That depends on how the rest of the earnings season goes but beware of being fooled by bounces off resistance that may appear to be rallies – especially when the fall has been so severe. A Dead Cat Bounce is a short-lived and often sharp rally that occurs within a secular downtrend based on the quote “Even a dead cat bounces when you throw it off a building.”

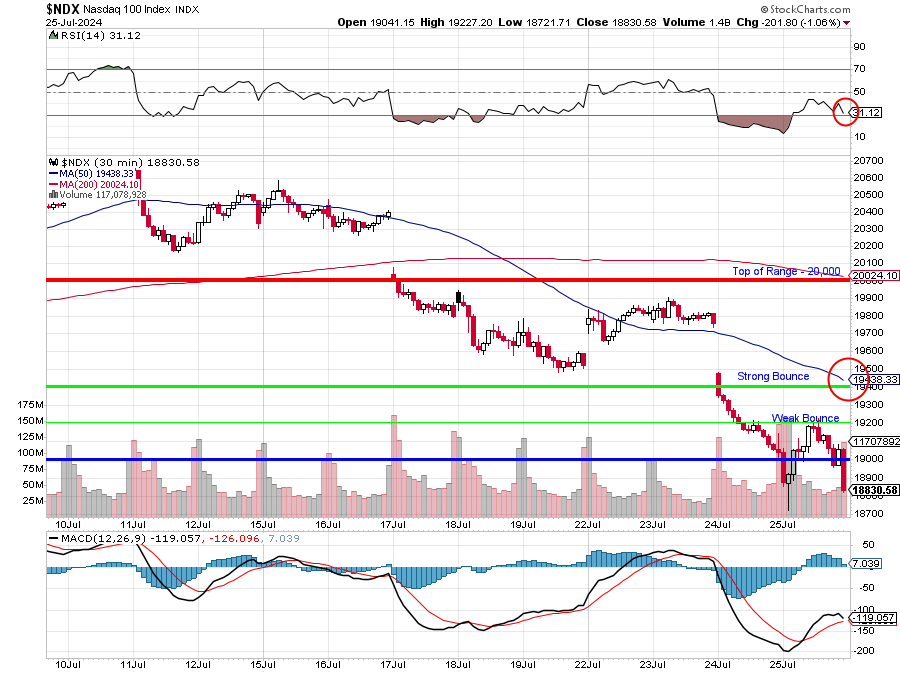

Our Fabulous 5% Rule™ is specifically designed to help guide us through such situations as one of the key tenets of the Rule is that we EXPECT to get bounces that are 20% of the drop from resistance to support. That’s something we can look at on this 10-day Nasdaq chart:

It was the 11th, with the RSI over 70, that I called for a 1,000 point correction as earnings season kicked off because the 40x p/e ratio of the Nasdaq was clearly unsustainable. And I wasn’t calling for 1,000 points from 20,500 – the 5% Rule™ also told us the extra 500 points was just an overshoot and we ignored that and called for a move back to 19,000 – which is exactly what happened.

