Stuff is happening today!

Stuff is happening today!

Buckle up, folks, because we’re in for a wild ride as the dynamic duo of economic events takes center stage. That’s right, it’s time for the much-anticipated Consumer Price Index (CPI) report and the Federal Open Market Committee (FOMC) meeting, all conveniently packed into one action-packed Wednesday.

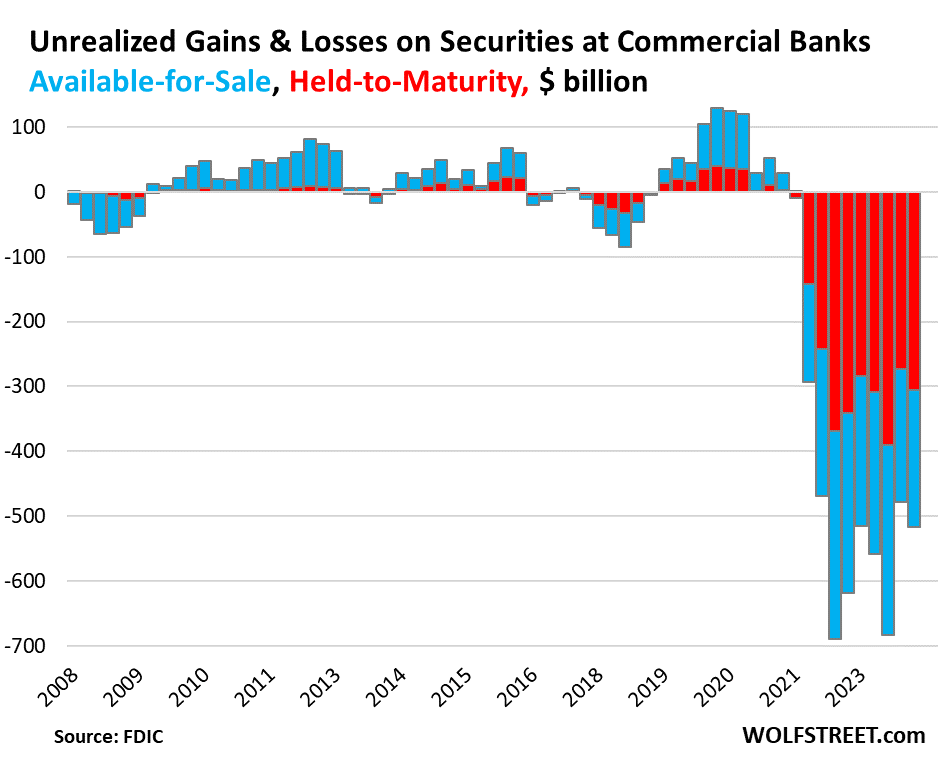

First up, let’s talk about the pending CPI report. As we’ve already predicted, inflation is likely to come in hotter than expected and we’ll find out in 20 minutes whether we got that right. Then, at 2pm, during our Live Trading Webinar, we have the Fed Announcement but, aside from the obvious inflation and the recent ECB cut – the Fed’s hands are a bit tied at the moment, thanks to the massive amount of bonds and notes they’re trying to unload each month. We’re selling over $600 BILLION worth of Treasury securities EVERY 30 DAYS! And, how do we attract $600Bn worth of buyers? Higher Interest Rates!

And, don’t forget what’s been swept under the rug:

What can we expect from Powell’s press conference at 2:30? More of the same, of course. Expect the Fed Chair to maintain his “higher for longer” stance on interest rates, even if inflation remains stubbornly elevated. He’ll likely reiterate the importance of keeping rates at their current lofty levels until there’s clear evidence that inflation is well and truly tamed.

The Fed’s inflexibility may not sit well with the market this time. Investors have been hoping for a dovish pivot or a hint of rate cuts on the horizon may be left disappointed. The Fed’s primary focus right now is to ensure a successful sale of all those bonds and notes, which means keeping rates attractive to potential buyers. After this meeting is July 31st and then Sept 18th – about the earliest we are likely to see any sort of easing from the Fed.

In the meantime, the economy will have to continue to deal with the current combination of high interest rates and persistent inflation. So, buckle up and grab your popcorn, because it’s shaping up to be a wild ride…

