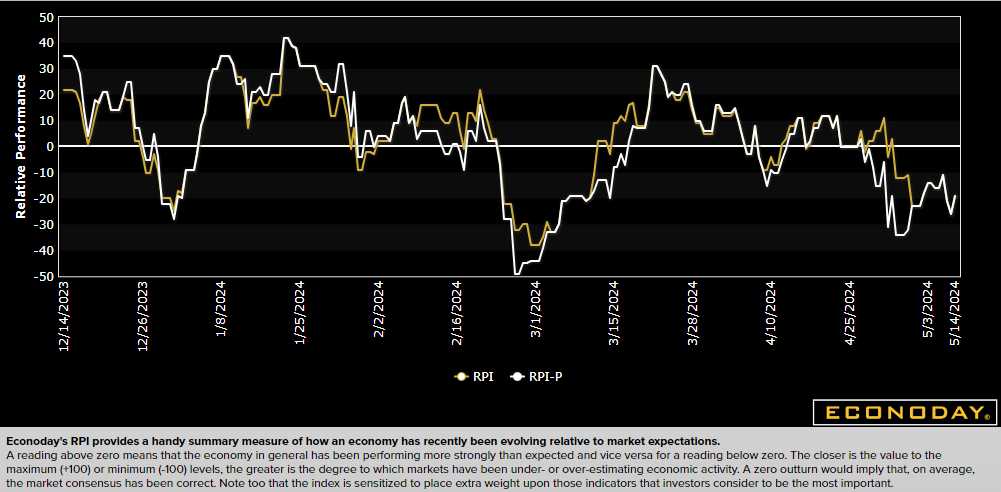

Minus 19!

Below 0 on the Small Business Optimism Index indicates how far below, as a percentage, things are going below expectations. At the moment, the economy is ACTUALLY performing at 30% below expectations for small businesses. 30%, for those of you without advanced degrees in Economics – is A LOT!

Boy, we are getting A LOT of data that says the Economy sucks but, at the same time, the S&P is crawling back to it’s all-time high – the one we were at on April Fool’s Day (5,300), before we fell back 5.6% to 5,000 on the 19th.

Boy, we are getting A LOT of data that says the Economy sucks but, at the same time, the S&P is crawling back to it’s all-time high – the one we were at on April Fool’s Day (5,300), before we fell back 5.6% to 5,000 on the 19th.

That’s all over now and we’re back to happy, happy land at 5,272 and most of the big caps have reported so, unless Wal-Mart really screws things up tomorrow – we should at least grind out a re-test this week or next.

Yesterday, Jerome Powell told us to ignore the 66.6% hotter-than-expected PPI – despite the fact that it’s the Fed’s 2nd most important data point and this morning I guess we’ll be told to ignore the CPI Report – which is THE MOST IMPORTANT data point the Fed is supposed to rely on.

As you can see from the chart, March CPI was up 0.4% and that’s an annualized 4.8% rate of inflation, which is 140% over the Fed’s supposed 2% annual target. Today, CPI is expected to be down to 0.3% in April and I’m no Leading Economoron but Oil, for example, started March at $78 and started April at $88 so there’s 12.8% right there.

- Cocoa was $6,000 to start March and $10,000 to start April – that’s up 66.6%

- Sugar went from $21 in March to $23 in April – up 9.5%

- Gold, which many consider an inflation measure, went from $2,050 in March to $2,400 in April – that’s up 17%

