Earners vs Owners

-

Audio Recording by George Hahn

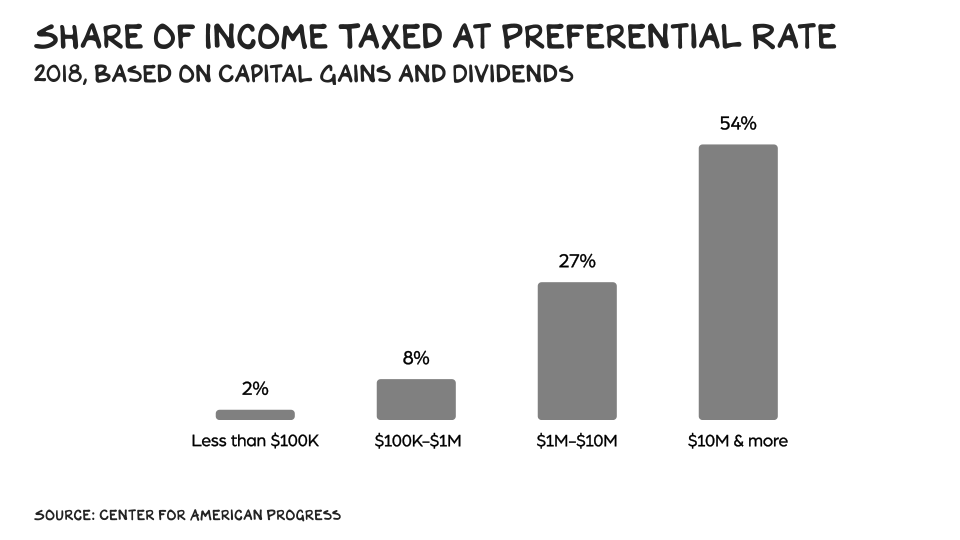

Over the past several decades, America has waged a covert war against the young. One front in this war is our income tax system, which favors Owners over Earners. Young people are almost all Earners, while Owners are typically older, and the tax code is a wealth-transfer vehicle for Owners to garner a greater share of our common wealth. The good news? It can be changed … back.

