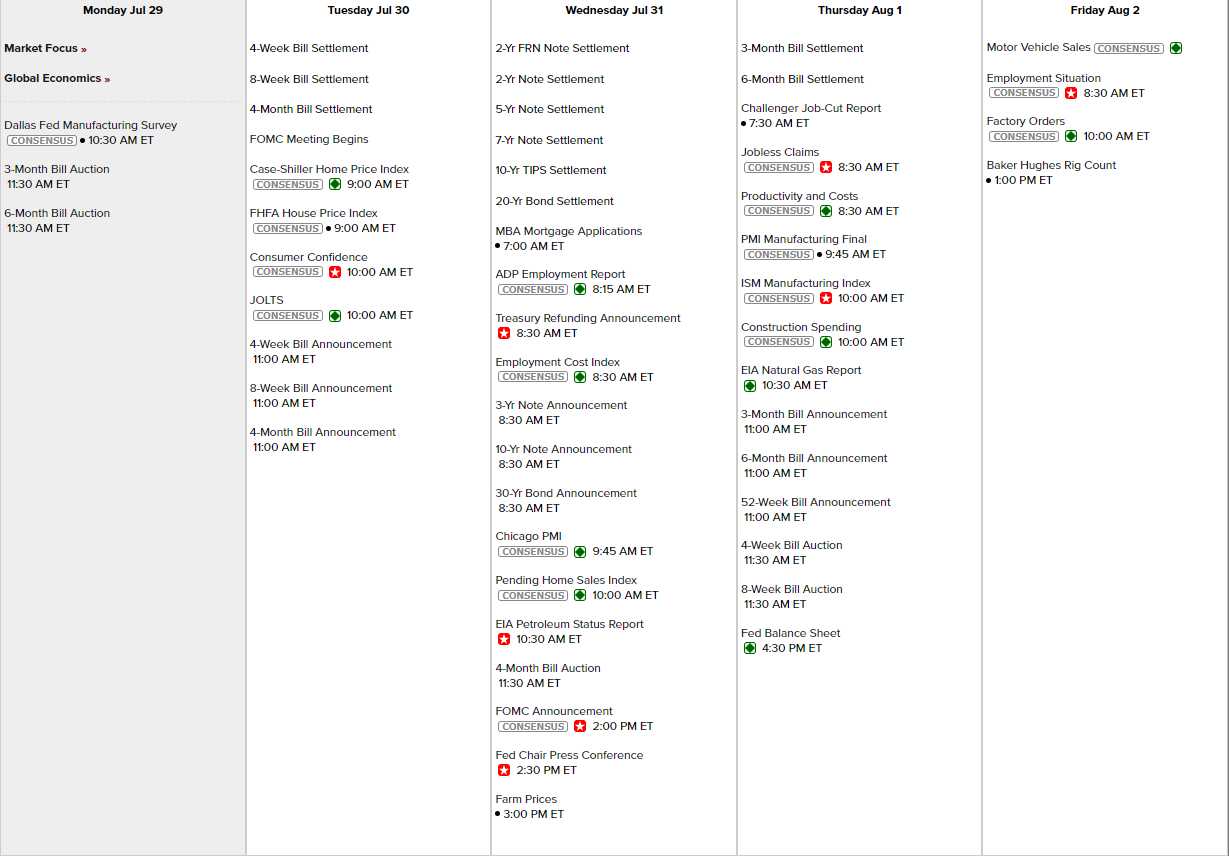

It’s a big data week.

It’s an even bigger earnings week and already the estimates for Q2 earnings growth has slipped from 10.1% to 8% after about 35% (175) of the S&P 500 has reported (and most of the big ones) so far. Of course, 8% is still the best year/year growth since the beginning of 2022 (easy comps) but it’s still not enough to justify 40x earnings on the Nasdaq, is it?

Our Magnificent 7 is up 29.8% in earnings so far but the 7 stocks are up 43.5% in market cap (now $16.1Tn) – even after the $2Tn (15%) pullback recently. NVDA is up 200% – from $1Tn to $3Tn – so that’s 40% of the total Nasdaq gains but it’s all insane and we know that – don’t we?

Even worse in the overall earnings – only 43 companies have raised guidance for 2024 so we’re not likely to recapture that +10% pace any time soon. That puts particular emphasis on the Fed, who are not going to lower rates on Wednesday but the market is hoping that one of the 10 words they change in their statement will give them a sign that rates will be lowered in September and THAT will fix everything – until the election 2 months later – of course.

RealClear Politics has aggregated 19 polls since July 5th, showing former President Trump leading Vice President Harris by an average of 1.9 points. But wait! The average margin of error is 2.7 points. It’s Schrödinger’s election – Trump is simultaneously leading and not leading until we open the ballot box!

And let’s not forget that most of these polls were conducted before Harris was even announced as the candidate just 8 days ago! That’s like asking people to review a movie based on the trailer for a different film – ridiculous. That’s why, instead of popping champagne over the 8% earnings gains, Wall Street is nervously eyeing the political roulette wheel, wondering whether to bet on red or black – or to just hide under the table.

And the pundits seem to be ignoring the race for control of the House and the Senate – all this uncertainty can lead to a lot of market tantrums in the 3+ long months until the elections. Meanwhile, candidate Trump who, in 2019 called BitCoin “not money” (Trump speak) and “based on thin air” has now become the Keynote speaker at this weekend’s BitCoin Conference in Nashville – after his campaign received $4M in BitCoin donations, including $2M from the Winklevoss twins but that was NOTHING compared to BTC, Inc’s David Bailey’s pledge to raise $100M and “get” 5M votes for Trump.

Of course direct corporate contributions to federal candidates is prohibited. If BTC Inc. is directly involved in raising or contributing these funds, it could violate campaign finance laws but following the law has never been the strong suit for Trump or his enablers. Even coordination between Trump and BTC, Inc. is technically illegal – as is the Quid Pro Quo of boosting the value of company making donations but Teflon Don and his minions know that laws are for little people – they don’t apply to them…

Of course direct corporate contributions to federal candidates is prohibited. If BTC Inc. is directly involved in raising or contributing these funds, it could violate campaign finance laws but following the law has never been the strong suit for Trump or his enablers. Even coordination between Trump and BTC, Inc. is technically illegal – as is the Quid Pro Quo of boosting the value of company making donations but Teflon Don and his minions know that laws are for little people – they don’t apply to them…

Trump promised to turn America into the “Bitcoin superpower of the world.” It’s like watching a teetotaler suddenly declare their undying love for tequila shots – unexpected, slightly concerning, but undeniably entertaining. Trump vowed to create a “strategic national Bitcoin reserve,” presumably right next to the nation’s stockpile of cheese. The ex-President promised to give SEC Chair, Gary Gensler, the boot faster than you can say “blockchain,” and declared an end to the Biden administration’s “war on crypto” – a war many weren’t aware was even being fought.

Interestingly, this is coming on the same day as the US National Debt officially passes $35 Tn but we’re also running a $2Tn deficit so we’ll hit $36Tn just in time for the next President to take office – yet neither candidate feels it’s an issue worth addressing. In fact, Trump’s “plan” to lower taxes for the Top 1% and Corporations will cost the US an additional $1.5Tn per year and we’ll be back to the record deficit pace he ran in his first term, which took the US from $19Tn to $28Tn – up 47% in 4 years.

Not that Biden has done much better as $36Tn will be up another $9Tn but at least the growth is down to 32% in Biden’s 4 years and, to be fair, Trump handed Biden his first $4Tn deficit in 2019 and, since then, they’ve cut it in half – without even rolling back Trump’s very expensive tax cuts.