The VIX says it all:

After our terrible finish last week, Asian and European markets decided to play catch-up with their own sharp sell-offs and now we have to catch up to them, etc. etc. until we find a bottom to the panic.

It’s a pretty indiscriminate selling-off of assets with Oil down at $72, Gold rejected at $2,500 (again) and back to $2,437, Silver $27, Copper $4 – even Cocoa, Sugar, Corn, Rice, Wheat and Soybeans are down – even hogs are down! Even the Dollar is down at 102.4 and that’s down more than 1% since Friday which SHOULD be supporting the market, so imagine where we’d be without that support.

So no one wants stocks, no one wants commodities and no one wants currencies. What do they want? Bonds! It’s been a while since we had a good flight to the “safety” of bonds and suddenly, the 10-Year Note is up 3% in two weeks? Half of that since the Fed so the bond market is sure the Fed will lower rates – which raises the relative value of older 10-Year Notes at higher rates – hence this chart effect we’re seeing.

The markets have been teetering on the edge for weeks, and this morning, they finally took the plunge. But what brought us to this precipice, and what was the final push that sent stocks tumbling?

Let’s rewind a bit. We’ve been riding high on a wave of AI-fueled optimism and hopes for a “soft landing” engineered by the Fed. But beneath the surface, cracks were forming. The tech sector, our market’s golden child, started showing signs of fatigue. Earnings reports came in mixed, with some high-profile misses adding to the unease. As I had been warning all year – the market that lives by the Magnificent 7 would die by the Magnificent 7 and that group is down 20% this earnings season (so far).

Then came Friday’s jobs report (weak at 114,000), landing like a lead balloon on Wall Street’s doorstep. Suddenly, the Fed’s decision to hold rates steady last week looked less like prudence and more like a potential misstep. Investors started wondering: Is the Fed behind the curve? Are we careening towards a recession after all?

This uncertainty has sent shockwaves across the globe. Japan’s Nikkei just had its worst day since 1987, officially entering bear market territory. European markets are bleeding red across all sectors. It’s as if someone yelled “Fire!” in the global financial theater, and now everyone’s rushing for the exits.

Adding fuel to that fire, the Bank of Japan has taken a more hawkish stance, sparking rumors about the collapse of the popular yen ‘carry trade‘ (borrowing money in Japanese Yen at very low interest rates, then converting that money into a currency with higher interest rates to generate cash-flow). This is like watching dominoes fall in slow motion, each one toppling into the next.

In times like these, investors typically seek shelter. And boy, are they seeking it now! Treasuries are being snatched up like hotcakes, the Swiss franc is looking mighty attractive, and gold is still glittering near all-time highs. It’s a classic flight to safety, folks, and it’s happening at breakneck speed with all the new efficiency we’ve come to expect from AI.

So here we are, watching years of gains evaporate in a matter of days. It’s a stark reminder that markets can turn on a dime, especially when they’ve been propped up by overly optimistic expectations and easy money policies (See July 30th’s “Technical Tuesday – Weak Bounces Ahead of the Fed“).

The recent disappointing U.S. jobs data has ignited concerns that the Federal Reserve may have made a mistake by keeping interest rates stable last week (See Aug 1st’s: “Federally Fueled Thursday – Did Powell Actually Say Anything That Bullish?“). This has heightened fears that the world’s largest economy could be heading towards a recession (the one 60% of our citizens already think we’re in! – see July 24’s: “Wednesday Worries – Uneven Earnings and a 60% Recession“).

The weak jobs figures have led investors to worry that the Federal Reserve may not be providing adequate policy support for a slowing U.S. economy. This has led to a shift in investor sentiment, with many now seeking safety in bonds and other haven assets.

While the current market downturn is undoubtedly painful, especially for those watching their portfolios shrink by 5-10% in a single morning, it’s crucial to maintain perspective.

Market corrections, even sharp ones, are a normal part of the investment cycle. Since 1980, the S&P 500 has experienced an AVERAGE intra-year decline of about 14%, yet has still provided positive annual returns in most years. This doesn’t make today’s losses any easier to swallow, but it reminds us of the importance of maintaining a long-term view.

In times like these, it’s essential to review your risk tolerance, ensure proper diversification, and avoid making panic-driven decisions – especially with the VIX this high. Remember, market downturns often present opportunities for patient, disciplined investors.

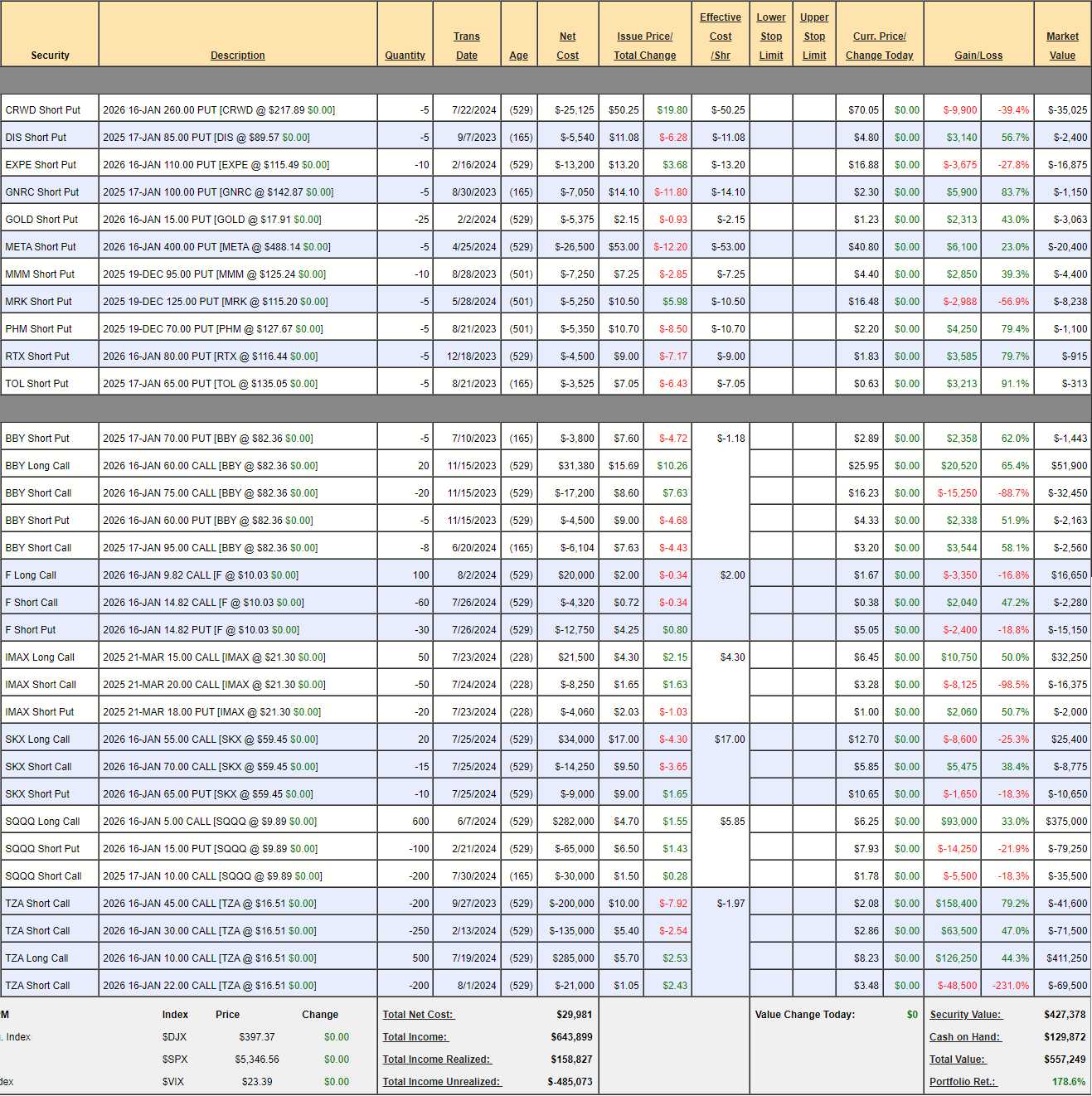

Fortunately, we do have our hedges: We reviewed our Short-Term Portfolio back on Jan 26th (“False Hope Friday – Watch for our Weak Bounces“) and made a couple of changes with the STP, at the time, at $430,447 (up 115.2%) and already, as of Friday’s close, our hedging portfolio had blasted up to $557,249 (up 178.6%) taking a lot of the sting out of the dip – so far.

In the July 26th Review, we had calculated that we had $819,575 worth of protection against a 20% drop in the Nasdaq and the Nasdaq 100 was at 19,117 and, this morning, we’re down at 18,040 – down 1,077 points (5.6%) and we’ve gained $126,802 – which is 15% of our potential coverage. Seems on track to me. Our big decision this week is whether we need to add more hedges or cash these out!

As always, we at PhilStockWorld are here to help you navigate these choppy waters with our proven strategies for hedging risk while maintaining upside potential.

And, of course, it’s Monday – Monday’s don’t count!