“Deep Economic Pessimism“

“Deep Economic Pessimism“

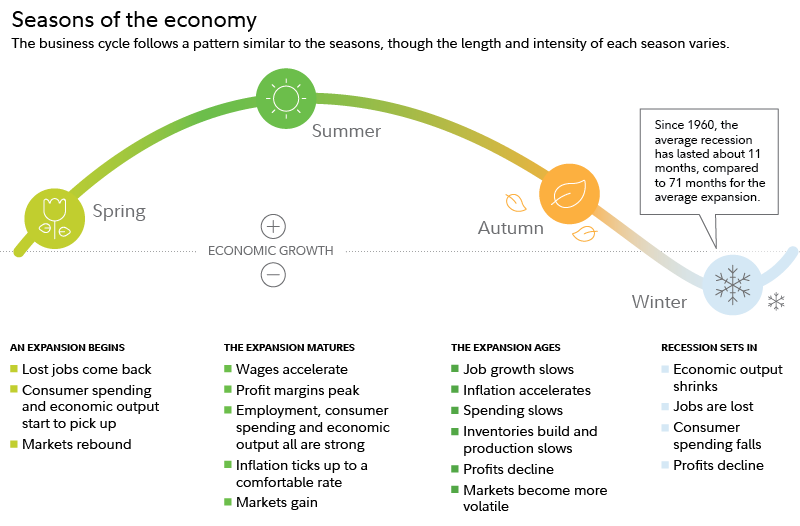

That’s the summary of the latest Bloomberg poll on voter sentiment and, of course, that’s bad news for President Biden but it’s also bad news for the economy as pessimistic Consumers can become depressed – and that’s where the word “Depression” comes from.

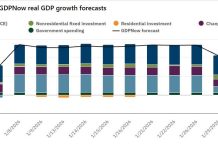

The poll shows deep voter pessimism about the U.S. economy’s trajectory, with most expecting worsening conditions by year’s end. This sentiment has significantly dented Biden’s previously gained traction in the polls. Despite economic indicators pointing to resilience in the job market and some cooling in inflation rates, the perceived economic outlook remains bleak among voters.

Voters’ concerns are focused on inflation and rising borrowing costs, with a majority believing these will worsen. Biden’s economic policies, dubbed “Bidenomics,” appear to be closely associated by voters with inflation trends, influencing their political support. Over three-quarters of respondents hold Biden directly responsible for the current economic performance.

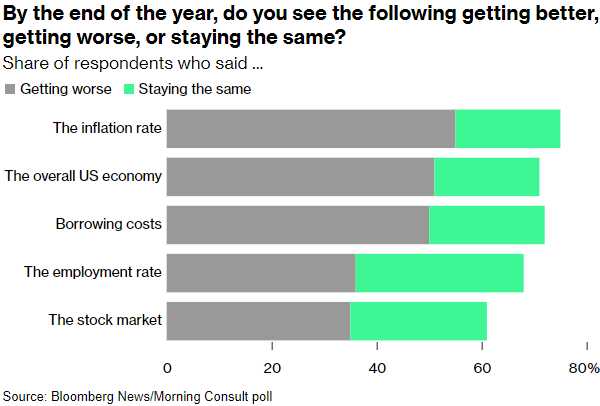

In fact, here’s something my own Mother got in the mail yesterday from Synchrony Bank on one of her credit cards. She has a good credit rating, she never misses a payment but still she gets this:

No wonder people are pessimistic. What “market conditions” have occurred that make changes like this “necessary“? There used to be laws about how much could be charged by credit card companies but the situation changed significantly in 1978 with the Supreme Court case Marquette National Bank of Minneapolis vs. First of Omaha Service Corp. This ruling allowed national banks to charge interest rates based on the laws of the state in which they are headquartered, rather than the laws of the state where the consumer resides.

This is hitting people who already have accounts and are seeing their APRs double! If they were barely keeping up before – they’ll be falling way behind now and it’s Consumers with notes like these in their hands that are answering the polls.

The implications of the polling data are substantial as it not only reflects the immediate challenges Biden faces in conveying economic gains but also underscores the potential volatility in voter sentiment leading up to the elections. The focus on economic issues over social ones, despite Biden’s campaign efforts to highlight topics like abortion following restrictive state rulings, suggests economic factors may dominate the electoral discourse.

The implications of the polling data are substantial as it not only reflects the immediate challenges Biden faces in conveying economic gains but also underscores the potential volatility in voter sentiment leading up to the elections. The focus on economic issues over social ones, despite Biden’s campaign efforts to highlight topics like abortion following restrictive state rulings, suggests economic factors may dominate the electoral discourse.

