Insight/2024/07.2024/07.19.2024_Earnings%20Insight/03-s%26p-500-earnings-growth-year-over-year-q2-2024.png?width=672&height=384&name=03-s%26p-500-earnings-growth-year-over-year-q2-2024.png)

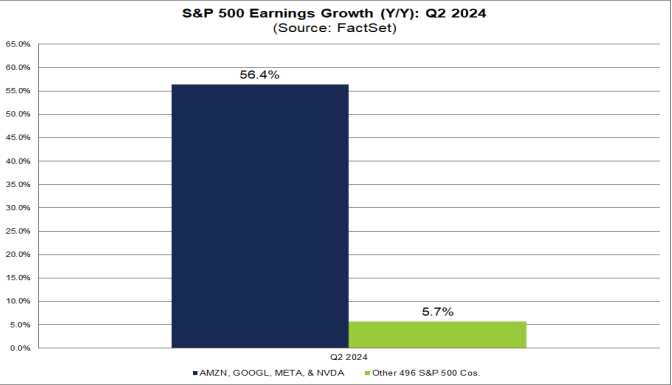

Two weeks into earnings season and 14% of the S&P 500 companies have reported their Q2 2024 results and, so far, 80% of them have exceeded earnings expectations(62% beat on Revenues) AND, going by this small sample, the S&P is on track for earnings growth of 10.1% year-over-year! This is a significant improvement from earlier projections. Of course, it’s important to note that while the Magnificent 7 Seven continue to play a significant role in earnings growth, other sectors are also beginning to contribute BUT let’s not kid ourselves – it’s still a Mag, Mag, Mag World:

As we move into the peak weeks of earnings season (July 22 – August 16), we’ll get a clearer picture of the overall corporate earnings landscape. Key reports from various sectors in the coming weeks will provide crucial insights into the broader health of Corporate America but, so far, these are the early trends:

-

- Banking Sector Performance:

Major banks like JPMorgan Chase, Wells Fargo, and Citigroup reported strong earnings in mid-July, beating expectations. This suggests the banking sector is showing resilience despite concerns earlier in the year about regional bank stability. - Technology Sector:

Tech giants have shown mixed results. While some companies like Microsoft and Alphabet (Google) are expected to post better-than-expected earnings, others like Netflix saw subscriber growth slow down slightly compared to previous quarters. The semiconductor industry, represented by companies like TSM, showed signs of recovery after a challenging 2023. - Consumer Goods:

Companies like Coca-Cola and Procter & Gamble reported solid earnings, indicating that consumer spending remains robust despite inflationary pressures. However, there are signs of consumers becoming more price-sensitive and shifting towards private label products in some categories. - Healthcare:

Pharmaceutical companies and health insurers generally reported positive results, with companies like UnitedHealth Group and Johnson & Johnson beating estimates. This sector continues to show stability and growth. - Industrial Sector:

Mixed results so far, with some beating expectations while others showed signs of slowing demand in certain markets. Supply chain issues seem to be largely resolved, but there are concerns about potential impacts from global economic slowdowns. - Energy:

Oil majors like ExxonMobil and Chevron are expected to report lower profits compared to the record highs of 2023, mainly due to lower oil and gas prices (and oil is back below $80 this week). However, earnings still generally beat analyst expectations.

- Banking Sector Performance:

Overall, we’re seeing that cost-cutting measures implemented in 2023 are showing positive impacts on margins for many companies but they are still generally cautious in their forward guidance, citing economic uncertainties and geopolitical tensions and the impact of AI and automation is becoming a more common topic in earnings calls, with many companies discussing investments in these areas.

It’s still early innings for the Q2 2024 Earnings Season, and these trends will evolve as more companies report in the coming weeks. We’ll continue to monitor and update our analysis as more data becomes available and we’ll also hopefully be able to start making a few predictions – once we have enough evidence to extrapolate with some degree of confidence.

It’s still early innings for the Q2 2024 Earnings Season, and these trends will evolve as more companies report in the coming weeks. We’ll continue to monitor and update our analysis as more data becomes available and we’ll also hopefully be able to start making a few predictions – once we have enough evidence to extrapolate with some degree of confidence.

