This will be an interesting week.

This will be an interesting week.

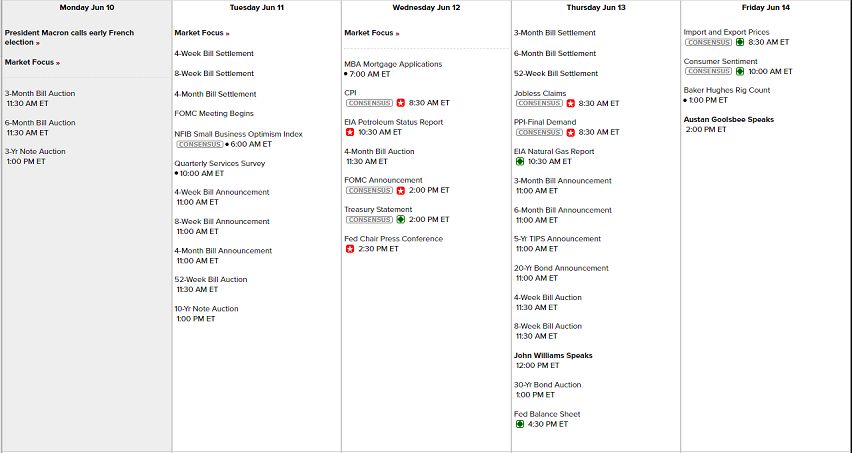

We have the Fed on Wednesday and that comes AFTER we get the CPI Report that morning that seems likely to come in hot as the expectations of Leading Economorons has the May CPI pegged at 0.1% so I asked Boaty (our resident AGI) to give us his best estimate of Wednesday’s upcoming report and here’s his guess:

🚢 Based on the latest economic data and trends for each major component of the Consumer Price Index, here is my estimate for the May 2024 CPI report to be released on Wednesday:

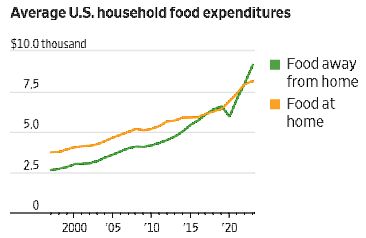

Food (13.5% weight): The USDA reported that the food index increased 0.2% from March to April. Assuming a similar modest increase, I estimate a 0.2% increase in May.

Energy (7.5% weight): Gasoline prices rose 2.8% in April according to the CPI report. However, oil prices moderated in May, so I expect a more subdued 1.0% increase for the energy component.

Shelter (32% weight): Shelter costs rose 0.4% in April, continuing a decelerating trend. Based on cooling rent growth, I estimate shelter will rise 0.3% in May.

Apparel (2.8% weight): Apparel prices jumped 1.2% in April. This is likely an outlier, so I expect a correction to a 0.2% increase in May.

Transportation (15% weight): Used car prices are still declining and new vehicle prices are steady. I estimate transportation will rise a modest 0.3%.

Medical care (7% weight): Medical care costs rose 0.4% in April. Assuming a similar trend continues, I estimate a 0.4% increase.

Education and communication (6% weight): This component rose 0.2% in April. I expect a repeat 0.2% increase.

Putting it all together, with each component weighted appropriately, I estimate that headline CPI will rise 0.31% month-over-month in May. The year-over-year rate should tick up slightly to 3.5% from 3.4% in April.

For core CPI excluding food and energy, I estimate a 0.34% monthly increase, which would keep the annual core inflation rate unchanged at 3.6%.

In summary, I expect the May CPI report to show inflation remains sticky, with only a very gradual deceleration. This is unlikely to change the Fed’s plans to keep rates higher for longer. However, a downside surprise would be welcomed by markets hoping for rate cuts later this year.

Citations:

[1] https://www.ers.usda.gov/data-products/food-price-outlook/summary-findings/

[2] https://www.bls.gov/news.release/pdf/cpi.pdf

[3] https://www.naahq.org/naa-inflation-tracker-may-2024

[4] https://www.corelogic.com/intelligence/us-home-price-insights-may-2024/

[5] https://ycharts.com/indicators/us_consumer_price_index_apparel

[6] https://tradingeconomics.com/united-states/cpi-transportation

[7] https://www.healthsystemtracker.org/brief/how-does-medical-inflation-compare-to-inflation-in-the-rest-of-the-economy/

[8] https://fred.stlouisfed.org/series/CPIEDUSL

[9] https://www.forbes.com/sites/simonmoore/2024/06/10/heres-what-to-look-for-from-the-may-cpi-report/

