Powell speaks at 10am.

Powell speaks at 10am.

He’ll be at the Foreign Banker’s Association so not technically a speech but every word the guy says has the ability to send the market flying off in one direction or another so we will be paying attention. More importantly, we have the PPI Report at 8:30 and we’ll see how inflation is looking and you KNOW the Fed is worried about that as they have Lisa Cook speaking right after (9:10) and she’s a bit of a hawk.

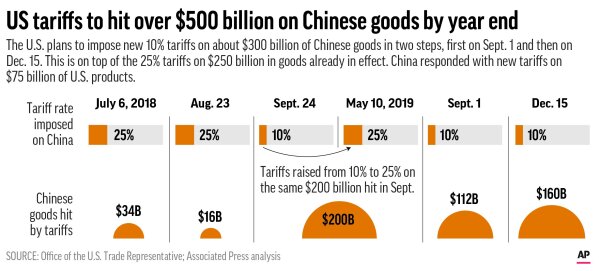

Speaking of things to be hawkish about – just last week we were musing about Biden’s plans to slap new tariffs on Chinese EVs, batteries, and solar cells and already the other shoe is dropping.

The White House announced a slew of tariff hikes on Tuesday with a jump from 7.5% to 25% on steel and aluminum, a doubling of duties on solar cells to 50%, and a brand spanking new 25% tariff on shipping cranes. And those are just the appetizers! The main course includes a delayed tariff hike on storage batteries and natural graphite, and a doubling of the semiconductor tariff to a whopping 50% by 2025.

All told, these new levies will hit over $500 billion in Chinese goods, from EV batteries to critical minerals to medical products. The Biden administration says they’re giving industries time to rejigger their supply chains, but let’s be real – this is a full-court press on China. And the Middle Kingdom is NOT pleased… A Chinese Foreign Ministry spokesman denounced the move last week, saying it’s only adding to tensions. Gee, ya think?

But here’s where things get really interesting. It seems our old pal Donald Trump is not about to be outdone in the tariff-slinging department. At a rally in New Jersey on Saturday, the Donald fired back, promising a 200% tax on every Chinese car coming in from Mexico if he retakes the White House. That’s right, 200%. Not 100%, not 150%, but a full-on 200% tariff. It’s a bizarre reverse-auction where the prize is economic mutually assured destruction and, perhaps, the White House.

Trump suggested Biden was ripping off his trade agenda, saying, “Biden finally listened to me. He’s about four years late.” Well, actually Biden left Trump’s tariffs in place and is now doubling down but Trump says he’ll double down on that and make it essentially impossible to buy Chinese goods in the US. That would be interesting. Horrifying but interesting…

Trump suggested Biden was ripping off his trade agenda, saying, “Biden finally listened to me. He’s about four years late.” Well, actually Biden left Trump’s tariffs in place and is now doubling down but Trump says he’ll double down on that and make it essentially impossible to buy Chinese goods in the US. That would be interesting. Horrifying but interesting…

So here we are, folks, in a brave new world where the leaders of both political parties are tripping over each other to see who can be tougher on China. Free trade? That’s so 2015. Nowadays, it’s all about those sweet, sweet tariffs.

Of course, not everyone’s thrilled with this protectionist arms race. The U.S. Chamber of Commerce, for one, is warning about costs to consumers. Imagine that, tariffs leading to higher prices – who could have possibly foreseen such a thing? But hey, this is politics in 2024. No one wants to look weak on China, even if it means turning global trade into a high-stakes game of chicken.

Where does this all end? Do we just keep ratcheting up tariffs until we’re paying $1,000 for a toaster? We will certainly end up with a bifurcated Global Economy, with the U.S. and China glowering at each other across a sea of duties and levies?

8:30 Update: Speaking of the stoking fires of Inflation, April PPI is up 0.5% (6% annualized!) and that is 6.66% hotter than 0.3% expected by our Leading Economorons and a 600% jump from March’s -0.1%. Hopefully the Core PPI is better but nooooooooooooo – it’s also 0.5% so this is a DISASTER and down the market goes – no surprise to use but everyone else seems SHOCKED that something like this could happen.

Inflation is like a horror movie villain: Every time you think it’s dead, it pops back up for one more scare. Core PPI is especially teriffying – even without the volatile stuff, inflation is still rearing its ugly head. That call is coming from inside the house!

Inflation is like a horror movie villain: Every time you think it’s dead, it pops back up for one more scare. Core PPI is especially teriffying – even without the volatile stuff, inflation is still rearing its ugly head. That call is coming from inside the house!

And it’s not just the consumers who are afraid to open their bills these days, small businesses are getting burned and they, in turn, become the ones stoking the fires of inflation for the consumers.

Just take a look at this Wall Street Journal article. It’s a veritable smorgasbord of small business woes. Aluminum and cardboard prices are soaring. Health insurance premiums are skyrocketing. And don’t even get them started on wages.

As Reid Baker, president of SuperGraphics in Seattle, so eloquently puts it, “We have death by a thousand paper cuts.” His company is constantly updating its software just to keep up with the rising cost of materials. It’s a similar story for Penny Mendelsohn, president of McFar, a commercial roofing company in New York. In the decade before Covid, they rarely adjusted prices. Now? They’ve raised rates by up to 10% between 2020 and 2023, with another 2% to 5% hike on the horizon this year. As Mendelsohn lamented, “We’ve increased more in the last four years than we had in 10. We don’t have a choice.”

And that’s where the inflation feedback loop kicks in. Unlike the big boys, small businesses don’t have armies of bean counters to constantly evaluate costs and contracts. Small businesses, facing higher costs on all fronts, are forced to raise prices to stay afloat. But those price hikes feed right back into the inflation beast, creating a vicious cycle that’s harder to break than a bad habit.

And that’s where the inflation feedback loop kicks in. Unlike the big boys, small businesses don’t have armies of bean counters to constantly evaluate costs and contracts. Small businesses, facing higher costs on all fronts, are forced to raise prices to stay afloat. But those price hikes feed right back into the inflation beast, creating a vicious cycle that’s harder to break than a bad habit.

It’s a catch-22 of epic proportions. Raise prices, and risk alienating customers. Don’t raise prices, and watch your margins evaporate. Small businesses are feeling the inflationary squeeze and, if this keeps up, Big Businesses will undercut them eventually and another cycle of consumers will abandon Mom and Pop for McDonald’s and Wal-Mart (who are already 12% of all retail in the US) but it’s less-efficient small businesses that account for 60% of the jobs in the US – if they go down, we all go down…

As we navigate these uncharted economic waters, one thing is clear: the fate of small businesses will play a crucial role in determining whether we sink or swim. Let’s hope Policymakers and Consumers alike recognize the value of our entrepreneurial engines before it’s too late to right the ship.