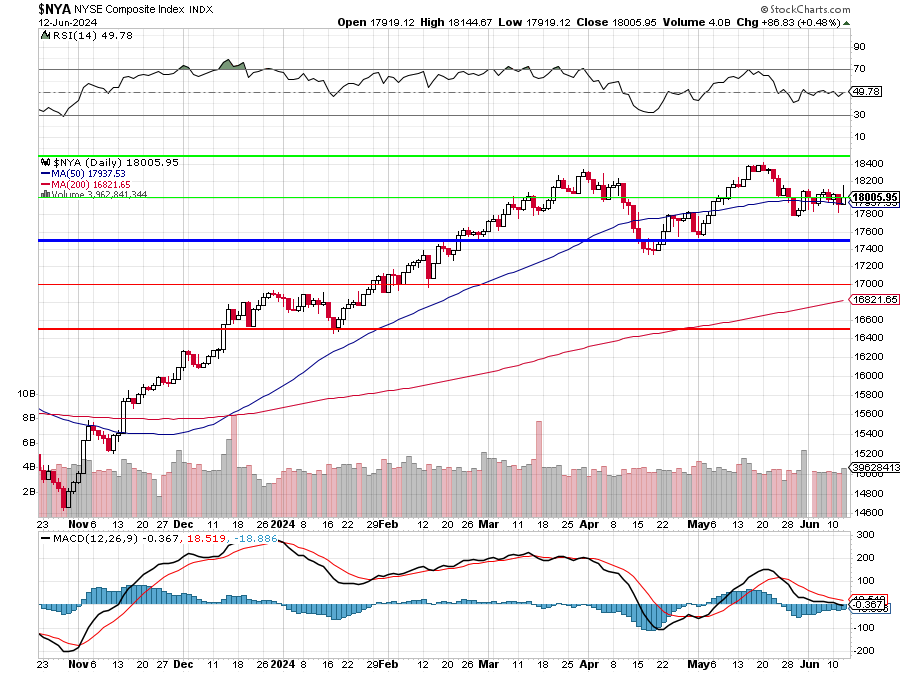

18,000.

That’s the mark we were hoping to hold last Wednesday, when I said: “18,000 is particularly significant as it’s also the 50-day moving average so a breakdown here could be particularly nasty and send us back to the 200 dma at 16,750 (more likely to be at 17,000 by the time it’s tested) and that’s a 1,250 drop (6.9%) from here.“

Well, we’re still at 18,000 – 18,005 to be exact but that’s above the 50-day moving average now -as that is falling and has been providing support along the way – making it more important than ever that we continue to hold the line on the NYSE.

