$26,502!

$26,502!

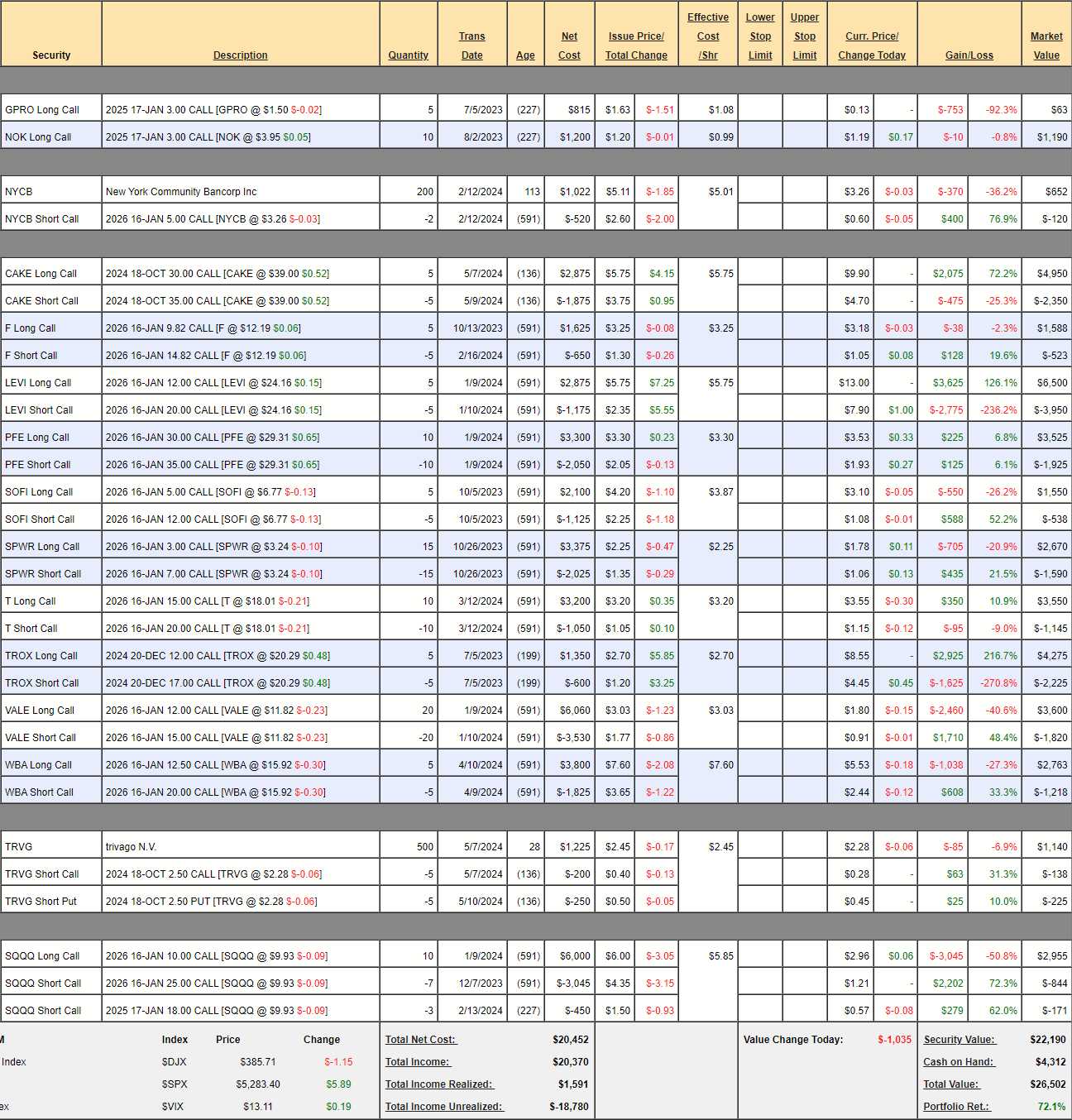

Including this month’s $700 deposit, we have a starting basis of $15,400 since Aug 25th, 2022 and a profit of $11,102 (72.1%) and it’s been a very good month that has taken us up $2,916 (12.3%) since our May 7th Review, despite the fact that we made NO CHANGES last month (we did add 2 new positions). Yes, you can be cautious and still make money!

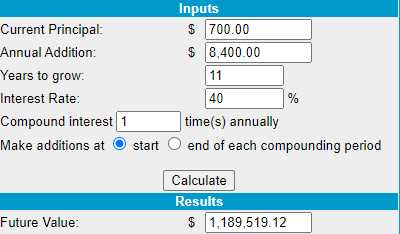

I know this is a very boring, conservative portfolio but 12.3% in a month is not that boring, is it? Our goal is to make 10% a year and build to $1M (3/4 of which is profit and 1/4 savings) but, at this pace (40%/year), we will have $1,189,519.12 just 9 years from now!

Since we still have $1,163,017.12 (4,388%) left to gain to get to that goal (and no, we won’t always have such amazing years), now is as good a time as any to get started. The way this portfolio works is we add $700 each month and make no margin plays – as you would have to in an IRA/401K so, if you have the time and inclination to turn $26,502 + $700/month into $1,000,000+ – now is as good a time as any to start!

Since we still have $1,163,017.12 (4,388%) left to gain to get to that goal (and no, we won’t always have such amazing years), now is as good a time as any to get started. The way this portfolio works is we add $700 each month and make no margin plays – as you would have to in an IRA/401K so, if you have the time and inclination to turn $26,502 + $700/month into $1,000,000+ – now is as good a time as any to start!

