Roughly 3 in 5 (60%) Americans believe that the U.S. is CURRENTLY in a recession.

Roughly 3 in 5 (60%) Americans believe that the U.S. is CURRENTLY in a recession.

Of the respondents, most said a recession started roughly 15 months ago, in March of last year, and could last until July of 2025, citing higher costs and more difficulty making ends meet, the San Francisco-based fintech company, Affirm, found in their June poll. Persistent inflation has weighed heavily on households, according to Vishal Kapoor, senior vice president of product at Affirm.

According to a separate Guardian/Harris poll from May, 56% of respondents said they believe the U.S. is in a recession, although gross domestic product has been increasing for the past several years.

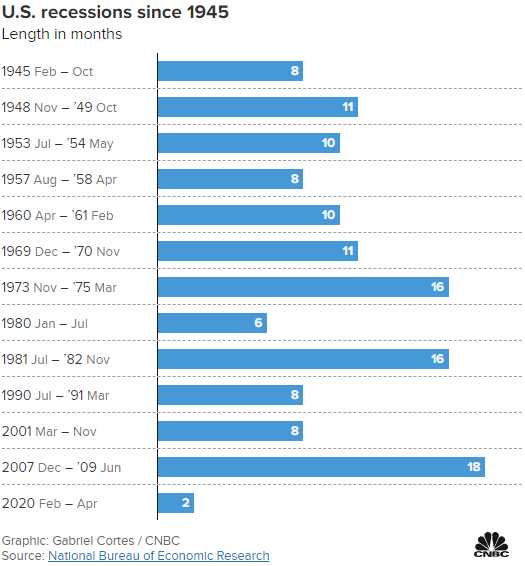

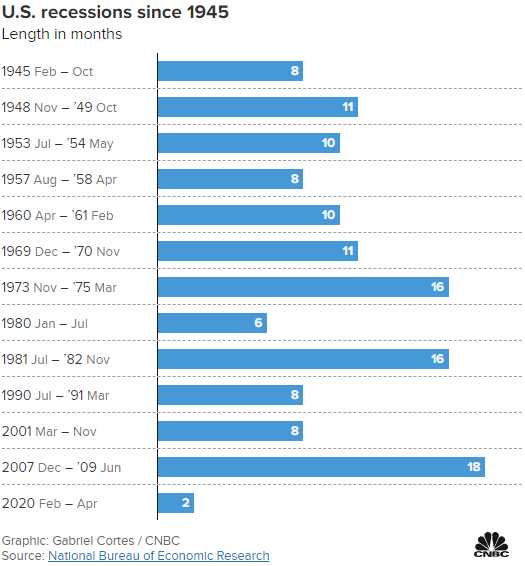

Officially, the National Bureau of Economic Research

defines a recession as “

a significant decline in economic activity that is spread across the economy and lasts more than a few months.” There have been more than a dozen recessions in the last century, some lasting as long as a year and a half. The last official recession was in 2020, at the start of the

Covid-19 pandemic.