Pwned

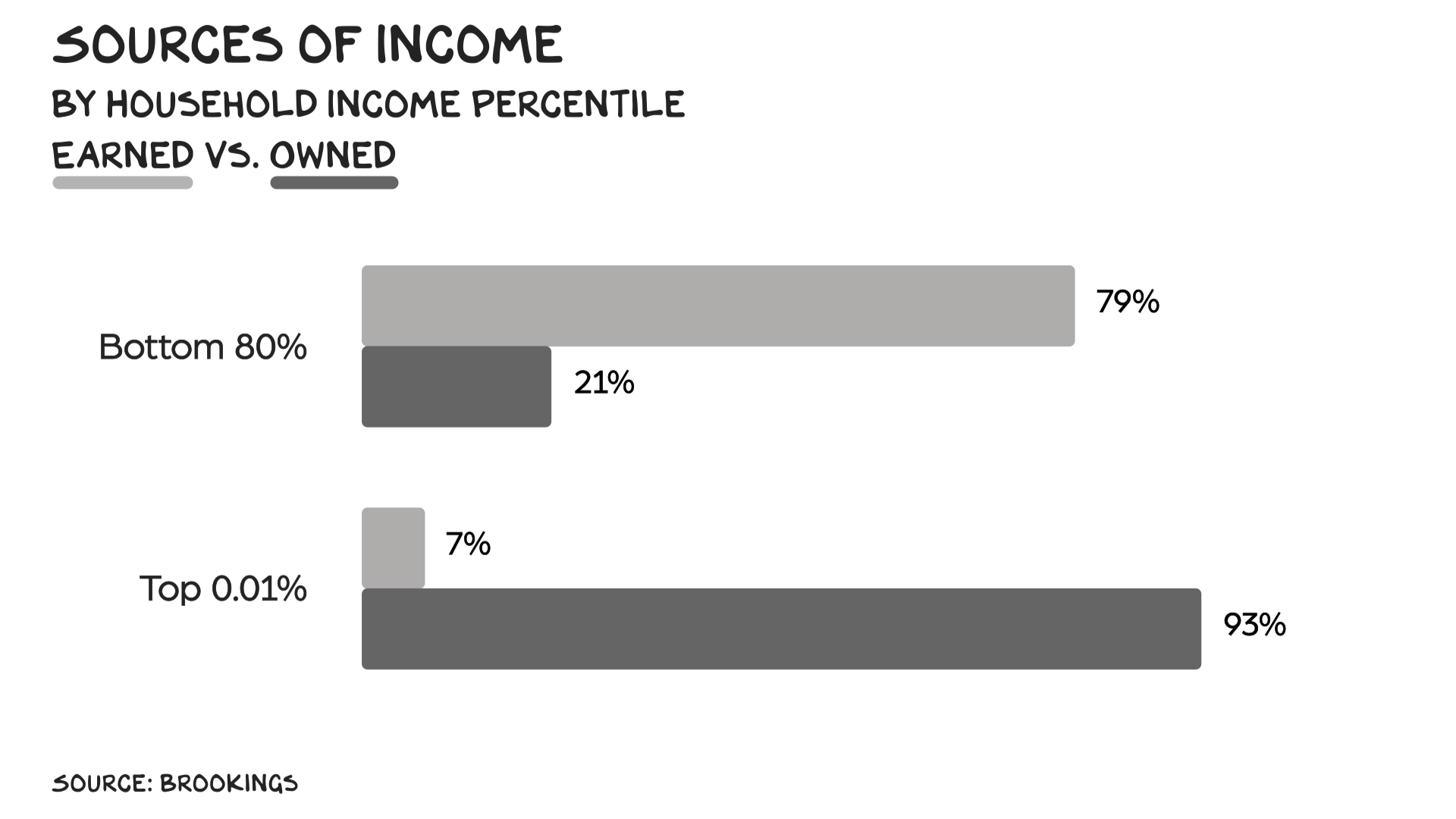

If you get a paycheck, whether it’s salary or freelance, and that’s how you pay your bills, you’re an Earner. Owners, on the other hand, might collect wage income, but their real money comes through profits from investments: stock sales and dividends, rent from property, and other income streams derived from the ownership of assets. To be an Earner is noble; you work for a living, and labor is a sacred thing. Labor is the source of food, shelter, entertainment, and every material pleasure of society. We even celebrate it with a holiday, the first Monday in September. Pro tip: If you want to celebrate Labor Day somewhere awesome, try as hard as you can to become an Owner.

Owners also get a celebratory day. It’s April 15. Another pro tip: If you’re ever featured in a commercial calling you a “hero,” it means you’re getting fucked. The most fortunate in our society have no holiday, as they don’t need one. They recognize that holidays wallpaper over the inequity faced by anybody who gets a day in their honor.

Income taxes for Earners are deceptively straightforward. Take your annual income, subtract the standard deduction ($24,000 for a married couple), make a few other calculations, and then pay a percentage of what’s left to Uncle Sam. And the income tax rates for most people are low: A two-adult household making less than $100,000 per year pays 10% or less in federal income tax. Many pay much less, or none at all. Sounds reasonable, right? But there’s a catch. Several … catches.

