organization’s leadership informed the mediators that it is not interested in further discussions about the deal, as long as there is no progress in its demands…”, according to journalist Kais citing Hezbollah-affiliated press.

- “US official to Al-Arabiya: We will participate in the response if Iran escalates with an appropriate response”, according to Al Arabiya

- Israel is prepared for an Iranian strike from its territory in the next 48 hours, according to WSJ. Israeli army said Iran is preparing its proxies in the region to attack them, according to Al Arabiya.

- Israeli Defence Minister Gallant told US Defense Secretary Austin that a direct Iranian attack on Israeli territory would compel Israel to respond in an appropriate way against Iran, according to Axios.

- Iran reportedly signalled to Washington it will respond to Israel’s attack on its Syrian embassy in a way that aims to avoid major escalation and it will not act hastily, according to Reuters citing Iranian sources. Furthermore, a source familiar with US intelligence was not aware of the message conveyed but said Iran has been very clear its response would be controlled and non-escalatory, and planned to use regional proxies to launch a number of attacks on Israel.

- US President Biden’s administration officials judge that Iran is planning a larger-than-usual aerial attack on Israel in the coming days which will likely feature a mix of missiles and drone strikes, according to two US officials cited by Politico.

- US official said the US expects an attack by Iran against Israel which they think will be calibrated to be bigger than usual but not so big it would draw the US into war, while US officials have also been in touch with regional partners to discuss efforts to manage and ultimately reduce further risks of escalation.

- US said it had restricted its employees in Israel and their family members from personal travel outside the greater Tel Aviv, Jerusalem and Be’er Sheva areas amid Iran’s threats of retaliation against Israel.

- US State Department senior official said a robust conversation with Iraq is likely to lead to a second US-Iraq joint security cooperation dialogue later this year.

Geopolitics: Other

- US President Biden warned that any attack on Philippine vessels in the South China Sea would invoke their mutual defence treaty.

- China’s top legislator Zhao Leji and North Korean counterpart discussed promoting exchange and cooperation in all fields, according to KCNA.

- Four drones shot down overnight near Russia’s Novoshakhtinsk in a town in near proximity to an oil refinery

US Event Calendar

- 08:30: March Import Price Index MoM, est. 0.3%, prior 0.3%

- 08:30: March Import Price Index ex Petroleu, est. 0.1%, prior 0.2%

- 08:30: March Import Price Index YoY, est. 0.3%, prior -0.8%

- 08:30: March Export Price Index YoY, est. -1.2%, prior -1.8%

- 08:30: March Export Price Index MoM, est. 0.3%, prior 0.8%

- 10:00: April U. of Mich. 5-10 Yr Inflation, est. 2.8%, prior 2.8%

- 10:00: April U. of Mich. Expectations, est. 78.0, prior 77.4

- 10:00: April U. of Mich. Current Conditions, est. 81.3, prior 82.5

- 10:00: April U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

- 10:00: April U. of Mich. Sentiment, est. 79.0, prior 79.4

Central Bank Speakers

- 09:00: Fed’s Collins Appears on Bloomberg TV

- 13:00: Fed’s Schmid Gives Speech on Economic Outlook

- 14:30: Fed’s Bostic Gives Speech on Housing

- 15:30: Fed’s Daly Participates in Fireside Chat

DB’s Jim Reid concludes the overnight wrap

It’s been a volatile 24 hours in markets, with bonds continuing to struggle thanks to concerns about inflation, whilst equities saw a tech-led rebound that meant the NASDAQ (+1.68%) closed at an all-time high. To be fair, front-end yields did stabilise after Wednesday’s dramatic selloff, as the US PPI release was softer than many feared, and the ECB added to the signals that they might cut rates at the next meeting. But ultimately, the big picture is that inflation is still proving more resilient than expected, whilst the chance of a Fed rate cut in H1 is seen as increasingly remote. Alongside that, several geopolitical concerns remain in the background, and gold prices (+1.65%) closed at a record high yesterday of $2,372/oz.

With that in mind, yesterday brought another bond selloff on both sides of the Atlantic, and 10yr yields across several countries hit their highest level since late-2023. In the US, the 10yr yield was up +4.3bps to 4.59%, which is its highest level since November, although overnight there’s been a -1.6bps pullback to 4.57%. This was driven by a fresh rise in real yields, with the 10yr real yield (+4.8bps) also up to a post-November high of 2.18%. Meanwhile at the front end, yesterday saw a modest decline in the 2yr yield (-1.2bps) to 4.96%, but that comes in the context of a +23bps increase the previous day, leaving it up by more than +20bps relative to its pre-CPI levels.

