It’s going to be a slow week.

Most of Wall Street is getting ready to re-open their Hamptons homes, so they aren’t very focused on trading this week. Usually, it’s a good time to bet on Oil heading higher but we just tested oil this morning on news that Iran’s President, Ebrahim Raisi (bet you would have gotten that wrong on Jeopardy) died in a helicopter crash and that sent oil back to $80 already this morning.

Keep in mind that Iran just “nicely” attacked Israel and Iran’s top diplomat was also on that helicopter so it’s possible we just lost the “voices or reason” that were keeping Iran in check. We’ll see how the action unfolds and we’ll keep a very close eye on the oil situation.

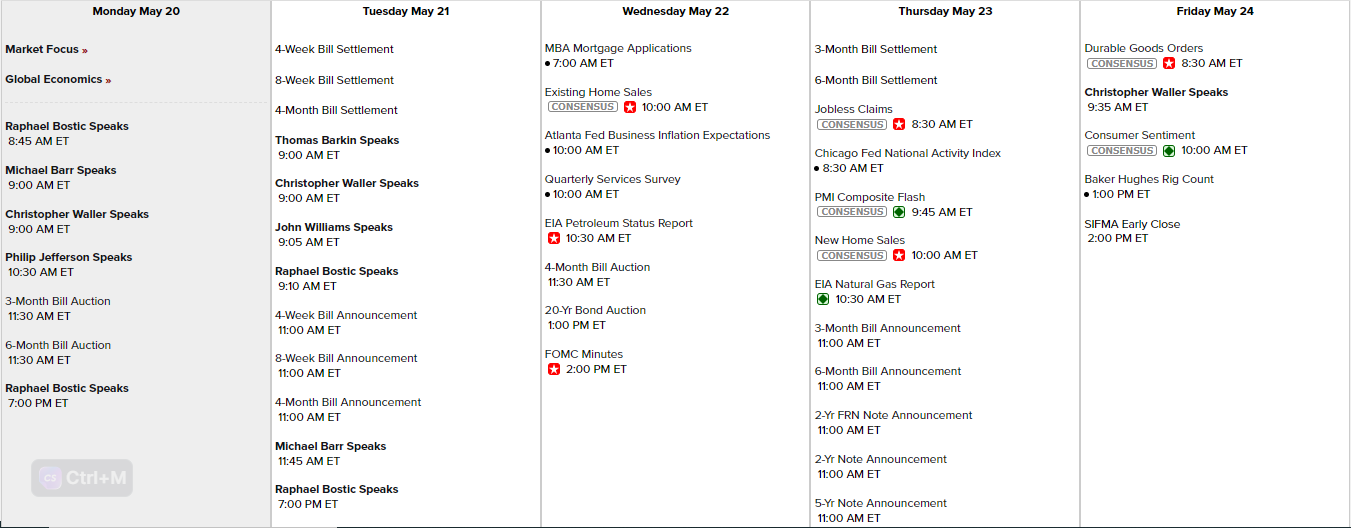

Almost as close of an eye as the Fed is keeping on Bond Auctions – just look at all those speakers swarming around! There’s not a lot of data so the focus will be on the Fed this week – especially with Wednesday’s minutes in the pipeline. We also have Durable Goods and Consumer Sentiment on Friday – but no one will be around to see it by then -so that will be next Tuesday’s problem.

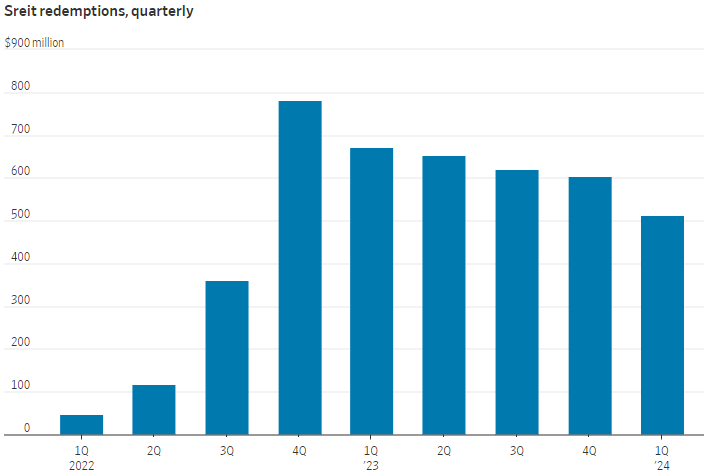

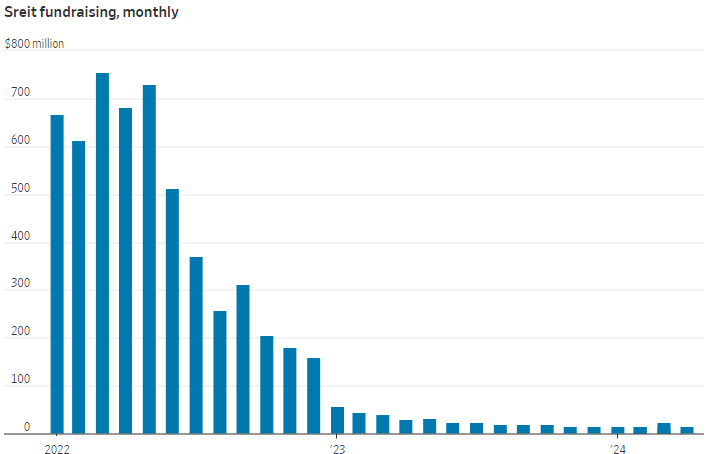

Speaking of disasters to watch: Starwood Capital Group’s $10Bn real-estate fund, Sreit, is grappling with a severe liquidity crunch as investor redemption requests outpace the fund’s ability to pay. Despite limiting withdrawals, Sreit’s available cash and credit have significantly dwindled, prompting concerns about its sustainability. The fund now faces tough decisions: take on more debt, sell properties in a depressed market, or halt further redemptions – each option carrying substantial risks.

Sreit has seen its liquidity plummet from $2.2Bn at the end of 2022 to $752M in April. In Q1 alone, it faced $1.3Bn in withdrawal requests but could only fulfill less than $500 million. The shrinking liquidity is attributed to high redemption requests amidst rising interest rates and falling commercial real-estate values.

Sreit has seen its liquidity plummet from $2.2Bn at the end of 2022 to $752M in April. In Q1 alone, it faced $1.3Bn in withdrawal requests but could only fulfill less than $500 million. The shrinking liquidity is attributed to high redemption requests amidst rising interest rates and falling commercial real-estate values.

Other nontraded real-estate investment trusts (REITs), like Blackstone’s Breit, also face redemption pressures but have managed better due to larger liquidity reserves ($7.5Bn). Breit’s ability to fulfill all redemption requests earlier this year contrasts sharply with Sreit’s struggles, highlighting the disparity in their financial health.

Sreit has three main options to address its cash crunch:

Sreit has three main options to address its cash crunch:

- Increasing Debt: Already leveraged at 57% of its assets, additional borrowing could be costly due to current high interest rates and may not be feasible.

- Selling Properties: Selling assets in a weak market could lead to significant losses. Sreit owns a diversified portfolio, primarily in warehouses and rental apartments, but market conditions and overbuilding in certain areas have depressed property values.

- Halting Redemptions: While stopping redemptions might conserve cash, it risks damaging investor confidence and future fundraising capabilities. Analysts view this as a last-resort option due to its potential to deter new investments.

As with many of these CRE funds, investors had been holding out hopes that the Fed Fairy was going to save them with rate cuts but those hopes are fading with persistent inflation and comments from people like JPM’s Jamie Dimon recently stating that Stagflation is still the probability for the US economy.

New York Community Bank (NYCB) recently plunged 80% after announcing a $2.4Bn write-off related to its commercial real estate (CRE) loan portfolio. This is a stark reminder of the looming CRE debt crisis, with nearly $1Tn in CRE debt maturing this year alone. NYCB’s troubles underscore the broader risks in the sector, especially as smaller, regional banks hold a significant portion of this debt.

The problem is compounded by the fact that many of these loans were issued during a period of historically low interest rates. Now, with rates substantially higher, property owners face increased costs just as revenues are falling due to high vacancy rates and the persistent trend of remote work. The nationwide office vacancy rate hit 19.6% in Q4 2024, a historic high, compared to the pre-pandemic average of 16.8%. Even more alarming – work-from-home numbers are still high so even the occupied offices are 1/3 empty!

Banks like NYCB are now grappling with these realities. NYCB’s announcement of material weaknesses in internal controls and the departure of two senior officials signals potential deeper issues with how CRE loans were vetted and approved. Investors interpreted this as a sign of more significant write-offs to come, driving share prices down further.

Small business owners, though seemingly distant from the $20.7Tn CRE market, are not immune to its ripples. A surge in loan defaults could trigger a broader economic shake-up, reminiscent of the 2007-2008 financial crisis. The Goldman Sachs report on this situation noted that nearly 80% of the $1 trillion in CRE debt maturing this year is held by smaller, regional banks, which are still recovering from last year’s Silicon Valley Bank collapse.

The potential contagion effect is alarming. CRE loans, unlike residential mortgages, typically require only monthly interest payments with the principal due at the end of the term. This structure means that any default could involve substantial amounts, threatening the stability of lenders. The situation is exacerbated by declining rental income, driven by lower occupancy rates as more businesses adopt remote or hybrid work models.

Moreover, a Newmark Group analysis highlights that these issues are particularly concentrated among small and regional banks, which hold a larger proportion of CRE loans and are often less well-capitalized than their larger counterparts. This concentration increases the risk of localized financial crises that could have broader implications.

The “extend and pretend” strategy, where banks refinance or restructure loans to avoid declaring them nonperforming, has been a temporary fix. However, with more loans coming due, this tactic is losing its effectiveness. CRE loans maturing by the end of 2024 have surged 41% from a year ago, indicating that many banks are running out of time and options.

In essence, the warning lights for CRE are flashing red. There are opportunities for buyers to acquire distressed properties at significant discounts, especially in less desirable markets. However, the sheer volume of vacant office space and banks’ reluctance to extend new loans further complicates the outlook.

The broader financial sector and municipal governments reliant on property taxes are also at risk. Falling property values and reduced rental income threaten to erode tax revenues, impacting the ability to fund public services. Howard Lutnick, CEO of Cantor Fitzgerald, painted a grim picture, predicting a very challenging market for owning real estate over the next 18 to 24 months.

As we move forward, the resilience of the CRE market and the financial sector’s ability to manage these pressures will be critical. Investors and stakeholders must keep a close watch on developments, as the outcomes will have significant implications for the broader economy.

So, while Wall Street enjoys its Hamptons respite, the real estate market and its intertwined financial issues continue to brew, requiring keen attention and strategic responses in the coming months.