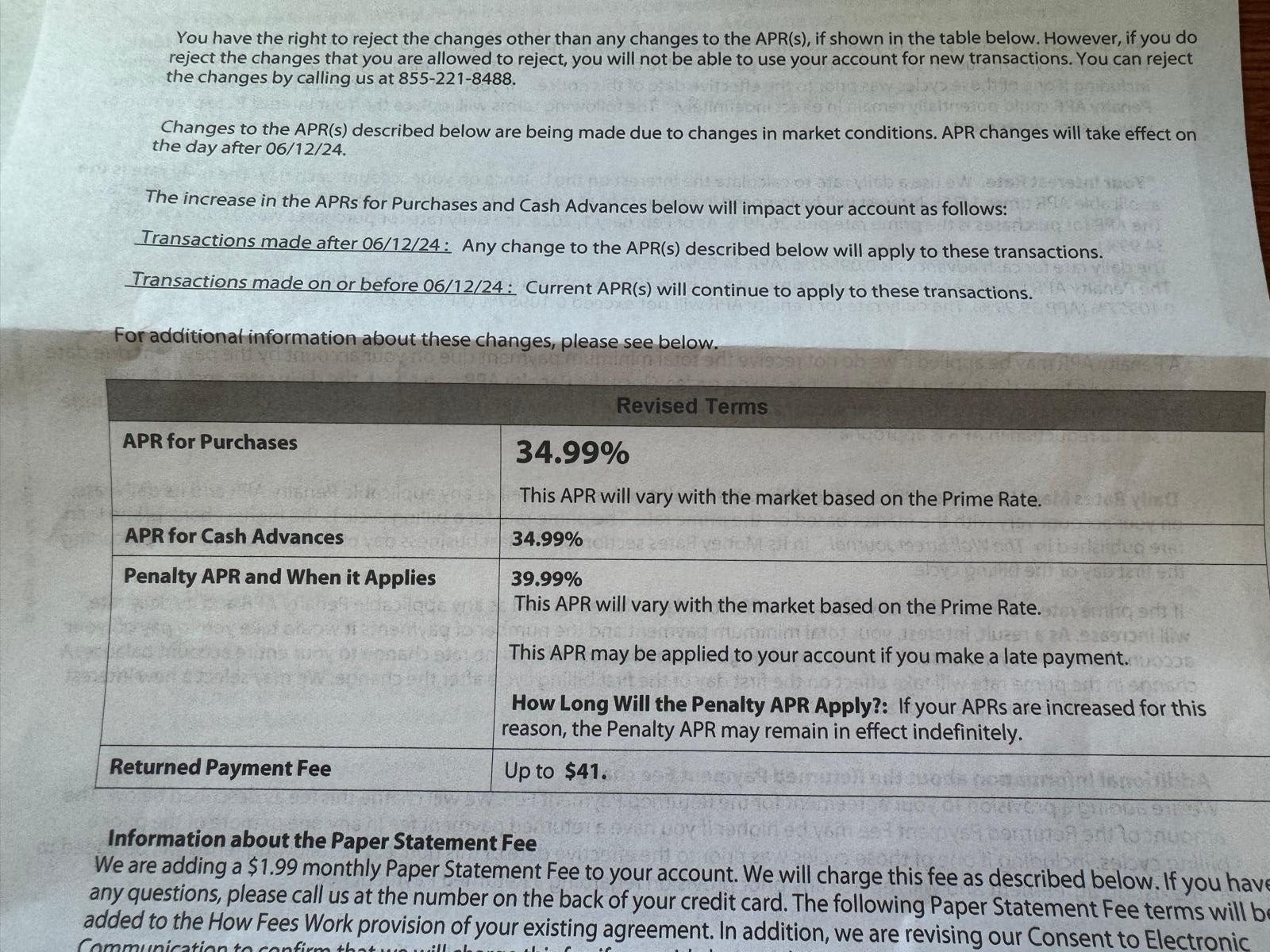

This pervasive economic gloom carries significant implications for investing. When consumers feel pessimistic, they are likely to cut back on spending, which can slow economic growth. This reduction in consumer expenditure affects a wide range of industries, from retail to real estate, potentially leading to a cyclical downturn that can depress markets.

Additionally, the sentiment of deep economic pessimism among voters, as shown in the poll, can create a self-fulfilling prophecy. As consumers expect the economy to worsen, their decreased spending and increased savings can actually lead to the economic slowdown they fear, a phenomenon known as “The Paradox of Thrift“. This negative outlook can dampen investor confidence, leading to reduced investments in not only the stock market but also in capital expansions and new ventures.

For investors, this means navigating a landscape where traditional investment strategies might need reassessment. The potential for a shift towards more defensive stocks or sectors that can weather economic downturns, such as utilities or consumer staples, becomes more pronounced. It also suggests a possible increase in the attractiveness of fixed-income investments if interest rates continue to rise in response to inflationary pressures.

The broader economic context underscored by voter sentiment could will shape investment strategies significantly.

8:30 Update: Mortgage Applications were down 2.7% this week but Durable Goods are up 2.6% for March but it’s all Transportation as ex-Transportation is only up 0.2% so nothing to get excited about – on the whole…

On the earnings front, we have beats from BIIB and, surprisingly, BA (not so surprising, we went long), HAS, HUM, COOP, OC, RCI, TMO, TNL, VIRT and WAB. Misses came from CSTM, ETR, GD, HELE (guidance), LAD, NAVI, EDU, NSC, SYF (boo, hiss!), TDY, WNC and WSO – not a stellar morning.

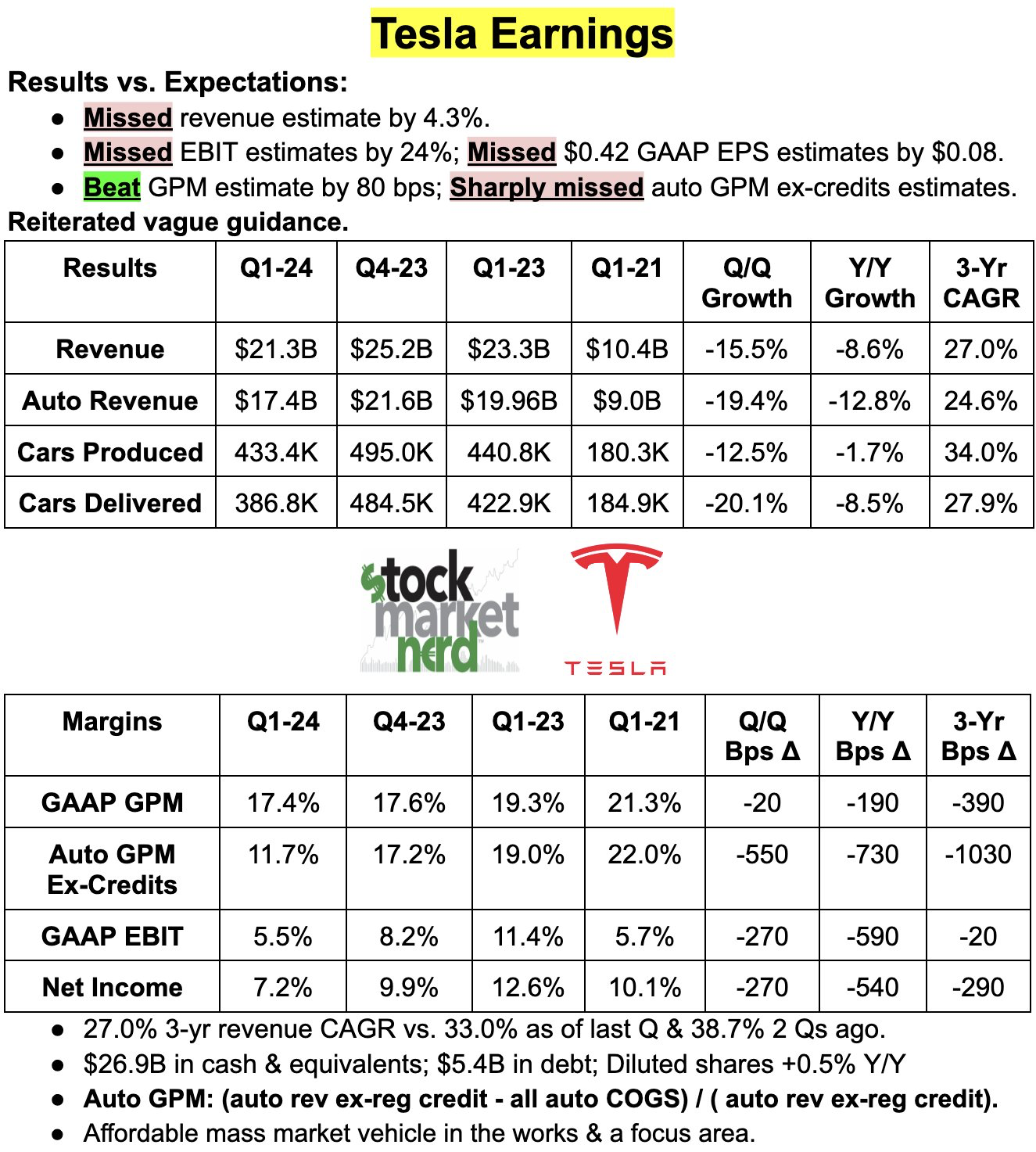

Yesterday, we took a stab at predicting some earnings and we thought GD would beat, we were right about COOP, BIIB and HUM but we thought BA would miss and TSLA did miss last night but not by enough to stop them from rallying (based on more BS promises by Elon, of course). OC beat and we thought miss CSTM did miss as expected, HAS had a huge beat. Bottom line is we shouldn’t try to be calling earnings yet!

Tesla (TSLA) is up 10% because Elon is pivoting to Robotics (why not, the car thing isn’t working) so I take all this with a grain of salt as it’s so silly.

Musk is also announcing “CyberCab” by the end of the year and, despite missing EVERY SINGLE Autonomous vehicle deadline EVER – people are believing this BS now. Elon also says TSLA will be buying 85,000 NVDA H100 GPUs by the end of the year and those are $30,000 each so that’s a $2.5Bn expense coming down the line – does anyone actually read these reports?

Be careful out there!