Oopsie!

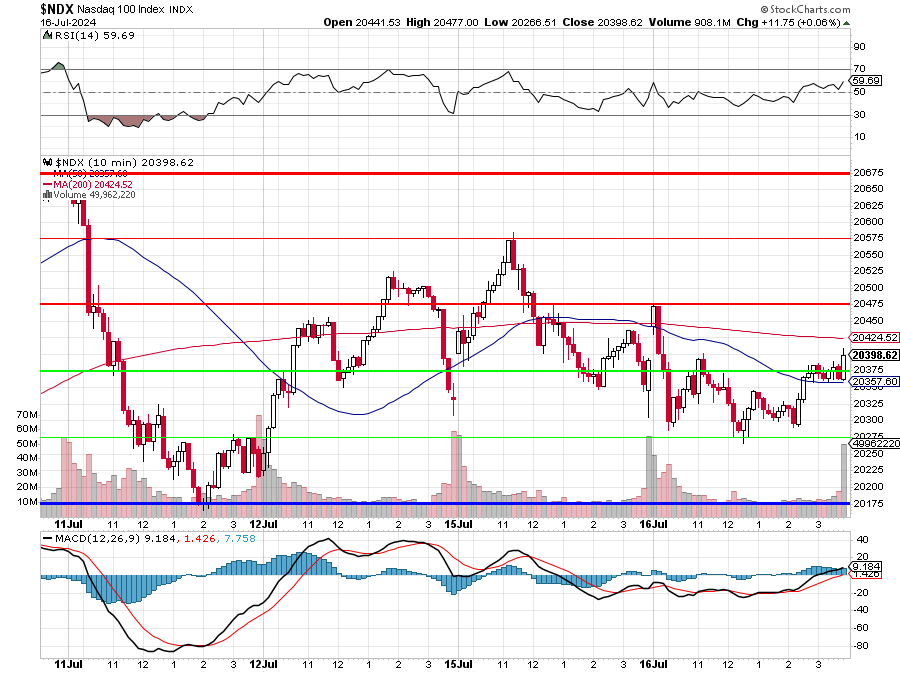

The Nasdaq is down 250 points (1.25%) in the Futures (7am) – though that may change with an earnings report. Well, not this morning as we don’t have any big tech names reporting but later maybe?

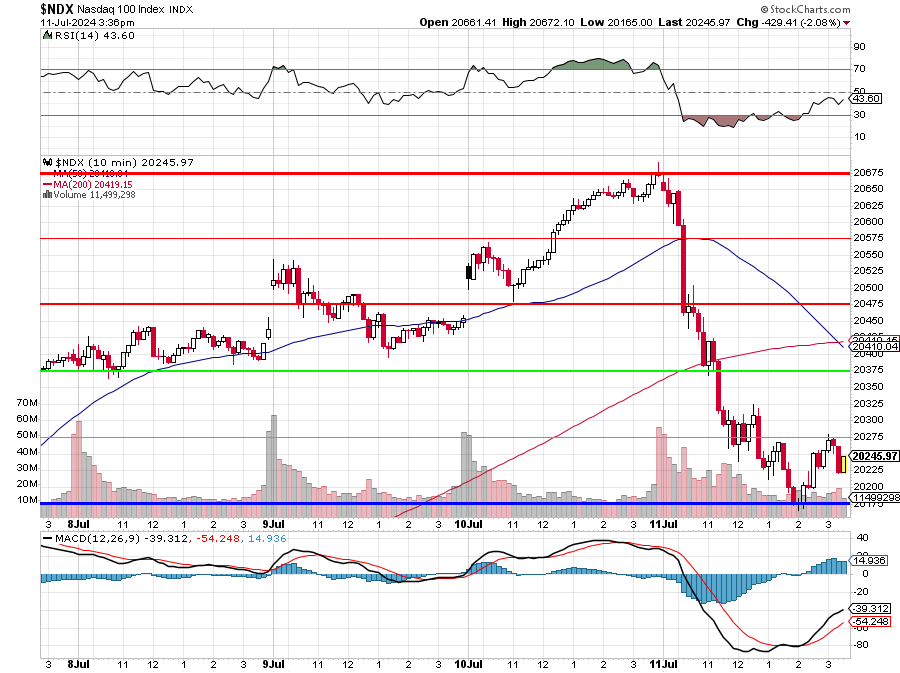

Last week, on the 11th, in our Live Member Chat Room, I said:

Nasdaq obeying the 5% Rule, which is good as it makes it predictable. I think we’re consolidating for a move lower, at least 250 more points. I’ll be wrong if we get back over the strong bounce at 20,375.

The death cross doesn’t mean much on a 10-minute chart but, once again, RSI over 70 leads to bad things…

Getting rejected exactly at a bounce line is a bad sign. Don’t forget, the 5% Rule is a reflection of how the algos trade so, when you see the lines hit on the mark – it means there are major selling programs at work.

And look at the uptick in volume on the move down.

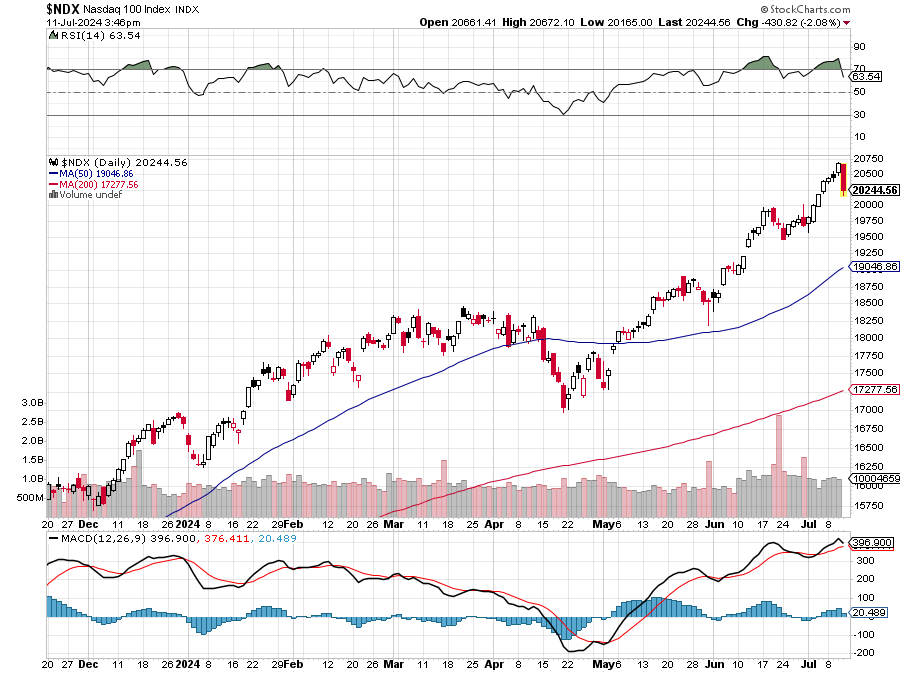

Here’s the bigger problem – this is what happens when you don’t bother to build support on the way up:

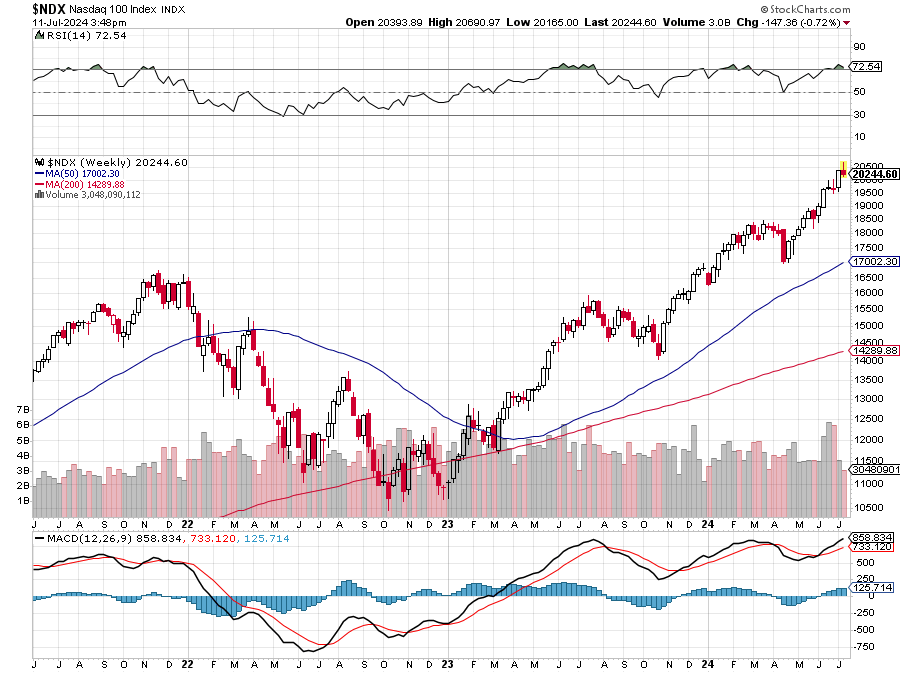

Weekly does not look better:

So imagine we have not completed a correction until the RSI is back at 50 (at least) – that’s quite a way down from here so check those hedges!

And that brings us to today and -250 points brings us back to 20,148 on this chart and that’s below our 20,175 baseline and the daily RSI is STILL 65.90 so let’s be very carful at this critical juncture.

There’s a significant slide in megacap tech and chip stocks, which is particularly affecting Nasdaq futures. Of course it’s NVDA, which is spooked by Biden cracking down on high-tech exports to China (and Tump is no China fan either) while Trump is saying Taiwan should pay us to defend them – and that is freaking out TSM and other Taiwanese stocks – which may soon become Chinese companies as Trump allows his fellow fascists to do what they will to our “allies” (JD Vance has already said the US should not aid Ukraine).

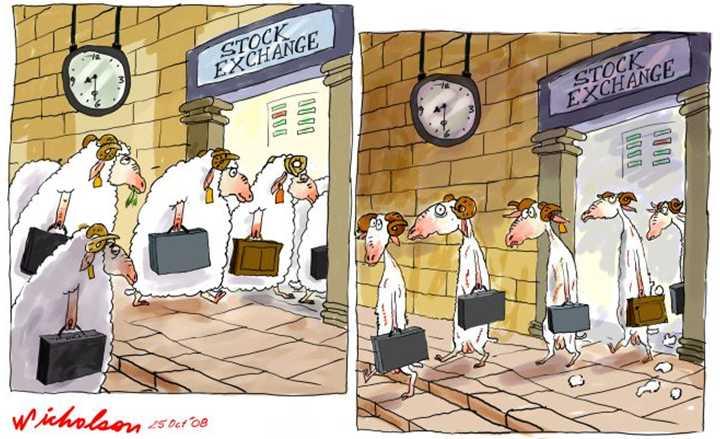

And, of course, there’s a degree of profit-taking after this huge first half. I see the Financial Media working double over-time to convince their Retail Trading audience to keep BUYBUYBUYing – despite the record highs while their Hedge Fund sponsors head for the exits. You know, the usual grift…

And, of course, it’s Earnings Season and it’s very hard to imagine we live up to the sky-high expectations that have driven the PE of the S&P 500 to just about 30x earnings while the Nasdaq is now at 35x earnings and 50x earnings for the non-Magnificent 93. EVEN the EXPECTED earnings growth for the S&P of 8.8% (still just the same 7 stocks) is not really enough to justify a 30x forward valuation – any signs of a Recession completely derail that premise.

Japan once again jumped in last night to prop up the Yen, which was down to 0.635 before they punched it up to 0.645 and that was enough to knock the Dollar down (because Japan uses Dollars to buy Yen, flooding the market with Dollars while creating a demand for Yen) to 103.4 – and that was the lowest reading on the Dollar since May – so we should find good support there and that, in turn, will make it much more expensive for the BOJ to prop up the Yen – which means we may get a next-level collapse soon.

Japanese authorities are suspected of having spent ¥3.5 trillion ($22 billion) last week to support the Yen, after deploying record amounts a couple of months earlier. The currency has depreciated around 11% over the past twelve months, to its weakest level since the 1980s.

Trump is a weak-Dollar fan as it improves our ability to export and hurts our ability to import, thus making America great??? Trump’s newly-revised Economic Platform, presented at the RNC, focuses on several key points:

-

- Extensive Tariffs: Trump advocates for broad tariffs on foreign-made goods, potentially escalating trade tensions and driving inflation.

- Tax Cuts: Proposals include eliminating taxes on tips (saving waiters an estimated $12Bn per year) and lowering corporate tax rates (saving the top 0.1% an estimated $1.2Tn per year, which is added to the National Debt burden that will ultimately be paid by the waiters)

- Energy Production: The platform calls for increased production of oil, natural gas, and coal while eliminating Global Warming by not discussing it any more.

- Immigration: Trump proposes the “largest Deportation Program in American History,” which will also cost tens of Billions of Dollars – enough to give each of the immigrants a House, Education and Job Training (but not Health Care – because no one can afford that!)

- Deregulation: Plans to reduce regulations to boost business activity and, once again, death by industry will become one of the leading causes of death in America. So great!

The platform is very light on specifics (almost free of them, in fact), with the Trump campaign emphasizing attitude over detailed policy proposals. In a surprising shift, Trump told Bloomberg Businessweek that he would allow Federal Reserve Chair Jerome Powell to complete his term if Trump wins in November.

Trump stated, “I would let him serve it out, especially if I thought he was doing the right thing.” This marks a significant change from Trump’s previous criticisms of Powell and the Fed’s policies. However, Trump also suggested that Powell might act to help Democrats, saying, “I think he’s political. I think he’s going to do something to probably help the Democrats, I think, if he lowers interest rates.”

Trump stated, “I would let him serve it out, especially if I thought he was doing the right thing.” This marks a significant change from Trump’s previous criticisms of Powell and the Fed’s policies. However, Trump also suggested that Powell might act to help Democrats, saying, “I think he’s political. I think he’s going to do something to probably help the Democrats, I think, if he lowers interest rates.”

Trump also “suggested” that Powell should not act to help Democrats, saying, “I think he’s political. I think he’s going to do something to probably help the Democrats, I think, if he lowers interest rates before the election.”

The still somewhat-independent Fed has been cautious about declaring victory over inflation. Key points include:

-

- Lack of Progress: In their May statement, the Fed noted a “lack of further progress” in bringing inflation back to the 2% target.

- Patience on Rate Cuts: Fed Chair Powell has indicated that several more months of low inflation readings would be needed before considering rate cuts.

- Economic Uncertainty: While job growth remains robust, there are signs of economic deceleration, complicating the Fed’s decision-making process.

- Potential for Rate Cuts: Most economists don’t anticipate rate cuts before September at the earliest, with updated projections possibly showing one or two cuts by year-end.

- Data Dependency: The Fed’s decisions will heavily rely on incoming economic data, particularly inflation reports.

This cautious approach by the Fed, combined with Trump’s economic proposals and shifting stance on Powell, creates a complex economic landscape. The potential for significant policy changes under a second Trump term, coupled with ongoing inflation concerns, suggests a period of economic uncertainty ahead. Investors should closely monitor both political developments and economic indicators as we move towards the election and beyond.