- Silver started March at $22.25 and hit $29 in April – up 30%

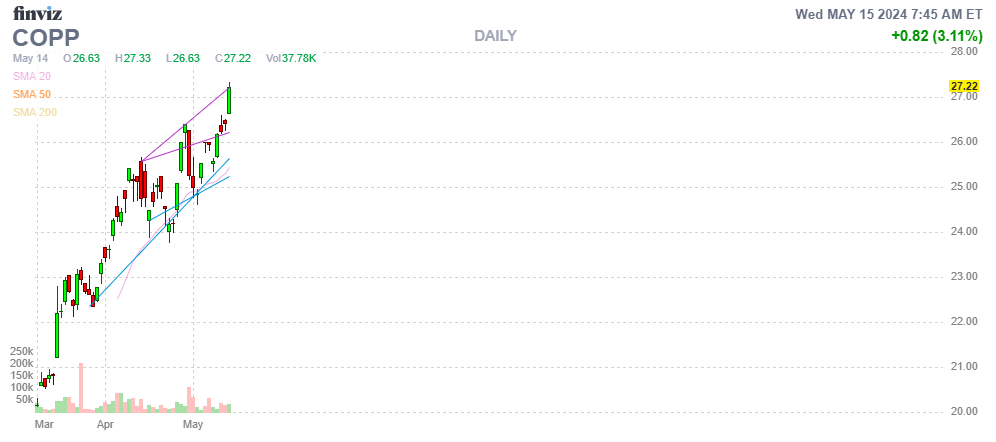

- Copper was $3.85 in March and hit $4.70 at the end of April (now $5!) – up 22%

- Beef prices fell from $185 in March to $172 in April – down 13%

- Hog prices rose from $85 to $105 – up 23%

- Corn went from $425 to $460 – up 8.2%

- Wheat went from $565 to $620 (now $685!) – up 9.7%

So I suppose Leading Economorons think we ate A LOT of beef in April? We’ll find out at 8:30 (45 mins) but I have a funny feeling CPI may be higher than expected. The copper ETF, which began trading in March, sums things up quite nicely:

And, of course, our friends in Japan are still desperately intervening in the currency markets to keep the Yen above 0.0064 (156 Yen to the Dollar) but, on the bright side for Japanese Exporters, it means when you pay $40,000 for a Camry it’s ¥6,228,160 vs. less than ¥5M last year so Toyota gets to show 20% more “profit” while using those overseas Dollars to buy back their own stock, propping up the Japanese markets thanks to their own weakness – isn’t Economics fun?

It’s not so much fun for the Japanese people but it certainly encourages them to stick to domestic purchases. Still, as with all countries these days, the Investing Class gets to make lemonade out of lemons:

According to Fumio Matsumoto, chief strategist at Okasan Securities, 53% of companies that reported earnings by May 10th announced plans to raise dividends in the current fiscal year. This move comes as the Tokyo Stock Exchange pressures companies to improve capital efficiency and valuations, which has helped spur a rebound in the Topix index after it nearly entered correction territory.

According to Fumio Matsumoto, chief strategist at Okasan Securities, 53% of companies that reported earnings by May 10th announced plans to raise dividends in the current fiscal year. This move comes as the Tokyo Stock Exchange pressures companies to improve capital efficiency and valuations, which has helped spur a rebound in the Topix index after it nearly entered correction territory.

In addition to dividend hikes, share buybacks are also at an all-time high. Goldman Sachs reports that firms announced ¥1.2Tn ($7.7Bn) in share buybacks in April alone, setting a record for the first month of the fiscal year. Bruce Kirk, Goldman’s chief Japan equity strategist, believes this bodes well for the prospects of another record year for buyback announcements.

While Japanese companies’ cautious earnings guidance for the current financial year may have disappointed some investors, the increased payouts to shareholders have helped offset this sentiment. Investors generally prefer dividend hikes that are part of a longer-term capital plan, such as increasing the overall payout ratio, as this provides better visibility and can be incorporated into valuation models more easily than share buybacks.

As the Japanese earnings season comes to a close this week, with most companies announcing their results by Wednesday, it will be essential to monitor how these trends develop. The commitment shown by Japanese companies to return capital to shareholders, despite the challenging economic conditions, could provide a much-needed boost to investor confidence and help support the stock market. On the other hand, the end of new buyback announcements may sour sentiment and spur an overdue correction…

8:30 Update: CPI did come in at 0.3% but the long-term readings are still hot. Retail Sales are flat to last month vs up 0.2% that was hoped for, so more signs of consumer weakness and, worst of all, Empire State Manufacturing is down 15.6% vs -7.5% expected so, as noted by Small Business Optimism – things are going worse than expected on many fronts.

Let’s be careful out there…