Regardless of the country’s economic standing,

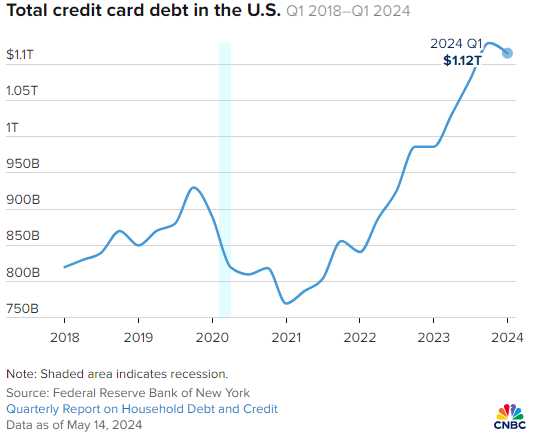

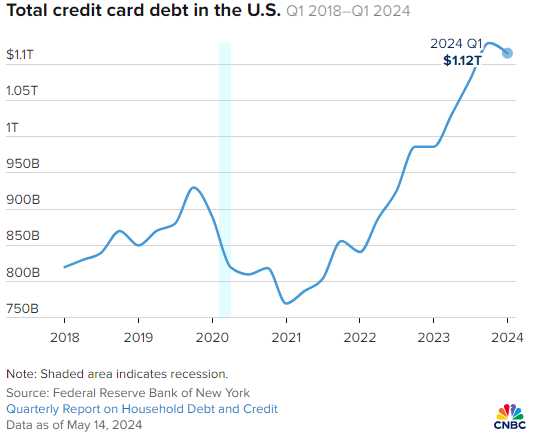

many Americans are struggling in the face of sky-high prices for everyday items, and most have exhausted their savings and are now leaning on credit cards to make ends meet, with Consumer Debt now well-past previous record highs – at the same time as interest on that debt is the highest it’s been since the 1980s. Over the last year, roughly 8.9% of credit card balances transitioned into delinquency, the New York Fed

reported in May.

“

The wealth creation was concentrated amongst homeowners and upper-income brackets, but you probably have about one-third of the population that’s been left out of that — that’s why there’s such a disconnect,”

JPM’s Joyce Chang said of the last few years.

This is absolutely not because the US Economy isn’t growing. After the Trump disaster of 2020, the US Economy has grown more than 5% on an annualized basis in every single quarter since so – no recession – but that masks the reality of the more and more unequal distribution of that growth and it’s not just in the US – this is a global crisis.

This is absolutely not because the US Economy isn’t growing. After the Trump disaster of 2020, the US Economy has grown more than 5% on an annualized basis in every single quarter since so – no recession – but that masks the reality of the more and more unequal distribution of that growth and it’s not just in the US – this is a global crisis.

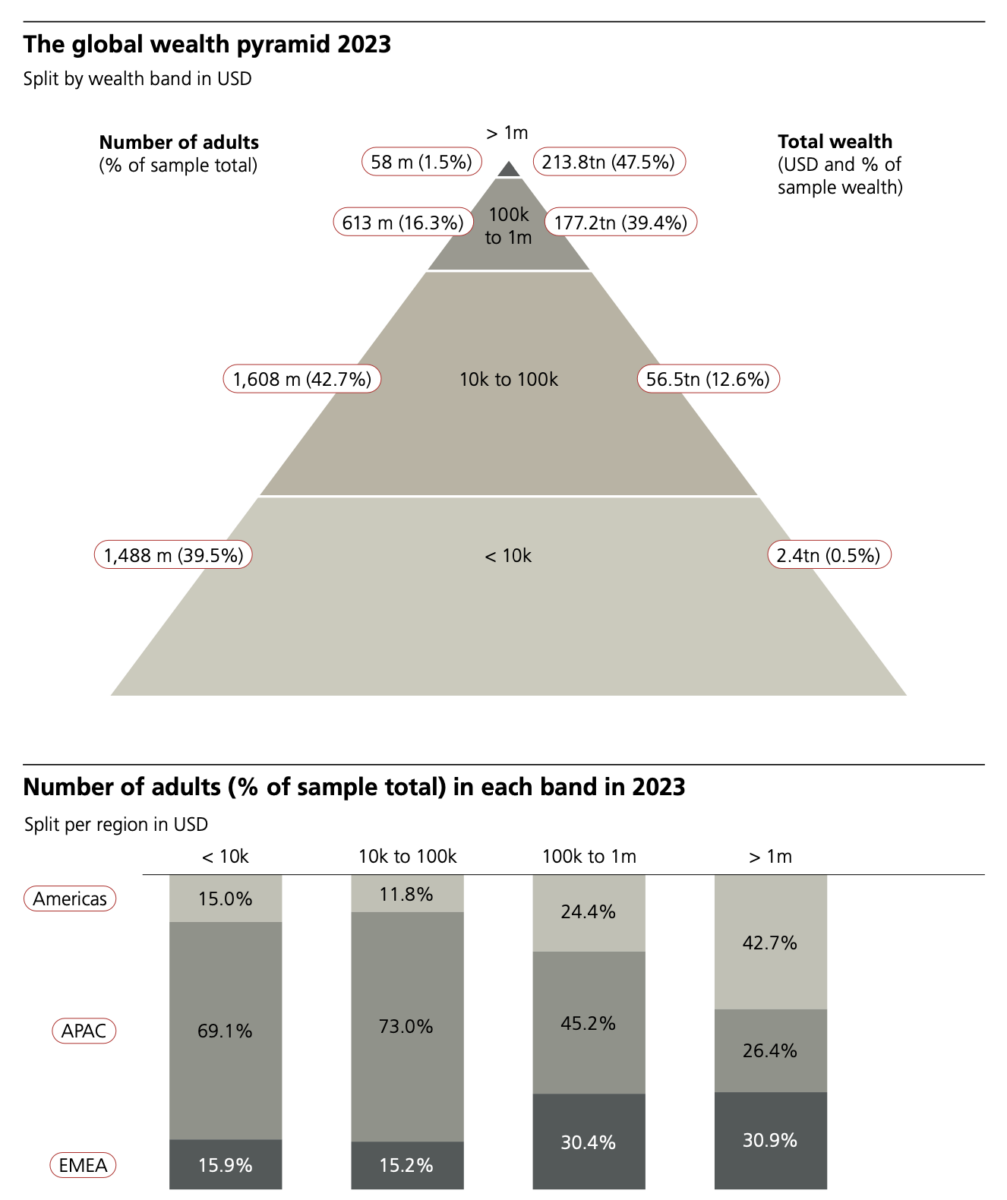

As you can see from this chart I shared with our Members yesterday – a study of 3.7Bn adults globally found that, out of $449.9 TRILLION of accumulated wealth, $213.8Tn (47.5%) of it belonged to just 58M (1.5%) people – who had an average of $3,686,206 each. The rest of the top 18% had $177Tn (39.4%) of the remaining Wealth and that worked out to $288,743 for each of them – not too shabby!

Unfortunately, for the next 1.6Bn (43%) of the people, that left just $56.5Tn (12.6% of the wealth) or $35,312 each while the bottom 1.488Bn (40%) were left with $2.4Tn ($1,600) to their names.

With this extreme level of inequality – even if the economy grows at 5% – that just means $10.6Tn more for the Top 1.5% and $120Bn more for the bottom 40% which means that, for every dollar gained by the bottom 40% (5% is $80 each), the Top 1.5% get $2,284 ($182,758 each).

The 5% annual gain for the Top 18% is 5 TIMES MORE than the TOTAL WEALTH of the bottom 40% – every year! And where does that money come from – the bottom 40% are the consumers – who pay up to the top 18% providers of goods and services. It’s a Marxian nightmare, isn’t it?

Obviously, this can’t possibly be solved by NOT taxing wealth. We’ve been not doing that for the past 40+ years and that’s how we got into this mess. In fact, our ENTIRE $36Tn budget deficit is right there – in the $590Tn we’ve funneled up to Top 18% since Ronald Reagan’s GOP promised us it would “Trickle Down.” We are still waiting for even a drop to touch the Poor and Middle Class, who have lost all the ground that the Top 18% has gained…

Obviously, this can’t possibly be solved by NOT taxing wealth. We’ve been not doing that for the past 40+ years and that’s how we got into this mess. In fact, our ENTIRE $36Tn budget deficit is right there – in the $590Tn we’ve funneled up to Top 18% since Ronald Reagan’s GOP promised us it would “Trickle Down.” We are still waiting for even a drop to touch the Poor and Middle Class, who have lost all the ground that the Top 18% has gained…

A simple 10% tax on the growth in wealth of the Top 18% over the past 40 years would have given the US a massive budget surplus – instead of the massive deficit we now face. There’s a very obvious fix to this but, unfortunately, it involves asking the people who have $590Tn to help out – and they are having none of it and that’s why they are lining up behind Trump (one of their own), who promises 4 more years of Wealth Accumulation ($10.6Tn) – at least.

And keep in mind that just the wealth of individuals. Thanks the the Supreme Court, our beloved Corporate Citizens can also vote with their wallets and donate to the candidates of their choice – and they tend to choose the people who won’t tax them either. In fact, Mr. Trump is promising a 15% Corporate Tax Rate – which is kind of funny as they only pay an average of 12% anyway but maybe they’ll pay 6% under the new rules?

