Wheeee!

It’s shaping up to be a rough start to the day, with U.S. stock futures pointing to a lower open across the board. Dow Futures are down 0.74%, S&P 500 Futures are off 0.51%, Nasdaq Futures have shed 0.3%, and the small-cap Russell 2000 is getting hit hardest, down 1.21%.

The weakness on Wall Street follows a sharp sell-off in European markets, with major indices there down around 1.5%. Political turmoil in France appears to be a key driver of the risk-off sentiment.

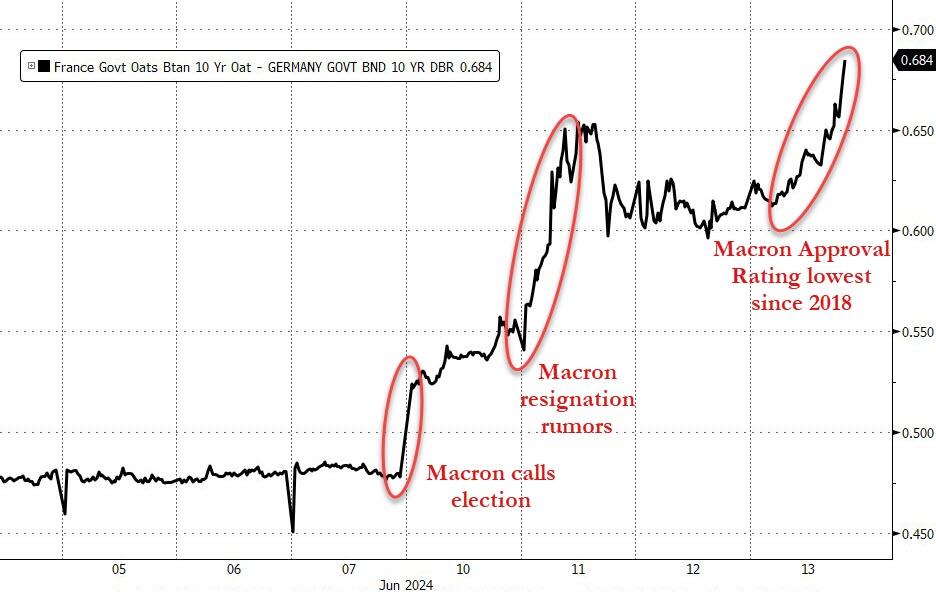

Last weekend, French President Emmanuel Macron called a surprise snap election after his party suffered a crushing defeat to the far-right National Rally in the European Elections. This has set off a mad scramble among left, right and center parties to form alliances ahead of the two-round legislative vote on June 30th and July 7th.

The uncertainty has spooked investors, with French bonds and bank stocks particularly hard hit. The spread between French and German 10-year bond yields has widened to levels not seen since 2017, reflecting the heightened political risk premium, which damages the Euro and sends the Dollar back over 105 – putting pressure on everything else.

Inflation continues to climb across Europe with France reporting a 2.3% annual inflation rate in May, while Poland and Slovakia saw prices rise 2.5% and 2.2% respectively over the same period. This is at odds with this week’s US numbers and makes it much more likely that our dip in inflation was an anomaly and not a trend.

The Euro Stoxx 50 index has now erased ALL of the gains since April and that was fast as I was just pointing out to our Members yesterday that Global stocks were underperforming our VERY NARROW rally. Meanwhile, London’s FTSE 100 is down 1.2%, Germany’s DAX has lost 1.4%, and France’s CAC 40 is off a hefty 1.48%, now trading near 4-month lows.

In the currency markets, the Dollar is flexing its muscles again, rebounding now to 105.21, up 1.25% since Wednesday’s Fed meeting. Looking ahead, the key event today will be the release of the Euro Area trade balance. Investors will also be keeping a close eye on any further developments in the French political drama.

This is all working out for the Fed as yields are mostly lower as investors seek out safe havens. The U.S. 10-year Treasury yield is down 1 basis point to 4.23%, while Germany’s 10-year yield has plunged 9 basis points to 2.40% and the U.K. 10-year Gilt yield is off 4 basis points at 4.08% in a flight (not yet a panic) to safety. We will hear from the Fed’s Goolsbee and Cook this afternoon.

Political risk is back on the radar in a big way. The situation in France has the potential to cause significant volatility in the days and weeks ahead, especially if the far-right makes further gains (not to mention the possibility of a far-right Government taking over the US in November). The ECB is also in a tough spot, trying to balance rising inflation pressures with the need to support their VERY fragile economic recovery.

It’s very possible that high-quality Bonds, Gold, and the U.S. dollar could outperform the markets until there is more clarity on the political front. Sectors like Utilities, Consumer Staples and Healthcare may hold up better than cyclicals – although defense just got a $50Bn boost as more money is approved for Ukraine – which then leads to more Global instability.

Be careful out there!

Have a great weekend,

-

- Phil