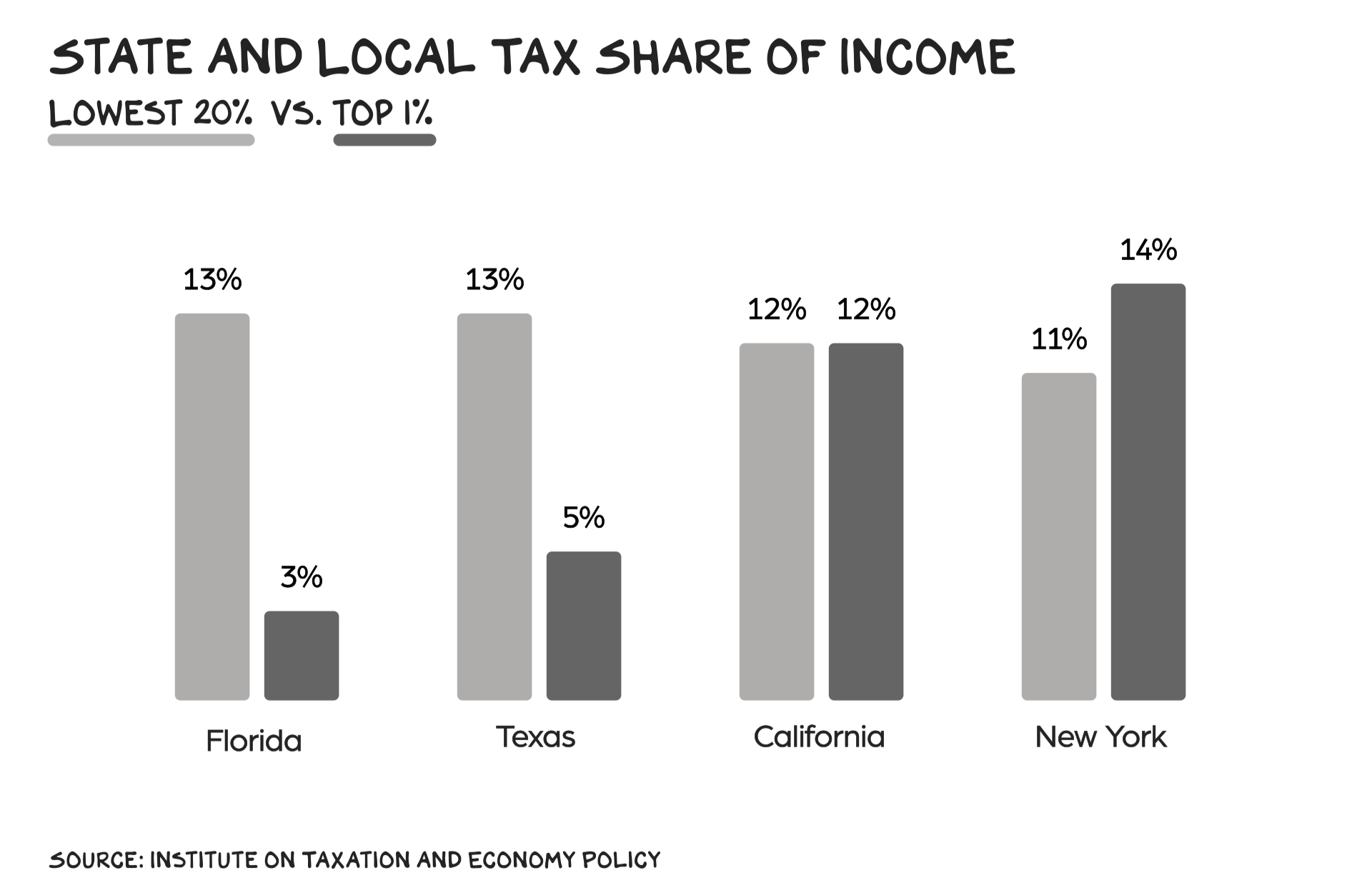

First, for those paying “only” 10% or less of their wages in income taxes, other forms of tax are a heavier burden. At the federal level, Social Security and Medicare add almost 8%. Then all states collect taxes, and most state tax systems are “regressive.” All told, lower-income people pay a greater portion of their income in taxes than many rich people.

Sales tax, property tax, and other government revenue sources (licensing fees, permits and filing fees, and car registrations) take a larger bite out of lower-income households. In “low-tax” Florida, the most regressive state, low-income families (Earners) pay 13.2% of their income in state and local taxes, the middle class pays 9.1%, and the top 1% (Owners) pays just 2.7%. In fact, lower- and middle-income Florida households pay about the same in total taxes as they would in “high-tax” California. The next time you hear someone complain about low-income people who “don’t pay any taxes,” remind them that income tax doesn’t exist in a vacuum — low-income people often pay over 25% of their income in taxes.

There’s a myth that the rich don’t pay their fair share of taxes. The reality is most “rich” people — the super-earners — pay more than their fair share. A married household making more than $500,000 per year is in the top 5% of households by income and pays an effective federal income tax rate around 25%. Half a million dollars may seem like a lot, but careers that pay that well require expensive college and graduate degrees, entail long hours, offer little job security, and they’re typically in high-cost-of-living locations with high state income tax — in New York or California, add another 10% on to that 25%. With other taxes, including sales tax, the total tax burden borne by mid-career professionals can reach 40% of their income. The baller who makes seven figures plus is often working for the government: Their (total) effective tax burden can approach 50%. Until, that is, they can make the jump to lightspeed (i.e., become an Owner).

