18,000!

18,000!

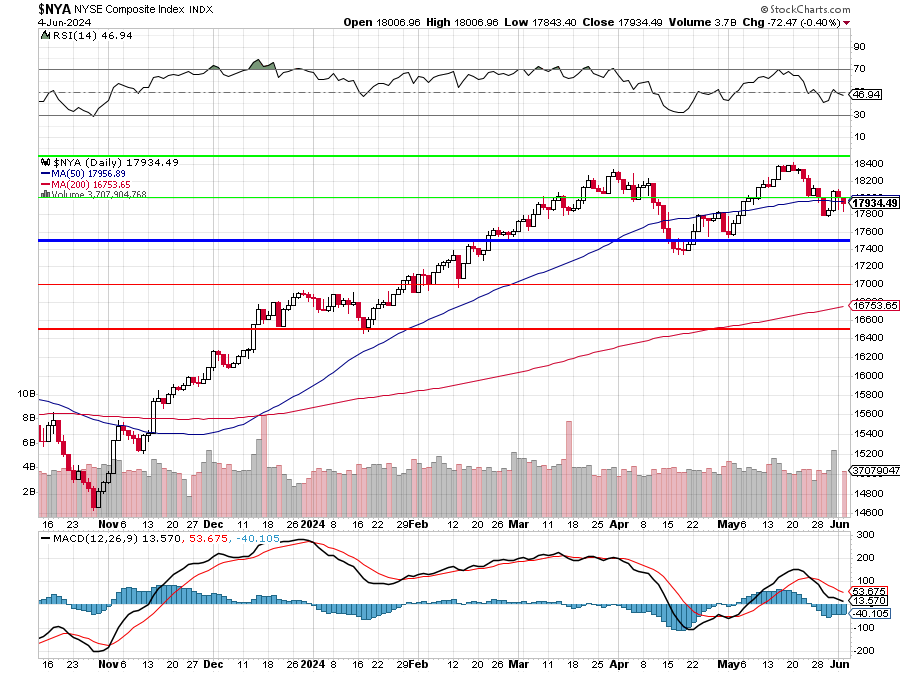

That’s off the high of 18,421 last month but still pretty good as we were at 14,638 in October. We’ve had a 3,362-point (22.9%) run in 7 months and that’s pretty, pretty good for our most global index.

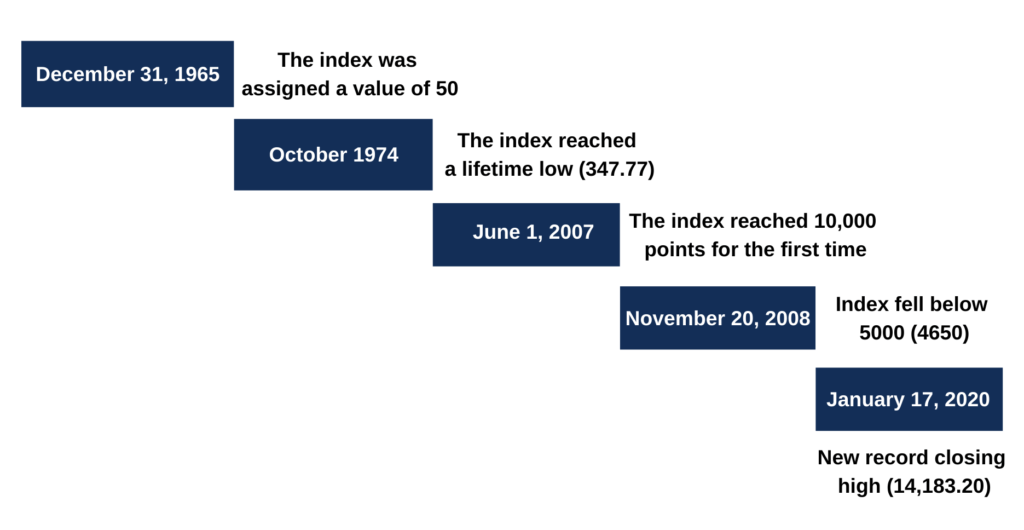

While the NYSE has 8,000 listed stocks, the NYSE Composite ($NYA) has the 2,000 largest of them, which is pretty much the S&P 500, 100 other US companies and 1,400 Global Corporations NOT based in the US. That’s why the NYSE is the best indicator of Global Economic Health – it’s fairly well-balanced to reflect many countries – not just US.

From the standpoint of our 5% Rule™, the NYSE moves in LONG-term 5,000-point increments so it’s 17,500 that matters as the index moves between the 15,000 and 20,000 range. We consolidated around 15,000 from early 2020 (fell to 9,000 during Covid) until November – when everything went nuts on a global scale:

18,000 is particularly significant as it’s also the 50-day moving average so a breakdown here could be particularly nasty and send us back to the 200 dma at 16,750 (more likely to be at 17,000 by the time it’s tested) and that’s a 1,250 drop (6.9%) from here.

Still, that would not be much of a pullback from the 3,400-point run – only 36.7% (strong retrace) of the recent gains. We’ll start watching the NYSE more closely as there are a lot of global cross-currents moving the markets into the summer and the NYSE will be a good barometer to keep us ahead of the storm.

No worries this morning as the indexes are moving up and we’re hoping the Russell plays a bit of catch-up as we played it long yesterday in our Live Member Chat Room as it just laid around all day while the other indexes moved higher in the afternoon. We have a stop below 2,040, specifically playing the IWM July $210 calls from $2.35 with a stop below $2 (closed at $2.25), hoping for a 50%+ gain this morning.

Speaking of nice trades – Yesterday we added the following spread to our $700/Month Portfolio:

-

-

- Buy 10 HPE 2026 $15 calls for $4.85 ($4,850)

- Sell 10 HPE 2026 $20 calls for $2.75 ($2,750)

-

That’s net $2,100 on the $5,000 spread so we have $3,900 (185%) upside potential and, like CAKE – we may be able to cash out early if earnings are good this evening. If not, we have 18 months for a nice blue-chip stock to recover and our net delta is only 0.21 or $210 per $1 change in price – a fairly low risk compared to the potential reward.

Earnings were, as expected, better than feared last night and HPE is up 15% pre-market – already above our $20 target so congratulations to all who played along at home as we’re well on our way to a 185% gain miles ahead of schedule!

We will be discussing our $700/Month Portfolio as well as the overall economic situation in this afternoon’s Live Trading Webinar at 1pm, EST – come join us!