Well, that’s one way to boost oil prices.

Israeli forces killed Hamas’ top guy, Ismail Haniyeh IN IRAN – IN TEHRAN – while he was attending the inauguration of Iran’s new President in what was supposed to be a show of force for their alliance. Haniyeh’s assassination is seen as a bold move by Israel, demonstrating its intelligence capabilities and willingness to strike deep within enemy territory – anywhere, any time – as they say.

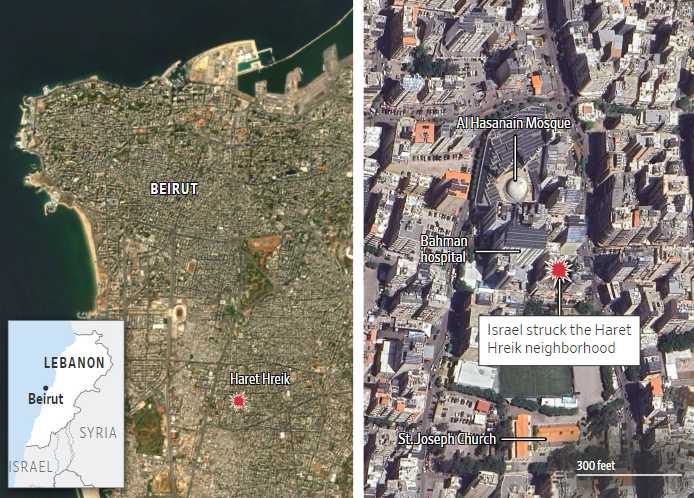

While that operation was going on, Israeli forces were also busy in Beirut in what they called a “targeted strike”, which took out a top Hezbollah Commander – along with an innocent woman, a girl and a boy while injuring 72 others and yes, the man was a monster who slaughtered women and children in the Golan Heights (12 children this weekend), but I don’t see how this is the way to respond.

While that operation was going on, Israeli forces were also busy in Beirut in what they called a “targeted strike”, which took out a top Hezbollah Commander – along with an innocent woman, a girl and a boy while injuring 72 others and yes, the man was a monster who slaughtered women and children in the Golan Heights (12 children this weekend), but I don’t see how this is the way to respond.

“Hezbollah crossed the red line,” Israeli Defense Minister Yoav Gallant said in a social-media post after the strike. Shukr was previously sanctioned and designated a terrorist by the U.S. government. He played a role in the 1983 bombing of the U.S. Marine Corps barracks in Beirut that killed 241 American personnel, and aided Hezbollah forces fighting rebels in Syria, according to a Justice Department notice offering a $5 million reward for information about him.

Lebanon’s prime minister, Najib Mikati, denounced the strike, saying, “This criminal act that took place tonight is one in a series of aggressive operations that are killing civilians in clear and explicit violation of international law.” This all started on Saturday (Sabbath), when Hezbollah carried out multiple attacks against civilians in Israel.

Lebanon’s prime minister, Najib Mikati, denounced the strike, saying, “This criminal act that took place tonight is one in a series of aggressive operations that are killing civilians in clear and explicit violation of international law.” This all started on Saturday (Sabbath), when Hezbollah carried out multiple attacks against civilians in Israel.

“The killing of Shukr backs Hezbollah into a corner: Its supporters expect it to deliver a significant retaliation but its hands are tied because Israel has shown that it has the military upper hand,” said Lina Khatib, an associate fellow at Chatham House, an international affairs institute in London.

Hezbollah is also Iran’s most important asset among its array of allied militias across the region. A full-scale war between Israel and Hezbollah would heighten the risk of Iran becoming more deeply involved in the conflict. Iran and Israel exchange fire with each other back in April when Iran launched their massive but ineffective rocket attack (in which Israel was pre-warned, so we’re not so sure what would happen if no warning were given).

Of course this is spiking Oil prices – which were just crashing below $75 yesterday but, more importantly, this risks a massive spread of the war yet the markets are up this morning because the Fed might lower rates (they won’t) and, in fact, the Bank of Japan just RAISED rates to fight inflation, leading to a 1,000-point drop on the Nikkei after the announcement.

“Ignore and Soar” is still the strategy for the US markets as the S&P 500 took the same news very well, now up 1% in the Futures at 8 am. That’s really because BOJ tightening led to a 2% rise in the Yen (0.67) – the first time over that level since March and that sent the Dollar down half a point – back to 103.80 and THAT helps boost both Oil and our Indexes and higher Oil prices boost the Oil Companies that boost the indexes as well so YAY!, I guess…

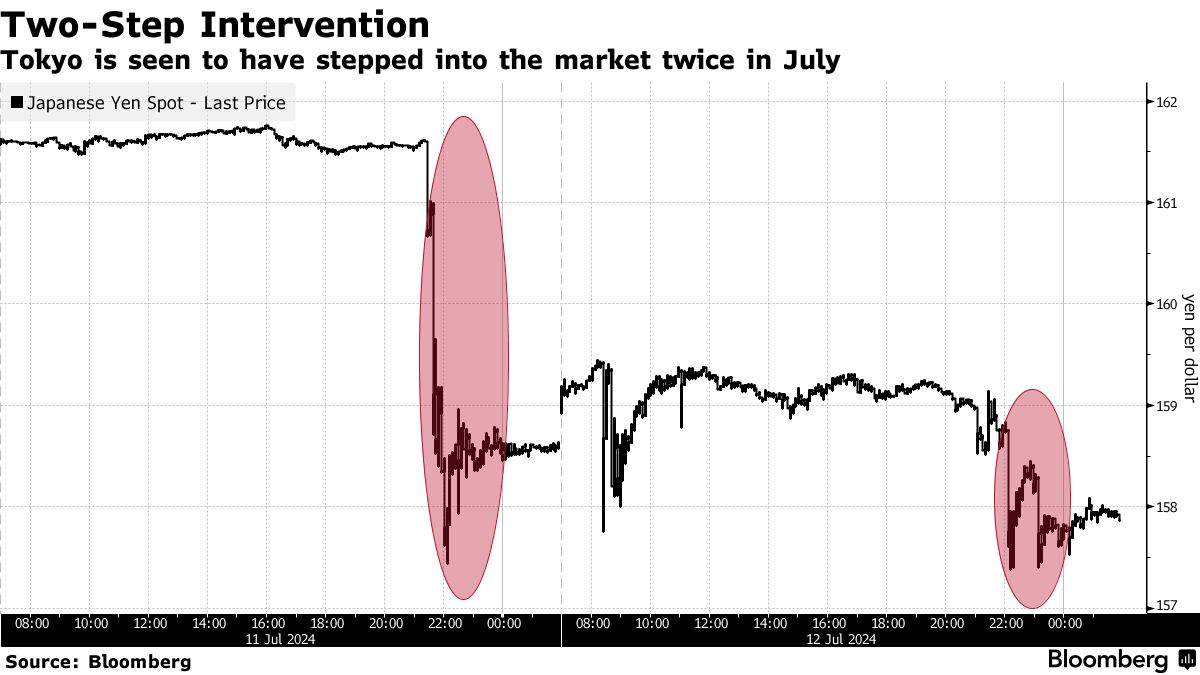

Overall, Japan spent 5.5 TRILLION Yen (only $36.6Bn) to prop up the Yen in July but it’s been speculated (by me) that they do not have the firepower left to do it again so they’ve switched tactics to raise rates, tightening the Yen, while the perception is that the Fed is about to lower rates – loosening the Dollar. So this is a free way for Japan to manipulate their currency based on perception alone.

But it’s not free as Japan is $15,000,000,000,0000 (2.3 QUADRILLION YEN) in debt and just today’s 0.25% increase (from 0%) is going to cost them $37.5Bn (over 5 TRILLION YEN) in interest – and that’s for a country that’s already running a 10% deficit that they have NO CHANCE of shrinking.

So the BOJ ran out of money after spending well over $100Bn this year intervening while the currency continued to collapse and, as that failed, they spent $37.5Bn more in forward interest payments in this last-ditch effort to stop the slide and, so far – it’s working! But for how long? It’s more likely a short squeeze at the moment – that will fade…

War in the Mideast will strengthen the Dollar and blow Japan’s strong Yen hopes and dreams out of the water and higher Oil prices will cost their manufacturing economy a pretty penny as well and a potential supply interruption. 20% of the World’s supply of oil go through the Strait of Hormuz.

Gold is benefitting from this nonsense as well, now $2,465 and Silver, as I predicted last week, saying to our Members: “Gold BLASTED back from $2,352 to $2,427 on the Paris incidents but Silver is still $27.96 so /SI is a good long with tight stops below $27.95 keeps the risk low ($100ish) with very high rewards.“ Silver Futures pay $50 per penny and we’re back at $28.77 – up over $4,000 per contract – congratulations to all who played along!

Our favorite Gold miner, Barrick (GOLD) is still pretty cheap at $18.42, they were featured in our Top Trade Alert from Feb 7th in which we called for a new trade as follows:

-

-

- Sell 10 GOLD 2026 $17 puts for $3.50 ($3,500)

- Buy 20 GOLD 2026 $13 calls for $3.80 ($7,600)

- Sell 20 GOLD 2026 $17 calls for $2.10 ($4,200)

-

That was a net $100 credit on the $800 spread and we’ve already blown past our very conservative 2026 goal with the puts at $1.85 ($1,850) and the Bull Call Spread at $6.20/3.65 ($5,100) so net $3,250 already is up $3,350 (3,350%) and still not even halfway to our goal of $8,000 with $4,750 (146%) left to gain in the next 18 months – still a very nice trade!

You don’t have to make big, risky bets to make fantastic returns using options – it’s a tool every good trader should have in his toolbelt.

While the geopolitical tensions in the Middle East are causing significant concern, the U.S. markets are focused on Domestic Economic Factors and Corporate Earnings. Microsoft (MSFT) reported earnings that beat expectations by a penny, but its revenue guidance for the next quarter came in below consensus. This news sent MSFT shares down 1.5% in pre-market trading, a significant move for such a large component of major indices.

However, the broader Tech Sector is showing strength, particularly in semiconductors. AMD’s strong earnings report has fueled a rally in chip stocks, with AMD up 8.4% and NVIDIA up 7.5% ($200Bn!) in pre-market trading. This surge is further supported by news that chip equipment export rules will have key exemptions for allies, boosting stocks like ASML, which is up 7.7%.

All eyes, of course, are on the Federal Reserve’s policy announcement due at 2:00 pm. While the market expects the FOMC to leave rates unchanged, there’s HUGE anticipation that the Fed might signal a potential rate cut at the September meeting. This expectation, combined with the Bank of Japan’s surprise rate hike, is contributing to the Dollar weakness, which in turn is supporting U.S. equities and commodities.

The morning’s Economic Data presents a mixed picture. The weekly MBA Mortgage Applications Index dropped 3.9%, continuing its downward trend while the Employment Cost Index rose 0.9% – still on pace for a 4% annual gain – which is double the Fed’s intended rate for wage growth, which leads to more inflation. Tomorrow’s Productivity Report is key, last Quarter it was just 0.2% – another report like that would be a disaster (2% is expected by eternally optimistic Economorons).

The Eurozone’s flash CPI for July came in at 2.6% year-over-year, also above inflation expectations. While Geopolitical tensions are creating significant risks, the market’s is on Tech Earnings and Fed policy. The Nasdaq is popping 400 points pre-market (strong bounce) but we’ll see what sticks – watch the Russell – which is making yet another attempt at 2,300.

We have our Live Webinar this afternoon (1pm, EST), just in time for the Fed Announcement at 2pm and, of course, Powell’s press conference at 2:30.

See you inside!

If you would like to take full advantage of future market opportunities and get more great trade ideas like Silver (/SI) and Barrick (GOLD) – come and join our Members at PhilStockWorld!

Join today and you will gain access to our 6 Member Portfolios (Basic and Premium Memberships only) as well as Trade Ideas, our Legendary Live Chat Room (Basic and Premium Memberships only), Live Trading Webinars, Trading Education and the best Artificial Intelligence Market Research Research in the World – along with other exclusive perks (Basic and Premium Memberships only).

Find out why Forbes called Phil Davis “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – madeline@philstockworld.com – for a 7-day FREE trial at sign up.