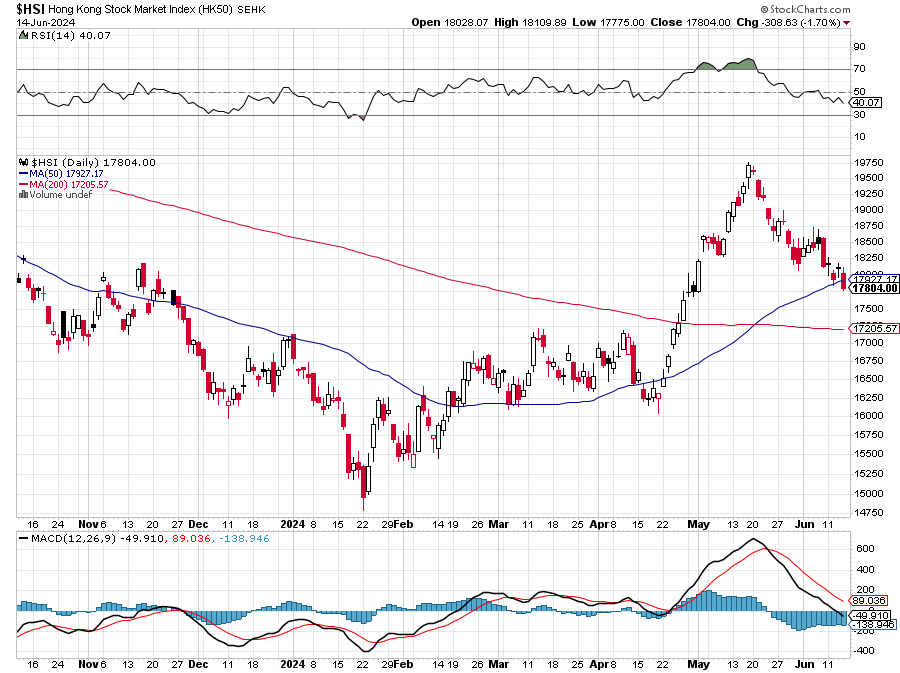

Down 10%.

That’s where the Hang Seng Index is for the past 30 days. While US Markets can’t seem to find enough new record highs to smash, China’s market is dropping like a rock as the country’s property woes continue to deepen despite aggressive stimulus measures.

New data out this morning paints a grim picture of China’s broken housing market. Home Prices in major cities fell 4.3% in May, compared to a year earlier, accelerating from a 3.5% decline in April. The secondhand home market looks even worse, with prices plummeting 7.5%.

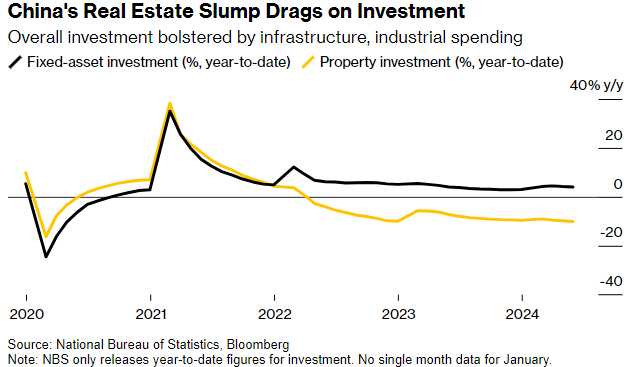

This persistent property slump is dragging down the broader economy. Real estate investment, a key growth driver for China, slid further in May to the worst pace since 2020 (Covid). Overall fixed-asset investment also lost momentum, rising just 4% year-over-year as the boost from government infrastructure spending fades.

Beijing has thrown the kitchen sink at the problem in recent months – relaxing mortgage rules, subsidizing home purchases, and launching a $41Bn program for banks to support the market. So far, these rescue efforts have failed to restore confidence among wary buyers and overleveraged developers as even $43Bn is just a drop in a very big bucket.

The contagion is spreading to local government finances, which rely heavily on land sales. Revenues fell in the first four months of the year as the property downturn deepened. Cash-strapped authorities are now resorting to desperate measures like hitting companies with decades-old tax bills to shore up their coffers.

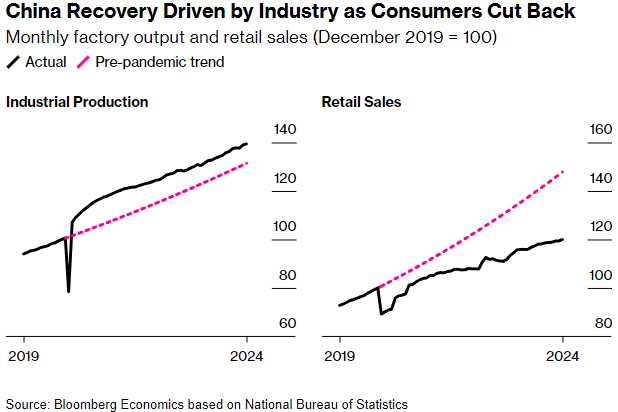

China’s lopsided, industry-driven recovery also looks increasingly fragile. While factory output remains a bright spot, propped up by government aid and exports, it disappointed in May with a 5.6% expansion, down from 6.7% in April and that export engine faces mounting threats as the US, EU and others erect new trade barriers against Chinese goods.

With the housing slump weighing like an anchor, China will struggle to hit its 5% growth target this year. Expect louder calls for more aggressive stimulus ahead of the key July Politburo meeting and that will weaken the Yuan vs the Dollar. As recent months have shown, reviving animal spirits in an unbalanced economy distorted by years of debt-fueled property excess is no easy feat – even for China’s top policymakers.

On the home front, Fed Governor Neel Kashkari just promised a Christmas Rate cut this morning and that’s keeping us bubbling along after Friday’s close. The Dollar is still up at 105.22 and we need to get it below 105 to push a new rally this week but that’s going to be hard to do with Europe in turmoil and China about to devalue their currency via stimulus – again.

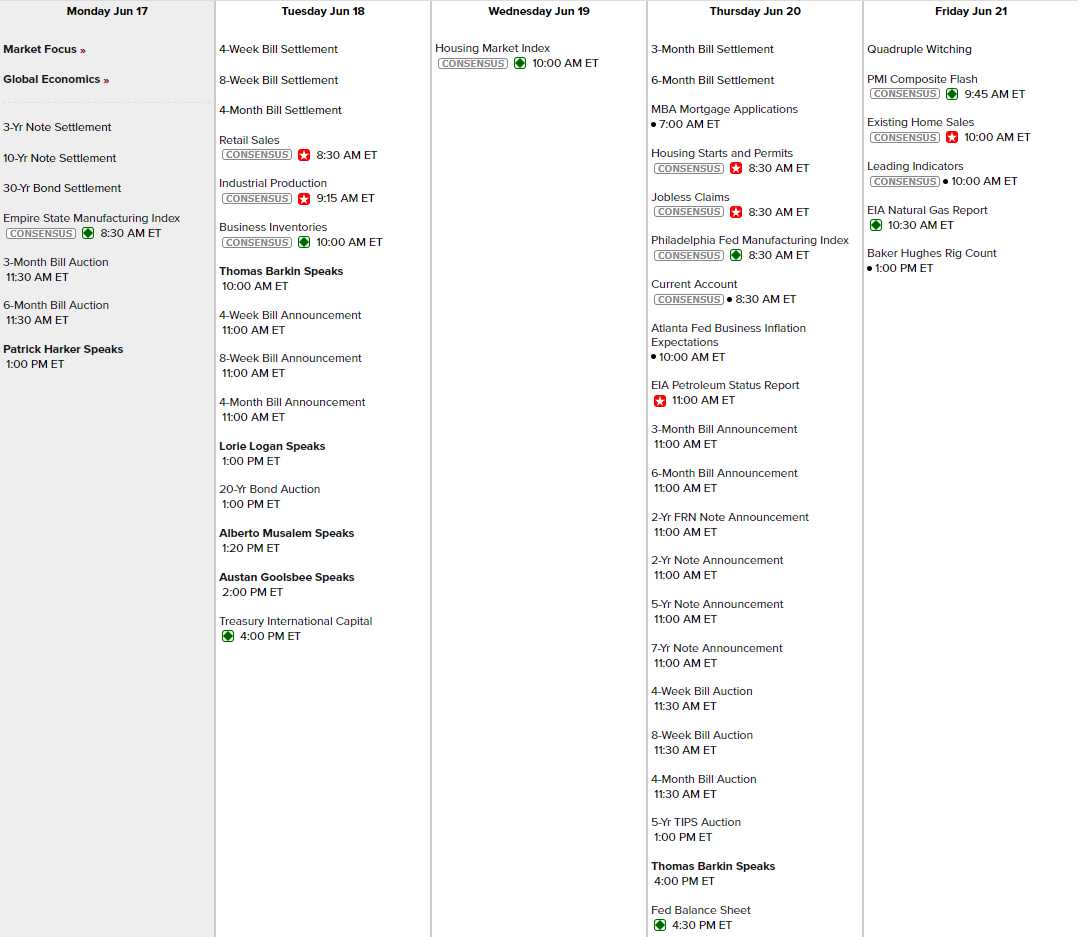

It’s a weird week as Wednesday is a holiday (Juneteenth) but, of course, the US has to hold Bond auctions as $7Tn isn’t going to fund itself. In fact, as recently as 1963 (when I was born), $7Tn was ALL THE MONEY IN THE WORLD. Now it’s just what the US is borrowing in 2024 – CRAZY!

It’s a weird week as Wednesday is a holiday (Juneteenth) but, of course, the US has to hold Bond auctions as $7Tn isn’t going to fund itself. In fact, as recently as 1963 (when I was born), $7Tn was ALL THE MONEY IN THE WORLD. Now it’s just what the US is borrowing in 2024 – CRAZY!

6 more Fed speakers are scheduled over the rest of the week and this morning we’ll see the always-awful Empire State Manufacturing Index and tomorrow we get Retail Sales, Industrial Production and Business Inventories. Wednesday it says Housing Index despite the holiday (that department didn’t get the memo?) and Thursday we pick it back up with the random Philly Fed, Housing Starts and Inflation Expectations and Friday is Quad Witching for Q2 along with Existing Home Sales and Leading Economic Indicators – Fun!

And yes, Virginia, we still have earnings – though now they are considered early and not late as Earnings Season for Q2 officially kicks off on July 12th – just 28 days from today (after yet another holiday)! This week we hear from our own Home Builders as well as used cars, guns and campers – a very American earnings week indeed!