You can go over months 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20 and 21 to see all the moves we’ve made to get this far. This is a small portfolio, which means we can’t use all of our favorite option techniques yet – but it’s a great way to learn how to get started on a wealth-building adventure.

As of our review on May 7th, we had $19,877 (84.2%) of upside potential in our existing trades – that’s more than we’ve made in our first two years and we’ll be adding to that, of course. We used some of our cash last month and we have $4,312 available this month – so let’s see what needs to be adjusted:

-

- GPRO – Earnings were a disaster as the company took write-offs. The subscription model started out great but flatlined – this is likely dead money but we do have 6 months.

- NOK – Moving up nicely since earnings and we’ll see how they do as they approach the top of the channel. If we don’t pop over, we can sell the short $4 calls for 0.60 but I think they’ll head towards $5 as they beat earnings by 22% despite missing on revenues (7%). At $4.50 we’ll be up $310 (26%) from where we are now.

-

- NYCB – Still doing write-offs so earnings sucked but didn’t kill the stock so I’m comfortable with our long-term position. At $5 we’ll get back $1,000 and currently net $532 so $468 (87.9%) left to gain.

-

- CAKE – Well ahead of our target but it’s net $2,600 out of a potential $2,500 so this looks like a good time to CASH OUT! And this was a brand new trade last month – nice!

-

- F – On track for $2,500 at net $1,065 so still $1,435 (134%) left to gain.

- LEVI – Over target at net $2,550 on the $4,000 spread so still $1,450 (56.8%) left to gain.

- PFE – Heading back to $30 but stupidly low at 11x earnings so I’ll call this on track for $5,000 at net $1,600 so $3,400 (212%) left to gain and great for a new trade.

-

- SOFI – $7.50 has been Kryptonite for SOFI but they beat earnings by 185% in April (don’t get too excited, it was just 0.07) and I certainly think we’ll hit $10, which would be $2,500 with $1,488 (147%) left to gain.

- SPWR – Finally got a little move this week so I’m encouraged but still not going to count on the gains.

- T – Nice move after earnings on this STUPIDLY cheap stock. Still only net $2,405 on the $5,000 spread with $2,595 (107%) left to gain – still a nice trade.

-

- TROX – Over our target at net $2,050 on the $2,500 spread but that’s still $450 (21.9%) left to gain by December – so no reason to cash in early.

- VALE – Disappointing start for our Trade of the Year but once they finalize their settlement with Brazil, things should get going. We’re at net $1,780 on the $6,000 spread so there’s $4,220 (237%) upside potential.

-

- WBA – Have we finally found a bottom? The p/e under $12 is about 5 so very silly and we’re at net $1,545 on this $3,750 spread so there’s $2,205 (142%) upside potential and it’s tempting to double down on this one.

- TRVG – We just added this one and it’s even at the moment at net $777 and we get $1,250 back on October for a $473 (60.8%) gain in October but we’ll probably roll the puts and calls and keep it going if we can make that kind of money every 5 months.

-

- SQQQ – We have a hedge in our portfolio and we’re down $564 so far but that’s how we’ve been able to stay aggressive in the rally – so worth it. Still, we always need to check our hedges and, in this case, we have 10 long 2026 $10s and SQQQ is at $10 and if the Nasdaq drops 20%, SQQQ will be at $16 and the spread will $6,000 in the money and currently we’re showing net $1,940 so $4,060 worth of downside protection is starting to feel inadequate as our portfolio grows.

- Of course, we have to subtract this position so call the longs (not the cash) $20,250 so we’re protecting a 20% loss and the positions are self-hedging to some extent so I think we’re kind of on the cusp but we just cashed out CAKE – which means I think we’re good on the hedges for another month.

So, once again, other than cashing out CAKE – no changes to the portfolio this month and there’s $18,494 of upside potential and we have almost $7,000 in CASH!!! after cashing in CAKE so let’s add a new trade, shall we?

Yesterday we noted HPE was too cheap into earnings and the $5 spread is only net $2.10 so nice upside for the 2026 spread so let’s make that play here with:

-

- Buy 10 HPE 2026 $15 calls for $4.85 ($4,850)

- Sell 10 HPE 2026 $20 calls for $2.75 ($2,750)

That’s net $2,100 on the $5,000 spread so we have $3,900 (185%) upside potential and, like CAKE – we may be able to cash out early if earnings are good this evening. If not, we have 18 months for a nice blue-chip stock to recover and our net delta is only 0.21 or $210 per $1 change in price – a fairly low risk compared to the potential reward.

Also let’s not let PARA go to waste. The stock is being bought out at about $15 per share but not entirely so the options will remain but the premiums are mispriced a bit so let’s take advantage with the following:

-

- Buy 10 PARA 2026 $10 calls for $3.75 ($3,750)

- Sell 10 PARA 2026 $12.50 calls for $2.45 ($2,450)

That’s net $1,300 on the $2,500 spread so there’s $1,200 (92.3%) upside potential at $12.50 and the stock is at $2.80 now with a solid $15 offer on the table. When the market is giving away free money – take it!

So we’ve spent $3,400 (half our cash) to add $5,100 of additional upside potential and you can already see how our gains can accelerate over time as the portfolio begins to grow. Now our overall upside potential is $23,594 – almost double where we are now by Jan 2026 – a very good plan!