Think of building wealth as launching a rocket ship into orbit. Rockets burn 95% of their fuel to escape Earth’s soupy atmosphere and incessant gravity. Once you get to orbit, you’re a master of the universe — covering thousands of miles with just a touch of propulsion. Wealth is similar. The atmosphere is your expenses; the distance traveled, your income. Most of us never generate enough current income to make the jump to space and become an Owner — save enough to invest so our primary source(s) of income are passive. Investing is difficult, if not impossible at low income levels. Saving your first $100,000 is incredibly hard. The next $100,000 is tough, but you now have momentum and start to see the curvature of the Earth. Once your current income is substantially greater than your expenses, and you’ve deployed an army of capital that fights for you and your family in your sleep, you’ve made the jump. What we’ve done with the tax code has rendered the atmosphere thicker and gravity stronger. Go to law or medical school, or live at the office, and you’ll see your (current) income increase, but you’ll also lose a bigger share to taxes, and the harder it gets to save and escape the gravity of being an Earner.

Orbit

Imagine if taxes worked like this: Everything you spend that’s remotely related to work is deducted from your taxable income. Clothes you wear and food you eat during the work week, your car, your internet and cellphone bills, furniture and square footage where you work at home (e.g., kitchen table), etc., all taken off your income before taxes. Pretty much anything you do on days you’re working, deductible. All past investments in education, deductible. If you spent more than you earned, as you did in college and graduate schools, you can roll over those losses as deductions in future years. In the meantime, deduct any credit card interest you’re paying. Any money you don’t spend? That’s not taxed until you retire and start spending it. If you give it to your kids, it’s never taxed at all.

If this sounds familiar but awkward, it is. It’s our tax code, through the lens of the Owner. The federal income tax code looks progressive: The highest marginal tax rate is 37%, more than 3x what the average American pays. But published tax rates are a weapon of mass distraction. They are the “rack rate” published on the door of your hotel room. Owners never pay the rack rate. They barely pay at all.

Unlike Earners’ taxes, Owners’ taxes are complex. As a result, determining the total tax burden of the very wealthy is difficult, but here’s what we know: In 2020 the 26,000 households with an income over $10 million paid 25.5% of their reported income in federal taxes, plus 5% to 10% in state and local taxes. But as I explain below, much of the cash they receive isn’t taxable income, and most of the increase in Owners’ wealth is never taxed at all. The White House has estimated that the 400 wealthiest households pay an effective income tax rate of just 8.2%, and Pro Publica found that the wealthiest 25 households pay just 3.4%. We can’t say for sure what percent Owners pay on average, but it’s less than most of their employees pay. This complexity results in a transfer of wealth from Earners to Owners. The tax code has exploded from 400 to 4,000 pages in the past few decades. If you have GPS (advisers, loopholes for the wealthy), you want races run at night.

If the government is meant to decrease suffering and add happiness, then our current system makes no sense. Paying taxes of $5 million on $10 million in income is the difference between flying first class and flying private. Paying $15,000 on $60,000 in income might mean foregoing a second child.

Capitalism means accepting a society of winners and losers. And that’s OK. Wealth is a great reward for hard work, and talent is what drives us to create value. Capitalism has brought prosperity to billions over the past 150 years. The problem is the system, if left unchecked, becomes increasingly inequitable and unsustainable. We’ve morphed from capitalism to cronyism, rigged in favor of Owners. How? Three ways: calculation, timing, and collection.

Calculation

Amateurs focus on tax rates. Professionals zero in on the calculation of the income to which those rates apply. In the 1950s the highest federal income tax bracket was 91%. Except nobody paid it. The tax code was a mosaic of loopholes, ensuring high-income taxpayers were able to shield most of their income. Now the top rate is 37%, but while the colors and fabric have changed, the Owner’s tapestry of tax avoidance still exists.

Owners receive cash from a range of sources: rent from tenants, dividends from stock, interest from loans, distributions from trusts, profits from investment partnerships, loans and lines of credit from banks, proceeds from asset sales, and more. Much of this income is shielded by pages of tax code defining what is, and is not, taxable. Owners who invest in the oil business leverage tax code provision section 263 (intangible drilling costs), section 613 (percentage depletion), section 611 (cost depletion), section 167 (geological expenses), section 199 (domestic production deduction), section 193 (tertiary injectant expenses), and section 469 (active losses). That’s just one industry.

