Nobody’s here.

Nobody’s here.

Hardly anyone was here yesterday and even less people will be here today as it’s officially a half day for the markets and tomorrow is a holiday and Friday will be a ghost town – that’s our forecast… It doesn’t matter what the indexes do on such low volume – yesterday’s sell-off quickly reversed I guess because Powell seemed to be in a good mood and, why not? He wasn’t here either – he was in Europe.

Powell claimed yesterday that the Central Bank has made “quite a bit of progress” in reducing inflation but emphasized officials need more evidence before lowering rates – a point that seems to have been lost on traders. In fact, shortly after he said that, CNBC had a guest who said a July 30th rate cut was back on the table. Though that person was obviously an idiot – no one challenged them – so it’s that poor journalism or blatant market manipulation?

“We are in a situation where momentum in the US equity market is still strong, we are seeing inflation tick lower and increasing odds of a Fed cut in September, all of which should be sufficient to keep the rally going,” said Guy Miller, chief market strategist at Zurich Insurance Co.

Now that the Supreme Court has handed Donald Trump the ring of power and immunity, how will he wield it and how will it affect the markets. His proposals not to tax the rich and to make it up by putting massive tariffs on everything we buy would seem to put a massive inflationary burden on the poor and middle class but clearly the market is pricing none of this in. Perhaps they still think Biden will win?

Or perhaps all this power means the Fed will no longer act as an independent body and will, like the Supreme Court, become a puppet for the President, making excuses rather than laws as it bends over backwards to do his bidding. In that case, sure, we may as well pay 40x earnings for stocks – they will pay less and less taxes and pass on those tariff costs to the consumers – what could possibly go wrong?

Over in Europe, the UK has elections today while, in France, there’s another round of voting on Sunday and the other parties are banding together to try to prevent Marine Le Pen’s far-right group from achieving an absolute majority. And guess who’s back in the UK? Farage! He’s the English Donald Trump (only less crazy and more articulate):

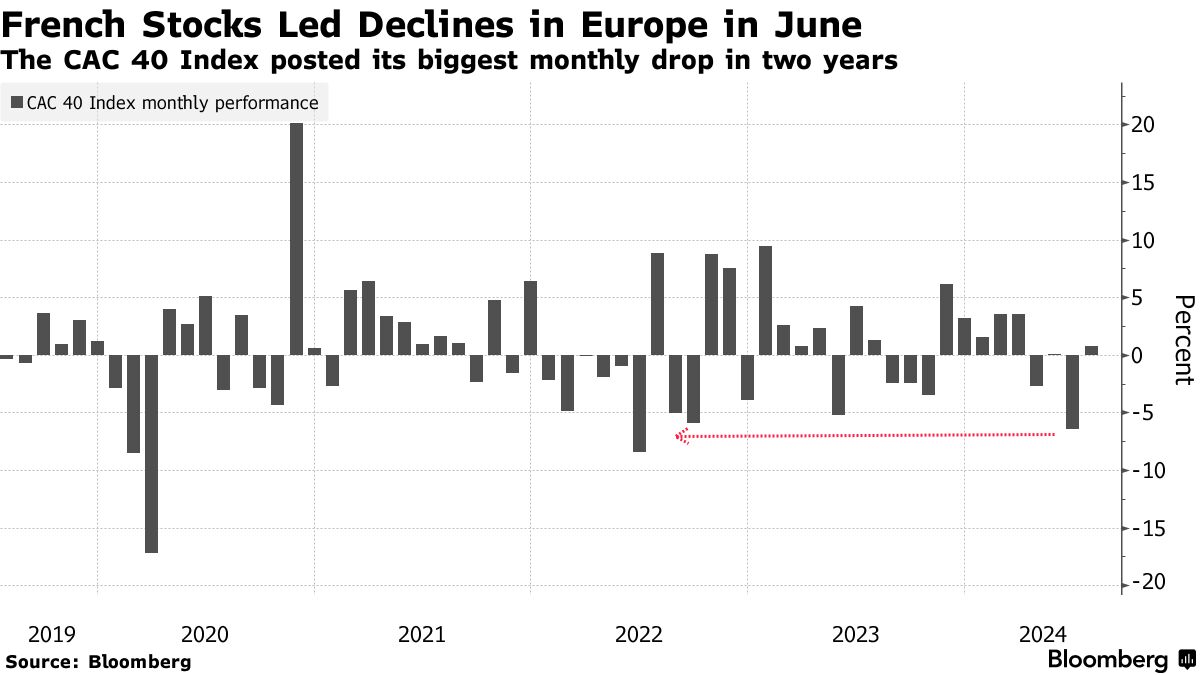

Still, money is moving out of the EU at the moment and France was hit very hard in June with a 6% drop in the CAC 40 as long positions were consistently being unwound. Europe suffered the biggest reduction in overweight positions among regions globally in June, reversing the buying trend seen in May, Goldman said. Funds cut the most exposure to financial stocks, particularly banks, with net selling for that sector the largest since November 2021.

Here’s a great summary of UK’s disaster (so far):

Well, we’ve all got problems, haven’t we. The US Government is likely to flip-flop in just 4 months and I only hope we are around to joke about it in 2028 – or allowed to joke about it for that matter…

Meanwhile, it’s been 248 years since we threw off tyranny and now we have a President with absolute power who will be in charge of commemorating this country’s 250th anniversary in 2026.

Happy 4th of July,

-

- Phil