Not much of a recovery so far.

Not much of a recovery so far.

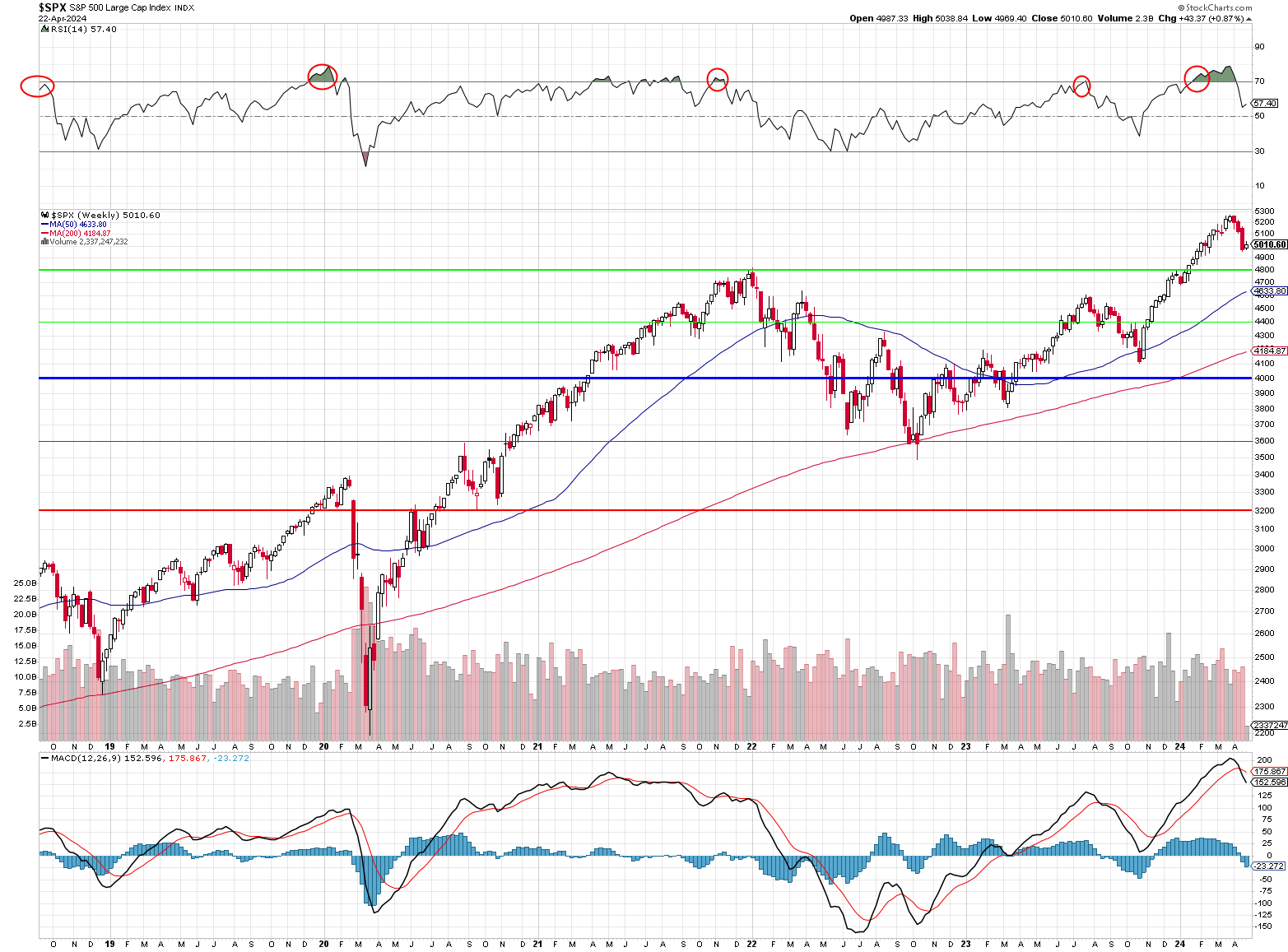

As you can see from our 5% Rule™ Chart, we haven’t even yet cleared the weak bounce lines on the indexes and, this morning, the Futures have us at Dow 38,338 (still not there), S&P 5,026, Nasdaq 17,274 (just short), Russell 1,970 (just short) and NYSE 17,664. So no green boxes added means there’s nothing to get excited about and, the longer it takes to get to a strong bounce, the less likely it is you’ll get a V-shaped recovery, right?

We spent 5 days dropping so, by definition, a V-shaped recovery should take 5 days. That means that, each day, we should be gaining a green box to get back to the high. Failing to make our strong bounces is a sign that we’re consolidating for a move down – not recovering.

We’re expecting the strong bounce lines to fail this week – probably on some disappointing earnings news and then we should test the 4,800 line (down 5% from here) next week and the 50 dma is at 4,633 which is 400 points below where we are now so it’s rising at (400/50 =) 8 points per day and it will take 20 days for the 50-day moving average to hit the 4,800 line and strengthen it’s support so, the faster we hit 4,800 – the less likely it is to hold.

See how easy charts are to understand? You don’t need to wait for them to be drawn and have “analysts” interpret the pretty pictures – you can use MATH to calculate the future shape of the chart and that will tell you where all the TA followers (pretty much everybody) will be throwing their money – then you just catch it!