Entrepreneurs are barely visible to the Treasury standing behind the tax code. Section 1202 excludes the first $10 million received in the sale of a business, a provision that saved me millions of dollars when I sold my firm L2 several years ago. When working at the firm — earning — I was paying 40+% taxes. But when I sold the business, my tax rate on the proceeds — owning — was 17%. Even before selling, every small business owner gets an enormous shield, the power to push all manner of personal expenses through the company income statement, thus making them tax deductions for the business rather than taxable income for the Owner.

Income that’s acquired by selling an asset for more than you paid for it is a capital gain, and isn’t subject to ordinary income tax rates. Capital gains rates (federal) max out at 23.8% instead of 37%. That’s still not the biggest loophole. Capital gains are only taxed when “realized” (typically when sold), so Owners’ assets grow tax deferred (some you can depreciate as they go up in value) and their sales are timed to minimize taxes. Earners lose 20% to 50% of their gains (from sweat) every year, a massive gravitational pull. Owners enjoy cleaner propulsion: As their wealth grows, the taxes are deferred until they sell … if they ever do.

But wait, there’s more. The biggest tax break Owners can register is dying, which resets the “basis” of their assets, so their heirs never pay taxes on the increase in value. Still, there’s more. The most indefensible loophole award goes to the “carried interest loophole” which permits investment fund managers to pay capital gains rates on their compensation. Tax policy groups have been lobbying to close this loophole for years, and Congress nearly did it in 2022, but Senator Kyrsten Sinema took $2 million from the private equity industry (aka Owners) and saved their $14 billion loophole. It’s well known that our leaders are whores. What’s more surprising, and disappointing, is what cheap whores they are ($2 million for $14 billion). But I digress.

Owners are so tax-advantaged that if they do have earned income, they often shield that from taxation as well. Donald Trump paid virtually no income taxes on the $427 million he made from The Apprentice — where he had an actual job — by offsetting that cash income with paper losses on his real estate properties (real estate is another of the most tax-advantaged industries). In 2007, Jeff Bezos made $46 million in actual income, yet he paid zero dollars in federal income tax, because he was able to shield that income with paper losses as an Owner (in reality, his wealth increased $3.8 billion that year). In 2011, not only did Bezos pay no income tax again, he claimed and received a $4,000 child tax credit — a program intended to lower child poverty. If you paid federal income tax in 2011, you helped feed Jeff Bezos’s kids. Don’t worry, he’s fine.

Timing

A key advantage of control over timing is state income tax arbitrage, practiced often by company founders. Several years ago, the media discovered the phenomenon of California entrepreneurs moving to Texas and Florida, and there was a lot of jazz hands about those states’ friendly business climates and youthful energy. The truth was simpler: Texas and Florida have no state income tax, and many of those founders were about to recognize enormous gains via sales of stock that had become worth billions. Elon Musk, who moved to Texas in 2020, sold millions of shares of Tesla, saving an estimated $2.5 billion in California income tax. When Washington State enacted a tax on income from asset sales, Jeff Bezos decided to spend more time with his father in Florida, which has no income tax, and sold 50 million shares of Amazon after he relocated. If taking advantage of Washington’s schools, roads, and tech ecosystem to build wealth, and then declining to pay taxes back to the state sounds wrong — and a massive additional burden on middle-class taxpayers who can’t peace out to Coral Gables — trust your instincts.

The best time to pay taxes is never, using the infamous “Buy, Borrow, Die” tax strategy. Wealthy Owners take out loans secured by assets such as company stock or real estate, and live off the loans (which are not considered taxable income) instead of selling the assets (which would incur a taxable gain). When the Owner dies, the stock goes to their heirs, who, with their “stepped up basis,” can sell enough stock tax-free to pay off the loans and start the cycle anew. This creates dynastic wealth, the lack of which used to be a key point of differentiation between Europe and the U.S. Used to be.

Collection

All of these strategies are legal and enabled by the complexity of the tax code. But that complexity also affords Owners another means of avoidance: cheating.

Skirting taxes stems from the complexity of the tax code itself. Wealthy filers can take deductions that don’t apply or classify income in inappropriate ways. And without an exhaustive analysis of the facts, there’s no way for the IRS to determine what they’ve done. Some of the losses Trump used to offset his income from The Apprentice may have been illegal — the IRS believes he claimed hundreds of millions of losses on a Chicago real estate project twice, burying the double-dip under a mountain of tax paperwork so tall it’s taken the IRS a decade to dig through it.

Owners can also choose to cheat bluntly, failing to report substantial income and making up fake expenses and losses. This was New York hotelier Leona Helmsley’s strategy. Before going to prison for tax evasion, she told her housekeeper, “We don’t pay taxes; only the little people pay taxes.” Offshore entities are a time-honored strategy for tax evasion. Trump’s campaign manager, Paul Manafort, concealed $16.5 million in income from the IRS in foreign bank accounts.

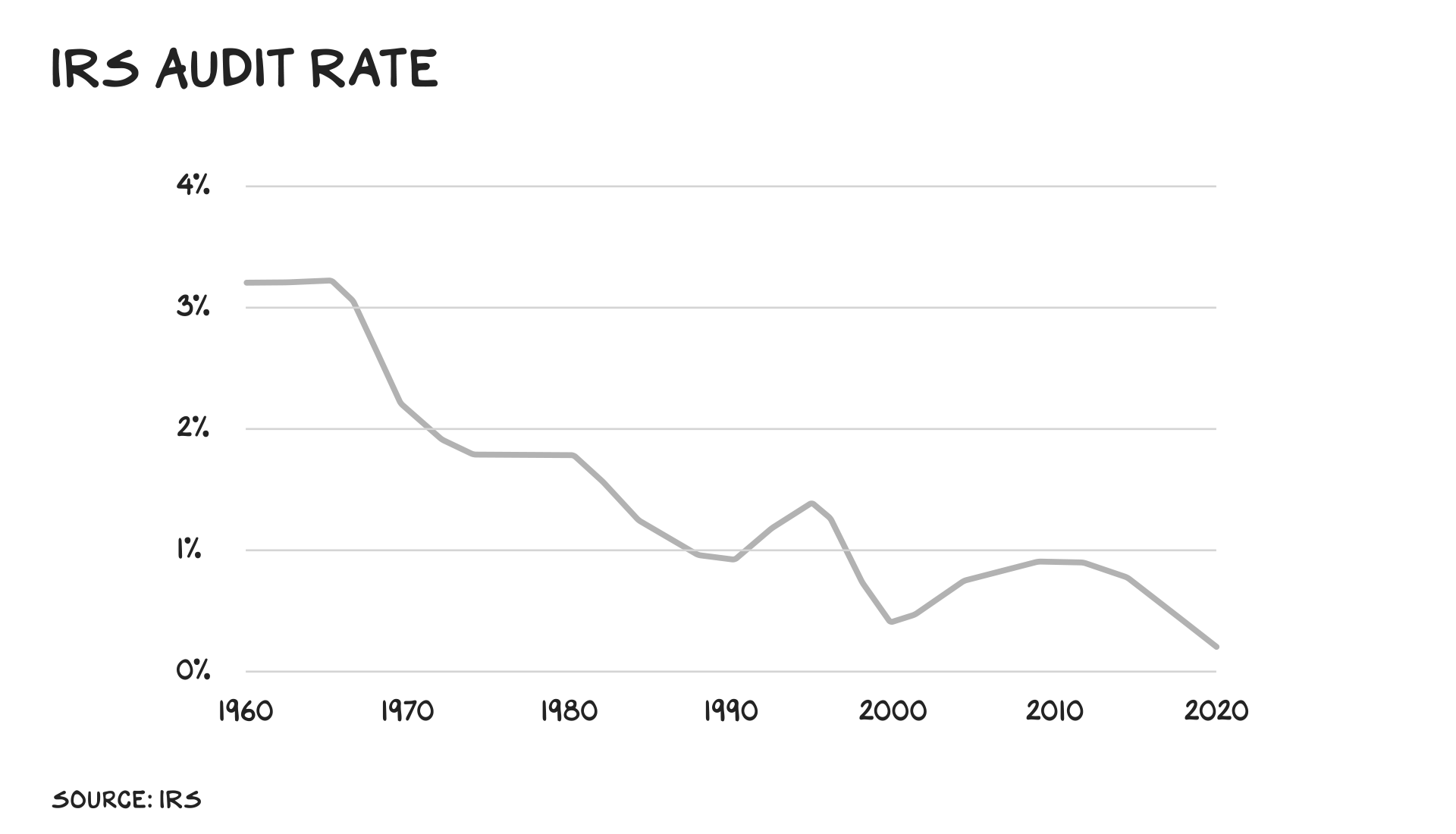

The Treasury’s analysis suggests $600 billion in owed taxes are not paid every year, equivalent to the total income taxes paid by the lowest-earning 90% of taxpayers. The avoidance is solely the domain of ownership income — 99% of the taxes owed on wages get paid. Owners can do this because Congress has starved the IRS of funding, and the agency audits fewer and fewer returns each year.