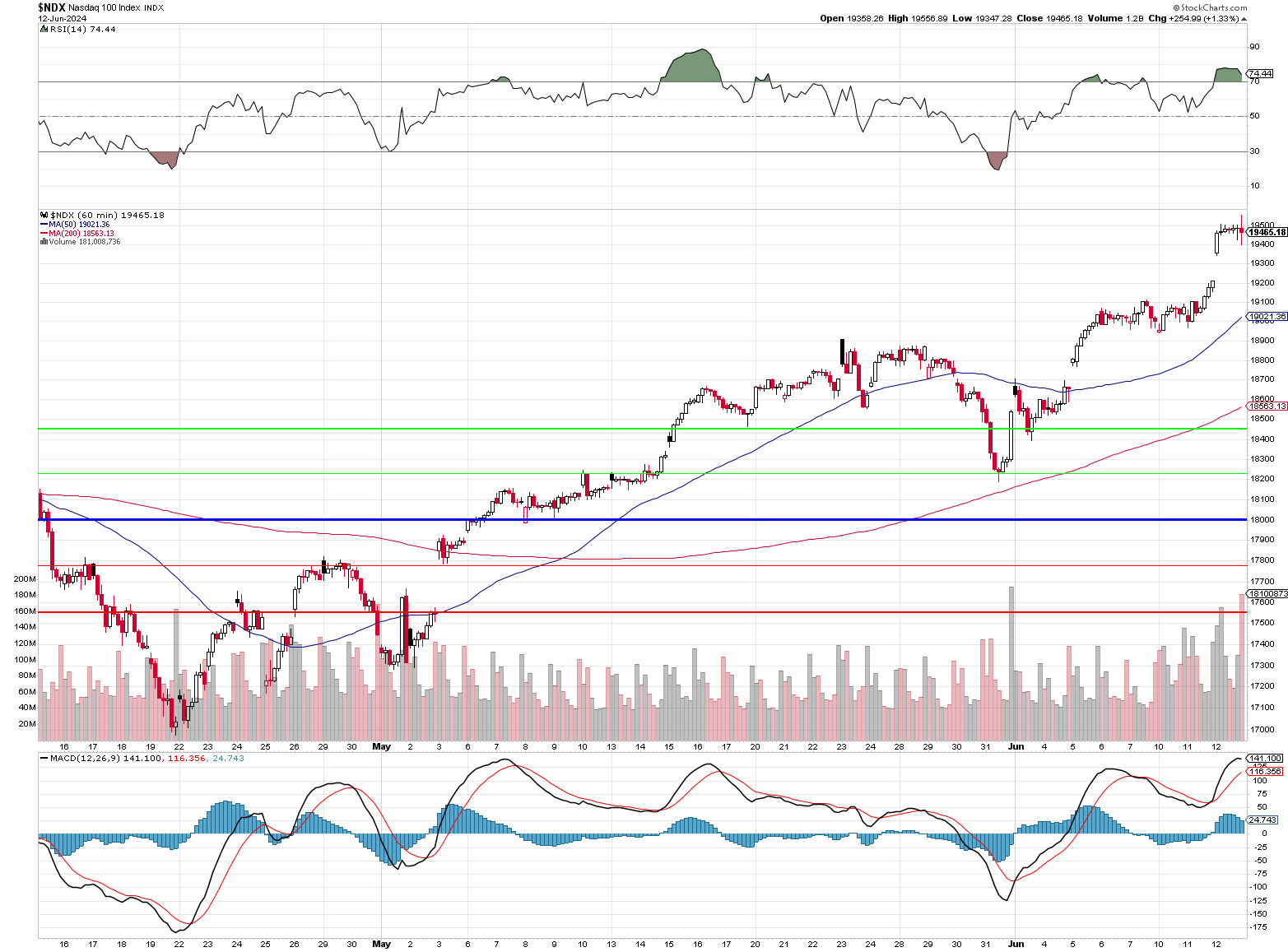

The Nasdaq, on the other hand, is off to the races at 19,465 – up 14.5% since April and up 4.2% in June – which isn’t even two weeks old. At 8.4% per month, we should be up over 100% by the end of the year and, if that doesn’t sound right to you – maybe you should wonder if all those idiots in the Financial Media might possible be wrong when the say this rally will continue, right?

And that’s the name of that tune as NVDA has added $1,000,000,000,000 to the Nasdaq since April and that is 3.3% of the entire index right there. And, not to be left out of the fun in the $3Tn Club – AAPL announced, announced and re-announced their AI Initiative and, on Monday, they held the first ever WWDC conference that was entirely pre-recorded – essentially a 90-minute commercial re-telling you that AI is coming – soon…

