Another week of coupon auctions has begun, and with $70BN in 5Y paper due Wednesday, and $44BN in 7Ys for sale on Thursday, moments ago the Treasury sold $69BN in 2Y paper in a solid auction.

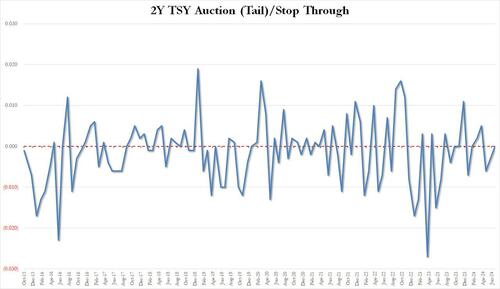

The high yield of 4.706% was “on the screws” with the When Issued which was also 4.706% ahead of the 1pm auction deadline, in fact this was the 2nd On The Screws auction this year, following a similar result in January; it was also the lowest 2Y auction yield since March and well below the 4.90% in both April and May.

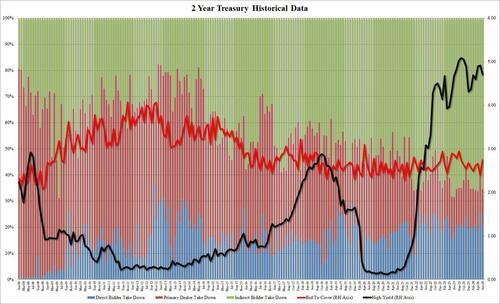

The bid to cover jumped from last month’s 2.406% (which was the lowest since Nov 2021) to 2.751%, well above the six-auction average of 2.57% and the highest since last July.

The internals were also solid, with Indirects awarded 65.6%, up from 57.9% in May which was the worst foreign demand since November. And with Directs taking down 20.9%, Dealers were left holding just 13.5%, the lowest since March.

Overall, a solid auction yet one which had no impact on secondary pricing levels with the 10Y unchanged after the result which was pretty much right as expected.