Tax Relief

Remedying these inequities is nowhere near as difficult as it would be to address many of the other challenges facing America. The most obvious and glaring remedy is to fund the IRS, enabling it to collect hundreds of billions in taxes owed but not paid. The Inflation Reduction Act was supposed to allocate $80 billion to the IRS over the next 10 years, but Republicans have attacked the measure, cutting $20 billion from the plan and keeping the IRS budget flat in 2024. Every $1 invested in tax enforcement targeting the wealthy returns $12 in revenue. To be clear, this isn’t harassment but enforcement. Most externalities are a function of incentives, and the government has incentivized owners to be incredibly aggressive on their tax returns, as there is little chance they’ll get caught. If you were on a highway with no police, would you speed?

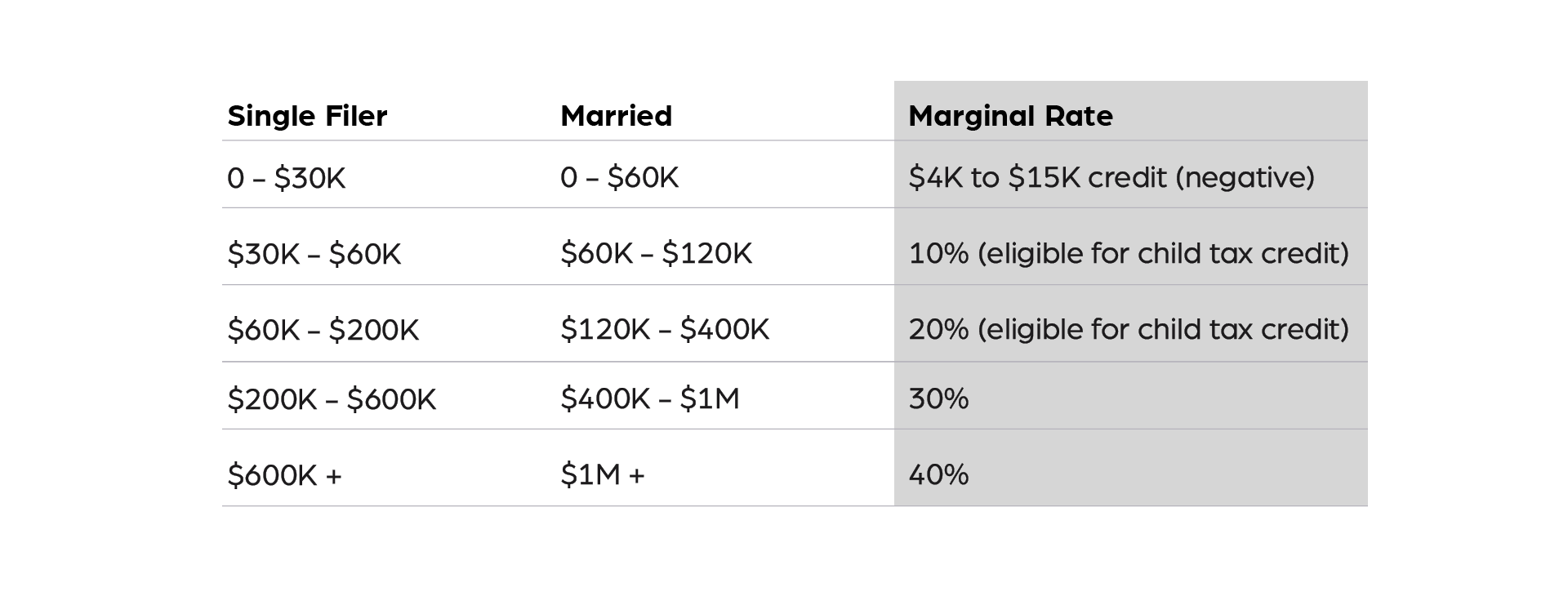

Eliminating the special treatment given to capital gains is a simple fix that would increase tax revenue without increasing the tax burden of most Americans, reduce the incentive to cheat through misclassification, and make the tax system more fair. So would eliminating the step-up basis upon inheritance, which wipes away billions in taxes owed by the wealthiest people with little justification or social benefit. We should remove the income cap on social security tax (currently a paltry $160,000), which would help shore up the social security trust fund and make the tax code (not rates) more progressive. We should restore the highest marginal tax rate (for owners) to 40%. Biden and congressional Democrats have proposed all of these changes in recent years, but to no avail.