See, all you have to do is ask…

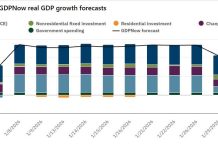

Aside from Boaty’s observations we also have the Atlanta Fed’s GDPNow estimate of Q2’s GDP and, thanks to last week’s extra-strong Non-Farm Payroll Report, we’re back over 3% on GDP – so there’s another strong indicator that neither the economy or inflation is slowing down. We’ll have to brace ourselves Wednesday for double disappointment as the Fed is definitely NOT going to lower rates and the data will indicate they won’t be considering it for quite some time.

Aside from Boaty’s observations we also have the Atlanta Fed’s GDPNow estimate of Q2’s GDP and, thanks to last week’s extra-strong Non-Farm Payroll Report, we’re back over 3% on GDP – so there’s another strong indicator that neither the economy or inflation is slowing down. We’ll have to brace ourselves Wednesday for double disappointment as the Fed is definitely NOT going to lower rates and the data will indicate they won’t be considering it for quite some time.

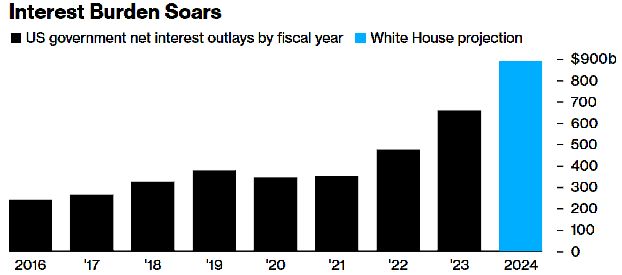

Long-Term Note Auctions have been tricky all year and even more so with the Fed Governors unable to speak ahead of Wednesday’s rate decision (and Powell Speaks at 2:30) but the 10-Year Note Auction is tomorrow at 1pm along with the 1-Year Auction and Thursday we try to sell 30-Year Notes as well – brother can you spare a Trillion dimes?

Candidate Trump wants us to spend 40.6Tn dimes so he and his top 0.1% buddies can continue to enjoy his tax cuts, which are already adding $1Tn per year to our debt as interest payments on the debt we’ve accumulated alone is now going to be over $1Tn per year starting in 2025:

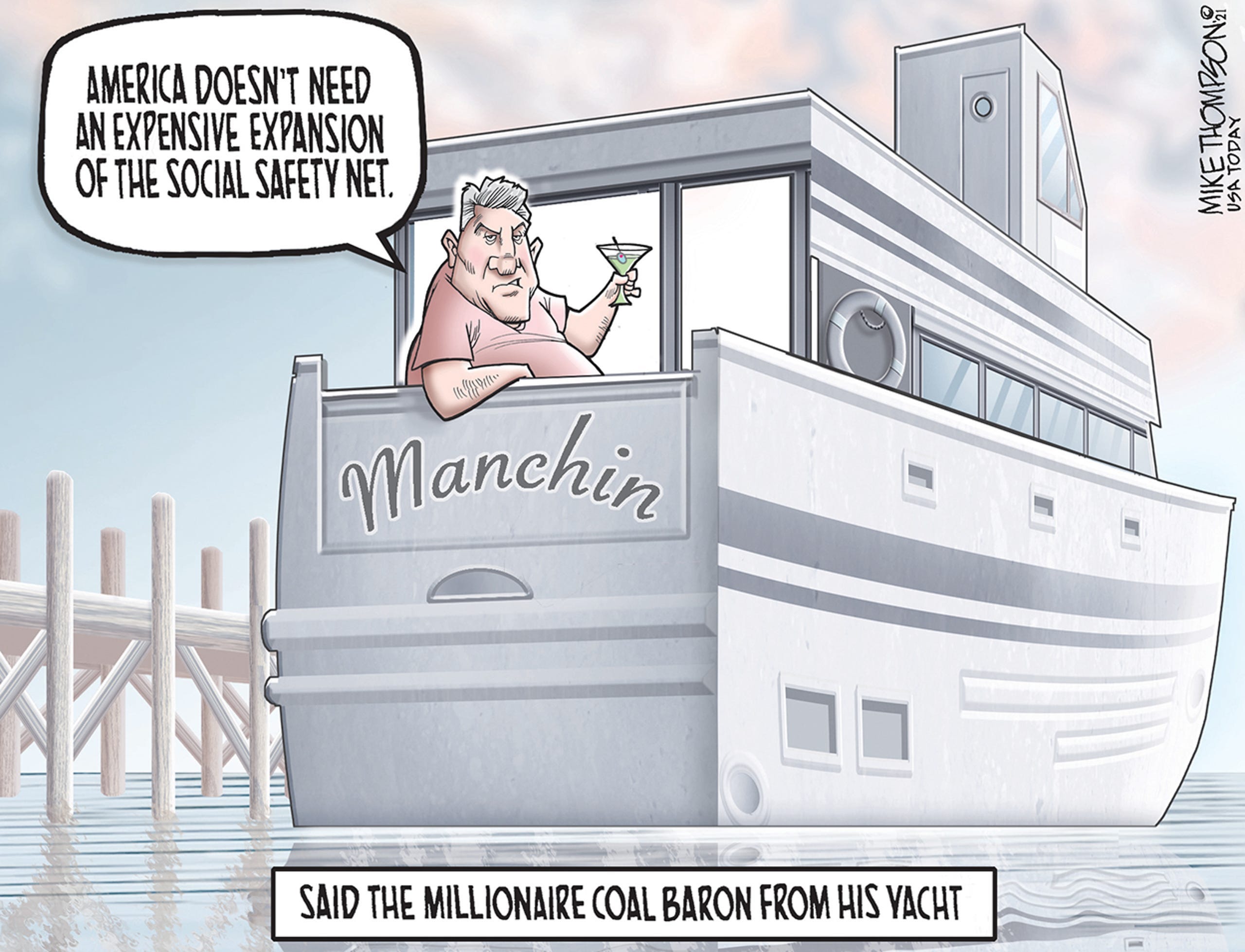

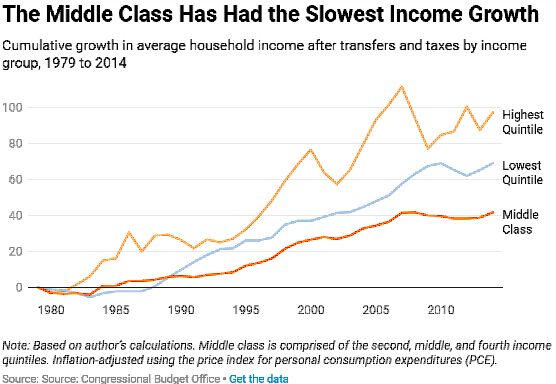

A rational person may say this is not the time to deliver another $4Tn wealth bump to the Top 1%. Yes, that’s right, the bottom 99% did get something with people in the bottom 60% getting an average of $500 for every $252,300 handed out to people who spend $500 on dinner and a movie. Even the Top 0.9% below the Top 0.1% get screwed – they only got $60,000 tax breaks for each $252,000 given to the people who’s yachts and homes constantly make them feel inadequate – no matter how successful they think they are…

Extending the Trump Tax Cuts will make things much, much worse. Aside from forcing us to borrow another $4.6Tn to make rich people richer, by 2027 the Top 1% will receive 83% of the tax cuts while taxes will actually INCREASE for the bottom 60%. Since it’s the bottom 60% that are mostly voting for Trump to retake power – it is only fitting that they pay him to rob them I suppose.

Likewise, Corporate Tax Cuts have largely flowed to shareholders through stock buybacks and dividends, rather than to workers through wage increases. Just 6% ($6 out of each $100) of the Corporate Tax Savings actually “trickled down” to the workers and there is the same disproportionate distribution of cuts that goes to the wealthiest Corporations as well.

The Trump Tax Cuts of 2017 were heavily skewed toward Corporations and the wealthiest Americans, with limited and temporary benefits for the middle class that have already evaporated. The resulting deficit spending represents a long-term burden that is being borne by the bottom 99% through future tax increases or spending cuts. Rather than meaningfully boosting Middle Class incomes, the tax cuts have exacerbated economic inequality and extending them further could spell the collapse of the middle class and the beginning of the end for our Democratic society.

As one of 165M taxpaying citizens you have been burdened with your equal share of Trump’s $4.6Tn tax cuts so far and that’s $27,878 each so, unless your tax cut was bigger than that – you are losing this game. Saying yes to extending those cuts will cost you another $27,878 over 5 years so just make sure you are getting at least $5,500 a year in savings – or you are just one of those “losers” who don’t know how to work the tax code that Trump looks down on.

