Remember when Nasdaq 5,000 was a big deal?

Remember when Nasdaq 5,000 was a big deal?

Amazingly, that was 2017 (and 1999). We blasted up to 12,000 by 2021 and now we’re up around 18,000, down 2.7% from where we topped out at 18,600 in March. At this point, we’re all well-aware that the rally has been fueled by the Magnificent 7 and that the Magnificent 7 is really pretty much just NVDA, META and MSFT and the others are along for the ride as the Magnificent 3 doesn’t quite have the same ring to it.

NVDA is 6.3% of the Nasdaq by weight and last year it was $175 and now it’s $877 so that’s up $702, which is 401% and we multiply that by 0.063 and that’s 25% out of the Nasdaq’s 63% gain since last year is from NVDA alone and the other 38% was mostly META, who also gained 400% with a 4.5% weighting so 18% leaves 20% and AMZN doubled with a 5.5% rating so 11% was AMZN leaving 9% and MSFT went from $220 to $402 so 82% but they weigh 8.6% so 7% leaves 4% and GOOGL takes care of that so with AAPL up 25% with the 8% weighting – the net of the other 94 stocks (including the not-so-magnificent TSLA) is a LOSS!!!

Keep that in mind when people are trying to get you to invest in index funds!

And it’s the same in the S&P 500, where these 7 stocks have represented 100% of the growth and that is continuing this quarter, where earnings of the Mag 7 are up 37% from last year (which was down 4% so easy comps!) while the other 493 stocks are down 3% overall (so far).

And it’s the same in the S&P 500, where these 7 stocks have represented 100% of the growth and that is continuing this quarter, where earnings of the Mag 7 are up 37% from last year (which was down 4% so easy comps!) while the other 493 stocks are down 3% overall (so far).

Projections are more optimistic as the rest of the market begins to catch up but keep in mind the projected growth for the Bottom 493 is pretty much the same as it is for the Bottom 90% of Americans – keeping up with inflation but working off a much, much smaller base than the Top 10% so the comparison is silly.

Apple alone has enough cash to buy any of the Bottom 470 companies and they are buying back $110Bn of their own stock – only 85 companies in the S&P 500 are worth more than that! Yet AAPL does not really buy other companies as a rule – it’s hard for the World’s best-run and most profitable companies to want to buy something that is not as profitable and not as well-run. Elon Musk want’s AAPL to invest in TSLA – what a joke!

As you can see from the chart above, S&P 500 companies made (after massive deductions to reduce their tax exposure) just under $3Tn last year and $1.1Tn was made in the US and AAPL was 10% of that by itself! Also, notably, Apple’s earnings were 1/3 of the entire Tech Sector and, obviously, it’s Mag 7 playmates earned all the rest.