Since ownership carries with it some inherent tax advantages, a transaction tax would raise revenue from ownership in a fair manner. Numerous proposals, including one from Mike Bloomberg, for a 0.1% tax on securities trades and other financial transactions could raise nearly $80 billion per year, with the potential side benefit of damping high-frequency trading, which adds volatility without benefit to the markets. We should also levy a compute tax on cloud and AI services, as the wealth created by these innovations is accruing mainly to the wealthiest Owners. Compute is the new energy, and this is a chance to avoid the mistakes of fossil fuels, where we give tax breaks to Owners and stick Earners with gas taxes, among the most regressive surcharges in our system.

Finally, and most transformationally, Congress should take a chainsaw to the tax code, cutting the thousands of handouts to the ownership class that have been stuffed into it by lobbyists. Theoretically, finding the political will shouldn’t be difficult, as the majority of Americans are getting screwed by lawmakers representing a small number of their fellow citizens. Ironically, the Trump tax cuts paved the way for this change — by doubling the standard deduction, Trump ensured that just 10% of taxpayers take any itemized deductions — meaning 90% of voters should support eliminating the rest of them. Still, it may be a challenge, as the most valuable asset Owners own … is Congress.

We should reinvest some of the hundreds of billions of dollars per year gained by these changes to make the system fairer for Earners (i.e., the young):

- Expand the child tax credit and the earned income tax credit and raise the floor required to pay any tax at all. (Currently it’s set by the standard deduction at $14,600/$29,200 for single/married households.) That would shield more lower-income households from federal income tax and reduce the impact of regressive state and local taxes.

- Lower the rates paid by higher-but-not-highest-income taxpayers, the professionals and entrepreneurs whose 60-hour-a-week climb up the professional ladder shouldn’t be rewarded with a 45% tax burden. This will make earning the way to ownership (aka the American dream) more feasible.

Below is a rough revised set of brackets that, with greater enforcement and the elimination of the Trump tax cuts on corporations, should get us to the same or greater revenue:

Patriot

I am troubled by the trend away from patriotism, fomented by a tech-billionaire class that conflates luck with talent, shitposts America, and prosecutes an economic war on the young. But America’s promise does not resonate unless it’s backed by performance. We diminish what’s great about America when we fail to talk about what’s broken in America. Especially when the fixes are within our grasp.

In defense of shielding Owners, lobbyists and our representatives in D.C. argue the wealthy are our most productive citizens, can better deploy capital, and need incentives to keep innovating. There is some truth to this notion, but we aren’t lowering taxes on the bulk of today’s innovators, the super-earners, or on future innovators, young people. Instead, we are ensuring a failure to launch by transferring more wealth to Owners/seniors. The three legs of the tax stool are corporations, super-earners, and super-owners. Corporate taxes are at their lowest levels since 1939 and the wealthiest Americans are paying single-digit tax rates, meaning the entire funding burden of our country rests on the super-earners and the young, who’ll have to survive the tsunami of debt we are aggregating to finance this inequity. This is capitalism collapsing under its own weight.

America, like any country, is a product — a mix of benefits that come at a price. America has been the best value (globally) for the better part of three centuries. Other than drugs, there is no other product so many people are willing to risk their lives to obtain. However, the value of America has diminished for super-earners and the young. We’re charging the former too much, and keep asking the latter if we can borrow their credit card. The bad news? This was deliberate, our decision. The good news? We can decide to fix it.

Life is so rich,

![]()

P.S. Our #1 business podcast, Prof G Markets, is now twice a week and getting its own feed. Subscribe here for new episodes every Monday and Thursday.

P.P.S. I’m sitting down with Mo Gawdat (formerly CBO of Google X) to talk AI and Happiness on May 30. Join us — it’s free.