Talk about an explosion of Wealth – in 1980, US companies were being taxes at up to 60% and the US Market Cap was $2Tn, now it’s $54Tn – up 2,600% in 44 years (50% per year on average) and $16Tn (30%) of that has gone to just 7 (0.1% of the S&P) magnificent stocks so, if you feel bad for the bottom 40% of the people in this country and wonder if they’ll be able to survive – think about what’s going to happen to the bottom 40% of the businesses in this country. It’s not hard to imagine – walk through any city in American and you’ll see the empty storefronts and deserted commercial buildings – you’re just not feeling it yet because the gap between the investing class and the working class has never been wider.

TSLA missed earnings (

Boaty was wrong yesterday) and those shares are down 9% pre-market while GOOG/L beat by 0.05, which is a drop in the bucket and not enough to satisfy traders – who are shaving 5% off that Mag 7 component:

V was in-line so only down 3.5% and T was in-line and that’s better than VZ so it’s up 3%

Mortgage Applications fell 2.2% so housing is BAD this week and Treasury yields are inverted (Recessionary!) with the 2-year at 4.42% and the 10-year at 4.23%. The logic is that the lower long-term rates indicate a slowing economy that will cause the Fed to lower rates in response. Isn’t that exactly what they said they wanted to do? That’s the soft landing but it’s the “soft landing” of 671M high-flying people landing on top of 3.1Bn people who can’t afford medical insurance.

“The accumulation of wealth at one pole is, therefore, at the same time accumulation of misery, the torment of labor, slavery, ignorance, brutalization, and moral degradation at the opposite pole.” – Karl Marx, Das Kapital

Roughly 3 in 5 (60%) Americans believe that the U.S. is CURRENTLY in a recession.

Roughly 3 in 5 (60%) Americans believe that the U.S. is CURRENTLY in a recession. Regardless of the country’s economic standing, many Americans are struggling in the face of sky-high prices for everyday items, and most have exhausted their savings and are now leaning on credit cards to make ends meet, with Consumer Debt now well-past previous record highs – at the same time as interest on that debt is the highest it’s been since the 1980s. Over the last year, roughly 8.9% of credit card balances transitioned into delinquency, the New York Fed reported in May.

Regardless of the country’s economic standing, many Americans are struggling in the face of sky-high prices for everyday items, and most have exhausted their savings and are now leaning on credit cards to make ends meet, with Consumer Debt now well-past previous record highs – at the same time as interest on that debt is the highest it’s been since the 1980s. Over the last year, roughly 8.9% of credit card balances transitioned into delinquency, the New York Fed reported in May.  This is absolutely not because the US Economy isn’t growing. After the Trump disaster of 2020, the US Economy has grown more than 5% on an annualized basis in every single quarter since so – no recession – but that masks the reality of the more and more unequal distribution of that growth and it’s not just in the US – this is a global crisis.

This is absolutely not because the US Economy isn’t growing. After the Trump disaster of 2020, the US Economy has grown more than 5% on an annualized basis in every single quarter since so – no recession – but that masks the reality of the more and more unequal distribution of that growth and it’s not just in the US – this is a global crisis.

Obviously, this can’t possibly be solved by NOT taxing wealth. We’ve been not doing that for the past 40+ years and that’s how we got into this mess. In fact, our ENTIRE $36Tn budget deficit is right there – in the $590Tn we’ve funneled up to Top 18% since Ronald Reagan’s GOP promised us it would “Trickle Down.” We are still waiting for even a drop to touch the Poor and Middle Class, who have lost all the ground that the Top 18% has gained…

Obviously, this can’t possibly be solved by NOT taxing wealth. We’ve been not doing that for the past 40+ years and that’s how we got into this mess. In fact, our ENTIRE $36Tn budget deficit is right there – in the $590Tn we’ve funneled up to Top 18% since Ronald Reagan’s GOP promised us it would “Trickle Down.” We are still waiting for even a drop to touch the Poor and Middle Class, who have lost all the ground that the Top 18% has gained…