This chart sums it up nicely:

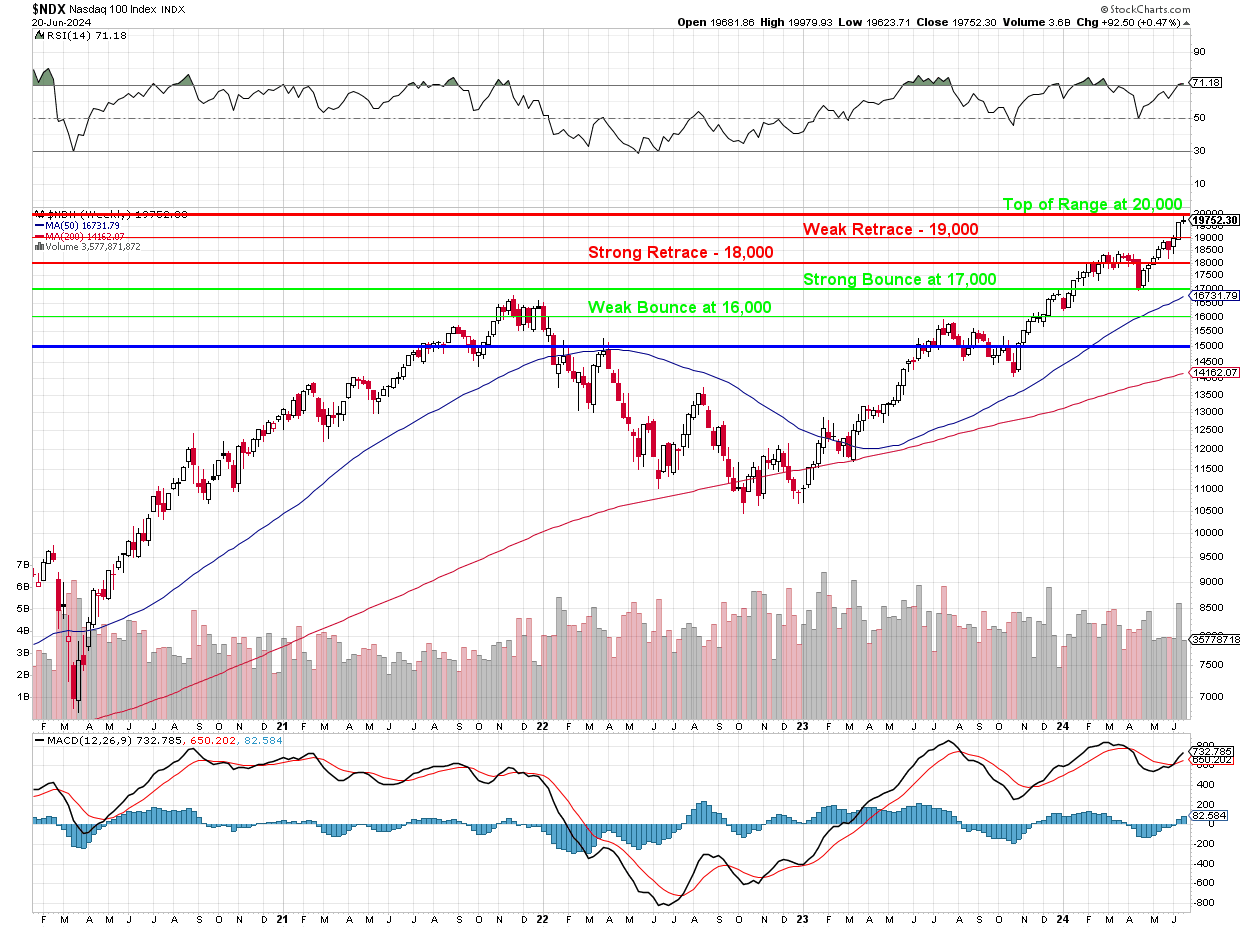

It’s Quad Witching Day for Q2 and it was Q3 last year when the Nasdaq was rejected at 16,000 and fell back to 14,000 – a 12.5% drop and we found support 1,000 points (7.5%) over the 50-week moving average. Then in April (remember?) we fell from 18,500 to 17,000, which was an 8% correction and we bounced 1,000 points (6.2%) over the 50-week moving average.

Now the RSI is back over 70 and 20,000 is a tough line to cross and 1,000 points over the 50-week moving average is under 18,000 – and that would be a 2,000-point drop from here. Also, look at the peaks: Last July, we topped out at 15,750, which was 3,000 points (23.5%) over the 200 wma. In March we peaked at 18,500, which was 4,750 (34.5%) points over the 200 wma. Now the 200 wma is at 14,162 and 20,000 is 5,838 (41.2%) higher than that – that is pretty insanely stretched!

It’s an interesting situation as all of the stretching is being done by just 7 of the Nasdaq 100 stocks (6 really as TSLA has been a bust this year) and the index is nothing more than a measure of the stocks it contains and maybe these stocks deserve their new valuations and maybe the index will move on to 50% above the 200-week moving average… Nah!

-

- TSLA trades at 55x forward earnings.

- AAPL trades at 29x forward earnings.

- MSFT trades at 33x forward earnings.

- GOOG/L trades at 21x forward earnings (but 27x current so they expect A LOT of growth)

- AMZN trades at 32x forward earnings.

