Now what?

Now what?

As we expected on Wednesday, the UKs Labour Party rode to a landslide victory in yesterday’s election – overturning 40 years of Torie rule. Will this bode ill for US Conservatives in November or did UK Conservatives particularly suck? As Keir Starmer prepares to move into 10 Downing Street, will this leftward lurch paint the markets red, or will Labour’s promised economic rejuvenation lead the UK into to a sea of green?

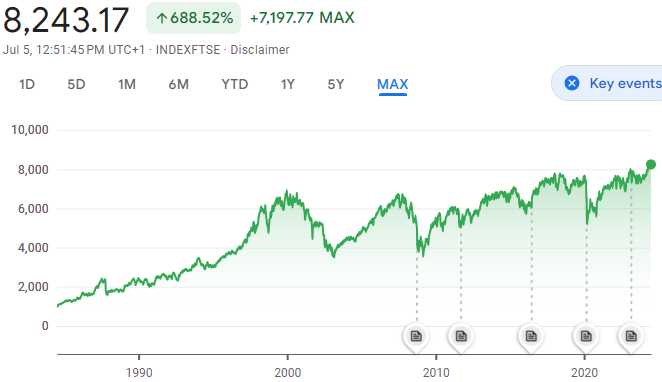

Labour’s victory, while decisive, comes with a paradox. Starmer ran on a platform of change, but with deliberately vague plans. This ambiguity has left markets in a state of cautious optimism, with the FTSE 100 and the pound showing modest gains in early trading but the index is only at 8,243 – up from 6,800 in 2000 – 21% in 24 years is not a very impressive performance. The S&P 500, by comparison, is 5,537 – up 295% from 1,400 during the same period – no wonder the Conservatives got the boot!

The new government’s economic agenda walks a tightrope between pro-business policies and increased social spending. Promises to freeze Corporate Tax Rates and encourage Private Investment have placated some business leaders, but concerns linger about Labour’s commitment to pouring substantial sums into entitlements like the NHS, which is badly in need of re-funding.

Global markets are watching closely, particularly as Labour navigates the complex waters of post-Brexit trade relations. Starmer’s pledge to forge closer ties with the EU could potentially ease some of the economic friction caused by Brexit, potentially boosting both UK and European markets.

However, the specter of increased government spending looms large. Bond markets may react nervously if Labour’s fiscal plans threaten to significantly increase the UK’s debt burden. The promise to raise defense spending to 2.5% of GDP, while geopolitically prudent, adds another layer of fiscal pressure.

The global implications of Labour’s victory extend beyond Economics. With populist movements gaining ground across Europe and the US gearing up for its own election, the UK’s leftward shift could signal a broader trend. If Labour successfully navigates the economic challenges ahead, it could provide a blueprint for center-left parties Worldwide to claw back the ground Conservatives have gained so far in the 21st Century.

In the short term, expect increased volatility as markets digest the implications of this political sea change. The Pound may experience fluctuations as currency traders bet on Labour’s ability to deliver on its economic promises.

Ultimately, the markets’ long-term reaction will depend on Labour’s ability to balance its social agenda with fiscal responsibility. For Global Investors, the message is clear: “Keep calm and carry on watching the UK as Labor finally gets a chance to run things again.” The next few months will be crucial in determining whether Labour’s victory heralds a new era of economic growth or a return to the economic turbulence (and punk rock) of the 1970s which ushered in their 40-year exile by Thatcher and her Tories.

One way or the other, it’s sure to be a jolly interesting ride.

8:30 Update: No excuses today as the Non-Farm Payrolls were perfect. Job growth 206,000 was a bit higher than 170,000 expected but last month was revised down from 272,000 to 218,000 so net 152,000 and other months were also revised lower so a nice, overall slowing trend to job growth. Unemployment confirmed that by ticking up to 4.1% and Hourly Earnings held steady at 0.3% along with the Average Workweek (34.3 hours).

So we’re hiring less people and paying them less money – Yay Capitalism!

Is AI finally starting to gain traction, sweeping away all those pesky workers? We don’t get the next Productivity Report until Aug 1st but that’s the dream, of course…

Next week we’ll have Consumer Credit, CPI, PPI and Consumer Sentiment – good data to check in on inflation and next week it’s EARNINGS SEASON!!! starting on Thursday with PEP, PGR, DAL & CAG and then Friday is Bank Day with JPM, WFC, C, BK and not-bank but still interesting: ERIC.

Have a great weekend,

-

- Phil