That pullback in front-end yields was in large part down to the PPI inflation print for March, with the 2yr yield having momentarily traded at 5% immediately before the release. That showed headline PPI at +0.2% on a monthly basis (vs. +0.3% expected), which meant the year-on-year measure rose to +2.1% (vs. +2.2% expected). Although it was only slightly beneath expectations, monthly moves in PPI components that feed into core PCE inflation came in on the weaker side, including airfares (-1.8%) and healthcare services (0.0%). So a big relief to investors after the upside surprise in CPI the previous day. It also meant futures raised the chance the Fed would still cut rates by July, which moved up from a 50% to a 56% chance after yesterday’s session, with a further rise this morning to 58%.

When it came to Fed officials themselves, their remarks yesterday signalled they weren’t in a hurry to cut rates. For instance, New York Fed President Williams said “There’s no clear need to adjust policy in the very near term”. Meanwhile, Boston Fed President Collins said that the recent data “implies that less easing of policy this year than previously thought may be warranted.” And Richmond Fed President Barkin said that “We’re not yet where we want to be” when it came to inflation.

In light of recent developments, DB’s US economists have now materially adjusted their Fed view for this year. They now only expect one rate cut at the December FOMC meeting, followed by modest further reductions in 2025. Beyond that, they expect the Fed to guide the policy rate back towards a neutral level, that is likely just below 4% by the end of 2026. And although a rate cut in July is still possible, their view is that it would need a string of more favourable inflation prints than they forecast, as well as some softening in the labour market and tightening in financial conditions. See the report here for more details on their latest forecast.

Speaking of central banks, we had the latest ECB decision earlier in the day, who left their deposit rate at 4% as expected. However, their statement suggested that they were moving closer to rate cuts, as it said “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” So a clear signpost that rate cuts could be near, and investors raised the chance of a cut by the June meeting from 82% to 87% by the close. Our European economists see the ECB as having a clear but conditional baseline of a June cut, while keeping its options open beyond this. They note that Lagarde’s expression of a “dialling down cycle” may be more consistent with gradual rate cuts. See their reaction note here for more.

The ECB’s decision helped to bring down 2yr yields on German (-0.4bps) and French (-0.6bps) government bonds. However, at the long end it was a different story, and yields moved noticeably higher across the continent, including on 10yr bunds (+2.8bps), OATs (+3.6bps) and BTPs (+6.8bps). Meanwhile for gilts, the 10yr yield (+5.5bps) closed at a post-November high of 4.20%. That came as investors continued to dial back the chance of a Bank of England rate cut by June, with overnight index swaps lowering the probability from 56% to 41% by the close. That followed comments from the BoE’s Greene in the FT we mentioned yesterday, who said that UK rate cuts “should still be a way off”.

Although bonds continued to sell off, a renewed tech rally saw equities recover in the latter half of the US session ahead of the earnings season kicking off in full today. The S&P 500 advanced +0.74%, with the NASDAQ (+1.68%) and the Magnificent 7 (+2.25%) strongly outperforming and closing at new all-time highs. All of the Magnificent 7 posted gains, with Apple (+4.33%) leading the way amid news that it plans to overhaul its line of Macs with new AI-focused chips. However, equity gains were limited outside tech, with more than half of S&P 500 constituents actually down on the day. And earlier in the day Europe saw fresh losses, with the STOXX 600 (-0.40%), the DAX (-0.79%) and the CAC 40 (-0.27%) all falling back. That came as European natural gas futures (+8.40%) rose following Russian attacks on energy facilities in Ukraine, including those for natural gas storage.

Overnight in Asia, most of the major equity indices have lost ground this morning, with losses for the Hang Seng (-1.73%), the CSI 300 (-0.28%), the Shanghai Comp (-0.04%) and the KOSPI (-0.80%). Japanese equities have been the main exception however, where the Nikkei is up +0.33%. And looking forward, US equity futures are slightly higher, with those on the S&P 500 up +0.05%. Elsewhere in Asia, the Bank of Korea kept its policy rate unchanged at 3.5%, marking its 10th consecutive decision to hold since it last hiked in January 2023.

To the day ahead now, and the Bank of England will release the Bernanke review on forecasting. Central bank speakers include the BoE’s Greene, the ECB’s Elderson, and the Fed’s Collins, Schmid, Bostic and Daly. Data releases include the UK GDP reading for February, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for April. Finally, earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.