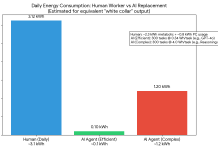

$26,000!

$26,000!

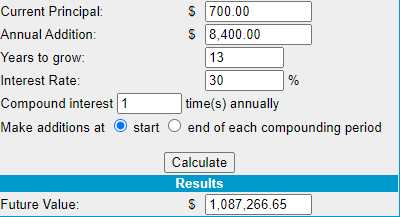

Including this month’s $700 deposit, we have a starting basis of $16,100 with our 2-year anniversary next month (Aug 25, 2022) and we have a profit of $9,900 (61.5%) – miles ahead of our goal of making 10% a year. At our current pace, rather than taking 30 years to get to $1M – it will only take 11 more years!

If you missed the first two years, you are not too far behind, it only takes $26,000 to catch up and then follow the commitment of adding $700 each month and, if all goes well – 11 year x 12 months x $700 is $92,400 more and, at 30% per year – we hit $1M during 2035 – that’s pretty good!

Of course, we can’t count on having years that are this great every year but our strategy does have a good chance of keeping us in the 20-30% range. 10% was our very conservative estimate when we started (see “The Secret to Consistent 20-40% Annual Returns on Stocks“). If you are young or if you have children/grandchildren that are young – I cannot stress strongly enough that you should be doing something like this for them…

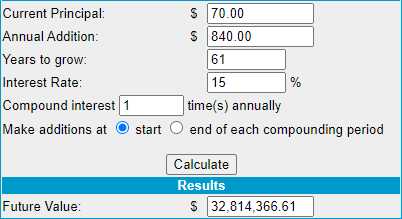

Let’s say you are 61, like me and when you were born your rich Uncle set up an account like this putting in, not $700/month (as that was a lot of money in 1963) but just $70/month. Let’s also say that we didn’t make 30% for 61 years but 15%. Today we would have over $32 MILLION!

Let’s say you are 61, like me and when you were born your rich Uncle set up an account like this putting in, not $700/month (as that was a lot of money in 1963) but just $70/month. Let’s also say that we didn’t make 30% for 61 years but 15%. Today we would have over $32 MILLION!

THAT is what we are trying to teach you how invest here – slowly and steadily!

THAT is all it takes to ensure your children’s and your grandchildren’s futures using the most conservative trading strategy we teach our Members at PhilStockWorld. I know I keep repeating this but that’s because it’s important – THIS is a simple strategy that works and consistently builds wealth over time.