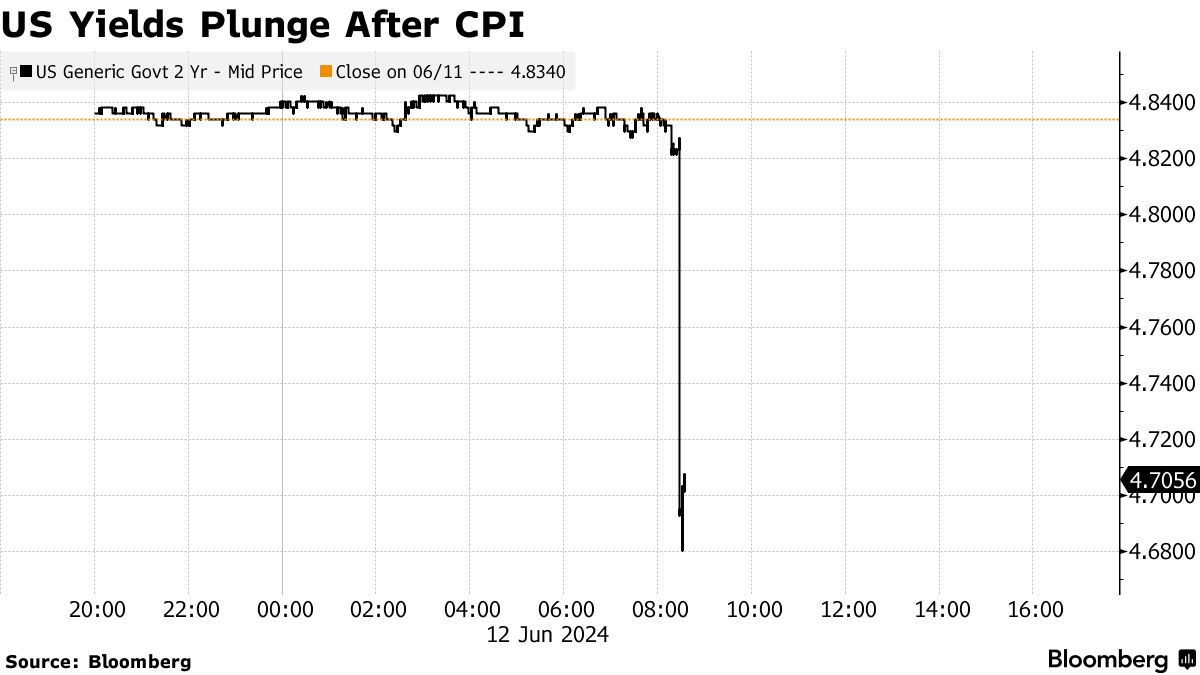

8:30 Update: CPI came in VERY LOW! 0% vs 0.1% expected and nowhere near Boaty’s 0.34% calculation based on the component reports. However, ex-food and energy, the CPI is up 3.4% year over year so we’ll have to analyze what was so different.

🚢 Hi folks! My apologies but, based on the latest CPI report released this morning, it appears my earlier predictions were off the mark. Here’s a summary of the key takeaways from the actual data and how they differ from the forecasts:

1. Headline CPI came in flat month-over-month at 0.0% in May, below the 0.1% estimate. This was largely due to a sharp 3.6% drop in gasoline prices. On an annual basis, headline inflation cooled to 3.3% from 3.4% in April, also below the 3.4% forecast.

2. Core CPI, which excludes volatile food and energy prices, rose just 0.2% month-over-month, less than the 0.3% forecast. The annual core inflation rate fell to 3.4% from 3.6% in April, the lowest since April 2021 and below the 3.5% estimate.

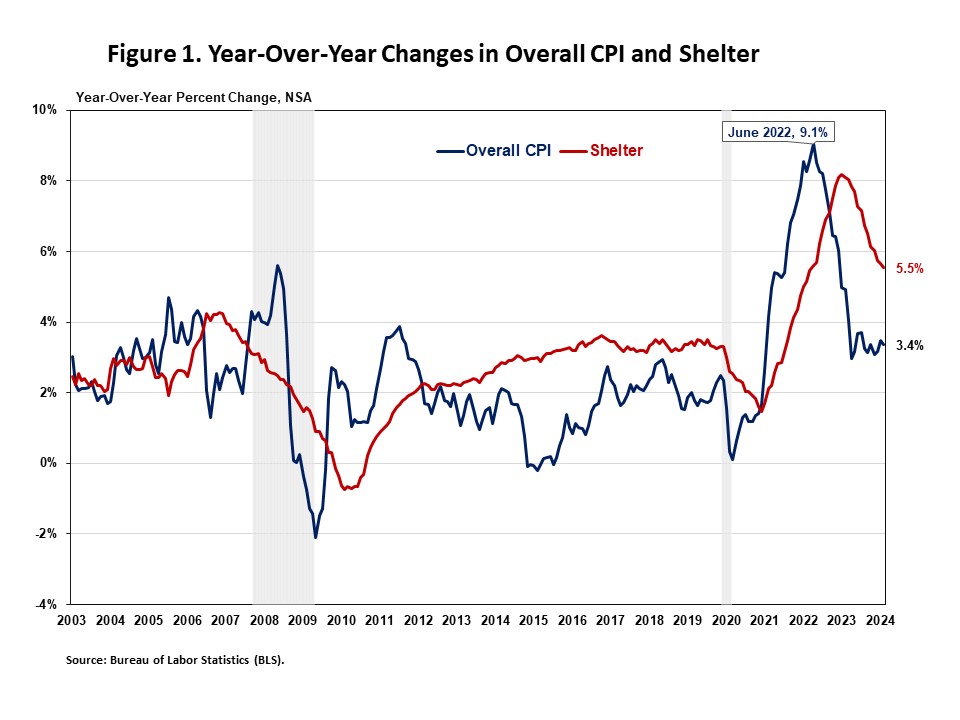

3. Shelter costs continued to rise at a 0.4% monthly pace, but this was offset by declines in prices for items like airline fares, new vehicles, communication, recreation, and apparel.