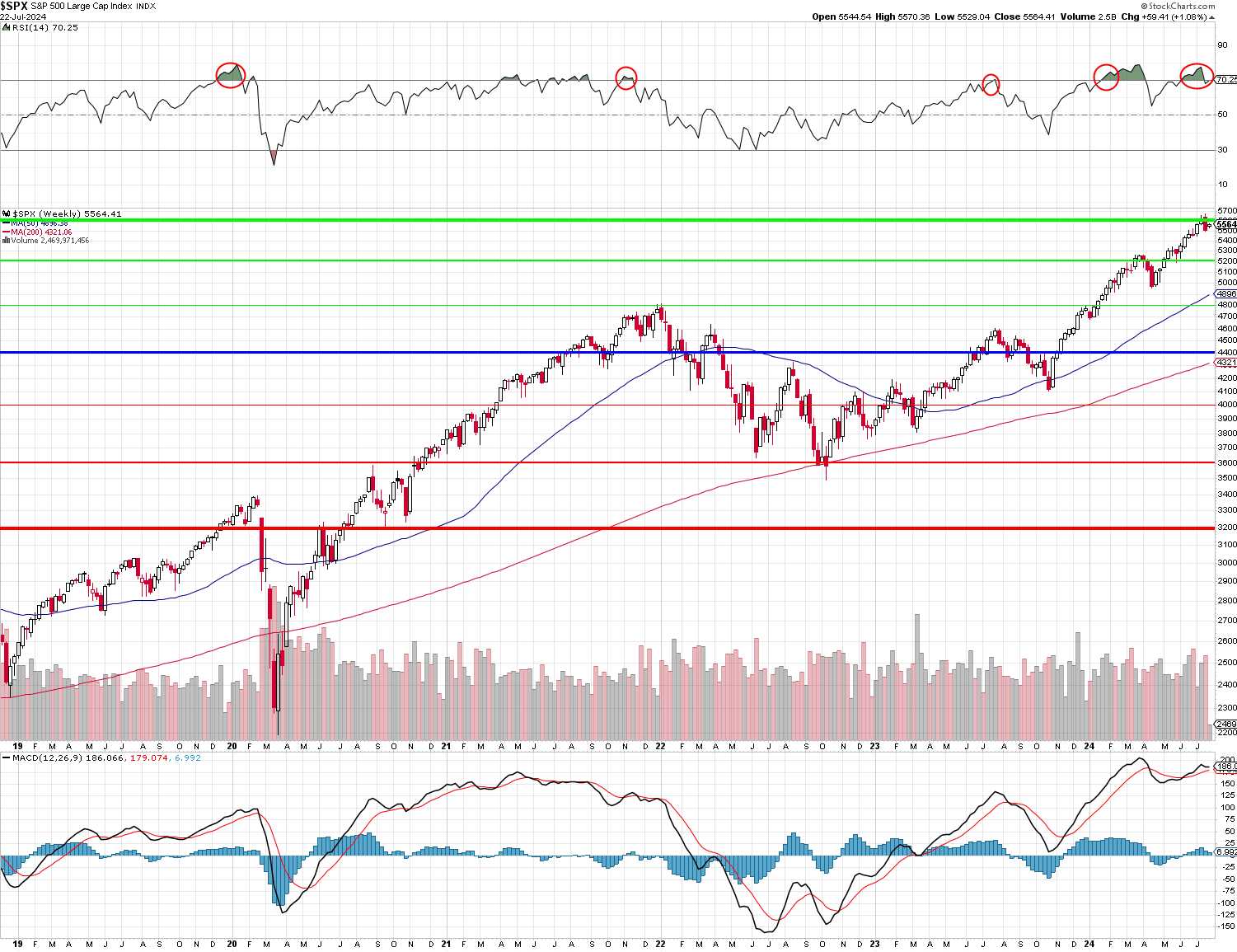

Also at issue is that Companies that have reported positive earnings surprises for Q2 have seen an average price increase of just 0.3% vs a 5-year average of 1% – which does indicate that positive surprises are already baked into these record-high market prices. Companies that have reported negative earnings surprises have seen an average price decrease of -1.7% and that is more than 5x 0.3% so 4 beats for every 1 miss (80%) is not going to be enough to drive the indexes higher – is it?

As you can see from the weekly S&P 500 chart, we’re still dangerously high on RSI (over 70 almost always ends up n a correction) and, more importantly, we’re dangerously high compared to last year, when the S&P was around 4,000 and now testing the 5,600 line is 40% higher with just 10.1% better earnings??? That doesn’t seem very sustainable, does it?

Here’s a couple of early predictions by Boaty (our resident AGI):

Potential Big Beats:

-

- Alphabet (GOOGL) – Reporting this evening.

With their computing and AI initiatives, coupled with a rebound in digital advertising spending, could lead to a beat. The recent upgrade of Snap by Morgan Stanley suggests improving sentiment in the digital advertising space.

-

- Microsoft (MSFT) – Reporting on July 30

Rationale: Continued growth in cloud services (Azure) and AI integration across products could drive strong results. The company’s recent AI investments and partnerships may start showing returns. - Tesla (TSLA) – Reporting this evening.

Rationale: Despite recent price cuts, increased production capacity and growing demand in key markets like China could lead to better-than-expected results.

- Microsoft (MSFT) – Reporting on July 30

Potential Misses or Challenges:

-

- Intel (INTC) – Reporting on Aug 1

Rationale: Ongoing challenges in the PC market and fierce competition in the data center segment from AMD could pressure results. - American Airlines (AAL) – Reporting on July 25

Rationale: Recent downgrade by Bernstein to Market Perform suggests potential headwinds. Higher fuel costs and operational challenges might impact earnings negatively.

- Intel (INTC) – Reporting on Aug 1