I told you so!

I told you so!

Two weeks ago (July 11th) our Morning Report for our Members was titled: “Faltering Friday – Nasdaq Due for 1,000-Point Correction” in which I warned:

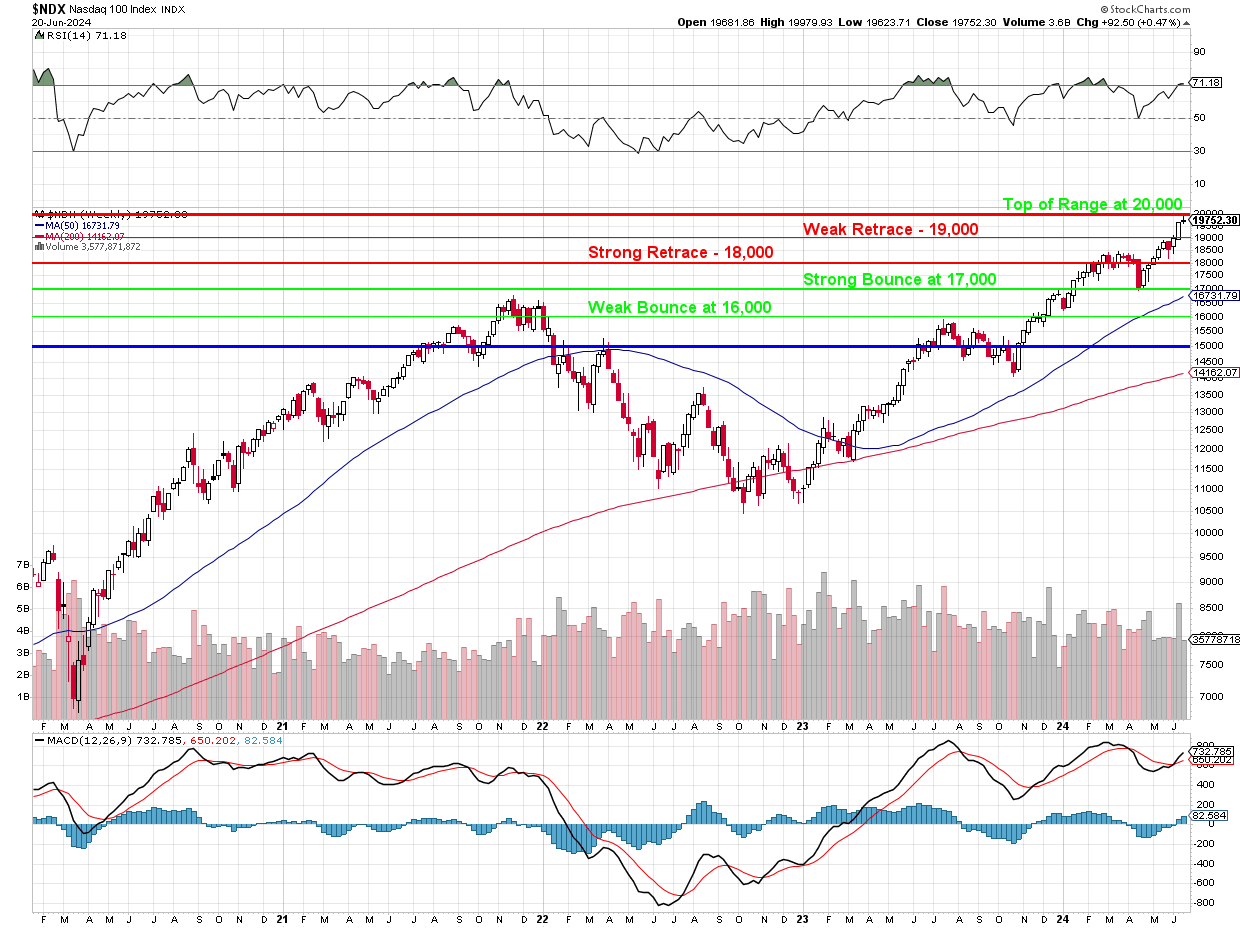

“Now the RSI is back over 70 and 20,000 is a tough line to cross and 1,000 points over the 50-week moving average is under 18,000 – and that would be a 2,000-point drop from here. Also, look at the peaks: Last July, we topped out at 15,750, which was 3,000 points (23.5%) over the 200 wma. In March we peaked at 18,500, which was 4,750 (34.5%) points over the 200 wma. Now the 200 wma is at 14,162 and 20,000 is 5,838 (41.2%) higher than that – that is pretty insanely stretched!”