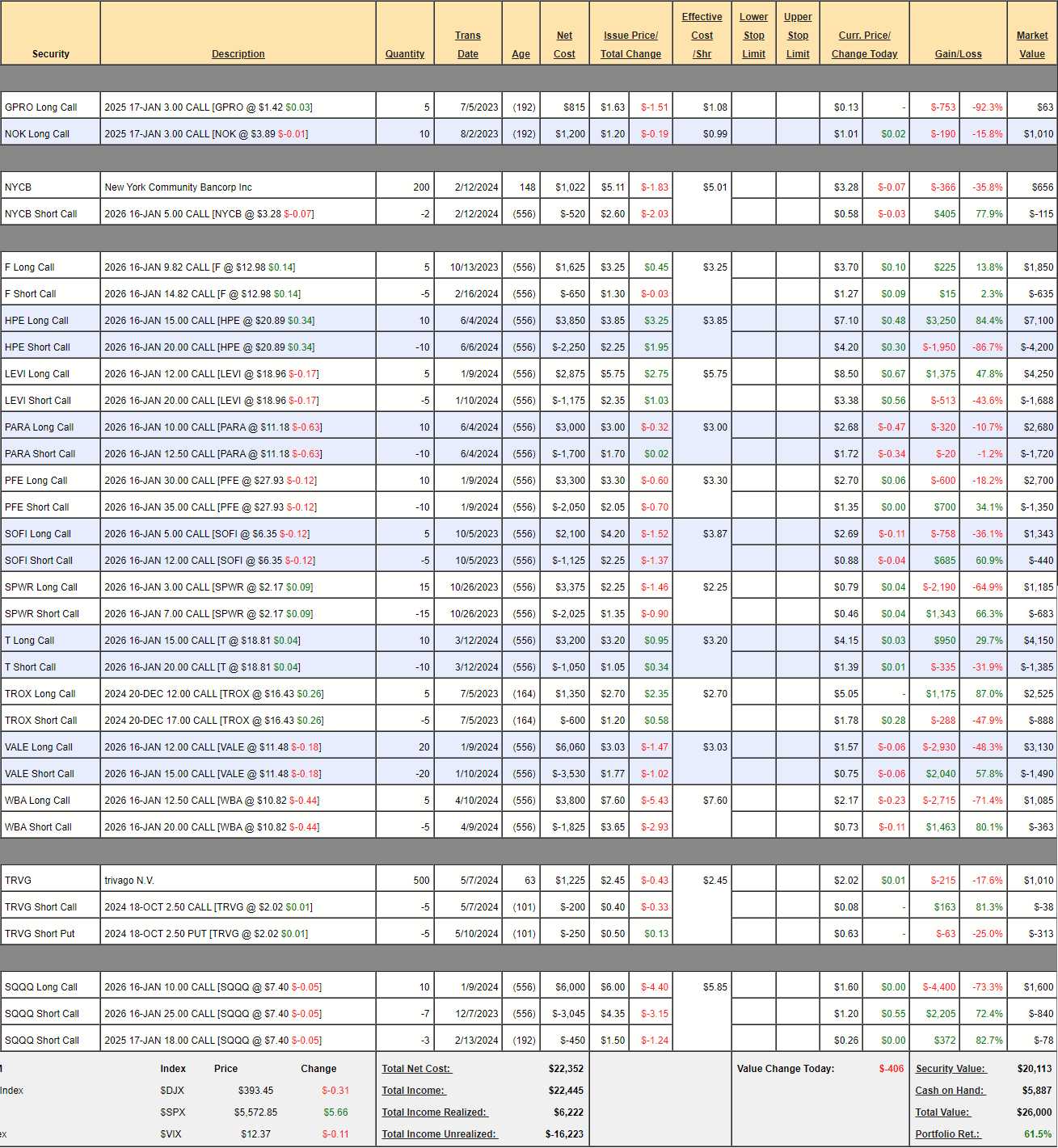

We made no changes in our last review and added no new trades during the month so we have $5,887 in cash to deploy but first, let’s take a look at our positions and see if anything needs to be adjusted:

-

- GPRO – Dead but not worth cashing until we see earnings (in case there’s a miracle)

- NOK – Another one where we’re hoping earnings (18th) will justify our faith. At our $4.50 target we’ll be up $490 (48.5%) from where we are now and we still believe.

-

- NYCB – They just paid a penny dividend on June 7th and, if things are back on track this year – we can expect that to increase significantly. We have faith in our $5 target 18 months from now and that would net us back $1,000 for a $459 (84.8%) potential gain.

- F – On track for our $2,500 goal and currently net $1,215 so a lovely $1,285 (105%) upside potential. I think doubling down on this trade may be the best use of another $1,215!

-

- HPE – Fairly new and already over our target at net $2,900 on the $5,000 spread so we still have $2,100 (72.4%) upside potential and all they have to do is hold $20. Aren’t options fun?

- LEVI – This one is almost at goal at net $2,562 on the $4,000 spread so there’s $1,438 (56.1%) upside potential here.

- PARA – We just added these to take advantage of the merger but very disappointing so far. We discussed this in Member Chat yesterday and I don’t see them not being worth $12.50 so I think this is good for a new trade at net $960 on the $2,500 spread with $1,540 (160%) upside potential and that’s just too good not to double down on!

-

- PFE – We intend to stay with this and the 2026 $30 calls are $2.70 and the $25 calls are $5 so $2.30 to roll down $5 is money well spent – let’s do that. That also allows us to roll the 10 2026 $35 calls at $1.35 to 10 Jan (2025) $30 calls at $1.20 for net $100 – they will expire much sooner and we can always roll back if PFE pops – worst case is we have the same $5,000 spread we started with. Assuming we keep the $10 spread over time, the upside potential is $10,000 less our original $1,250 and the $2,400 we’re spending on rolls leaves us with $6,350 (173%) upside potential.

-

- SOFI – Despite beating in their last two reports, the stock keeps going down but I do have long-term faith. At net $903 at $8 we’ll have $1,500 and I think that’s realistic with $597 (66%) upside potential.

-

- SPWR – This one is looking dead in the water but net $502 isn’t worth pulling before earnings.

-

- T – Right on track for our full $5,000 at net $2,765 so we have $2,235 (80%) upside potential on this one that looks like easy money.

- TROX – Took a huge dip but still on track for us! Net $1,637 on the $2,500 spread has $863 (52.7%) upside potential.

-

- VALE – Very disappointing first half for our Trade of the Year but $15 is certainly in range for 2026 and that would be $6,000 from our current net $1,640 so there’s $4,360 (265%) upside potential at $15.

-

- WBA – Down and down they go and $20 seems out of range. We’ve already spent our money on other adjustments so let’s wait until after earnings to see if there’s any hope.

- TRVG – Not off to a good start but our net is $1.55 and we’ll roll the short puts and sell more puts and calls to further lower the basis, so I’m not worried. Earnings should be at the end of the month, so we’ll see.

-

- SQQQ – Our hedges took a huge beating and SQQQ will reverse-split if it gets much lower. On the bright side, the short calls are expiring so let’s: Buy back both short calls ($918) and sell 7 Jan $8 calls for $1 and let’s roll down our 10 2026 $10 calls at $1.60 to 10 2026 $5 calls at $2.70 for net $1.10 ($1,100).

- Assuming we can roll the short calls back to $10, we collect $5,000 over $10 and our net was $682 and we just spent $1,218 so net net $1,900 means we have $3,100 worth of downside protection.

We’ve spent $4,578 making adjustments and now we have $23,257 (89.4%) of upside potential that we are counting on and that’s almost a double over the next 18 months so we’re in very good shape if the markets hold up and, if they don’t, we have $3,100 of downside protection as well.

As I said – you can do very well just starting off from here!

If you would like to join us on the path the true, realistic wealth-building, come and join our Members at PhilStockWorld – because your children and grandchildren deserve to have a worry-free retirement, don’t they?

Join today and you will gain access to our 6 Member Portfolios (Basic and Premium Memberships only) as well as Trade Ideas, our Legendary Live Chat Room (Basic and Premium Memberships only), Live Trading Webinars, Trading Education our AGI partners and other exclusive perks (Basic and Premium Memberships only).

Find out why Forbes called Phil Davis “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – madeline@philstockworld.com – for a 7-day FREE trial at sign up.