Courtesy of Zerohedge

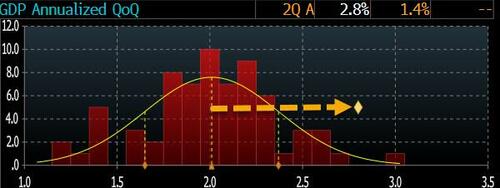

After yesterday’s panicked oped by idiot Bill “recession is here, so cut rates before Trump is elected” Dudley, expectations were for a Q2 GDP print this morning at zero if not outright negative to greenlight a July rate cut. Of course, that oped is all that was needed for Kamala’s Census Bureau to release a blowout print (because we now have just 100 days to establish Kamalanomics as the next sliced bread) and that’s precisely what happened moments ago when the first estimate of Q2 GDP came in at a whopping 2.8%, double the final Q1 print of 1.4% (which was already the lowest print since the technical recession in Q2 2022)…

… and also came in more than 2-sigma higher than the consensus estimate of 2.0%; in fact, there was just one analyst estimate that was higher at 3.0%.

The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment, according to the BEA.

According to UBS, details suggest very strong growth: investment rose 8.4% q/q SSAR, the highest since Q3 2023. It looks like AI-related investment supported the growth as information processing equipment rose 10.2% q/q. Personal consumption rose 2.5% in Q2, better than the decline of 2.3% in Q1. Government spending rose 3.1% q/q, higher than 1.8% in Q1.

Meanwhile, core PCE index fell to 2.9% y/y from 3.7%, but higher than 2.7% consensus.

Developing