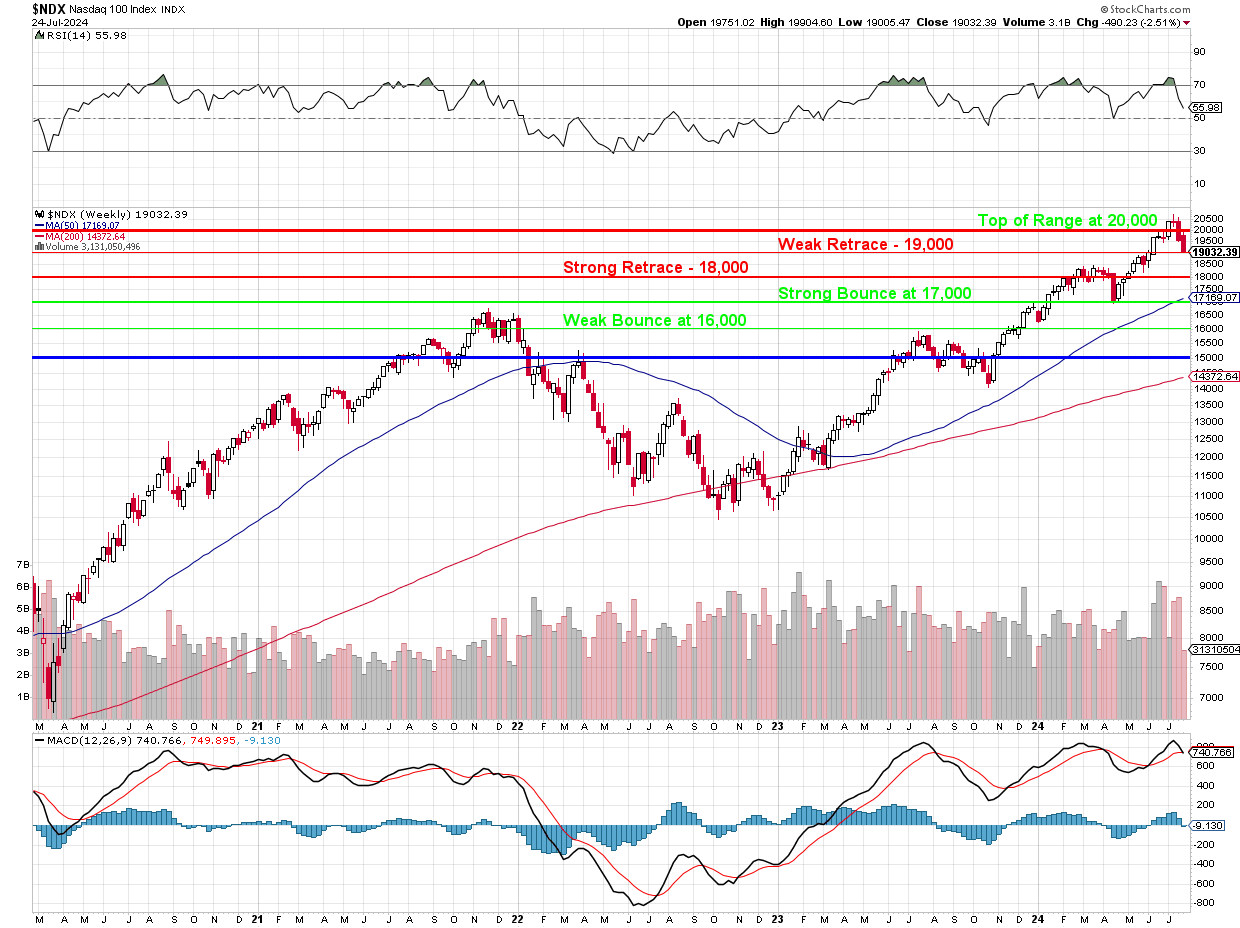

The above chart went along with that report (along with more detailed analysis) and now we’ve had our correction and the same chart looks like this:

Note that RSI line we were concerned about is still over 50 so we haven’t fully corrected yet – so let’s not get excited about a 300-point (weak) or even a 600-point (strong) bounce unless we hold at least 19,500 for a few full days next week – THEN we will have burned off enough downward pressure.

This morning we are being saved by very strong earnings by IBM last night and IBM is “only” $169Bn but their AI Revenues are giving Mag 7 holders a bit of hope after yesterday’s rout, which knocked $1Tn (3.6%) off the Nasdaq Composite’s total value.