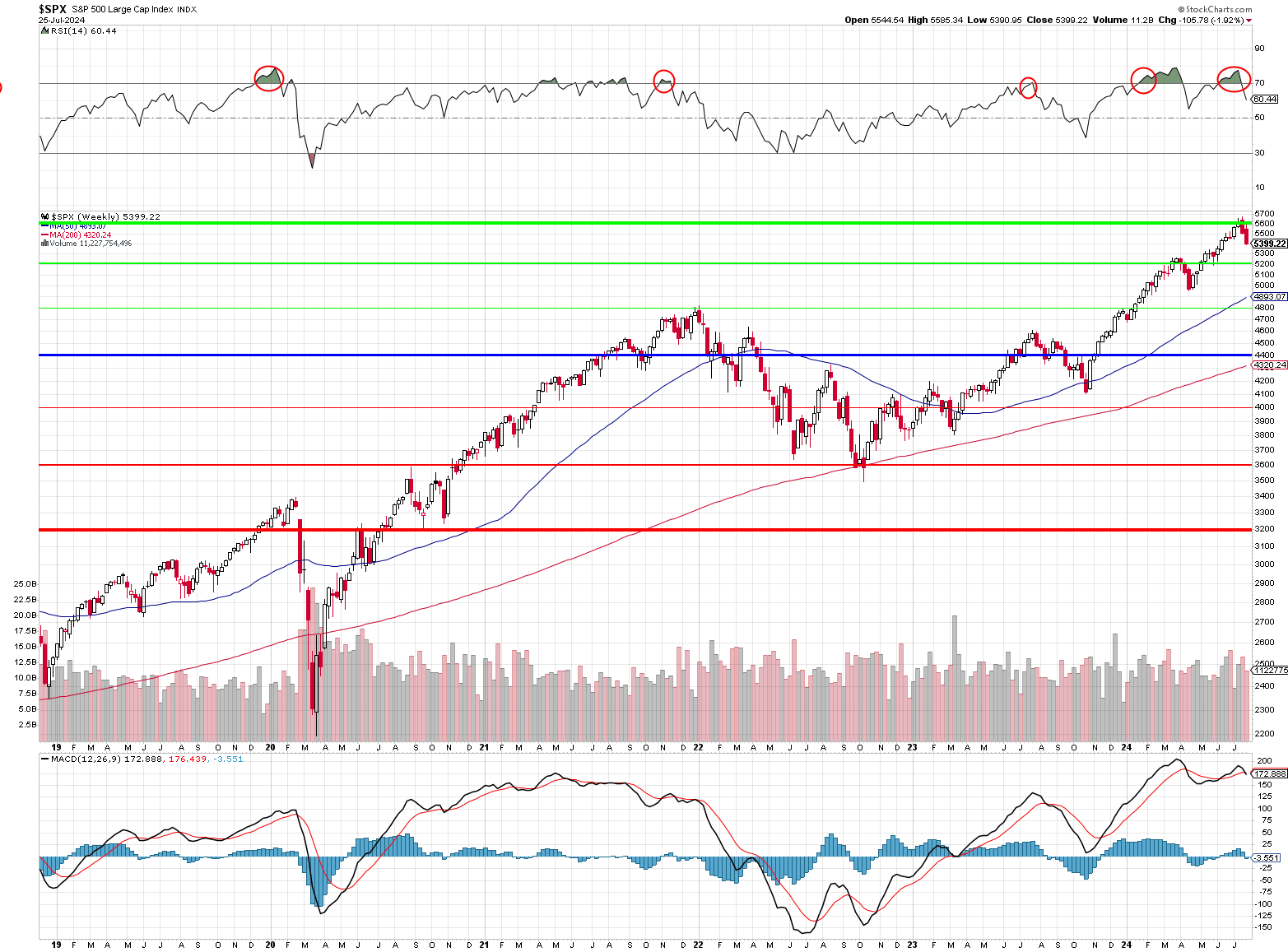

19,000 itself is a weak retrace of the run from 15,000 to 20,000 (-20% of the run) and, if that line holds – then we are possibly consolidating for a move higher. BUT, didn’t we say 20,000 was ridiculous already? It was ridiculous pre-earnings as there was nothing to justify it but, if earnings are up 10% then the p/e of the Nasdaq is 36 and if the Nasdaq is down 10% (from 20,000 to 18,000), then the p/e of the Nasdaq is 32.4 and we know that can be sustained (but it doesn’t mean we run out and buy it – as it’s still toppy).

Below 18,000 (strong retrace) would indicate something is very wrong with the forward valuations and we may normalize back to (for the Nasdaq) 25x forward earnings which would be, unfortunately, all the way back to 15,000. So all it takes for what would seem like a catastrophic 25% correction in the Nasdaq is a reversion to the mean for p/e.

What could change sentiment? Earnings Growth below 10% could call all future growth into question. Donald Trump’s promised trade wars and immigrant round-ups could throw a lot of things into chaos. Even as I’m writing this, Paris is under lockdown as MULTIPLE arson attacks have been committed against France’s High-Speed Rail System (TGV) coordinated just as record amounts of people are traveling into the city for the Olympics opening ceremony.

The Atlantic, Northern and Eastern routs were attacked and a 4th attack on the Southern rout was thwarted. Fires were set along the tracks and in signal boxes – aimed at disabling the system. Cables have also been cut – 800,000 passengers have had their travel affected and it will take until Monday to restore service. All bridges have been shut down (so traffic is essentially shut down) and there is a 150-mile “no-fly” zone in effect around Paris.

Happy Olympics!

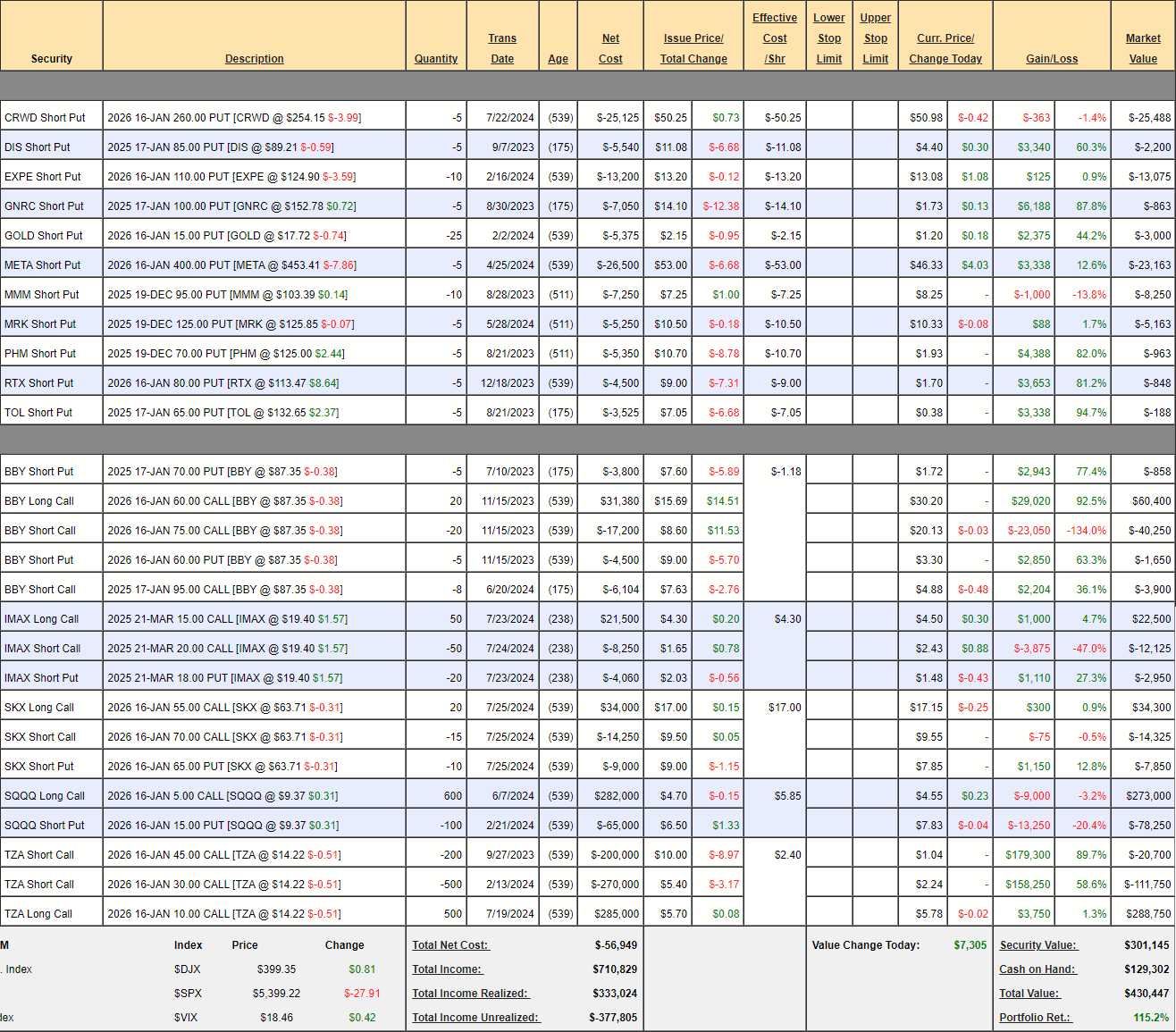

Should anything go boom over the weekend, 2-3Bn people will be watching it live and that is VERY LIKELY to affect market sentiment on Monday so we’re kind of on a knife edge here and I think it’s a good time to check our hedges and make sure we’re well-covered. When we did our Portfolio Reviews on the 16th, we were already expecting the 1,000-point drop and our Short-Term Portfolio (STP) was up 74.6% at $349,262 and the sell-off since than has driven our hedging portfolio up to $430,447 for a gain of $81,185 (23.2%) against the 10-day market drop:

We added IMAX and SKX as earnings plays this week – both went well so far. Let’s not worry about anything but our hedges though – that’s the only thing that needs adjusting at the moment:

-

- SQQQ – Well these are VERY aggressive. So much so that we should sell 200 (33%) of the Jan $10 calls for $1.50 ($30,000) just to put a little money in our pocket. Those can be rolled to the 2026 $20 calls ($1.35) so we’re covered to $20 (but then we can 2x to the $25s (now 0.85) and SQQQ is at $9.37 that’s up over 100% and that would take a 33% correction in the Nasdaq (as it’s a 3x inverse ETF) – to 12,500 and we don’t think that’s going to happen THEREFORE – it would be silly not to take the $30,000 – wouldn’t it?

- If we realistically plan for a 20% drop in the Nasdaq, back to 15,000 as our worst-case, that would put SQQQ at (1.6 x $9.37=) $15 and our $5 calls would be $10 ($600,000) in the money and the current net of our spread (after selling the above calls) is $194,750 so we’ve got $405,250 downside protection with the SQQQs.

-

- TZA – The Russell has gone the other way and TZA is now lower, at $13.61, than it was 10 days ago ($14.01). A 20% drop on the Russell from 2,222 to 1,777 would pop TZA 60% to $21.77 so we have no reason to buy back the short 2026 $45 calls – they are miles out of the money and so are the $30s but we’re already up 71.2% on those with $77,750 left and divided by 18 months, they can only pay us $4,319/month so let’s buy half (250) of those back and sell 200 (40%) of the Jan $22 calls for $1.05 ($21,000) as they will decay much faster – and we can always roll them back and those will pay us $3,500/month with more flexibility vs $2,159/month for the 250 we’re buying back.

- So we’re spending net $17,875 but, once the short Jan $12s expire, we have 2 more 6-month periods to make $21,000 – we’re laying the foundation for future profits! That brings our net on the spread that would be $11.77 ($588,500) in the money on a 20% drop to $174,175 with and upside (downside) potential of $414,325.

So that’s $819,575 of downside protection against a 20% drop in the indexes and I think that’s enough to survive whatever the weekend may bring. In case the market doesn’t go to hell in a handbasket – I’d like to add a long play in the STP and, fortunately, Ford (F) is a gift after plunging 22% to $11.23 after an earnings miss we EXPECTED to happen back in June, when I wrote: “The CDK Global Ransomware Attack: A Case Study in Industry-Wide Cybersecurity Vulnerabilities.”

Despite the ransomware incident, Ford reported strong Q2 results with revenue growth of 6% year-over-year and raised their full-year free cash flow guidance. This suggests that any financial impact from the attack was not material enough to significantly affect their overall performance or outlook – yet investors bailed out of them like they were Tesla!

While not directly quantified, Ford likely incurred some costs in supporting their dealers through the disruptions caused by the attack on CDK Global and, in our June analysis, we found that a large amount of sales – which would be an even larger percentage of the quarterly profits (the marginal sales) could not be completed in Q2 but they WILL be reconciled in Q3 – boosting the next Q!

So, given that premise and as we have no auto stocks in the Long-Term Portfolio (LTP), let’s play F in the STP with the following trade:

-

- Sell 30 F 2026 $14.82 puts for $4.25 ($12,750)

- Buy 100 F 2026 $9.82 calls for $2.40 ($24,000)

- Sell 60 F Dec 2026 $14.82 calls for $1.15 ($6,900)

That’s net $4,350 on the $50,000 spread that’s only 60% covered and if F goes up sharply, we can 2x roll the short calls to higher strikes (and roll for the year if we need to) and we’re happy to buy more longs and, if F goes down – we can sell 40 Jan $11 calls for about $1 (now $1.10), which would be $4,000 income against our net $4,350 spread – so that’s fine too!

If F is flat, we still sell some short-term calls but $11.16 is $13,400 in the money and we’d either roll the short puts along or give them to the LTP so the STP CANNOT lose on this position and stands to make up to $45,650 (1,049%) if F can get back to $14.82 in 18 months – not bad!

Have a great weekend,

-

-

- Phil

-

100 years ago: