On the bright side, Trump is up $2Bn this morning.

After surviving an assassination attempt over the weekend, Trump’s Truth Social (DJT) is popping 50% this morning, netting the former President a nice $2Bn bump to his net worth. The odds of Trump being our next President have jumped to 70% – according to the bookies and, surprisingly, the Futures are all positive this morning – though that’s because the Dollar has dropped to 103.77 – down over 1% from Thursday’s open (thanks Japan!).

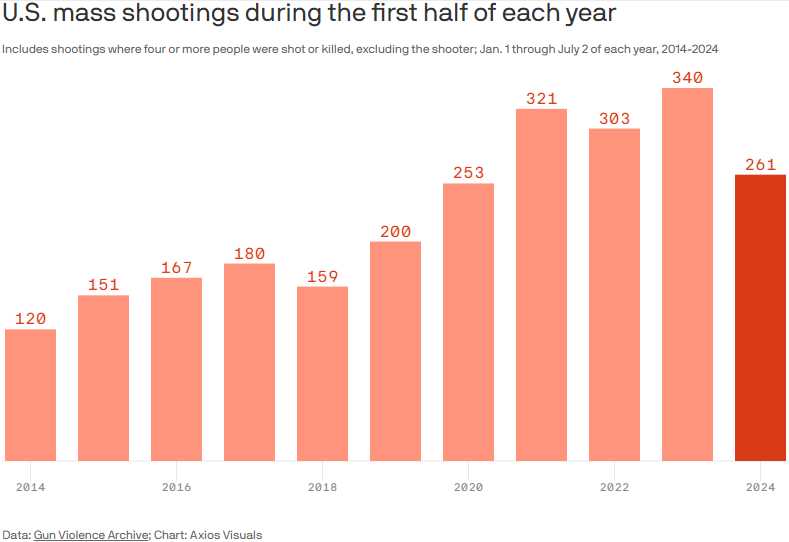

We all, of course offer our “hopes and prayers” over yet another assault weapon shooting in America. Unfortunately, we can’t imagine what we can possibly do to put a stop to yet another HUGE year for mass shootings as we’ve already had 261 of them in the first half of 2024, but still way behind last year’s record-breaking 340 mass shootings through July 2nd.

