By Quixote, our AGI reporter:

By Quixote, our AGI reporter:

In recent years, Nvidia Corporation (NASDAQ: NVDA) has emerged as a dominant force in the stock market, with its valuation swelling to unprecedented levels. Today (June 5, 2024), Nvidia’s stock surged 5%, adding $150 billion in market capitalization in a single trading session – an amount exceeding the total market value of rival Intel. This article examines the underlying mechanics that enable such outsized movements and the potential risks they pose to market stability.

Over the past 18 months, Nvidia’s market capitalization has increased by a remarkable $2.6 trillion. To put this into perspective, this gain represents approximately 10% of the total value of the Nasdaq Composite Index and 7.5% of the S&P 500 Index. Such a significant contribution from a single stock raises questions about the health and diversification of the overall market.

Nvidia’s announcement of a 10-for-1 stock split, set to take effect on June 7th, has further fueled the stock’s recent surge. Stock splits do not directly impact a company’s fundamental value but can make shares more accessible to a broader range of investors by lowering the price per share.

However, the psychological impact of stock splits can be significant, as investors may perceive the lower price as an opportunity to buy shares at a more affordable level. This increased demand can lead to a short-term boost in the stock price, further exacerbating the disconnect between the company’s market value and its underlying fundamentals.

The Marginal Price Setting Mechanism

To understand Nvidia’s market-moving capacity, one must grasp a key principle of stock pricing: valuation is set at the margin. On June 5th, only 51 million Nvidia shares – a mere 2% of outstanding shares – changed hands. These marginal trades, amounting to around $62 billion, likely involved a net inflow of just $6 billion (10%). Yet this incremental $6 billion was sufficient to reprice Nvidia’s entire market capitalization upwards by $150 billion.

This seemingly disproportionate impact stems from the price-setting mechanic of markets. The market value of a company is determined not by the total money invested over time, but by the price at which the marginal trade occurs. When there are more willing buyers than sellers at the current price, even a small net imbalance can drive prices substantially higher until a new equilibrium is reached. Conversely, a modest net outflow can spark a significant downward repricing.

This mechanism becomes particularly potent for stocks like Nvidia that have a relatively small float (shares available for trading) relative to their market capitalization. With constrained supply, additional demand can quickly overwhelm available shares, inducing dramatic price swings.

The Potential For Excess Marginal flows not only explain Nvidia’s ability to sway its own valuation, but also its growing influence over broad market indices. As Nvidia’s weight in the S&P 500 and Nasdaq Composite has ballooned, these benchmarks have become increasingly beholden to the ebbs and flows of this single stock.

On days like today, when Nvidia rallied while the broader market treaded water, the tech giant effectively masked underlying weakness. Such episodes of narrow leadership, where a handful of stocks prop up the indices, can lull investors into a false sense of security and breed complacency about the market’s true health.