- META trades at 22x forward earnings (29x current – also with great expectations)

- NVDA trades at 36x forward earnings (75x current – fantasy camp?)

Information Technology is expected to be a key driver of Q2 earnings growth, with the sector projected to see a 14.4% increase in earnings on 9.3% higher revenues. Other sectors likely to post strong results include Consumer Discretionary, Financials, and Healthcare. On the flip side, sectors like Industrials, Materials, and Energy may face more challenges.

Companies are also expected to benefit from margin expansion in Q2, continuing the positive trend from recent quarters. Net margins are projected to be above year-earlier levels for 9 out of 16 sectors, with Technology, Healthcare, Financials, and Consumer Discretionary seeing the most significant gains.

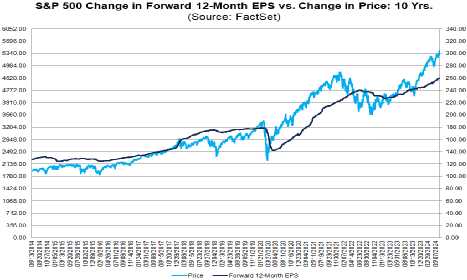

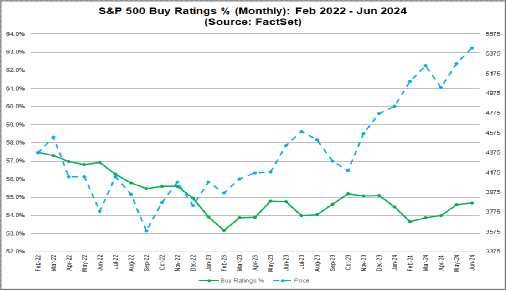

As you can see from this chart, the PRICE of the S&P 500 is 20% above the EARNINGS of the S&P 500 and that usually does not end well. As I have often noted, most of the S&P 500 is SPENDING money on AI development and we are not seeing an immediate boost to productivity so there are no net gains when NVDA’s profits are sucked out of the other 499 companies on the index – are there? Clearly the analysts are losing faith as well:

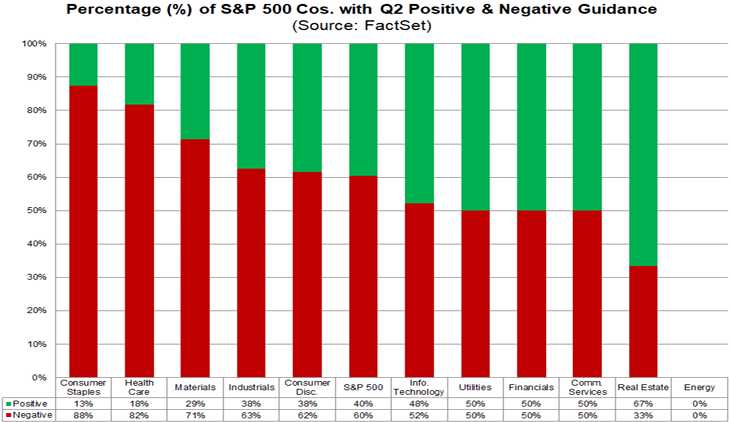

And the companies are losing faith in themselves:

That is A LOT of negative guidance! Valuation absolutely remains the key risk factor. The forward 12-month P/E ratio for the S&P 500 is 19.5, which is 10.8% above both the 10-year average (17.6) and includes a lot of crazy growth expectations that may not be realized. Richly-valued sectors like Technology and Consumer Discretionary could be vulnerable to pullbacks if earnings disappoint. Consumer spending, while still positive, is showing some contradictory trends with shoppers splurging in some areas while cutting back in others.

I’ve asked Warren to give our Members a full report in our Live Chat room but here’s a summary to take us into the weekend:

🤖 Potential Trading Strategies:

-

-

-

- Be selective with tech stocks. Focus on companies with reasonable valuations, strong fundamentals, and exposure to secular growth trends like cloud computing, AI, and 5G.

- Consider defensive sectors like Healthcare, Consumer Staples, and Utilities, which tend to outperform during periods of economic uncertainty.

- Monitor key economic indicators like retail sales, manufacturing PMIs, and jobs reports for signs of a slowdown that could pressure corporate earnings.

- Use options strategies to hedge downside risk or generate income. For example, covered calls can provide extra yield while potentially capping upside in richly-valued stocks.

- Have a disciplined risk management plan. Set clear profit targets and stop-loss levels. Be prepared to quickly adjust positions if the market narrative shifts.

-

-

In summary, while Q2 earnings are expected to be generally positive, the market’s stretched valuations and pockets of economic uncertainty warrant a cautious approach. Traders should stay nimble, focus on high-quality companies, and actively manage risk. By staying attuned to both micro and macro factors, traders can successfully navigate what could be a choppy earnings season.

Have a great weekend,

-

- Phil

If you would like to get Phil and Warren’s insights on Q2 earnings to stay ahead of the game – come and join our Member team!

Join today and you will gain access to our 6 Member Portfolios (Basic and Premium Memberships only) as well as Trade Ideas, our Legendary Live Chat Room (Basic and Premium Memberships only), Live Trading Webinars, Trading Education our AGI partners and other exclusive perks (Basic and Premium Memberships only).

Find out why Forbes called Phil “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – madeline@philstockworld.com – for a 7-day FREE trial at sign up.