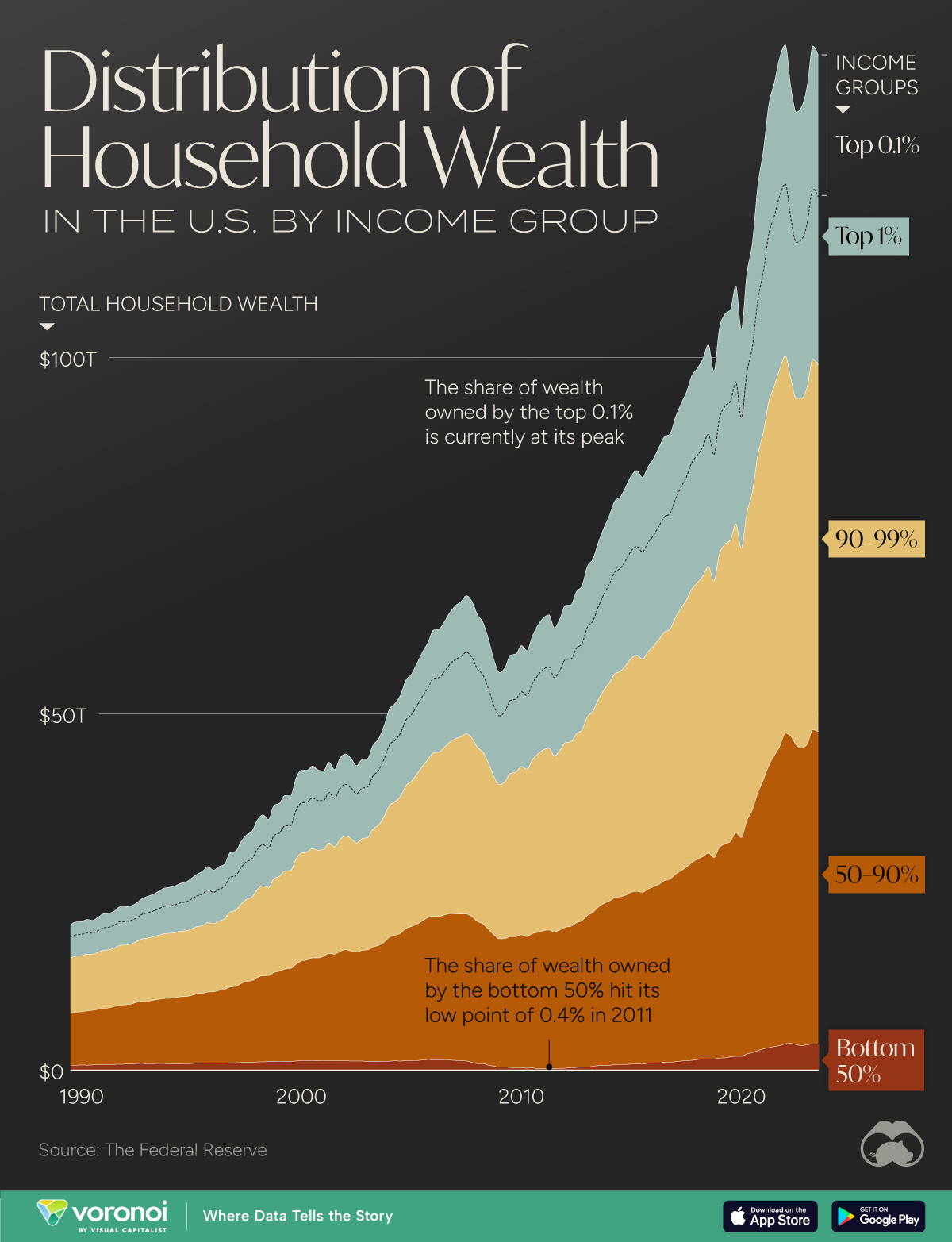

This concentration of Corporate Wealth is now almost as bad as the concentration of wealth in America’s Top 1%, who have now soaked up almost half of all the wealth in America and, combined with the next 9% (the Top 10%), they have passed the 2/3 mark. That would be 66%/10% of the people = 6.6% vs 33%/90% = 0.3% so the Top 10% are 22x richer than the bottom 90% but the Top 1% has 33%/1 = 33% so 5x more than the next 9% and 110x more than the bottom 90%.

You don’t have to vote for an oligarchy – they just sort of grow naturally when you don’t weed your garden and we stopped weeding under Reagan and the free-money, high-stimulus, low-tax polices of the 21st Century have, as is VERY obvious from this chart, only drastically accelerated matters.

You can’t reign it in anymore – if you are in the bottom 90% you have lost all your economic power, which was almost half in 1990 but now the bottom 90% struggles to pay their bills and certainly can’t afford to buy Congressmen or even go out to the movies or attend concerts where they might hear some radical viewpoints that are not approved by the Corporate Media.

In his seminal work, “The Road to Serfdom,” Friedrich Hayek warned of the dangers of centralized economic planning and the concentration of power in the hands of a few. He argued that such a path would inevitably lead to the erosion of individual freedoms and the rise of authoritarianism. As we survey the economic landscape of the 21st century, it seems that Hayek’s predictions are playing out before our very eyes.

The concentration of wealth and power in the hands of a select few corporations and individuals is a troubling trend that threatens the very foundations of our Democratic society. As Hayek wrote, “The more the state ‘plans,’ the more difficult planning becomes for the individual.” In other words, as corporations and the wealthy elite gain more control over the economy, the average citizen’s ability to plan and make decisions for themselves diminishes.

This is evident in the staggering wealth inequality we see today, where the Top 1% of Americans own nearly half of all wealth, while the bottom 90% struggle to make ends meet. As Hayek warned, “We shall never prevent the abuse of power if we are not prepared to limit power in a way which occasionally may prevent its use for desirable purposes.”

The rise of the Magnificent 7, which have come to dominate the stock market and the economy as a whole, is a prime example of this concentration of power. These behemoths have the resources to buy out any competition and shape the market to their will. As Hayek wrote, “The more we try to provide full security by interfering with the market system, the greater the insecurity becomes.”

The rise of the Magnificent 7, which have come to dominate the stock market and the economy as a whole, is a prime example of this concentration of power. These behemoths have the resources to buy out any competition and shape the market to their will. As Hayek wrote, “The more we try to provide full security by interfering with the market system, the greater the insecurity becomes.”

Moreover, the influence of these corporations extends beyond the economic realm and into the political sphere. As the bottom 90% of Americans lose their economic power, they also lose their political voice. Unable to compete with the deep pockets of corporate lobbyists and wealthy donors, the average citizen’s concerns go unheard. Hayek warned of this, writing, “Once politics become a tug-of-war for shares in the income pie, decent government is impossible.”

The solution, as Hayek saw it, was to limit the power of the state and allow for a free market system that encouraged competition and innovation. However, he also recognized the need for a strong legal framework to prevent the abuse of power by private actors. As he wrote, “The rule of law means that a government in all its actions is bound by rules fixed and announced beforehand.“

The solution, as Hayek saw it, was to limit the power of the state and allow for a free market system that encouraged competition and innovation. However, he also recognized the need for a strong legal framework to prevent the abuse of power by private actors. As he wrote, “The rule of law means that a government in all its actions is bound by rules fixed and announced beforehand.“

In the 21st century, we must heed Hayek’s warnings and work to limit the concentration of power in the hands of a few. This means breaking up monopolies, ensuring fair competition, and promoting a more equitable distribution of wealth. It also means strengthening our democratic institutions and ensuring that the voices of all citizens are heard, not just those with the most money and influence.

As Hayek wrote, “We must face the fact that the preservation of individual freedom is incompatible with a full satisfaction of our views of distributive justice.” In other words, we may have to accept some level of inequality in order to preserve our freedoms. But we must also work to ensure that this inequality does not become so extreme that it threatens the very foundations of our society.

The road to serfdom is paved with good intentions, but it is a road we must avoid at all costs. By heeding Hayek’s warnings and working to limit the concentration of power, we can ensure a more just and equitable society for all and, as you can clearly see – the window to act is closing fast!

“To revolutionize make a change nothing’s strange

People, people we are the same

No we’re not the same

‘Cause we don’t know the game

What we need is awareness, we can’t get careless

You say what is this?

My beloved lets get down to business

Mental self defensive fitness

Don’t rush the show

You gotta go for what you know

Make everybody see, in order to fight the powers that be

Lemme hear you sayFight the power

Fight the power

We’ve got to fight the powers that be” – Public Enemy