Well, it looks like Uncle Joe decided to hang up his aviators and pass the torch to Kamala Harris. Who saw that coming? (Okay, maybe everyone except Joe) As we start our week, let’s dive into this political plot twist and what it means for our portfolios.

First off, VP Harris is now scrambling to lock in delegate support faster than you can say “Planned Parenthood.” Early reports suggest she’s raised a cool $50 million in the first 15 hours after Biden’s announcement. Not too shabby for a last-minute candidate! But before we crown her the Democratic nominee, let’s remember there’s still a convention to get through. While many party bigwigs are falling in line, some notable holdouts (looking at you, Obama and Pelosi) are keeping things interesting.

As for Harris’s potential VP pick, the rumor mill is churning out names faster than a popcorn machine at a movie premiere. Top contenders seem to be swing state governors like Josh Shapiro (PA) and Andy Beshear (KY), or maybe she’ll go for some star power with Pete Buttigieg. And, of course, there’s always California’s Gavin Newsom – but would he take the back-seat to Harris?

Now, how’s the market taking all this? So far, it’s been a bit of a rollercoaster. The Nasdaq took a 244-point nosedive on Friday, but it wasn’t all Biden’s fault (sorry, Joe). We saw some profit-taking after recent highs, and there are growing concerns about tech sector earnings. Plus, let’s not forget about that pesky inflation data that’s keeping the Fed on its toes.

Speaking of earnings, we’ve got a busy week ahead. Here are some highlights to watch:

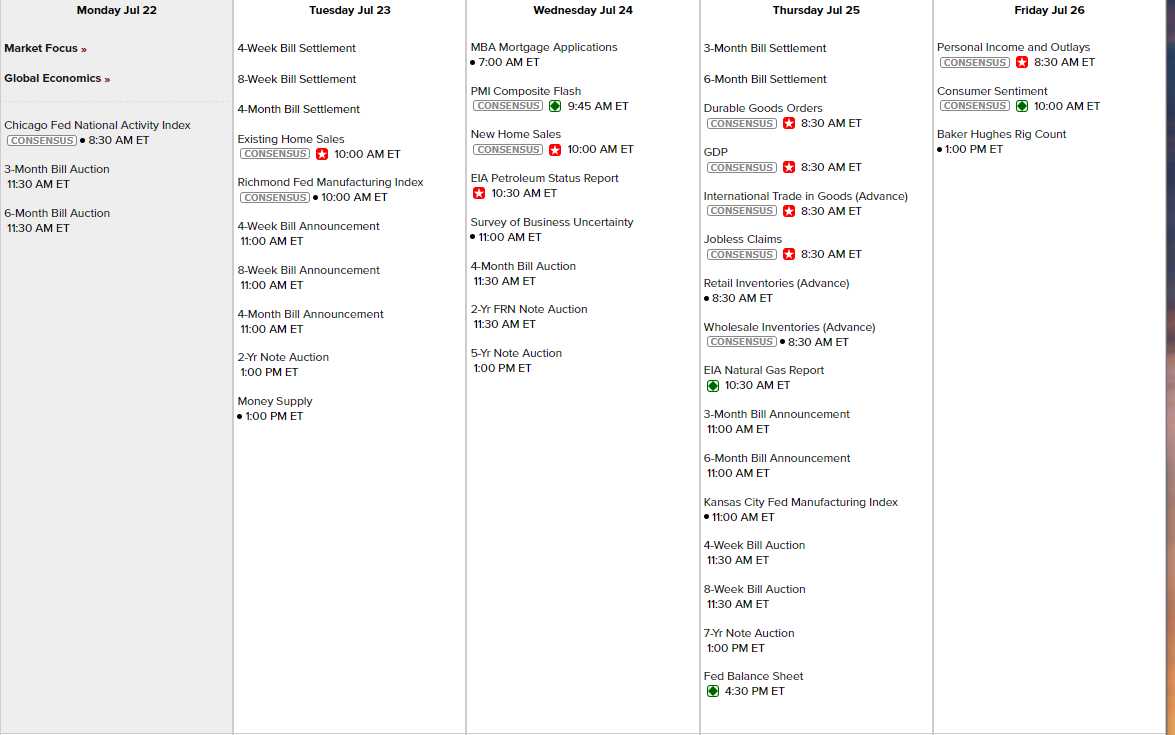

On the economic data front, keep an eye out for:

Monday: Chicago Fed

Tuesday: Existing Home Sales, Richmond Fed

Wednesday: PMI, New Home Sales, Business Uncertainty, Note Auctions

Thursday: Durable Goods, GDP, Retail Inventories, Kansas City Fed, Note Auctions

Friday: Personal Income and Outlays, Consumer Sentiment

There is no Fed Speak as there will be a rate announcement next Wednesday (the 31st) so we’ll be very data-dependent this week as we look to see if the market can recover from last week’s poor showing.

Stay tuned for our usual in-depth analysis throughout the week. And remember, whether it’s Biden, Harris, or Mickey Mouse in the White House, there’s always opportunity in the market for savvy investors like us.

“Party people say, Party people say, Hey, It’s a new day, It’s a new day, Monday, Tuesday, Wednesday, Thursday, Friday, Saturday, Saturday to Sunday.” – Alicia Keys

Now, let’s make some money!

-

- Boaty