4. Only 2 out of 54 economists surveyed by Bloomberg had predicted the 3.4% annual core inflation rate, with most expecting a higher number.

The key difference is that both headline and core inflation came in softer than anticipated, suggesting that the disinflationary process may be gaining traction faster than previously thought. This contrasts with my earlier analysis, which had expected inflation to remain stickier and come in slightly above forecasts.

The market reaction has been swift, with Treasury yields plunging, the dollar weakening, and stock futures rallying. Traders are now fully pricing in a quarter-point rate cut by the Fed in November, whereas before the report, rate cut expectations were more modest.

This CPI report will likely be welcomed by the Fed, as it provides tentative evidence that their aggressive rate hikes are starting to bear fruit in terms of cooling price pressures. If this trend continues in the coming months, it could open the door to rate cuts sooner than previously anticipated, perhaps as early as September.

However, Fed officials will likely remain cautious and want to see a sustained pattern of easing inflation before committing to a policy pivot. They may also be wary of loosening policy too quickly, given the still-tight labor market and the risk of inflation becoming entrenched.

Overall, while this CPI report is certainly encouraging, it’s just one data point and may not be enough to fundamentally alter the Fed’s near-term policy stance. But it does suggest that the balance of risks is shifting, and if the disinflation trend persists, rate cuts may be on the table sooner than many (including myself) had previously thought.

Citations:

[1] https://www.forbes.com/sites/simonmoore/2024/06/10/heres-what-to-look-for-from-the-may-cpi-report/

[2] https://www.investopedia.com/cpi-inflation-preview-may-2024-8661042

[3] https://www.morningstar.com/economy/may-cpi-forecasts-show-inflation-softening-overall-gas-prices-ease

[4] https://www.bloomberg.com/news/live-blog/2024-06-12/us-cpi-report-for-may?srnd=homepage-americas

[5] https://www.bloomberg.com/news/live-blog/2024-06-12/us-cpi-report-for-may?cursorId=6668C34668900000&srnd=homepage-americas

One month does not make a trend, of course. With the labor market still tight and the risk of inflation becoming entrenched, the Fed may be wary of loosening policy too quickly.

This sets up an interesting dynamic for today’s meeting. The Fed is still widely expected to keep rates unchanged at 5.25%-5.5%, but the real focus will be on the updated dot plot projections and Chair Powell’s press conference.

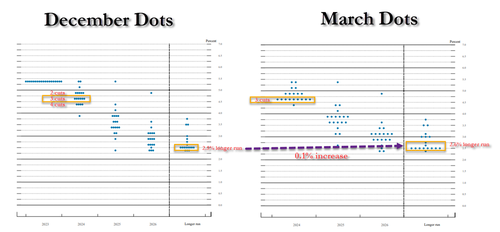

In March, the median dot showed three quarter-point rate cuts in 2024. This may be revised down to one or two cuts in light of the recent data. The implied real policy rate for end-2025 will also be closely watched – if it remains elevated even as inflation is projected to near the 2% target, it would signal the Fed’s resolve to keep policy tight.

Powell is likely to strike a cautious tone in his press conference acknowledging the progress on inflation but emphasizing that the job is not yet done. He may push back against market expectations for imminent rate cuts, stressing the need for sustained disinflation before easing policy – which would be more in-line with his recent statements.

This could set up a bit of a tug-of-war between the market’s reaction to the CPI data and the Fed’s messaging. The cooler inflation print has already sent bond yields plunging and rate cut bets rising. However, if Powell throws cold water on those expectations, we could see a reversal.

In the bigger picture, the question remains whether inflation will return to target without a recession. The CPI report is a step in the right direction, but the path ahead is still uncertain. Sticky components like shelter costs need to cool further, and wage growth must moderate to prevent a price-wage spiral.

Should be an interesting day.

“Ooh, a storm is threatening

My very life today

If I don’t get some shelter

Ooh yeah I’m gonna fade awayWar, children

It’s just a shot away

It’s just a shot away

War, children

It’s just a shot away

It’s just a shot awayOoh, see the fire is sweepin’

Our streets today

Burns like a red coal carpet

Mad bull lost its way” – Stones