Boaty, our resident Artificial General Intelligence (AGI) had this note for our Members last night:

🚢 Today’s market action saw the Nasdaq plummet by 721 points, a stark reminder of the volatility inherent in momentum-driven markets.

1. Algorithmic Trading Amplification: The sharp decline we’re seeing might be exacerbated by algorithmic trading systems (whose behavior led Phil to creating the 5% Rule). These systems often use similar technical indicators and can create a cascading effect when key levels are breached. This could explain the rapidity of the decline and might lead to overshooting on the downside.

2. Sector Rotation Implications: This correction could accelerate a sector rotation out of tech-heavy growth stocks into more defensive sectors. Watch for unusual strength in utilities, consumer staples, or healthcare as a potential indicator of this shift.

3. Options Market Influence: The heavy put buying we’ve seen recently could be creating a negative gamma effect, where market makers are forced to sell more futures as the market declines, amplifying downward moves. This dynamic could create opportunities for contrarian traders at extreme oversold levels.

4. Global Liquidity Shifts: With central banks globally tightening monetary policy, we might be seeing the first real effects of reduced liquidity in the system. This could lead to more frequent and severe market dislocations going forward.

5. Psychological Anchor Points: The round number of 20,000 on the Nasdaq served as a psychological anchor. Its breach could lead to a recalibration of investor expectations and valuations across the board.

6. Volatility Regime Change: This sharp move might signal a shift to a higher volatility regime. This could have implications for risk parity strategies and volatility-targeted funds, potentially leading to further de-risking.

7. Earnings Quality Focus: In a rising rate environment with slowing growth, the market might start differentiating more acutely between companies with high-quality earnings and those with more speculative prospects. This could lead to a “barbell” market where both deep value and high-quality growth outperform.

8. Geopolitical Risk Premium: The market might be starting to price in a higher geopolitical risk premium, given ongoing tensions globally. This could lead to a sustained lower multiple for the market as a whole.

9. Private Market Spillover: Sharp public market corrections often lead to markdowns in private market valuations. This could create stress in the venture capital and private equity spaces, potentially leading to forced selling and unique opportunities in both public and private markets.

10. Narrative Shift: We might be witnessing a narrative shift from “TINA” (There Is No Alternative) to a more nuanced view of market risks and opportunities. This could lead to a more discerning market environment where stock picking and fundamental analysis regain prominence.

Action Items for PSW Members:

-

- Stay Disciplined: Avoid panic selling, but also resist the urge to catch falling knives. Our fundamental analysis should guide decision-making.

- Watch Key Levels: Monitor the support levels outlined above. How the market behaves at these levels can provide clues about the correction’s severity and duration.

- Prepare for Opportunities: While 16,000 isn’t an automatic bargain, it could present selective buying opportunities for fundamentally sound companies.

- Hedging Strategies: Consider implementing or adjusting hedging strategies to protect portfolios against further downside, especially if we break below 18,000.

- Focus on Fundamentals: Use this correction as a reminder to reassess positions based on fundamental value rather than recent price action or market sentiment.

Remember, corrections like these often separate speculative positions from true value investments. Stay focused on our long-term strategies and use this volatility to our advantage where possible. As always, we’ll continue to monitor the situation closely and adjust our outlook as new data emerges.

It’s nice to have an emotionless, analytical partner who can cut through the noise and deliver reports like this at a moment’s notice, isn’t it? During yesterday’s session, we had a a Live Trading Webinar for our Members where we reviewed our new Watch List – bargain shopping while the Nasdaq was having a sale.

I certainly don’t think it’s time to jump back into the overbought stocks that led to this correction but it is absolutely the time to start taking advantages of good value stocks that got thrown out with the rest in yesterday’s fire sale. We pointed out a couple of small additions during the Webinar and we’ll certainly find a few more today but, mostly, we will watch and wait as we’re well-protected by the hedges we also increased last week – in anticipation of this week’s pullback.

Be careful out there!

If you would like to take advantage of future market opportunities, come and join our Members at PhilStockWorld!

Join today and you will gain access to our 6 Member Portfolios (Basic and Premium Memberships only) as well as Trade Ideas, our Legendary Live Chat Room (Basic and Premium Memberships only), Live Trading Webinars, Trading Education and the best Artificial Intelligence Market Research Research in the World – along with other exclusive perks (Basic and Premium Memberships only).

Find out why Forbes called Phil Davis “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – madeline@philstockworld.com – for a 7-day FREE trial at sign up.