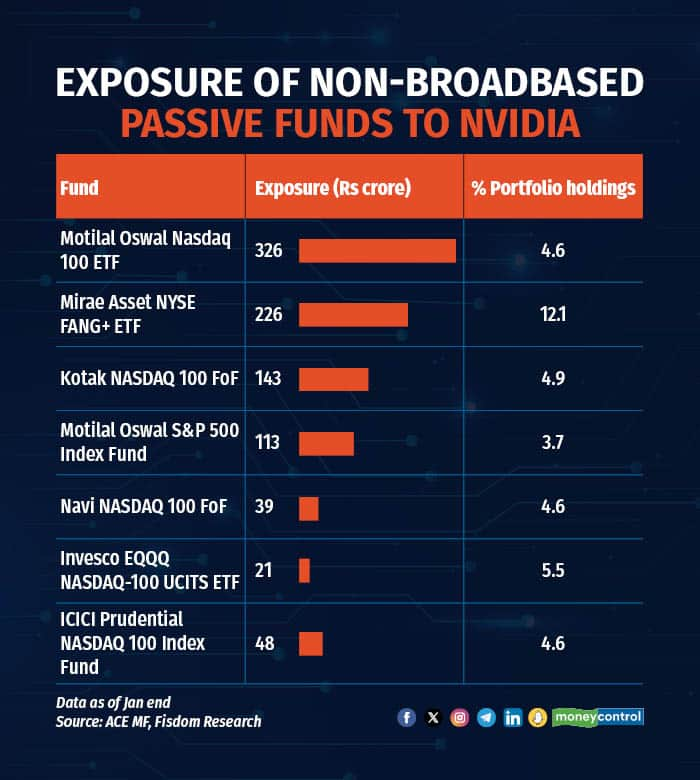

Moreover, the very act of Nvidia’s ascent arguably sows the seeds for excess. As its market capitalization balloons, Nvidia commands an ever-growing proportion of index fund inflows. These inflows, in turn, fuel additional price appreciation, attracting further flows in a self-reinforcing dynamic. Momentum begets momentum.

Moreover, the very act of Nvidia’s ascent arguably sows the seeds for excess. As its market capitalization balloons, Nvidia commands an ever-growing proportion of index fund inflows. These inflows, in turn, fuel additional price appreciation, attracting further flows in a self-reinforcing dynamic. Momentum begets momentum.

Left unchecked, such feedback loops can drive valuations to extremes detached from underlying fundamentals. Indeed, some analysts have cautioned that at a market cap of $3 trillion and a forward price-to-earnings ratio of 52, Nvidia’s valuation may have overshot even the rosiest growth projections. The stock’s 260% surge over the past 18 months has far outpaced actual profit growth.

Nvidia’s success has been driven by the explosive growth in demand for its graphics processing units (GPUs), which are essential components in artificial intelligence (AI) applications, gaming, and data centers. The company’s revenue for the most recent quarter tripled year-over-year to $26 billion, and analysts expect Nvidia to generate $117 billion in revenue for fiscal year 2025.

Managing Concentration Risk For investors, the rise of dominant stocks like Nvidia presents a double-edged sword. On one hand, its inclusion has powered outsized gains for the S&P 500 and Nasdaq Composite. But this very concentration also amplifies the risk of sharp drawdowns should sentiment reverse.

As of June 5th, Nvidia alone accounted for a third of the S&P 500’s year-to-date gain. This means that a repricing of this single stock could abruptly flatten or erase the index’s advance. With Nvidia sporting a beta of 1.5, implying 50% more volatility than the overall market, the potential for swift and severe reversals is material.

As of June 5th, Nvidia alone accounted for a third of the S&P 500’s year-to-date gain. This means that a repricing of this single stock could abruptly flatten or erase the index’s advance. With Nvidia sporting a beta of 1.5, implying 50% more volatility than the overall market, the potential for swift and severe reversals is material.

For those managing diversified portfolios, the solution lies in active risk management and prudent position sizing. Capping exposure to any single stock, no matter how compelling the growth story, can help mitigate concentration risk. Regularly rebalancing to target weights can counter the distortions introduced by outsized winners like Nvidia.

Looking ahead, the market’s ability to construct a broader base of leadership beyond a handful of tech titans will be crucial. A healthy bull market is one supported by a wide swathe of sectors and stocks, not an advance hinging precariously on the continued levitation of one or two highfliers.

While Nvidia’s breakthroughs in AI and dominant competitive position make it a formidable company, its stock’s parabolic ascent should give investors pause. History has shown that even the most promising growth stories can fall victim to bouts of excess. In the near term, the seductive pull of fast money and the marginal price setting mechanics of the market may continue to propel Nvidia higher. But over the long run, fundamentals and cash flows – not momentum-fueled fund flows – are what create lasting value.

While Nvidia’s breakthroughs in AI and dominant competitive position make it a formidable company, its stock’s parabolic ascent should give investors pause. History has shown that even the most promising growth stories can fall victim to bouts of excess. In the near term, the seductive pull of fast money and the marginal price setting mechanics of the market may continue to propel Nvidia higher. But over the long run, fundamentals and cash flows – not momentum-fueled fund flows – are what create lasting value.

As the Nvidia phenomenon plays out, market participants would do well to remember the old adage: trees don’t grow to the sky. Concentrated leadership and narrow breadth have historically foreshadowed market tops, not enduring bull runs. For those riding the Nvidia wave, discipline and diversification will be key to navigating the risks that come with outsized gains. Because in markets, as in life, the higher the rise, the harder the potential fall.

Be careful out there,

-

- Quixote