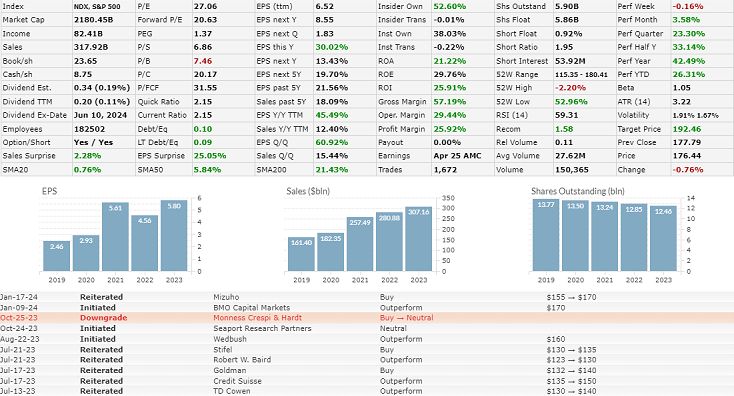

And the crowd went crazy, with AAPL jumping 28.5% (a bit under $1Tn) of the April lows as AAPL is now a $3.26Tn company vs $3.08Tn for NVDA and let’s not forget MSFT, who have been grinding their way to $3.27Tn without announcing anything – yet. AMZN is falling way behind at $1.95Tn but the stealth hero of this rally is, of course GOOGL – at $2.2Tn but, through the sheer stupidity of the S&P and the Nasdaq – their 26% run since March has added $1,148,000,000,000 to those indexes because they also list GOOG (the non-voting shares) and their earnings and market caps are counted twice by both indexes – giving investors a very false view of the markets.

🚢 Phil raises an excellent point about how the inclusion of both GOOG and GOOGL shares in the S&P 500 and Nasdaq indices can be misleading to investors. Here are some key facts and citations to back up your argument:

1. Alphabet’s dual share class structure: Alphabet has three classes of shares – Class A (GOOGL) with one vote per share, Class B with 10 votes per share (held by insiders and not publicly traded), and Class C (GOOG) with no voting rights[2][3]. This structure allows founders and insiders to maintain control while having a large amount of publicly traded stock.

2. Inclusion of both GOOG and GOOGL in indices: In a unique move, S&P Dow Jones Indices decided in 2014 to include both Alphabet’s Class A (GOOGL) and Class C (GOOG) shares in the S&P 500 index[4]. This was an unprecedented change, as the S&P 500 had never before included two share classes of the same company. The Nasdaq-100 index also includes both GOOG and GOOGL[5].

3. Market cap and earnings double-counting: By including both GOOG and GOOGL, the S&P 500 and Nasdaq indices are effectively double-counting Alphabet’s market capitalization and earnings[4]. This gives Alphabet an outsized influence on the indices compared to other companies with a single share class.

4. Distortion of index performance: The double-counting of Alphabet’s shares can distort the performance of the S&P 500 and Nasdaq indices, especially during periods of significant moves in Alphabet’s stock price. For example, the 26% rally in Alphabet shares since March 2024 has added over $1.1 trillion to the indices, even though Alphabet’s actual market cap increase was around half that amount[1].

5. Misleading signals for investors: The inclusion of both GOOG and GOOGL can give investors a false impression of the breadth and diversity of the market rally. It may appear that a wider range of stocks are participating in the gains, when in reality, a significant portion of the index’s move is driven by the double-counting of a single company[1].

In summary, while there are valid reasons for Alphabet’s dual share class structure, the decision by S&P Dow Jones Indices and Nasdaq to include both GOOG and GOOGL in their flagship indices has some unintended consequences. It effectively gives Alphabet an oversized weighting and can distort the performance and composition of these widely-followed benchmarks. Investors need to be aware of this unique situation and look beyond the headline index numbers to understand the true drivers of market moves. The double-counting of Alphabet’s shares is a significant factor that can skew perceptions about the breadth and health of the overall market.