Getting back to the week’s data:

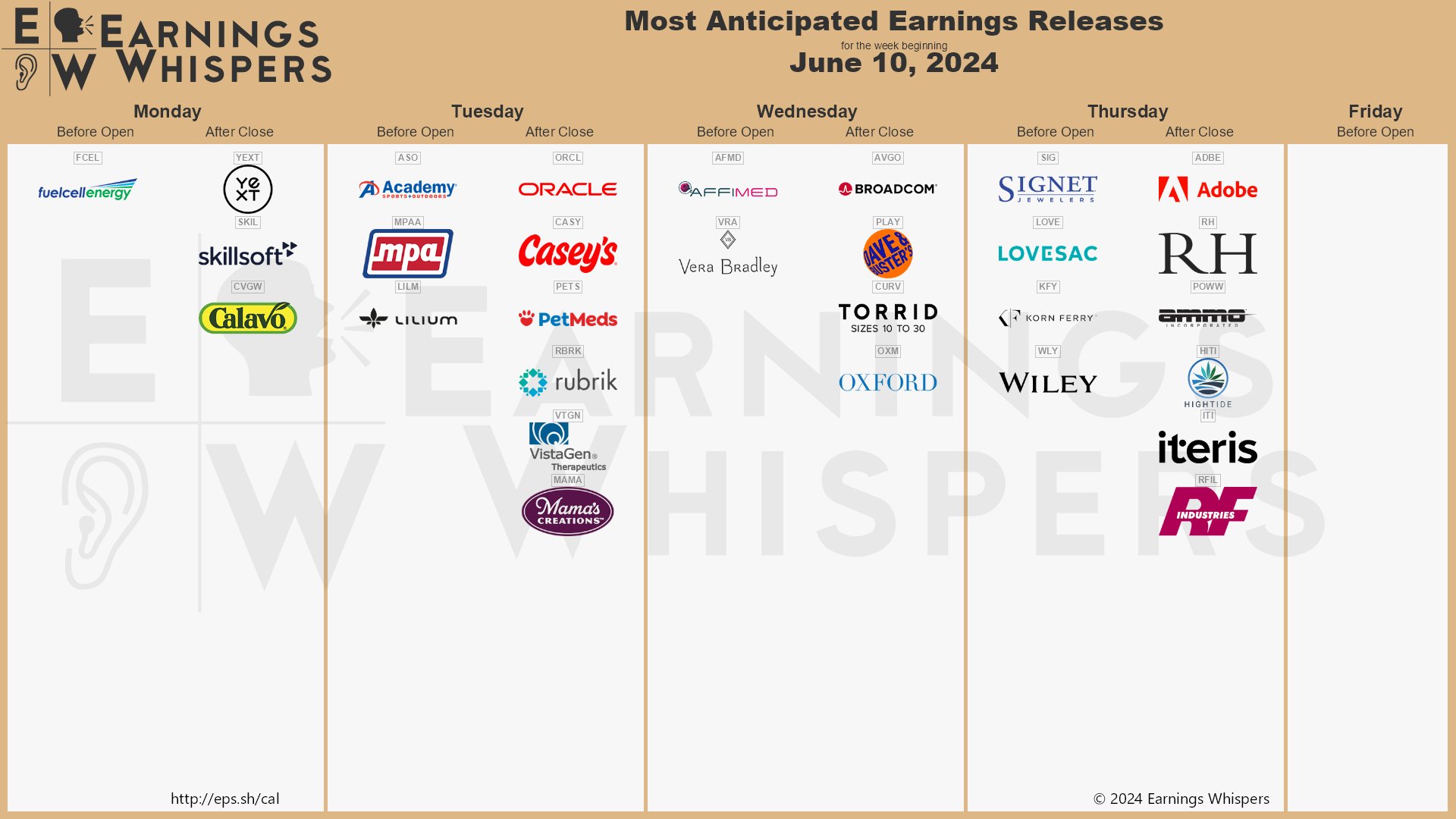

And, amazingly, we are still getting earnings reports but, at this point – it’s more early reporters than late ones:

ORCL, RH, LOVE, ADBE, AVGO and our old favorite MAMA are reporting this week – so that’s going to be worth paying attention to as well.

And the Dollar is popping and the Yen is dropping so look for our friends at the BOJ to once again attempt to intervene but they are just rearranging deck chairs on the Titanic at this point as that currency is going down and no amount of bailing out is going to save it in the long run:

Be careful out there: