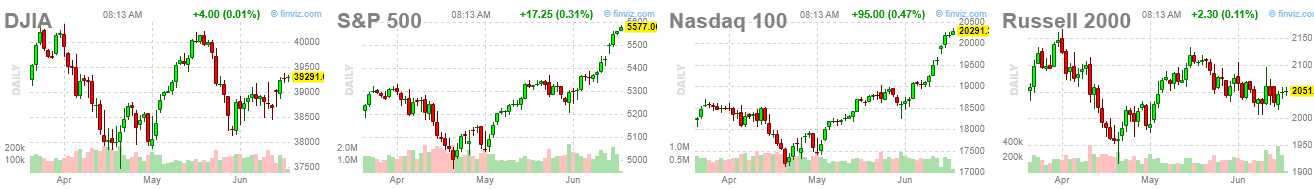

Up and up we go!

As you can see, the Dow and the Russell have still not confirmed the rally but you only need 7 stocks to move the S&P and the Nasdaq – as illustrated by this heat map for the S&P 500 over the past month, where you can see how only about 100 out of 500 companies are even positive yet the index is up 7%. Of course, NVDA being up 50% ($1Tn) for the month doesn’t hurt:

We’re doing our Portfolio Reviews this week and, unfortunately, we don’t own NVDA, AVGO, ORCL or MU – so we have been lagging the S&P and the Nasdaq but we’ve got a lot of very good value stocks that, hopefully, will come back into fashion one day.

This morning, we had a very low number of Housing Starts (1.277M vs 1.375M expected) and Building Permits (1.386M vs 1.445M expected) to go with the very low number of Mortgage Applications (0.9% vs 15.6% prior) and now we have a 1.3 Philly Fed – down from 4.5 last month. Not good data on the whole – but that certainly doesn’t seem to matter this year.

The Bank of England held their rates steady this morning and the Yen is back below 0.64 and the Dollar is back over 105 but Oil is $80.80 and Natural Gas is $2.84 with the first hurricane of the season forming in the gulf.

Speaking of Europe – EV sales dropped 12% in May as German subsidies and French discounts wound down. According to an industry study, the German government spent €10B in subsidies since 2014 towards the purchase of 2.1M EVs and plug-in hybrids. But amid accusations that spending targets for “climate neutral transformation” were unlawfully booked, and to comply with constitutional limits on spending, the German government will eliminate €45B in climate spending for 2024. This translated into a 31% drop in battery/electric vehicle, or BEV, registrations in Germany in May from a year ago.

Speaking of Europe – EV sales dropped 12% in May as German subsidies and French discounts wound down. According to an industry study, the German government spent €10B in subsidies since 2014 towards the purchase of 2.1M EVs and plug-in hybrids. But amid accusations that spending targets for “climate neutral transformation” were unlawfully booked, and to comply with constitutional limits on spending, the German government will eliminate €45B in climate spending for 2024. This translated into a 31% drop in battery/electric vehicle, or BEV, registrations in Germany in May from a year ago.

Meanwhile, in France, citizens were no longer able to purchase Chinese, South Korean, or American-made EVs at a discount at the start of 2024. Only vehicles manufactured in the EU will be subsidized with larger subsidies offered to French-made vehicles from Renault (RNO.PA), Peugeot, and Citroen. As a result, of the new law, a Chinese-made Tesla (NASDAQ:TSLA) Model 3 will no longer be eligible for a French subsidy, while the German-made Tesla (TSLA) Model Y SUV will.

Nonetheless, the global electric vehicle market continues its upward trajectory, driven by environmental concerns, government incentives, and technological advancements.

According to the International Energy Agency (IEA), global EV sales could reach around 17M units in 2024, representing over 20% of total car sales worldwide. China remains the largest EV market, with sales projected to reach around 10M units in 2024, accounting for nearly 45% of the country’s total car sales. The phase-out of subsidies has had a minimal impact on demand, as Chinese automakers offer competitively priced EVs.

In Europe, EV sales growth is expected to be relatively slower due to the winding down of subsidies – as we also experienced here in the US. However, stricter emissions regulations and the planned phase-out of internal combustion engines by 2035 will continue to drive EV adoption.

The United States is poised for strong EV sales growth, supported by the Inflation Reduction Act’s tax credits, emissions standards, and investments in charging infrastructure. EV sales could reach around 20% of total car sales by the end of 2024. Considering these trends and the competitive landscape, here are some potential investment opportunities:

- Tesla (TSLA): Despite facing increasing competition, Tesla remains a market leader with a strong brand, innovative technology, and a loyal customer base. Its focus on affordability with the upcoming Model 2 and advancements in autonomous driving could further solidify its position.

- BYD (BYDDY): As the largest EV manufacturer in China, BYD is well-positioned to capitalize on the country’s booming EV market. Its diverse product line, competitive pricing, and strong domestic demand make it an attractive investment option.

- Volkswagen Group (VWAGY): With a comprehensive EV strategy and a wide range of models across its brands (VW, Audi, Porsche), Volkswagen is a major player in the global EV market. Its strong presence in Europe and China could drive growth.

- General Motors (GM): GM’s commitment to an all-electric future, with models like the Chevrolet Bolt and Cadillac Lyriq, positions it well for the growing EV market in the United States and beyond.

- Battery and EV component manufacturers: Companies like Albemarle (ALB), Panasonic (PCRFY), and LG Chem (051910.KS) could benefit from the increasing demand for EV batteries and components, making them potential investment opportunities.

We’ll be taking a deep dive into the EV marketplace for our next round of portfolio editions as some of these companies are an excellent intersection of Tech, Growth and Value – a winning combination for our current market conditions!