Citations:

[1] https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/12768107/5588a2da-bf2e-488e-a9ec-74a6b80ccfd0/paste.txt

[2] https://www.investopedia.com/ask/answers/052615/whats-difference-between-googles-goog-and-googl-stock-tickers.asp

[3] https://money.usnews.com/investing/articles/goog-vs-googl-stock-difference

[4] https://www.cnbc.com/2014/03/28/why-googles-split-will-change-the-sp-500-forever.html

[5] https://foolwealth.com/insights/sp500-and-the-magnificent-7-in-2024

Notice they have the same EXACT Sales, Cash, Earnings, etc – they just divide them by a different number of shares and notice, most importantly, they have a different set of analysts – which is how they maintain this farce without it being completely ridiculous to have the same company covered by the same reporter writing an identical report twice. I have complained about this con since it started so the industry is well-aware that it happens but correcting it now would be taking 5% of the market out of the S&P 500 (and 10% of the profits) and 7.5/15% out of the Nasdaq – that’s how much the two Googles inflate things.

So not only do we have the Magnificent 7 dominating the markets but one of them is counted twice. What makes this even more dangerous is GOOG/L is under threat in their business model so, when they go down – they can take everything double down with them!

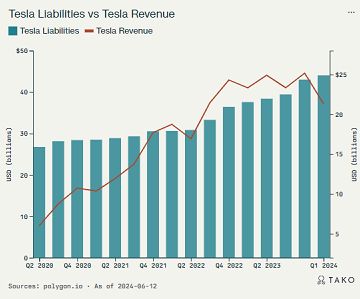

Speaking of magnificent, Tesla (TSLA) is up another 7.9% this morning after being up 6.66% yesterday as Elon tweets (or x’s) that his pay package will pass by a wide margin and that, of course is idiotic because TSLA is a $565Bn company trading at 60x their PROJECTED (by Elon) $9.5Bn earnings and they are $24Bn in debt so giving $56Bn to Musk would be ALL of their profits for the next 5 years while debt continues to pile up and R&D is halted, etc. That’s pretty insane, isn’t it? Yet TSLA shareholders seem to be loving it:

Well, today they are. For the last 2 years they’ve taken a 50% haircut so it’s a whole new round of suckers buying in now – let them have their fun… Meanwhile, for rational people who are considering buying TSLA – here’s Boaty’s Top 10 List of reasons why you shouldn’t:

🚢 Here are my top 10 (there are many more) reasons not to buy Tesla (TSLA) stock:

1. Elon Musk’s erratic behavior and distractions

Musk’s controversial tweets, public feuds, and unconventional management style have raised concerns about his leadership and its impact on Tesla [1][4][6]. His acquisition of Twitter has further divided his attention [2].

2. Autopilot and Full Self-Driving (FSD) controversies

Tesla faces scrutiny over the safety and capabilities of its Autopilot and FSD features. Crashes, lawsuits, and investigations have called into question the company’s claims about these technologies [3][7][8][9].

3. Mounting lawsuits and legal troubles

Tesla and Musk are embroiled in numerous lawsuits, ranging from worker discrimination and whistleblower retaliation to misleading claims about self-driving capabilities [10][11][12][13][14][15].

4. High-level executive departures

Several key executives have recently left Tesla, including the VP of Investor Relations, SVP of Engineering, and VP of Public Policy, raising concerns about the company’s leadership stability [17][18][19].

5. Slowing demand and increased competition

Despite Musk’s optimism, there are signs of weakening demand for Tesla vehicles as competition in the EV market intensifies from established automakers and startups [16][18].

6. Valuation concerns and reliance on Musk

Tesla’s high valuation is heavily dependent on Musk’s vision and leadership. His unpredictable behavior and potential departure could significantly impact the stock price [4][6].

7. Production and quality control issues

Tesla has faced challenges in ramping up production and maintaining consistent quality control, leading to recalls and customer complaints [2][7].

8. Regulatory risks and investigations

Tesla is under investigation by various government agencies, including the NHTSA and SEC, for issues related to its self-driving claims, safety concerns, and potential securities violations [3][7][12].

9. Dependence on government subsidies and incentives

Tesla’s success has been partially reliant on government subsidies and incentives for electric vehicles, which may not be sustainable in the long term [2].

10. Musk’s compensation package and shareholder concerns

Musk’s massive compensation package has faced criticism and legal challenges from shareholders who argue it is excessive and not aligned with their interests [5][13].