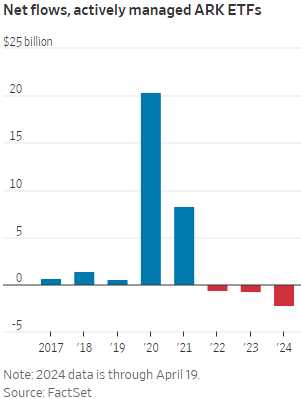

Speaking of catching it – poor Cathie Wood, whose ARK ETFs are heavy tech investors, has had $2.2 BILLION worth of withdrawals this year and that’s 30% of their total! It’s notable because those withdrawals force ARK to liquidate their tech holdings – causing more downward pressure which then hurts the performance of the fund and leads to more withdrawals. This is the danger of concentrated investment ETFs!

Speaking of catching it – poor Cathie Wood, whose ARK ETFs are heavy tech investors, has had $2.2 BILLION worth of withdrawals this year and that’s 30% of their total! It’s notable because those withdrawals force ARK to liquidate their tech holdings – causing more downward pressure which then hurts the performance of the fund and leads to more withdrawals. This is the danger of concentrated investment ETFs!

“By the end of last year, ARK funds had destroyed more wealth than any other asset manager over the previous decade, losing investors a collective $14.3 billion, according to Morningstar. ARK’s biggest inflows came in the months surrounding the innovation fund’s February 2021 peak, unfortunate timing for many investors.” – Wall Stret Jounal

And that net $2.2Bn would be double that if ARK hadn’t added a Crypto Fund this year for BitCoin, which was bought at the top and is also now sinking. Why? Because the ETFs take in money and buy the Bitcoins, which drives up the price and, once the frenzy plays out, Bitcoin begins to sink and people leave the ETF – forcing them to sell Bitcoins, putting more pressure on the price and further damaging the people who remain in the fund – it’s lunacy!

Speaking of lunacy – earnings reports for the week are providing a mixed picture of the overall market. While individual companies and sectors showed both positive and negative trends, some broader themes are emerging in week two:

- Inflation and Rising Costs: Many companies, particularly those in manufacturing or reliant on commodities (Nucor, Packaging Corp) indicated the impact of inflation and supply chain pressures on costs. This trend seems likely to continue in the near term.

- Tech Disappointments: Several major tech companies delivered underwhelming earnings, often including revenue misses or lowered guidance (Cadence, Meta, Alphabet). This reflects ongoing economic headwinds and a potential slowdown in digital investments.

- Earnings Surprises: Despite some concerns, the week brought a number of significant earnings surprises. Banks, aerospace (General Electric), and healthcare (Medpace) showed stronger-than-expected results, highlighting the resilience of specific sectors.

- Earnings Highlight Diverse Impacts: While there are overarching trends, earnings reports continue to show how different sectors of the economy are being impacted very differently. Consumer-facing companies might see mixed spending habits (positive for discounters like Albertsons, less so for some discretionary goods), while industrial sectors feel the squeeze on margins.

We’ll keep our eye on the data we discussed yesterday. This morning we get the PMI Report (9:45) along with New Home Sales but tomorrow’s Durable Goods, Thursday’s GDP and Friday’s Personal Income and Spending along with Consumer Sentiment will lend color to the earnings reports we’re getting.

We’ll keep our eye on the data we discussed yesterday. This morning we get the PMI Report (9:45) along with New Home Sales but tomorrow’s Durable Goods, Thursday’s GDP and Friday’s Personal Income and Spending along with Consumer Sentiment will lend color to the earnings reports we’re getting.

Many of the companies reporting, particularly in manufacturing and consumer goods, are likely to discuss the impact of inflation on their costs and consumer spending. Look for how they’re managing rising costs and if they’re passing them on to consumers. Companies like Hasbro, Hilton (HLT), and Travel + Leisure (TNL) can provide insight into consumer spending patterns. Are consumers still spending on discretionary items and travel? Financials like AT&T, Bank of New York Mellon (BK), and others could see their earnings impacted by changing interest rates. We’ll pay attention to their comments on loan demand and profit margins.

It’s a little early to make big earnings calls but let’s practice with this set over the next 24 hours:

Potential Large Beats

- Healthcare: Biogen (BIIB), Humana (HUM) – Analysts are predicting earnings lower than last year, but these healthcare giants could surprise, reflecting either resilience in the sector or positive one-time events.

- Financials: Evercore, (EVR), Mr. Cooper Group (COOP): If these financial companies significantly outperform the lower expectations, it could indicate a stronger-than-anticipated financial sector.

- Industrials: General Dynamics (GD), Teledyne Tech (TDY) – Large beats here might signify robust demand within the defense and aerospace industries.

Potential Large Misses

- Tech/Consumer Discretionary: Boeing (BA), Tesla (TSLA), Hasbro (HAS) – Underperforming expectations could point to lingering supply chain issues, slowing demand, or company-specific problems. A significant miss from Tesla could cause ripples throughout the market.

- Materials: Constellium (CSTM), Owens Corning (OC) – Weak earnings might indicate headwinds for the construction and manufacturing industries, potentially tied to inflation and interest rates.

This morning we have beats from CBU, GE, GM, KMB, LMT, NEP, PHM, R & UPS with misses by IVZ, PM (guidance), SHW, WBS and XRX (huge miss). We’ll see how things play out…