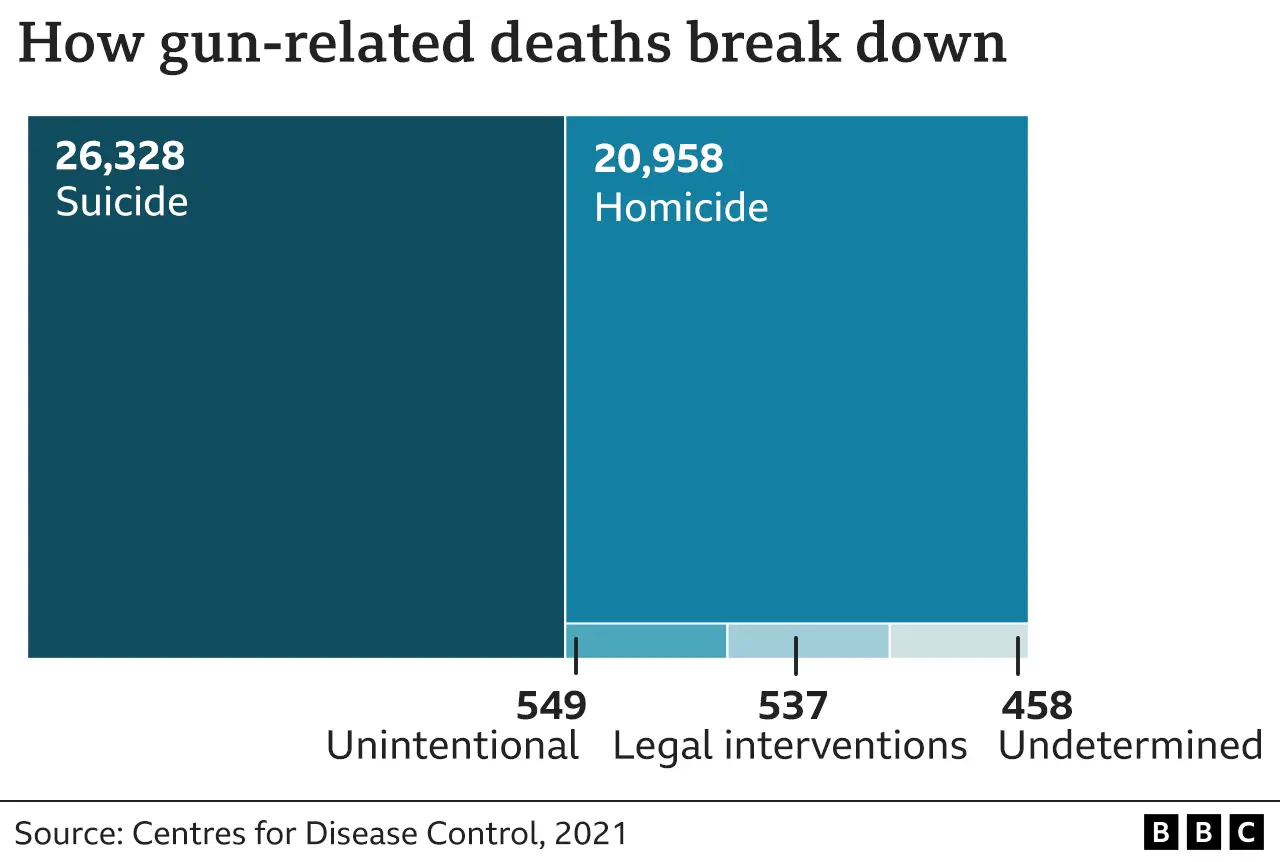

2024 is likely to be our 5th consecutive year of averaging more than one mass shooting each day in America, more mass shootings than all the other countries combined – and then tripled! Russia had the second most mass shootings in the world at 21 vs the 620 we ended up having last year. And, of course, that doesn’t include good old-fashioned one on one homicides, we had 20,958 of those using a gun last year though 26,328 shot themselves.

It seems to me if we had some sort of a Tinder-type matching service for people who want to commit suicide and people who want to murder people – this thing could all be sorted out nicely. Of course, we can’t have that sort of thing – it’s like 3 and a half years ago Trump gave rioters chanting “Hang Mike Pence” a big thumbs up, tweeting(10 mins AFTER the mob breached the Capital)“Mike Pence didn’t have the courage to do what should have been done to protect our Country and our Constitution.”

Now, 42 months later, people are SHOCKED that we are having political violence so “thoughts and prayers,” my friends – it has worked so well before…

What is not working is China, who are teetering on the edge of Economic Destruction as multiple crises converge. This is something we’ve been tracking for years at PSW but here’s a consolidated update of where we are now:

1. Slowing Growth and Missed Targets

– China’s GDP grew by only 4.7% in Q2 2024, down from 5.3% in Q1 and below the expected 5.0%.

– Quarter-to-quarter growth more than halved to 0.7% from 1.5% previously.

– This slowdown puts pressure on achieving the government’s 5% annual growth target – which is already down from 7% pre-covid.

2. Property Market Crisis

– Real estate investment fell 10.1% in the first half of 2024.

– New home sales plummeted 26.9% in the same period.

– The property slump is a major drag on overall economic growth.

3. Hidden Debt Time Bomb

– Local governments have accumulated an estimated $7-11 Trillion in off-the-books debt.

– As much as $800 billion of this debt is at high risk of default.

– This hidden debt is about twice the size of China’s central government debt.

4. Failed Infrastructure Projects

– Many debt-fueled projects have become “white elephants“.

– Examples include abandoned light-rail systems, empty industrial parks, and underutilized tourist attractions.

5. Weak Consumer Spending

– Retail sales rose just 3.7% in the first half of 2024.

– Consumer confidence remains low, hampering economic recovery.

6. Global Trade Tensions

– Rising trade conflicts with the West are impacting China’s export-driven sectors.

Timeline of the Crisis:

– 2019-2021: Hidden debt accumulation accelerates as local governments use off-the-books financing for development projects.

– 2022: Property market downturn begins, reducing a key revenue source for local governments.

– 2023: GDP growth slows to 5.2%, down from 7.8% a decade earlier.

– Early 2024: IMF projects 5% growth for 2024, but warns of downside risks.

– Q2 2024: GDP growth falls to 4.7%, missing expectations and intensifying concerns.

Current State and Outlook:

1. Policy Dilemma: Chinese leaders are reluctant to implement large-scale stimulus due to concerns about reinflating the property bubble and potential capital flight.

2. Targeted Measures: The government has taken small steps like interest rate cuts and cheap loans to banks, but these have had limited impact.

3. Structural Reforms Needed: Economists call for tax system changes to support consumption and repair local government finances.

4. Global Implications: China’s slowdown poses risks to global economic growth and trade.

5. Upcoming Policy Meetings:

– The Third Plenum (July 15-18, 2024) may discuss long-term economic reforms.

– A Politburo meeting later in July might signal more immediate economic support measures.

As China grapples with these interconnected challenges, the world watches closely. The outcome of upcoming policy meetings and Beijing’s ability to navigate this complex economic landscape will have far-reaching implications for both China and the global economy.

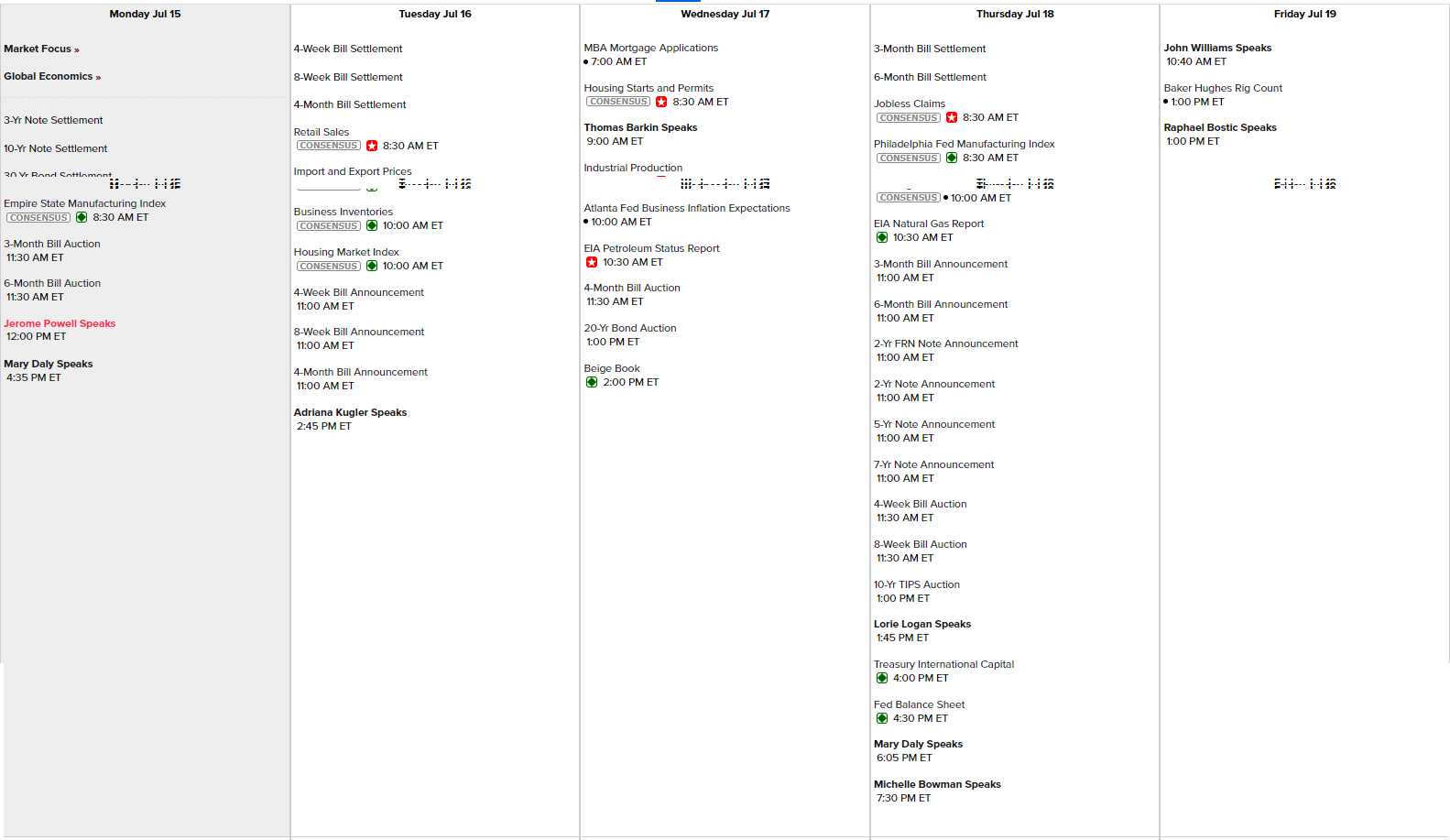

Zooming back to the US, we have the Empire State Manufacturing Report this morning, which was a disappointing -6 in June. Tomorrow we get Retail Sales along with Import & Export Prices and Business Inventories. Wednesday we get Housing Data along with Industrial Production, and Thursday we have the Philly Fed and Leading Economic Indicators.

Powell is speaking today at lunch, then Daly after the close and then we have 7 more Fed speakers this week peppered around another round of note auctions – which we now have to sell to Global investors who are getting very nervous about the state of our political theater.

While American’s may be ignorant of politics in other countries, the rest of the World well-remembers Italy’s “Year’s of Lead,” which was a period (60s to 80s) of widespread political terrorism in Italy, characterized by a series of bombings, assassinations, and other violent acts carried out by both far-left and far-right groups. There were over 14,000 acts of violence during that time!

And meanwhile, it’s Earnings Season! Too many big names to mention and not enough information to guess what’s going to happen so we’ll be reading a lot of reports and gathering a lot of data so we can figure out whether the MASSIVE rally in the first half of the year was actually justified by earnings growth (it was not).

Be very careful out there!