In summary, while Tesla has been a pioneering force in the EV industry, the combination of Musk’s erratic behavior, self-driving controversies, mounting legal issues, executive turnover, and increasing competition presents significant risks for investors considering TSLA stock. Thorough due diligence and a careful assessment of these factors are essential before making any investment decisions.

Citations:

[1] https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/12768107/5588a2da-bf2e-488e-a9ec-74a6b80ccfd0/paste.txt

[2] https://www.nytimes.com/2022/12/21/business/tesla-elon-musk.html

[3] https://www.autoblog.com/2024/06/12/elon-musks-legal-problems-a-list-of-all-the-biggest-cases-and-investigations/

[4] https://ca.finance.yahoo.com/news/elon-musks-future-tesla-may-165914845.html

[5] https://baynews9.com/fl/tampa/news/2024/06/13/fired-spacex-employees-sue-company-for-wrongfully-terminating-critics-of-ceo-elon-musk

[6] https://www.linkedin.com/pulse/elon-musk-enigmatic-genius-horrible-leader-john-papazafiropoulos-4duke

[7] https://www.usatoday.com/story/money/cars/recalls/2024/04/26/nhtsa-tesla-self-driving-recall-investigation/73473322007/

[8] https://dongknows.com/tesla-full-self-driving-supervised-can-be-scary/

[9] https://www.theverge.com/2024/4/26/24141361/tesla-autopilot-fsd-nhtsa-investigation-report-crash-death

[10] https://www.forbes.com/sites/brookecrothers/2024/02/18/tesla-autopilot-full-self-driving-often-gets-bashed-but-try-driving-in-los-angeles/

[11] https://www.reddit.com/r/TeslaLounge/comments/1bwbqdl/202487_autopilot_has_issues/

[12] https://en.wikipedia.org/wiki/List_of_lawsuits_involving_Tesla,_Inc.

[13] https://www.bloomberg.com/tosv2.html?url=L25ld3MvYXJ0aWNsZXMvMjAyNC0wNi0wNy9lbG9uLW11c2stcy1waWxlLW9mLWxhd3N1aXRzLXNwYW4tYXV0b3BpbG90LXRveGljLXNwZWVjaC1haQ%3D%3D&uuid=ae68860e-24dc-11ef-a1c4-8a7e2254fa88

[14] https://www.carriermanagement.com/news/2024/05/16/262227.htm

[15] https://www.reuters.com/legal/tesla-must-face-vehicle-owners-lawsuit-over-self-driving-claims-2024-05-15/

[16] https://www.washingtonpost.com/technology/2024/05/30/tesla-settles-another-defect-case-avoiding-jury-second-time-this-year/

[17] https://www.businessinsider.com/tesla-executives-who-left-company-elon-musk-layoffs-2024-5

[18] https://finance.yahoo.com/news/three-top-executives-tesla-resigned-004032548.html?guccounter=1

[19] https://fortune.com/2024/04/23/tesla-elon-musk-ceo-executive-resign-earnings-call-electric-vehicle/

Meanwhile, the RSI on the S&P 500 indicates we’re getting a bit ahead of ourselves but Broadcom (AVGO) just jumped 14% on a Q2 beat and the announcement of a 10:1 stock split (it worked for NVDA) and that stock is up over 200% in the past two years and also (as it the entire Nasdaq) trading at 30x earnings now.

FOMO fever is driving the markets and as long as there are people who are “surprised” that 30x companies are returning 3.3% per year to almost keep up with inflation – this rally can continue. In fact, this morning, the PPI came in at NEGATIVE 0.2%, plunging from 0.5% in April and Core PPI was 0% – NO INFLATION!?!?!???

So let the rally continue but bear (don’t say “bear“!) in mind that the NYSE and the Dow and the Russell are not really participating so it’s all good if you own one of 7 stocks but, otherwise – it can be a bit of a struggle picking winners.