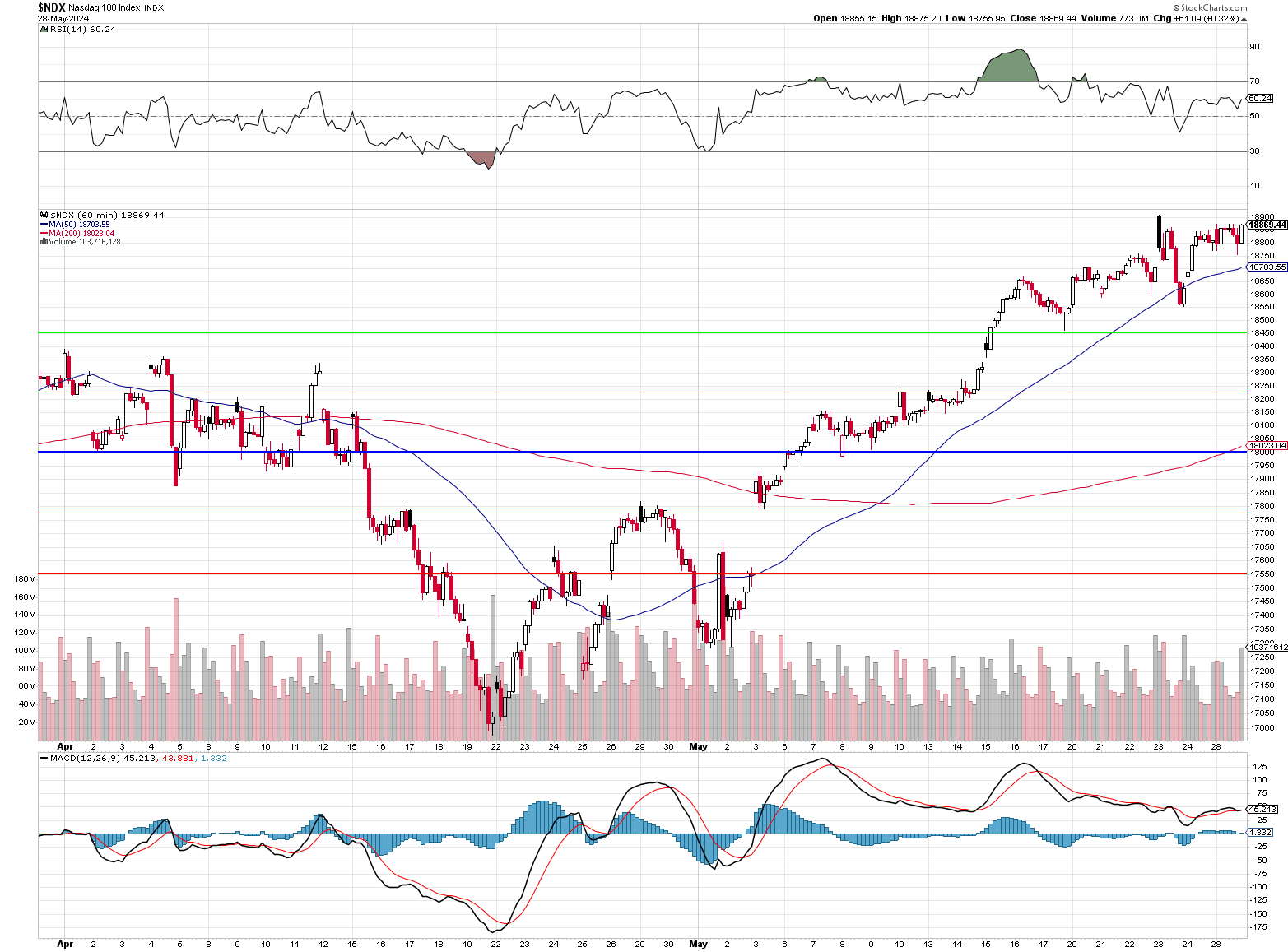

Another record high for the Nasdaq!

This is only an hourly chart but you can see the 200-hour moving average has moved over 18,000 and that will be very bullish if it sticks through the week. Unfortunately, the markets are looking a bit shaky this morning as renewed inflation concerns have investors pulling back from the record highs.

The Futures are currently (7:30) pointing to a lower open, with the Dow set to drop over 200 points, the S&P 500 down 0.6%, and the Nasdaq also off 0.6% despite hitting a new record yesterday.

The big driver seems to be a spike in Treasury yields, with the 10-year yield rising above 4.56% in this big auction week as traders worry (after comments by Kashkari that we discussed yesterday) that persistent inflation will keep the Fed from cutting rates anytime soon. Despite Kashkari’s push, we had a couple of weak Treasury auctions yesterday on short-term paper.

The odds of a September rate cut have fallen to just 44% according to the CME FedWatch tool, down from over 50% a week ago. Goldman Sachs has even pushed out their projection for the first cut to September from July. The recent string of strong economic data, like the (small) jump in Consumer Confidence reported yesterday, is making the Fed’s job harder.

We’ll keep an eye on American Airlines (AAL) today. Shares are down over 8.5% pre-market after the carrier slashed its Q2 sales outlook. This is dragging other airlines lower as well and the travel sector had been a strong leader in the rally. This is going back to my premise that the Consumers, confident or not, are hitting a wall on their spending capacity. On the other side, Robinhood is up 3% on news of a new $1 billion buyback program but that news is lagging as they did well in the market rally that might be fading at this point.

Speaking of companies that are swimming in cash: ConocoPhillips (COP) is reportedly in talks to acquire Marathon Oil (MRO) in a $15 billion deal ($17.1Bn in stock plus $5.4Bn in debt). Marathon shares are up 7.5% on the news to $28.50, which is pretty much exactly $15Bn in market cap – indicating it is strongly expected to be going through.

In short, it looks like inflation jitters are making a comeback, putting the Fed’s rate cut timeline in doubt. This could lead to some near-term volatility and profit-taking after the strong run we’ve seen in May. The S&P is still up over 5% for the month, while the Nasdaq has surged nearly 9% in the last 30 days – not a pace that’s likely to be sustained.

Tom Lee from Fundstrat said last night that the earnings outlook may be better than most expect, providing some fundamental support but in the short-term, the inflation narrative is driving the action. We’ll keep a close eye on the data and the Fed speak and we’ll check out the Beige Book in this afternoon’s Webinar at 1pm.